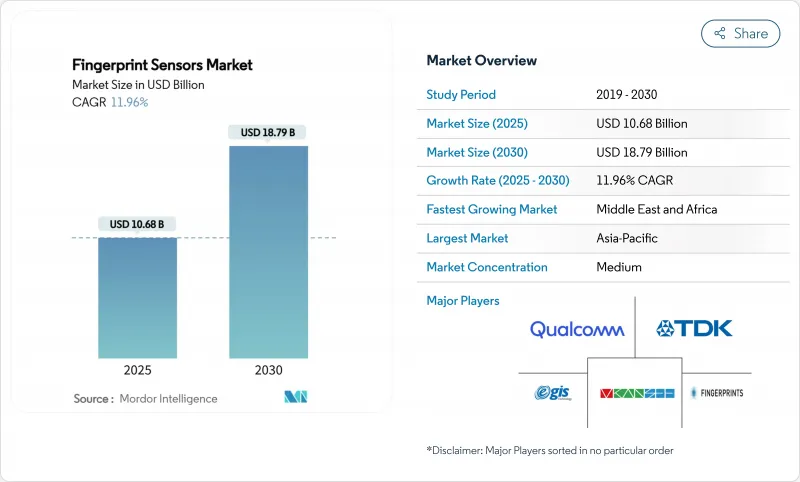

지문 센서 시장은 2025년에 106억 8,000만 달러, 2030년에는 187억 9,000만 달러에 이르고, CAGR은 11.96%를 나타낼 전망입니다.

소비자 일렉트로닉스, 모빌리티, 지불, 정부의 정체성 프로그램에서 생체 인증의 의무화가 확대되고, 주소 지정 가능한 기반이 계속 넓어지고 있습니다. 스마트폰 브랜드는 스푸핑 내성을 손상시키지 않고 베젤 프리 디자인을 실현하기 위해 초음파 언더 디스플레이 솔루션을 채택하고, 결제 등급의 생체 인식 카드는 PSD3 및 EMV 요구 사항을 충족하는 카드 제시 거래를 가능하게합니다. 자동차 부품 제조업체는 키리스 엔트리 및 차내 개인화를 위해 AEC-Q100 지문 IC 인증을 획득하고 있으며, PMUT 제조 비용의 저하로 부품 비용의 압력이 완화되고 있습니다. AI 기반의 활성 검출과 에지 처리의 병렬 개선은 지문 인증의 신뢰성을 더욱 향상시키고, 보다 광범위한 멀티모달 보안 스택의 지위를 향상시킵니다.

초음파 센서를 디스플레이 아래에 배치하는 디자인으로 휴대폰 제조업체는 에지 투 에지 OLED 스크린을 유지하면서 안정적인 생체 인식 보안을 보장합니다. Qualcomm의 최신 3D Sonic Max 트랜스듀서는 250ms로 600mm2의 이미지를 캡처하여 젖은 피부와 유성 피부에서도 잠금 해제를 유지합니다. 삼성, 구글, 샤오미는 2025년 제품 로드맵에서 FAR/FRR 인증 임계값을 높이는 안드로이드 16 바이오메트릭 API에 맞추어 플래그쉽 라인에 초음파 구현을 약속하고 있습니다. 그 결과 스케일 이코노미가 Tier 2OEM의 ASP를 낮추고 가격대를 넘어서는 수량 성장을 가속화하고 지문 센서 시장을 다음 디바이스 사이클로 끌어 올립니다.

아랍에미리트(UAE)(UAE)에서 남아프리카에 이르기까지 디지털 ID 프로그램은 현재 보안 요소에 저장된 지문 템플릿을 포함하는 다중 요소 생체 인식을 지정합니다. 모리셔스는 2024년 2월에 MNIC 3.0 카드를 발행하여 월렛 기반 국경을 넘어 인증할 수 있는 매치 온 카드 지문 인증을 통합했습니다. 파푸아 뉴기니의 세비스 패스 파일럿(SevisPass pilot)은 소규모 경제국들이 레거시 인프라 없이 생체인식 ID로 도약하는 방법을 강조합니다. 이러한 방식은 신뢰할 수있는 센서 모듈의 여러 해에 걸쳐 조달의 파도를 만들어 내고 지문 센서 시장을 공공 부문의 예산주기에 정착시킵니다.

Apple의 iPhone 17 시리즈와 삼성 Galaxy Z7 Fold Pro는 모두 3D 얼굴 잠금 해제를 기본으로 하고 있으며, 생체인증의 마인드 쉐어는 카메라 기반의 모달리티로 이동하고 있습니다. 그러나 2025년에 출하되는 휴대 단말기의 93%는 여전히 지문 리더를 탑재하고 있으며, 기술이 애플의 0.002%의 FAR 목표를 달성한 새벽에는 디스플레이 아래 센서가 iPhone의 포트폴리오로 돌아갈 것으로 예상되고 있습니다. 지문 인증 방식은 젖은 환경, 장갑을 착용한 상태에서의 사용, 장치에 템플릿 스토리지를 필요로 하는 은행 앱과 같은 프라이버시에 민감한 워크플로우에서 여전히 선호되고 있기 때문에 카니버리제이션은 지문 센서 시장의 대부분이 아니라 프리미엄 테일에 크게 영향을 미칩니다.

2024년 지문 센서 시장에서는 성숙한 코스트 커브와 폭넓은 용도으로 정전용량식 유닛이 51%의 점유율을 유지했습니다. 그러나 초음파 칩은 CAGR 15.42%로 상승하고 OEM이 고차의 휴대전화와 자동차 콘솔을 체적 이미징으로 전환시키기 때문에 2030년까지 수익 격차가 줄어들 것으로 예측됩니다. 초음파 디바이스의 지문 센서 시장 규모는 프리미엄 ASP와 자동차 자격 마진을 반영하여 2030년까지 40억 달러를 돌파할 것으로 예상됩니다. 버클리 학교의 센서 및 액추에이터 센터 조사에 따르면 KNN 기반 PMUT 어레이는 105.5dB/V의 출력을 생성하여 두꺼운 커버 유리와 장갑을 통한 침투력을 향상시킵니다.

성능의 이점은 인증 획득으로 이어지고 있습니다. 퀄컴의 3D Sonic Max는 2025년 FIDO Level-3 및 BSI CC EAL 6을 달성하여 독일의 eID 컴플라이언스를 실현했습니다. 광학 센서는 비용에 중점을 둔 계층과 키오스크 단말기에 계속 서비스를 제공하고 열 센서는 가혹한 환경과 사후 포렌식을 위한 틈새 제품에 머물고 있습니다. 전반적으로 기술의 다양성은 프리미엄 부문에서 초음파의 리더십이 확고해지더라도 더욱 광범위한 시장 세분화를 지원합니다.

후면/전면 마운트는 레거시 핸드셋 디자인과 러기드 핸드헬드에 도움을 받아 2024년 매출의 42%를 창출했습니다. 그러나 디스플레이 아래의 초음파 모듈은 OLED 기판의 박형화와 국소적인 음향 결합층을 이용하여 CAGR 가장 빠른 16.28%를 기록합니다. 베젤리스 디자인이 400달러 이하의 장치에 보급됨에 따라 언더 디스플레이 방식의 지문 센서 시장 점유율은 2030년까지 38%를 보일 것으로 예측됩니다. Apple, Samsung, Oppo는 2024년 하반기 생산 프레임에서 2억 5,000만 개 이상의 언더디스플레이 센서의 다이를 주문하고 있으며 대규모 채택을 시사하고 있습니다.

사이드마운트의 정전용량식 스트립은 신속한 탭 검출을 우선하는 접이식 휴대전화나 게임용 휴대전화에서는 여전히 인기가 높지만, 키보드의 교환 사이클이 스마트폰보다 2-3년 늦은 기업용 노트북에서는 온버튼/홈키 설계가 남아 있습니다. BOE와 Visionox에서 테스트 중인 센서 인 OLED 프로토타입은 지문 인증과 심박광전 센서를 통합하여 지문 센서 시장의 다음 장을 재정의할 수 있는 다기능 패널을 제안합니다.

지문 센서 시장은 센서 유형(광학, 정전용량식, 기타), 폼 팩터(후면/프론트 마운트, 사이드 마운트 등), 용도(스마트폰 및 태블릿, 노트북 PC/PC 등), 최종 사용자 산업(가전 OEM, BFSI & FinTech 등), 지역별로 세분화되어 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

아시아태평양의 수익 점유율 46%는 공급망 깊이와 엔드마켓 수요의 독특한 통합을 반영합니다. 중국의 수직 통합 휴대폰 생태계, 한국의 AMOLED 혁신, 일본의 압전 세라믹 리더십은이 지역의 밸류체인을 견고하게 만듭니다. 인도의 Aadhaar 2.0 로드맵과 인도네시아의 e-KTP 업그레이드 파이프라인은 다년간의 국내 수요를 더욱 지원합니다. 또한 각국 정부는 현지에서 실리콘 제조의 장려책을 강구함으로써 육양비를 낮추고 아시아태평양을 지문센서 시장의 중력의 중심지로 강화하고 있습니다.

중동 및 아프리카는 CAGR 15.4%로 세계 최고 속도로 확대될 것으로 예측됩니다. 아랍에미리트(UAE)의 국가 바이오메트릭스 지갑과 사우디아라비아의 Nafath 플랫폼은 시민 온보딩에 인증 지문 모듈을 요구하며 카드와 키오스크 대량 주문의 계기가 되었습니다. 남아프리카의 250만 달러의 스마트 ID 카드 입찰은 2029년 선거 전 대량 발행을 목표로 하고 있으며, 아프리카의 디지털 ID 인프라로의 도약을 이야기하고 있습니다. made나 e-Fawateer 등 지역 결제 네트워크가 생체인식 토크나이제이션으로 이행하는 중 센서 공급업체 파이프라인은 박박하고 신흥국의 지문 센서 시장의 성장 가능성이 부각되고 있습니다.

북미와 유럽은 자동차 바이오메트릭스, 기업 보안 업그레이드, 엄격한 데이터 프라이버시 컴플라이언스에 힘입어 한 자릿수 중반의 성장 궤도를 유지하고 있습니다. 유럽의 디지털 ID 프레임워크는 2026년까지 지갑의 도입을 의무화하고 있으며, 4억 5,000만 명의 주민이 기기 또는 카드 기반 지문 인증을 요구하게 됩니다. TSMC의 400억 달러를 투입한 애리조나 공장은 2026년 2기 라인을 개설할 예정이며 미국의 주요 휴대전화 회사용 초음파 PMUT 웨이퍼 생산을 시작하고 온쇼어 공급의 회복력을 강화하며 지문 센서 시장의 글로벌 유통 균형을 맞출 예정입니다.

The fingerprint sensors market stands at USD 10.68 billion in 2025 and is forecast to reach USD 18.79 billion by 2030, reflecting an 11.96% CAGR.

Expanding biometric mandates in consumer electronics, mobility, payments and government identity programs continue to widen the addressable base. Smartphone brands have turned to ultrasonic under-display solutions to deliver bezel-free designs without compromising spoof resistance, while payment-grade biometric cards enable card-present transactions that meet PSD3 and EMV requirements. Automotive suppliers are qualifying AEC-Q100 fingerprint ICs for keyless entry and in-cabin personalization and falling PMUT production costs are easing bill-of-materials pressures. Parallel improvements in AI-based liveness detection and edge processing further lift the reliability of fingerprint authentication, reinforcing its position in the wider multimodal security stack.

Ultrasonic under-display designs let handset makers preserve edge-to-edge OLED screens while retaining high-confidence biometric security. Qualcomm's latest 3D Sonic Max transducer captures a 600 mm2 image in 250 ms and sustains unlock even with damp or oily skin, outperforming optical modules in spoof testing. Samsung, Google and Xiaomi have committed flagship lines to ultrasonic implementations in 2025 product roadmaps, aligning with Android 16 biometric APIs that raise FAR/FRR certification thresholds. The resulting scale economies lower ASPs for tier-2 OEMs, accelerating volume growth across price bands and propelling the fingerprint sensors market into its next device cycle.

Digital identity programs from the UAE to South Africa now specify multi-factor biometrics, typically including fingerprint templates stored in secure elements. Mauritius issued its MNIC 3.0 card in February 2024, embedding match-on-card fingerprint authentication that enables wallet-based cross-border recognition. Papua New Guinea's SevisPass pilot underscores how small economies leapfrog to biometric IDs without legacy infrastructure. Such schemes create multi-year procurement waves for trusted sensor modules, anchoring the fingerprint sensors market in the public-sector budget cycle.

Apple's iPhone 17 range and Samsung's Galaxy Z7 Fold Pro both default to 3-D facial unlock, shifting biometric mindshare toward camera-based modalities. Yet 93% of handsets shipping in 2025 still carry a fingerprint reader, and under-display sensors are expected to return to the iPhone portfolio when technology meets Apple's 0.002 % FAR target. Fingerprint methods remain preferred for wet environments, gloved usage and privacy-sensitive workflows such as banking apps that require on-device template storage, so cannibalization largely affects the premium tail rather than the bulk of the fingerprint sensors market.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Capacitive units retained a 51% share of the fingerprint sensors market in 2024 owing to mature cost curves and broad application reach. Ultrasonic chips, however, are set to climb at 15.42% CAGR and are projected to narrow the revenue gap by 2030 as OEMs migrate high-tier phones and automotive consoles toward volumetric imaging. The fingerprint sensors market size for ultrasonic devices is on track to surpass USD 4 billion by 2030, reflecting premium ASPs and automotive qualification margins. Research from Berkeley's Sensor & Actuator Center shows KNN-based PMUT arrays generating 105.5 dB/V output, enhancing penetration through thick cover glass and gloves.

Performance advantages are translating into certification wins. Qualcomm's 3D Sonic Max achieved FIDO Level-3 and BSI CC EAL 6+ in 2025, enabling German eID compliance. Optical sensors continue servicing cost-sensitive tiers and kiosk terminals, while thermal variants remain niche for harsh-environment and postmortem forensics. Altogether, technology diversity sustains the broader fingerprint sensors market even as ultrasonic leadership cements in premium segments.

Rear/front mounts generated 42% of 2024 revenue, helped by legacy handset designs and rugged handhelds. Yet under-display ultrasonic modules will post the fastest 16.28% CAGR, taking advantage of OLED substrate thinning and localized acoustic coupling layers. The fingerprint sensors market share for under-display formats is expected to reach 38% by 2030 as bezel-less design becomes ubiquitous among sub-USD 400 devices. Apple, Samsung and Oppo collectively placed orders exceeding 250 million under-display sensors die in H2 2024 production slots, signalling scale adoption.

Side-mounted capacitive strips remain popular in foldables and gaming phones that prioritize rapid tap detection, while on-button/home-key designs linger in enterprise notebooks where keyboard replacement cycles lag smartphones by 2-3 years. Sensor-in-OLED prototypes under test at BOE and Visionox merge fingerprint capture with heart rate photoplethysmography, hinting at multifunctional panels that could redefine the next chapter of the fingerprint sensors market.

Fingerprint Sensors Market Segmented by Sensor Type (Optical, Capacitive, and More), Form Factor (Rear/Front Mount, Side-Mounted, and More), Application (Smartphones & Tablets, Laptops/PCs, and More), End-User Industry (Consumer Electronics OEM, BFSI & FinTech, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Asia-Pacific's 46% revenue share reflects a unique integration of supply chain depth and end-market demand. China's vertically aligned handset ecosystem, Korea's AMOLED innovation and Japan's piezo ceramics leadership collectively anchor a resilient regional value chain. India's Aadhaar 2.0 roadmap and Indonesia's e-KTP upgrade pipeline further underwrite multi-year domestic demand. Regional governments also sponsor local silicon fabrication incentives, lowering landed costs and reinforcing Asia-Pacific as the gravitational center of the fingerprint sensors market.

Middle East & Africa is projected to expand at 15.4% CAGR, the fastest worldwide. The UAE's national biometric wallet and Saudi Arabia's Nafath platform both require certified fingerprint modules for citizen onboarding, catalysing bulk card and kiosk orders. South Africa's USD 2.5 million smart ID card tender aims for mass issuance before the 2029 elections, illustrating Africa's leapfrogging toward digital identity infrastructures. With regional payment networks such as made and e-Fawateer shifting to biometric tokenization, supplier pipelines for sensors are tightening, underscoring the growth potential of the fingerprint sensors market in emerging economies.

North America and Europe sustain mid-single-digit trajectories underpinned by automotive biometrics, enterprise security upgrades and stringent data-privacy compliance. The European Digital Identity Framework mandates wallet rollout by 2026, translating into 450 million residents requiring device or card-based fingerprint authentication. TSMC's USD 40 billion Arizona fabs, due to open Phase 2 lines in 2026, will localize ultrasonic PMUT wafer starts for key U.S. handset accounts, strengthening onshore supply resilience and balancing the global distribution of the fingerprint sensors market.