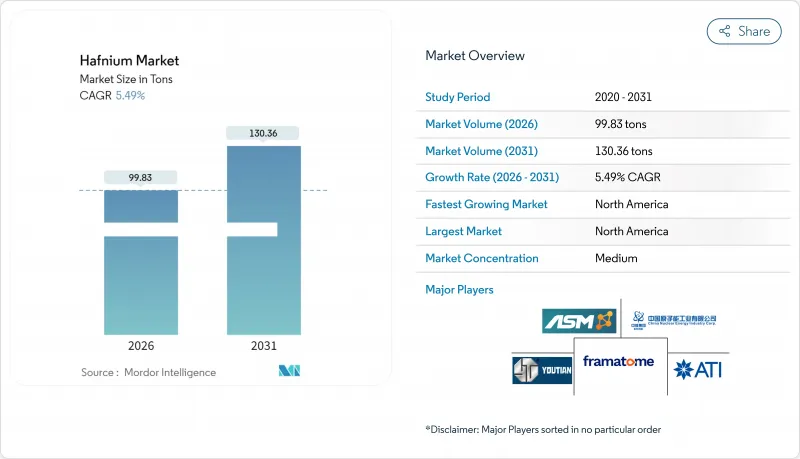

2026년 하프늄 시장 규모는 99.83톤으로 추정되며, 2025년 94.63톤에서 성장한 수치이며, 2031년에는 130.36톤에 이를 것으로 예측됩니다.

2026년부터 2031년까지 연평균 복합 성장률(CAGR) 5.49%로 성장할 전망입니다.

이 성장의 기세는 세 가지 요인이 함께 발생하고 있습니다. 최첨단 칩의 트랜지스터 게이트 크기 축소, 항공우주 분야의 초고온 재료에 대한 수요, 중성자 흡수 제어봉을 필요로 하는 원자력 발전소의 갱신입니다. 레늄을 하프늄으로 대체하는 초합금, 3나노미터 논리 노드로의 이행, 원자로 운영자에 의한 전략적 비축이 함께 수요를 확대하고 있습니다. 공급면에서는 정제생산량이 극히 소수의 시설에 한정되어 있기 때문에 과점구조가 강화되어 지정학적 리스크와 가격 결정력이 함께 영향을 강화하고 있습니다. 프랑스의 푸라마톰, 미국의 ATI, 중국의 정제업자, 러시아공급업체가 함께 연간 70-75톤의 1차 제품을 공급할 뿐이며, 하류 사용자는 관세 변동이나 수출 규제의 영향을 받기 쉬운 상황에 있습니다.

반도체 제조업체는 이산화규소에서 하프늄 산화물 게이트 유전체로의 이행을 진행하고 있습니다. 이는 종래의 재료에서는 산화막 두께가 1nm 미만이면 누설 전류를 억제할 수 없기 때문입니다. 대만 세미컨덕터 매뉴팩처링 컴퍼니(TSMC)가 출원한 특허는 하프늄 산화물층과 란탄 산화물의 조합이 평면 미세화를 연장하여 2026년을 목표로 하는 2nm 노드로의 지속적인 진전을 가능하게 한다는 것을 보여줍니다. 종래의 트랜지스터를 넘어 강유전성 하프늄-지르코늄 산화물 박막은 900을 넘는 유전율을 실현해, 저소비 전력의 매립 메모리나 커패시터 구조에의 길을 엽니다. 이러한 혁신은 무어의 법칙을 유지하기 위한 중요한 기반이 되어 세계 하프늄 시장의 꾸준한 성장을 이끌고 있습니다.

재사용형 발사 시스템에서는 팁 타일과 로켓 목구멍 인서트가 2,000℃를 초과하는 재돌입 사이클을 반복적으로 경험합니다. 융점 약 3,890℃의 탄화 하프늄은 런던 제국 학원에서 레이저 가열 시험에서 입증된 대로 비교할 수 없는 내산화성을 제공합니다. 5.7% 이상의 탄화하프늄이 도핑된 탄소계 복합재료는 절제 손실을 거의 반감시켜 로켓의 부품 수명을 연장합니다. 민간 및 방어 프로그램의 출격 빈도가 증가함에 따라 조달 담당자는 하프늄 세라믹을 노즈콘, 제어면, 엔진 라이너에 통합하여 하프늄 시장에 추가 수요를 창출하고 있습니다.

하프늄은 지르코늄 중간체를 처리하는 과정에서만 생성되며, 일반적으로 질량비 50:1로 추출됩니다. 따라서 생산 능력의 향상은 지르코늄의 경제성에 달려 있습니다. 지르코늄 광석의 매장량이 주로 남아프리카, 호주, 모잠비크에 집중되어 있기 때문에 미네랄 모래 공급 충격은 하프늄의 가용성에 연쇄적으로 영향을 미칩니다. 분리 플랜트가 프랑스, 미국, 중국, 러시아로 제한되어 있기 때문에 운영 정지 및 정책 전환이 발생하면 세계 수급 균형이 급속히 급박합니다. 자본 집약도의 높이도 신규 진출을 더욱 제한하고 하프늄 시장의 집중 상태를 영속시키고 있습니다.

2025년 하프늄 소비량 중 48.20%를 탄화물 카테고리가 차지했습니다. 이것은 타의 추종을 불허하는 융점과 로켓 노즐 인서트 및 극초음속기의 앞 가장자리에서 입증 된 용도 때문입니다. 이 이점은 재료 유형별로 분류된 하프늄 시장 규모의 거의 절반을 차지합니다. 질화물 유도체는 더 낮은 절제 손실을 약속하지만, 기본 수요는 여전히 순수한 하프늄 탄화물에 의존합니다. 따라서 세계 하프늄 시장은 기준 톤수에서 탄화물의 안정성에 의존합니다.

파브라인이 3nm 공정으로 이행하여 2nm 생산으로 향하는 가운데 산화하프늄은 2031년까지 6.05%라는 가장 빠른 CAGR을 기록하고 있습니다. 게이트 스택의 채택, 강유전체 메모리의 프로토타입, 커패시터 기술의 혁신으로 산화물 수요량은 과거의 기준치를 크게 웃돌고 있습니다. 이 부문의 성장 궤도는 예측 기간 동안 하프늄 시장 점유율의 확대를 시사하고 있으며, 특히 칩 수익이 10년 이내에 1조 달러를 목표로 하는 가운데 두드러집니다. 제조업체는 현재 1조분의 1레벨 불순물 임계값을 요구하고 있으며, 전자 부품 등급의 산화물을 공급할 수 있는 공급업체에 대한 수요가 증가하고 있습니다.

하프늄 보고서는 유형별(산화하프늄, 탄화하프늄 등), 용도별(초합금, 광학 코팅, 원자력, 플라즈마 절단 등), 지역별(아시아태평양, 북미, 유럽, 세계 기타 지역)으로 분류됩니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

북미는 2025년 세계 수요의 38.55%를 차지했으며, 지역별 최대 점유율을 유지하고 있습니다. 국내 생산이 한정적임에도 불구하고 2031년까지 연평균 복합 성장률(CAGR) 5.66%로 성장할 전망입니다. ATI사의 오리건주 및 유타주 공장에서는 특수합금을 생산하고 있지만, 2017년부터 2020년에 걸쳐 미국 바이어의 수입원은 여전히 독일이 42%, 프랑스가 29%, 중국이 24%를 차지했습니다. 보잉사의 민간 항공기 프로그램, 방어용 터빈 오버홀 계획, 인텔사의 선진 팹이 하프늄 시장의 소비 확대를 지원하고 있습니다.

유럽은 프랑스의 쟈리 정제소를 통해 전략적 우위성을 가지고 있으며, 이곳은 정제능력의 약 43%를 차지하고 연간 약 30톤을 생산하고 있습니다. 에어버스, 사프란, 롤스로이스는 국내 공급에 의존하고 있으며 독일이 미국을 위한 주요 수출국으로서의 역사적 역할을 담당해 온 것은 이 지역의 가공 전문성을 부각하고 있습니다. 최근 프랑스 수출 수수료로 대서양 횡단 무역이 축소되었지만 항공기 수주 잔량과 원자로의 유지 보수 사이클 증가로 인해 EU 지역 내 수요가 안정되고 있습니다.

아시아태평양에서는 일본과 한국이 원자력 발전량과 반도체 생산 라인을 확대함에 따라 하프늄 도입에 속도를 내고 있습니다. 중국은 생산국인 동시에 신흥 소비국이라는 이중 입장에 있으며, 국내 반도체 공장과 로켓 제조 기업이 산화 하프늄과 탄화 하프늄의 소비량을 증가시키고 있기 때문에 공급면에서 마찰이 발생하고 있습니다. 대만의 3나노미터 논리회로 채택의 주도적 입장과 베트남의 희토류 개발은 이 지역에서 자급자족에 대한 의욕의 고조를 뒷받침하고 있습니다. 전반적으로 고속로의 제어봉에서 재사용가능한 로켓의 내열 타일에 이르기까지 응용 분야의 지역적 다양성이 아시아태평양 전역의 하프늄 시장 전망을 견고하게 지원하고 있습니다.

Hafnium market size in 2026 is estimated at 99.83 tons, growing from 2025 value of 94.63 tons with 2031 projections showing 130.36 tons, growing at 5.49% CAGR over 2026-2031.

This growth momentum flows from three converging forces: shrinking transistor gate dimensions in leading-edge chips, aerospace demand for ultra-high-temperature materials, and nuclear fleet upgrades that require neutron-absorbing control rods. Superalloys that replace rhenium with hafnium, the march toward 3-nm logic nodes, and strategic stockpiling by reactor operators collectively widen demand. On the supply side, refined output is confined to a handful of facilities, reinforcing an oligopolistic structure that compounds geopolitical risk and pricing power. France's Framatome, the United States' ATI, Chinese refiners, and Russian suppliers together deliver only 70-75 tons of primary product annually, leaving downstream users exposed to tariff shifts and export controls.

Chipmakers are shifting from silicon dioxide to hafnium oxide gate dielectrics because the older material cannot suppress leakage when oxide thickness drops below 1 nm. Patents filed by Taiwan Semiconductor Manufacturing Company illustrate how hafnium oxide layers paired with lanthanum oxide extend planar scaling and enable continued progress toward 2-nm nodes slated for 2026. Beyond conventional transistors, ferroelectric hafnium-zirconium oxide films deliver dielectric permittivity above 900, opening doors for low-power embedded memory and capacitor architectures. These breakthroughs anchor an essential pathway for sustaining Moore's Law, driving steady growth for the hafnium market worldwide.

Reusable launch systems subject leading-edge tiles and rocket throat inserts to repeated re-entry cycles exceeding 2,000 °C. Hafnium carbide, with a melting point near 3,890 °C, offers unmatched oxidation resistance, as validated through laser-heating studies at Imperial College London. Carbon-carbon composites doped with more than 5.7% hafnium carbide cut ablation losses nearly in half, extending component life in launch vehicles. As commercial and defense programs accelerate sortie rates, procurement managers are embedding hafnium ceramics into nose cones, control surfaces, and engine liners, pulling incremental tons into the hafnium market.

Hafnium emerges only when zirconium intermediates are processed, typically at a 50:1 mass ratio, making capacity additions hostage to zirconium economics. Since zirconium ore reserves reside mainly in South Africa, Australia, and Mozambique, supply shocks in mineral sands cascade into hafnium availability. With separation plants limited to France, the United States, China, and Russia, any outage or policy shift quickly tightens global balances. Capital intensity further restricts new entrants, perpetuating concentration in the hafnium market.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

The carbide category captured 48.20% of 2025 volumes, thanks to its unmatched melting point and proven use in rocket throat inserts and hypersonic leading edges. This dominance accounts for nearly half of the hafnium market size allocated to material types. Although nitrided derivatives promise even lower ablation losses, foundational demand remains anchored in pure hafnium carbide. The global hafnium market, therefore, leans on carbide stability for baseline tonnage.

Hafnium oxide is charting the fastest 6.05% CAGR to 2031 as fab lines transition to 3-nm and move toward 2-nm production. Gate-stack adoption, ferroelectric memory prototypes, and capacitor innovations lift oxide volumes well above historical baselines. The segment's trajectory hints at a growing slice of hafnium market share across the forecast horizon, especially as chip revenue aims toward USD 1 trillion by decade-end. Fabricators now specify parts-per-trillion impurity thresholds, putting a premium on suppliers able to deliver electronics-grade oxide.

The Hafnium Report is Segmented by Type (Hafnium Oxide, Hafnium Carbide, and Other Types), Application (Super Alloy, Optical Coating, Nuclear, Plasma Cutting, and Other Applications), and Geography (Asia-Pacific, North America, Europe, and Rest of the World). The Market Forecasts are Provided in Terms of Volume (Tons).

North America controlled 38.55% of global demand in 2025, the largest share by region, and is on course for a 5.66% CAGR through 2031 despite limited indigenous production. ATI's Oregon and Utah operations produce specialty alloys, yet U.S. buyers still sourced 42% of imports from Germany, 29% from France, and 24% from China during 2017-20. Boeing's civil airframe programs, defense turbine overhaul schedules, and Intel's advanced fabs anchor consumption growth in the hafnium market.

Europe wields strategic leverage through France's Jarrie refinery, which holds roughly 43% of refined capacity and turns out nearly 30 tons per year. Airbus, Safran, and Rolls-Royce rely on this domestic supply, while Germany's historical role as the leading exporter to the United States highlights the region's processing specialization. Recent French export fees have tightened trans-Atlantic trade, but intra-EU demand remains steady amid aircraft backlog and rising reactor maintenance cycles.

Asia-Pacific's uptake accelerates as Japan and South Korea boost nuclear output and semiconductor lines. China's dual status as both producer and rising consumer introduces supply friction, since domestic fabs and launch-vehicle builders increasingly capture oxide and carbide volumes. Taiwan's leadership in 3-nm logic adoption and Vietnam's rare-earth development underscore the region's growing self-sufficiency aspirations. Overall, regional diversity in end uses, from control rods in fast reactors to thermal tiles on reusable rockets, keeps the hafnium market outlook constructive across Asia-Pacific.