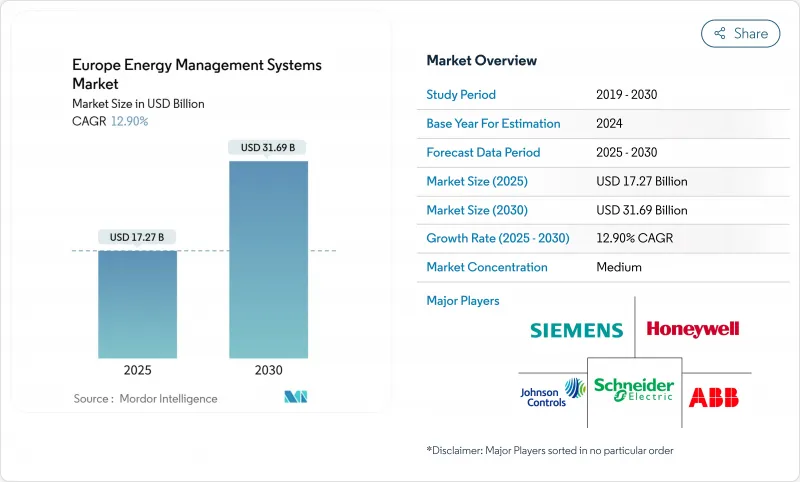

유럽의 에너지 관리 시스템 시장은 2025년에 172억 7,000만 달러에 이르고, 2030년에는 316억 9,000만 달러에 달할 것으로 예상됩니다.

디지털 우선 송전망의 업그레이드, FIT-FOR-55의 의무화, 가속하는 기업의 넷·제로 목표가 총체적으로 이 확대를 지지하고 있으며, 이 기술은 재량적인 지출에서 인프라의 필수품으로 이행하고 있습니다. 5,840억 유로 규모의 전력 투자가 계획된 급속한 스마트 그리드 현대화는 소프트웨어 중심 최적화 플랫폼에 대한 광범위한 수요를 야기하고 있습니다. 건물 수준의 인공지능 도구는 에너지 강도를 30% 줄이고 시설을 활성 그리드 노드로 전환합니다. 독일은 신재생에너지 80%라는 목표를 배경으로 조기 도입을 진행하고, 스페인에서는 스마트홈 붐이 주택용 스케일업의 페이스를 만들고 있습니다. 벤더 각사가 예측 분석과 사이버 보안의 통합을 향한 경쟁을 펼치는 가운데 경쟁의 격렬함도 증가하고 있습니다.

EU의 전력회사는 2030년까지 5,840억 유로의 송전망 투자를 계획하고 있으며, 이 중 1,700억 유로는 견고한 EMS 플랫폼에 의존하는 디지털화에 충당됩니다. 분산형 재생에너지, 차량 대 그리드 흐름, 가상 변전소에서는 실시간 오케스트레이션이 필요하며 EMS는 비용 절감에서 그리드 크리티컬 자산으로 승격합니다. Enlit 2024에서 슈나이더 일렉트릭 가상 변전소의 배치는 양방향 전력 아키텍처에 대한 공급업체의 위치를 보여주었습니다. 빌은 현재 유연성 서비스를 제공하고 HEMS와 배전 시스템 운영자 사이에 상호 데이터 루프를 생성하고 있습니다. GridX는 상호 운용성 표준의 성숙과 함께 2030년까지 유럽 주택 EMS가 11배로 확대될 것으로 예측됩니다.

개정 건축물 에너지 성능 지령은 2030년까지의 제로 방출 건축과 가장 성능이 나쁜 스톡에 대한 단계적인 업그레이드를 의무화하고 있으며, EMS의 기능이 준수의 전제조건이 되고 있습니다. 전체 수명 탄소 평가의 의무화는 에어컨, 조명, 현장 재생에너지에 걸친 통합 모니터링을 추진합니다. 스페인에서는 국가 통합 에너지·기후 계획을 통해 이미 빌딩 자동화 소프트웨어를 연간 17.21% 끌어 올리고 있으며, 규제의 긴급성이 그대로 판매 파이프라인에 반영되고 있습니다. 데이터 로깅, 분석 및 보고를 번들로 제공하는 솔루션은 감사 사이클을 단축하고 인증 위험을 줄입니다.

EU 수준의 지침이 있음에도 불구하고 각국의 규칙이 어색해지므로 공급업체는 인증 및 인터페이스를 사용자 정의해야 하며 프로젝트 수명주기가 늘어나고 있습니다. 독일의 기준은 스페인이나 이탈리아의 기준에서 크게 벗어나기 때문에 여러 국가의 벤더가 병행하여 개발을 진행할 수밖에 없습니다. 에너지 스마트 어플라이언스를 위한 자발적인 행동 규범은 프로토콜의 정합을 도모하려고 하지만 강제력이 부족합니다. 규제 전문가가 없는 중소기업은 경쟁에 어려움을 겪고 통합을 촉구하고 있습니다.

2024년 유럽의 에너지 관리 시스템 시장 점유율의 45.3%를 빌 에너지 관리 시스템(BEMS)이 차지했습니다. BEMS와 관련된 유럽의 에너지 관리 시스템 시장 규모는 사무실과 소매 체인이 그리드 서비스를 위해 HVAC, 조명 및 현장 스토리지를 개조함에 따라 꾸준히 상승할 것으로 예측됩니다. 공급업체는 수요 반응 모듈과 모니터링 제어를 번들링하고 건물을 유연성 자산으로 배치합니다. 가정용 에너지 관리 시스템(HEMS)의 CAGR은 13.1%로 가장 빠르고, 2025년까지 380만 호의 주택을 스마트화한다는 스페인의 계획에 추진되고 있습니다. AI 지원 대시보드와 모바일 앱은 소비자 이용을 촉진하고 전력 회사 리베이트로 투자 회수를 더욱 촉진합니다. 2030년까지 HEMS가 11배로 확대될 것이라는 GridX의 예측은 EU 소비자 인센티브와 일치하여 주택 파괴 가능성을 강조하고 있습니다.

산업용 EMS의 틈새 시장은 범위 1의 완화를 추구하는 에너지 집약적 섹터를 대상으로 더 작은 기반에서 성장하고 있습니다. 데이터센터 EMS와 스마트 시티 플랫폼은 '기타' 버킷에 속하며, 대기 시간에 민감한 최적화가 견인 역할을 하고 있습니다. BEMS 공급업체는 마이크로그리드 컨트롤러를 통합하고 HEMS 앱은 EV-to-home 및 VPP 참여 기능을 공개합니다.

하드웨어는 2024년 매출의 42.7%를 차지하며 애널리틱스가 활발해지기 전에 미터, 게이트웨이, 컨트롤러가 필요함을 강조했습니다. 그러나 소프트웨어가 CAGR 14.3%로 성장을 이끌고 있으며, 유럽의 에너지 관리 시스템 시장이 클라우드와 AI의 가치 레이어로 축족을 옮기는 것을 반영하고 있습니다. 급속하게 진화하는 SaaS 패키지는 예지 보전, 탄소 회계, 요금 적응형 스케줄링 등을 실현합니다. 소프트웨어와 관련된 유럽의 에너지 관리 시스템 시장 규모는 구독 모델이 영구 라이선스로 대체되고 자본 제약이 완화됨에 따라 확대될 것으로 예측됩니다.

서비스 도입, 재위탁, 관리된 최적화는 앞서 언급한 인재의 공백을 채우는 것입니다. 공급업체는 하드웨어가 상품화하는 동안 자문 서비스를 교차 셀링하여 이익을 유지합니다. Johnson Controls 분석에 중점을 둔 Metasys 14.0은 정적 대시보드에서 지속적인 개선 엔진으로의 전환을 보여주며 소프트웨어 및 서비스의 경계를 모호하게 만듭니다.

유럽의 에너지 관리 시스템 시장은 솔루션 유형(건물 에너지 관리 시스템(BEMS), 가정 에너지 관리 시스템(HEMS) 등), 구성요소(하드웨어, 소프트웨어, 서비스), 배포 형태(On-Premise, 클라우드 기반), 최종 사용자(상업/소매, 주택, 기타), 국가별로 구분됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

The Europe energy management systems market reached USD 17.27 billion in 2025 and is projected to attain USD 31.69 billion by 2030, reflecting a 12.9% CAGR.

Digital-first grid upgrades, Fit-for-55 mandates, and accelerating corporate net-zero targets collectively underpin this expansion, moving the technology from discretionary spend to infrastructure necessity. Rapid smart-grid modernization, worth EUR 584 billion in planned electricity investments, is triggering widespread demand for software-centric optimization platforms. Building-level artificial-intelligence tools are unlocking 30% energy-intensity cuts, turning facilities into active grid nodes. Germany anchors early adoption on the back of 80% renewable-power goals, while Spain's smart-home boom sets the pace for residential scale-up. Competitive intensity is rising as vendors race to integrate predictive analytics and cybersecurity by design.

EU utilities plan EUR 584 billion of grid spending by 2030, with EUR 170 billion earmarked for digitalization that depends on robust EMS platforms. Distributed renewables, vehicle-to-grid flows, and virtual substations require real-time orchestration, elevating EMS from cost-saver to grid-critical asset. Schneider Electric's Virtual Substation rollout at Enlit 2024 illustrates vendor positioning for two-way power architectures. Buildings now supply flexibility services, creating reciprocal data loops between HEMS and distribution system operators. GridX forecasts an 11-fold expansion of European residential EMS by 2030 as interoperability standards mature via-tt.com.

The revised Energy Performance of Buildings Directive enforces zero-emission construction by 2030 and stepwise upgrades for worst-performing stock, making EMS functionality a compliance prerequisite. Mandatory whole-life-carbon assessments drive integrated monitoring across HVAC, lighting, and on-site renewables. Spain's transposition through its National Integrated Energy and Climate Plan is already lifting building-automation software 17.21% annually, translating regulatory urgency directly into sales pipelines. Solutions that bundle data logging, analytics, and reporting shorten audit cycles and de-risk certification.

Despite an EU-level directive, divergent national rules compel suppliers to customise certifications and interfaces, inflating project lifecycles. Germany's standards depart materially from those in Spain and Italy, compelling multi-country vendors to run parallel development tracks. The voluntary Code of Conduct for Energy Smart Appliances seeks to align protocols yet lacks enforcement teeth. Smaller firms without regulatory specialists can struggle to compete, nudging consolidation.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Building Energy Management Systems (BEMS) captured 45.3% of the Europe energy management systems market share in 2024, reflecting mandated zero-emission targets for commercial real estate. The Europe energy management systems market size tied to BEMS is expected to climb steadily as office and retail chains retrofit HVAC, lighting, and on-site storage for grid services. Vendors bundle demand-response modules with supervisory controls, positioning buildings as flexibility assets. Home Energy Management Systems (HEMS) post the swiftest 13.1% CAGR, propelled by Spain's plan to make 3.8 million homes smart by 2025. AI-ready dashboards and mobile apps drive consumer uptake, and utility rebates further sweeten paybacks. GridX's projection of 11-fold HEMS expansion by 2030 dovetails with EU prosumer incentives, underlining residential disruption potential.

The industrial EMS niche grows off a smaller base, serving energy-intensive sectors chasing scope 1 abatements. Data-center EMS and smart-city platforms populate the "others" bucket, where latency-sensitive optimisation gains traction. Cross-segment convergence is visible; BEMS suppliers integrate microgrid controllers while HEMS apps expose EV-to-home and VPP participation features.

Hardware claimed 42.7% of 2024 revenue, underlining the need for meters, gateways, and controllers before analytics can flourish. Yet software leads growth at 14.3% CAGR, mirroring the Europe energy management systems market's pivot to cloud and AI value layers. Fast-evolving SaaS packages unlock predictive maintenance, carbon accounting, and tariff-adaptive scheduling. The Europe energy management systems market size attached to software is forecast to broaden as subscription models replace perpetual licences, easing capital constraints.

Services installation, retro-commissioning, and managed optimisation fill the talent void discussed earlier. Vendors cross-sell advisory offerings to sustain margins as hardware commoditises. Johnson Controls' analytics-heavy Metasys 14.0 exemplifies the move from static dashboards to continuous-improvement engines, blurring the line between software and service.

Europe Energy Management Systems Market is Segmented by Solution Type (Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS), and More), Component (Hardware, Software, and Services), Deployment Mode (On-Premises and Cloud-Based), End-User (Commercial and Retail, Residential, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).