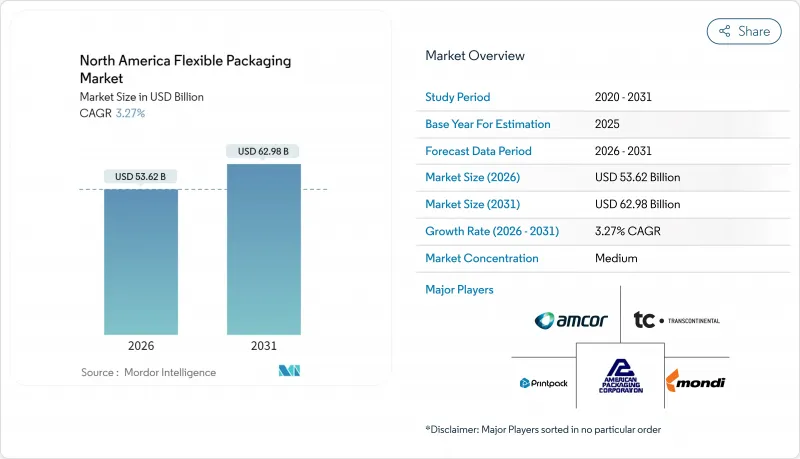

북미의 연포장 시장 규모는 2026년 536억 2,000만 달러로 추정되고, 2025년 519억 2,000만 달러에서 성장할 전망입니다. 2031년 예측은 629억 8,000만 달러에 이를 것으로 예측되며, 2026-2031년 연평균 복합 성장률(CAGR) 3.27%로 확대될 전망입니다.

성숙한 최종 사용자 수요, 엄격한 지속가능성 규제, 단계적 기술 업그레이드가 이러한 안정적인 성장 궤도를 지원합니다. 성장의 중심은 재활용 가능한 단일 소재 설계, 전자상거래 완성의 자동화, 의료 포장량의 급증에 있습니다. 한편, 폴리머 가격의 변동 및 다층 필름의 리사이클 갭이 단기적인 상승폭을 억제하고 있습니다. 브랜드 소유자는 현재 소비 후 재생 수지의 사용 목표를 장기 조달 계약에 직접 통합하고 있는 반면, 컨버터는 소매업체의 플라스틱 감소 공약에 대응하기 위해 섬유 기반 제품 라인을 확대하고 있습니다. 경쟁 환경은 여전히 분산 상태이지만, 규모가 큰 기업은 순환형 경제의 노하우를 획득하고 비용 우위를 확보하기 위해 통합을 진행하고 있습니다.

휴대 소비 습관의 확대에 따라 단품 포장에 대한 투자가 지속적으로 증가하고 있습니다. 마스사와 펩시코사의 2024년 제품 라인업 확충에서는 보존 기간 및 분량 관리의 밸런스를 양립하는 연포장이 채용되어 컨버터 각사는 고속 충전 씰 설비의 증강을 추진하고 있습니다. 포장 기계의 출하액은 2023년에 109억 달러에 이르렀고, 분속 70-100개 대응의 파우치 라인이 견인했습니다. 식품 접촉 용도에 있어서 재생 폴리에틸렌 사용 조건이 명확화되어 제품의 무결성을 유지하면서 PCR(사용한 재생재)을 사전 혼합하는 것이 가능하게 되었습니다. 이 규제의 명확화에 의해 How2Recycle의 '점포 회수' 기준을 충족하는 단일 소재 PE제 스탠드업 파우치를 이용한 스낵 제품의 발매가 지원되어 판매량의 기세가 더욱 강해지고 있습니다.

다층 필름은 종래, 배리어 과제의 해결에 공헌해 왔지만, 북미에서의 회수율은 10% 미만에 머물고 있습니다. 브랜드 소유자는 현재 단일 폴리머 구조를 중심으로 제품 포트폴리오의 재설계를 진행하고 있습니다. Mondi사가 Skanemejerier사 용으로 개발한 폴리프로필렌제 요구르트용 파우치는 기존의 재활용 시스템에 통합하면서 60일간의 보존 기간을 유지했습니다. Amco의 AmPrima Plus 플랫폼은 적층 구조와 비교하여 제조 단계까지의 탄소 실적를 최대 68% 줄인 것으로 보고되었습니다. 이 이행에는 기능성 배리어 수지가 불가결하며, 연신 폴리프로필렌과 원자층 코팅을 기반으로 하는 EVOH 대체 화학 기술이 공압출 타이층 없이 산소 투과율 0.1cc/m2/일 이하를 실현합니다. 지속적인 개선 프로토콜은 재활용 가능성에 대한 주장과 소매업체 목록 게시를 보장하기 위해 설계를 APR 중요 지침에 비추어 평가합니다.

다층 라미네이트는 연포장 총 중량의 26%를 차지하는 반면, 혼합 폴리머가 기계적 분리를 방해하기 때문에 곡선측 회수율은 10% 미만에 머물고 있습니다. BASF사와 톰라사의 화학적 박리 파일럿 플랜트에서는 최대 69%의 청정 분획을 추출 가능하지만, 상업화는 초기 단계입니다. 지자체 프로그램은 고가치 PET 병을 우선하기 때문에 필름 스트림에의 자금 투입이 부족해, 이것에 의해 북미 연포장 시장은 스케일러블한 선별 솔루션이 등장할 때까지 억제될 전망입니다.

플라스틱 기재는 2025년 시점에서 북미 연포장 시장의 86.72%의 점유율을 유지했으며, 밀봉성, 강성 및 비용 효율의 균형이 뛰어난 LDPE, HDPE, BOPP 필름이 견인하고 있습니다. 그러나 소매업체가 재생할 수 없는 적층재에서 섬유 기반의 가방 및 우송용 가방으로 전환하는 움직임에 따라 판지 등급은 CAGR 4.41%로 확대되고 있습니다. Sappi North America사에 의한 5억 달러 규모의 제지기 2호기의 업그레이드에 의해 고형 표백 황산 펄프의 생산 능력이 연간 47만 톤으로 확대되었습니다. 이것은 높은 장벽 코트 용지에 대한 확고한 신뢰를 보여줍니다. 알루미늄 포일은 습기에 민감한 의약품의 보호 용도로 계속 활용되고 있지만, 에너지 소비량이 높아 소규모 틈새 시장에 머물고 있습니다.

순환형 경제의 요청에 의해 PCR(포스트 컨슈머 재생재)의 채용이 가속되고 있습니다. FDA(미국 식품의약국)의 2022년 지침에서는 식품 등급 재생 PE의 화학적 요건이 명확화되어 장벽 성능을 손상시키지 않고 최대 30%의 PCR율 달성이 가능해졌습니다. 북미의 종이 기재 관련 연포장 시장 규모는 2031년까지 21억 8,000만 달러의 증수가 전망됩니다. 한편, 다층 필름 제조업체는 리사이클성을 유지하기 위해, 무용제 라미네이션과 상용화제 첨가물로의 전환을 진행하고 있습니다. 브랜드 소유자는 금속화 층을 기능성 수성 코팅으로 대체하는 섬유 및 폴리 하이브리드 형식을 평가하고 있으며 기존 플라스틱 공급업체의 혼란 위험을 완화하는 전환 경로를 창출하고 있습니다.

North America flexible packaging market size in 2026 is estimated at USD 53.62 billion, growing from 2025 value of USD 51.92 billion with 2031 projections showing USD 62.98 billion, growing at 3.27% CAGR over 2026-2031.

Mature end-user demand, tightening sustainability regulations and incremental technology upgrades underpin this steady trajectory. Growth centers on recyclable mono-material designs, automation in e-commerce fulfillment, and surging health-care packaging volumes, even as polymer-price volatility and multilayer film recycling gaps temper near-term upside. Brand owners now embed post-consumer resin targets directly into long-term procurement contracts, while converters expand fiber-based offerings to serve retailers' plastic-reduction pledges. The competitive field remains fragmented; scale players consolidate to access circular-economy know-how and lock in cost advantages.

Portable consumption habits continue to expand single-serve packaging investments. Mars and PepsiCo's 2024 portfolio additions relied on flexibles that balance shelf life with portion control, prompting converters to scale high-speed form-fill-seal capacity. packaging-machinery shipments reached USD 10.9 billion in 2023, led by pouching lanes optimized for 70-100 units per minute guidance now clarifies conditions under which recycled polyethylene can enter food-contact applications, enabling brands to pre-blend PCR while protecting product integrity. The regulatory clarity supports snack launches in mono-material PE stand-up pouches that meet How2Recycle "store-drop-off" criteria, reinforcing volume momentum.

Multilayer films historically solved barrier challenges but suffer from <10% collection rates in North America. Brand owners now redesign portfolios around single-polymer formats; Mondi's polypropylene yogurt pouch for Skanemejerier maintained 60-day shelf life while entering existing recycle streams . Amcor's AmPrima Plus platform reports up to 68% lower cradle-to-gate carbon footprint versus laminated structures. The transition depends on functional barrier resins, including EVOH replacement chemistries that rely on oriented PP plus atomic-layer coatings, enabling oxygen-transmission rates under 0.1 cc/m2/day without co-extruded tie layers. Continuous-improvement protocols now benchmark designs against APR Critical Guidance to secure recyclability claims and retailer listings.

Multilayer laminates make up 26% of flexible-packaging tonnage yet achieve <10% curbside recovery because mixed polymers hinder mechanical separation.Chemical-delamination pilots from BASF and Tomra extract up to 69% clean fractions, but commercialization is at early stages. Municipal programs prioritize higher-value PET bottles, leaving film streams underfunded, thereby restraining the North America flexible packaging market until scalable sortation solutions emerge.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Plastic substrates retained 86.72% share of the North America flexible packaging market in 2025, led by LDPE, HDPE and BOPP films that balance sealability, stiffness and cost efficiency. Yet paperboard grades grow at a 4.41% CAGR as retailers substitute non-recyclable laminates with fiber-based sachets and mailers. Sappi North America's USD 500 million upgrade of Paper Machine 2 boosts solid-bleached-sulfate capacity to 470,000 t/y, signaling confidence in high-barrier coated papers. Aluminum foil continues to protect moisture-sensitive pharmaceuticals but remains a small-volume niche owing to high energy intensity.

Circular-economy imperatives accelerate PCR incorporation, and FDA's 2022 guidance clarifies chemistry requirements for food-grade recycled PE, facilitating PCR rates up to 30% without barrier compromises. The North America flexible packaging market size tied to paper substrates is forecast to add USD 2.18 billion incremental revenue by 2031, while multilayer film producers pivot toward solvent-less lamination and compatibilizer additives to maintain recyclability. Brand owners evaluate fiber-poly hybrid formats where functional waterborne coatings replace metallized layers, creating a transition path that tempers disruptive risk for incumbent plastic suppliers.

The North America Flexible Packaging Market Report is Segmented by Material Type (Plastics, Paper, and Aluminum Foil), Product Type (Pouches, Bags and Sachets, Films and Wraps, Shrink Sleeves and Labels, and More), End-User Industry (Food, Beverage, Pharmaceutical and Medical, Household and Personal Care, and Industrial and Chemical), and Country. The Market Forecasts are Provided in Terms of Value (USD).