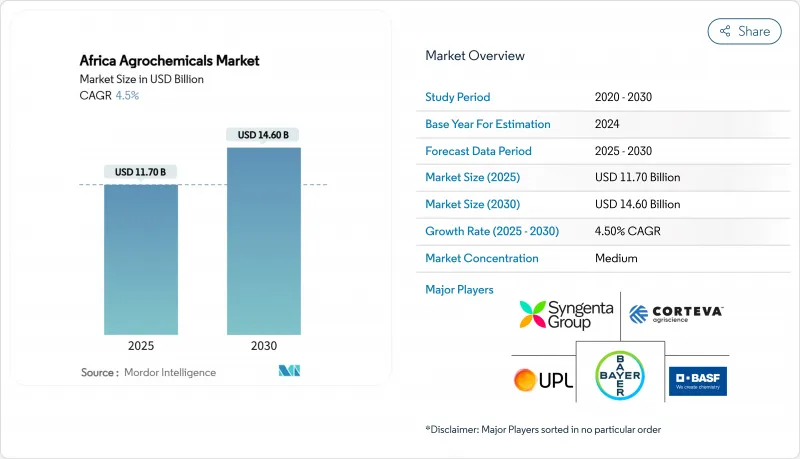

아프리카 농약 시장 규모는 2025년에 117억 달러, 2030년에는 CAGR 4.5%로 성장하여 146억 달러에 달할 것으로 예측됩니다.

2024년에는 아프리카 전역에서 토양양분의 고갈이 확산되고 있는 것을 배경으로 비료가 51%의 점유율을 차지하고 시장을 독점하고 있습니다. 식물성장조정제는 농가가 정밀한 살포방법을 채택하고 있기 때문에 CAGR 6.90%로 가장 높은 성장률을 보였습니다. 시장 성장을 지원하는 것은 해충 과제 증가, 인구 확대로 인한 식량 수요 증가, 영세 농민들의 접근성을 개선하는 정부 보조금 제도입니다. 높은 투입 비용과 지역 간의 일관성 없는 규제는 농업의 수율 격차 시정에 대한 노력을 제한하고 있습니다. 시장 진출기업은 현지 제조 시설의 설립, 혁신적인 유통망의 개발, 정밀화학 솔루션에 의한 지속 가능한 제품 라인의 구축을 진행하고 있습니다. 게다가 정부는 창고수취형 대출제도와 기계화 지원 프로그램을 확충하고 있으며, 이는 농약 시장 수요 증가를 뒷받침하고 있습니다.

불안정한 날씨 패턴은 아프리카 여러 나라에서 가을과 같은 침입 해충의 확산을 확대하여 옥수수 수율에 큰 영향을 미칩니다. 곡물 재배 지역에서의 스트라이거 잡초의 만연은 수확에 계속 영향을 미치고 있으며, 농부들은 종합적인 화학적 방제 프로그램을 실시하기에 이르고 있습니다. 케냐, 가나, 에티오피아는 응급 대응 프로토콜을 수립하고 지역 조직은 병해충 모니터링 네트워크를 조정하고 있습니다. 농업 관련 기업은 해충의 유충을 표적으로 한 정밀 살충제의 개발을 가속화하고 있으며, 디지털 모니터링 플랫폼은 농가에게 실시간 경보를 제공합니다. 이러한 요인은 아프리카 농약 시장의 지속적인 성장을 뒷받침하고 있습니다. 이 시장은 종자 처리제와 농가 교육 프로그램에 대한 투자를 통해 더욱 기세를 늘리고 있습니다. 민간 파트너십은 새로운 작물 보호 솔루션에 대한 농부의 접근을 개선하고 있습니다.

영세 농가가 농약을 권장 수준 이하로 사용하기 때문에 농업 생산성은 여전히 제한적입니다. 나이지리아, 에티오피아, 탄자니아에서는 도시로 이주하여 큰 제약이 발생하여 농업 노동력이 감소하고 있습니다. 정부의 이니셔티브는 국내 비료 생산과 관개 인프라 투자로 인한 수율 향상을 포함합니다. 에티오피아 관개 확대 프로그램은 저지대 생산성 향상과 수입 의존도 감소에 중점을 둡니다. 식량 수요 증가는 비료, 농약, 식물 성장 조절제 제품의 아프리카 농약 시장을 계속 견인하고 있습니다. 농업 딜러 네트워크 및 모바일 권고 서비스의 확장은 농민들의 투입 자재와 지식에 대한 접근성을 향상시키는 데 도움이 됩니다. 농부들은 날씨 변화에 대응하기 때문에 기후 변화에 강한 농약 솔루션을 채택하고 있습니다.

내륙 국가에서는 운송 비용이 최종 소매 가격의 최대 50%를 차지하고 있으며, 에티오피아에서는 최근 비료 가격이 크게 상승하고 있습니다. 케냐에서는 2025년 재정법안을 통해 농약에 16%의 부가가치세를 부과하는 것이 제안되어 생산비용이 크게 상승할 수 있습니다. 나이지리아에서는 2024년 중반에 기록적인 고수준의 식량 인플레이션이 발생하여 가계는 소득의 대부분을 식량에 지출할 수 없게 되어 농업 투자에 사용할 수 있는 자금이 감소했습니다. 농부들은 종종 높은 금리를 청구하는 비정규 금융업자에게 손을 내밀고 아프리카 농약 시장의 성장을 제한하는 부채 사이클을 생성합니다. 결과적으로 가격 문제로 인해 효과적인 작물 보호 제품의 도입이 줄어들고 수율이 최적화되지 않고 식량 안보 문제가 계속됩니다.

비료는 2024년 아프리카 농약 시장 점유율의 51%를 차지했고 광범위한 토양 양분 부족을 다루며 다양한 농업 생태학적 지역에서 농업 생산성을 지원합니다. 질소 기반 제제는 곡물 생산에 필수적인 것은 아니지만, 인산 비료와 칼리 비료는 균형 잡힌 영양 프로그램을 통해 보급되고 있습니다. 디지털 보조금 전자 바우처와 창고 수취형 신용 시스템은 경제적 장벽을 줄이고 시기 적절한 시비를 가능하게 합니다.

식물 성장 조절제는 CAGR 6.9%를 나타내며, 이는 스트레스 내성, 뿌리 발달, 수율 가능성을 향상시키는 영양소의 채택 증가에 기인합니다. 농약은 아프리카 전역에서 상당한 양을 유지하고 있으며 노동력 부족과 잡초의 내성 개체수 때문에 제초제가 우세합니다. 살충제 수요는 기후와 관련된 해충의 발생에 따라 증가하고 살균제의 사용은 원예 지역에서 확대됩니다. 보조제는 정밀 살포 장치가 잎 코팅 속도를 향상시키고 탱크 혼합을 단순화하기 위해 고급 제제를 필요로 하기 때문에 작은 분야이지만 중요성이 커지고 있습니다.

The Africa agrochemicals market size reached USD 11.7 billion in 2025 and is projected to grow at a CAGR of 4.5% to USD 14.6 billion by 2030.

Fertilizers dominated the market with a 51% share in 2024, driven by widespread soil nutrient depletion across Africa. Plant growth regulators exhibited the highest growth rate at 6.90% CAGR, as farmers adopt precision application methods. The market growth is supported by increasing pest challenges, growing food demand from population expansion, and government subsidy programs that improve access for smallholder farmers. High input costs and inconsistent regulations across regions limit efforts to close the agricultural yield gap. Market participants are establishing local manufacturing facilities, developing innovative distribution networks, and creating sustainable product lines with precision chemical solutions. Additionally, governments are expanding warehouse-receipt financing systems and mechanization support programs, which drive increased demand in the agrochemicals market.

Variable weather patterns have increased the spread of invasive pests like fall armyworm across multiple African nations, significantly impacting maize yields. Striga weed infestations in cereal-growing regions continue to affect harvests, leading farmers to implement integrated chemical control programs. Kenya, Ghana, and Ethiopia have established emergency response protocols, while regional organizations coordinate pest surveillance networks. Agricultural companies have accelerated the development of precision insecticides targeting pest larvae, and digital monitoring platforms provide real-time alerts to farmers. These factors drive sustained growth in the Africa agrochemicals market. The market gains additional momentum through investments in seed treatment chemicals and farmer education programs. Public-private partnerships are improving farmer access to new crop protection solutions.

Agricultural productivity remains limited as smallholder farmers use agrochemicals below recommended levels. Nigeria, Ethiopia, and Tanzania experience significant constraints due to urban migration, reducing the agricultural workforce. Government initiatives include investments in domestic fertilizer production and irrigation infrastructure to improve yields. Ethiopia's irrigation expansion program focuses on increasing lowland productivity and decreasing import dependence. Growing food demand continues to drive the African agrochemicals market for fertilizers, pesticides, and plant growth regulator products. The expansion of agricultural dealer networks and mobile advisory services helps improve farmers' access to inputs and knowledge. Farmers increasingly adopt climate-resilient agrochemical solutions to address changing weather conditions.

Transport costs in landlocked countries account for up to 50% of final retail prices, while Ethiopia experienced significant increases in fertilizer prices in recent years. Kenya's proposed 16% VAT on agrochemicals through the 2025 Finance Bill may substantially increase production costs. Nigeria's record-high food inflation in mid-2024 forced households to spend most of their income on food, reducing funds available for farm investments. Farmers often turn to informal lenders charging high weekly interest rates, creating debt cycles that limit growth in the Africa agrochemicals market. The resulting affordability issues reduce the adoption of effective crop protection products, leading to suboptimal yields and continued food security challenges.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Fertilizers held 51% of the Africa agrochemicals market share in 2024, addressing widespread soil nutrient deficiencies and supporting agricultural productivity across various agroecological zones. Nitrogen-based formulations remain essential for cereal production, while phosphatic and potassic fertilizers gain adoption through balanced nutrition programs. Digital subsidy e-vouchers and warehouse-receipt credit systems reduce financial barriers and enable timely fertilizer application.

Plant growth regulators demonstrate a 6.9% CAGR, driven by increased adoption of nutrients that improve stress tolerance, root development, and yield potential. Pesticides maintain significant volume across Africa, with herbicides dominating due to labor shortages and resistant weed populations. Insecticide demand increases in response to climate-related pest outbreaks, while fungicide use expands in horticultural regions. Adjuvants, though a smaller segment, grow in importance as precision spraying equipment requires advanced formulations for improved leaf coverage and simplified tank mixing.

The African Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators), by Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Commercial Crops), and by Geography (Egypt, Morocco, Tanzania, South Africa, and More). The Report Offers the Market Size and Forecasts in Terms of Value (USD).