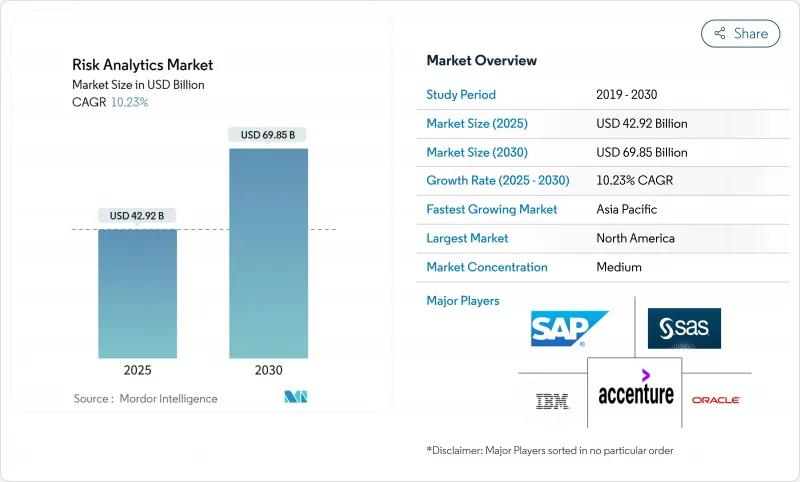

세계의 리스크 분석 시장 규모는 2025년에 429억 2,000만 달러, 2030년에는 CAGR 10.2%로 698억 5,000만 달러에 이를 것으로 예상됩니다.

규제 당국의 감시 강화, 즉각적인 결제 레일의 실시간 부정 행위, 기후 변화 위험 공개의 의무화에 따라 고급 분석은 재량적인 IT 지출이 아니라 전략적으로 필요합니다. 금융기관은 규칙 기반 도구를 폐지하고 수백만 개의 데이터 포인트를 밀리초 단위로 평가하고 자본 최적화, 부정행위 차단, 기후 변화 시나리오 모델링을 지원하는 AI 주도 플랫폼을 채택하고 있습니다. 클라우드 네이티브 아키텍처, 내양자성 알고리즘 및 통합 데이터 패브릭은 총 소유 비용을 줄이는 동시에 법률을 넘어 병렬 컴플라이언스 보고를 가능하게 합니다. 이러한 세력의 수렴은 소프트웨어, 컨설팅, 매니지드 오퍼레이션을 융합한 Platform-as-a-Service 딜리버리로 벤더 전략을 재구성하고 있습니다.

즉시 결제 환경은 배치 사기 도구를 압도하는 트랜잭션 수준의 공격에 은행을 노출합니다. 세계의 실시간 결제 건수는 2028년까지 5,750억 건에 이를 전망으로, 금융기관은 오검지율을 1% 미만으로 유지하면서 행동 바이오메트릭스, 기기 인텔리전스, 네트워크 분석을 융합한 밀리초 분석의 도입을 강요받고 있습니다. 영국에서는 푸시 지불에 의한 부정 행위에 대한 환불 규칙이 의무화되어 거래 발생과 동시에 점수를 매기는 AI 네이티브 플랫폼의 경제적 가치가 높아지고 있습니다. 스트리밍 데이터 수집, 그래프 분석 및 모델 거버넌스를 단일 클라우드 네이티브 스택으로 통합할 수 있는 공급업체는 결정적인 이점을 유지합니다.

EU의 2025년 1월 바젤 IV 도입 및 FINMA의 운영 리스크 강화 조례는 다국적 은행이 여러 리스크 가중 자산 계산을 병행하여 수행하도록 의무화되었습니다. 클라우드 기반 몬테카를로 엔진은 BCBS239의 데이터 집계 테스트를 충족하면서 서로 다른 룰 세트간에 거의 실시간 자본 최적화를 가능하게 합니다. 규제 당국이 현장에서 데이터 감사를 강화하는 동안, 통합된 데이터 연계, 감사 추적 및 시나리오 라이브러리에 대한 수요는 규제 로직을 기본적으로 통합한 서비스 풍부한 플랫폼으로의 전환을 가속화하고 있습니다.

은행의 54%가 정량적 검증 기술 부족을 보고하고 있으며 모델 출시를 늦추고 컴플라이언스 비용을 늘리고 있습니다. 통계, 규제에 대한 인사이트, AI 능력을 겸비한 전문가의 급여 상승률이 가장 높습니다. 금융기관은 프로덕션 데이터를 재생하고 거버넌스 경보를 발행하는 자동 검증 툴킷을 채택하고 있지만 감독 당국은 여전히 인간의 사인 오프가 필요합니다. 워크플로우, 문서화, 자동화된 테스트 기능을 번들하는 공급업체는 제약을 완화하지만 희귀 전문성을 완전히 대체할 수는 없습니다.

시장 점유율 데이터에 따르면 2024년 시장 규모는 솔루션이 65%이었지만 서비스 부문은 CAGR 11.8%로 보다 빠르게 확대되고 있습니다. 은행이 AI 거버넌스, 기후 변화 스트레스 테스트, 양자 리스크 모델링을 진행하면서 컨설팅, 구현 및 관리 운영과 관련된 리스크 분석 시장 규모가 확대됩니다. 서비스 회사는 첨단 엔진과 레거시 코어의 통합을 지원함과 동시에 출력을 관할 템플릿에 맞춥니다. 이와 병행하여, 코어 소프트웨어는 저코드로 구성 가능한 것, 자연 언어 프론트엔드, 내양자성 라이브러리로 진화하고 있습니다.

지속적인 규제 변경으로 고객은 모델 인벤토리의 큐레이션, 문서화 및 검증을 외부 전문가에 의존합니다. 데이터 품질, 시나리오 라이브러리 및 실시간 모니터링을 다루는 관리형 서비스는 중견 기업의 오버헤드를 줄입니다. 결과적으로 영구 라이선스가 유지되는 경우에도 지출은 정기적인 서비스 계약에 기울어집니다. 소프트웨어 업그레이드와 성과 기반 서비스 계약을 융합시킨 공급업체는 업데이트 및 업셀 기회를 확보합니다.

On-Premise 시스템은 2024년에도 67.6%의 점유율을 유지했습니다. 그러나 클라우드의 CAGR은 12.1%로 SaaS와 platform-as-a-service 모델을 통해 제공되는 리스크 분석 시장의 가치를 높여 결정적인 전환세를 보이고 있습니다. 클라우드 배포는 주간 스트레스 테스트, 실시간 악성 스코어링, 높은 빈도 시장 위험 재계산을 위한 탄력적인 컴퓨팅 버스트를 지원합니다. 소블린 클라우드 존 공급자는 유럽, 중동 및 아시아에서 데이터 거주에 대한 이의를 완화합니다.

마이그레이션 로드맵에서는 하이브리드 아키텍처가 주류입니다. 레거시 크레딧 엔진은 On-Premise로 유지되며 AI 추론 레이어, 시각화 대시보드 및 배치 보고는 클라우드 마이크로서비스로 전환됩니다. 고객은 멀티클라우드 오케스트레이터를 사용하여 잠금을 피하고 대기 시간, 비용 및 데이터 현지화 제약에 맞게 워크로드를 조정합니다. 워크로드 게재위치 로직과 크로스클라우드 비용 분석을 통합한 솔루션은 금융기관이 자원 할당 전략을 정교하게 함에 따라 월렛 점유율을 얻습니다.

리스크 분석 시장 보고서는 구성 요소별(솔루션 및 서비스), 배포별(On-Premise 및 클라우드), 위험 유형별(신용, 운영, 기타), 용도별(부정 감지 및 AML, 스트레스 테스트 및 시나리오 분석 등), 최종 사용자 업계별(은행, 금융서비스 및 보험(BFSI), 의료 및 생명 과학, 기타), 조직 규모별(대기업 및 중소기업)

북미는 엄격한 감독 체제와 하이퍼스케일 클라우드의 조기 도입에 힘입어 2024년 매출의 38.6%를 차지했습니다. 미 연방 준비 제도 이사회(FRB)의 기후 지침과 바젤 III의 최종 규칙은 자본 최적화, 스트레스 테스트, 데이터 연계 솔루션에 대한 지출을 지원합니다. 미국 금융기관은 또한 IBM의 수십억 달러 규모의 양자 로드맵에 의해 지원되며, 미래를 기대하는 결제 레일을 위해 내양자암호화를 시험적으로 도입하고 있습니다.

유럽은 큰 점유율을 차지하고 세계 규제 템플릿을 형성합니다. 2025년 디지털 운영 탄력성 법을 시행함으로써 은행은 ICT-리스크 분석을 기존 금융 리스크 지표와 통합해야 합니다. BCBS239 준수는 실시간 데이터 집계에 대한 투자를 뒷받침합니다. 분할된 회원국의 규칙은 여러 보고 스키마를 일관된 데이터 모델에 매핑하는 플랫폼에 대한 수요를 높이고 있습니다.

아시아태평양은 CAGR 11.5%로 가장 빠르게 성장하고 있습니다. 인도의 Unified Payments Interface는 매월 수십억 건의 송금을 처리하여 실시간 부정 행위의 필요성을 높이고 있습니다. 중국은 공급망 금융 분석을 심화시켜 디지털 통화 리스크의 틀을 준비했습니다. 동남아시아 시장에서는 얼터너티브 데이터를 이용한 첫 차용인 신용 스코어링이 가속화되었습니다. 규제 당국이 공급업체의 승인을 가속화하는 샌드박스 방식을 채용하여 현지 데이터 현지화 규범에 적합한 확장 가능한 클라우드 제공 제품의 신속한 배포를 촉진합니다.

The global risk analytics market is valued at USD 42.92 billion in 2025 and is projected to reach USD 69.85 billion by 2030 at a 10.2% CAGR.

Heightened regulatory scrutiny, real-time fraud exposure on instant-payment rails, and mandatory climate-risk disclosure are making advanced analytics a strategic necessity rather than a discretionary IT spend. Financial institutions are phasing out rule-based tools in favor of AI-driven platforms that evaluate millions of data points within milliseconds to support capital optimization, fraud interdiction, and climate scenario modeling. Cloud-native architectures, quantum-resistant algorithms, and unified data fabrics are cutting total cost of ownership while enabling parallel compliance reporting across jurisdictions. The convergence of these forces is reshaping vendor strategies toward platform-as-a-service delivery that merges software, consulting, and managed operations.

Instant settlement environments expose banks to transaction-level attacks that overwhelm batch fraud tools. Global real-time payment volumes are on track to hit 575 billion transactions by 2028, forcing institutions to deploy millisecond analytics that blend behavioral biometrics, device intelligence, and network analytics while maintaining false-positive rates below 1%. The United Kingdom's mandatory reimbursement rule for authorized push-payment fraud strengthens the economic case for AI-native platforms that score transactions as they occur. Vendors that can combine streaming data ingestion, graph analytics, and model governance within a single cloud-native stack hold a decisive edge.

The EU's January 2025 Basel IV rollout and FINMA's enhanced operational-risk ordinances oblige multinational banks to run several risk-weighted asset calculations in parallel. Cloud-based Monte-Carlo engines allow near real-time capital optimization across diverging rulesets while satisfying BCBS 239 data-aggregation tests. As regulators intensify on-site data audits, demand for unified data lineage, audit trails, and scenario libraries accelerates the migration toward service-rich platforms that embed regulatory logic natively.

Fifty-four percent of banks report gaps in quantitative validation skills, delaying model releases and inflating compliance costs. Salary inflation is steepest for specialists who combine statistics, regulatory insight, and AI competence. Institutions are adopting automated validation toolkits that replay production data and issue governance alerts, but supervisors still require human sign-off. Vendors that bundle workflow, documentation, and auto-testing capabilities mitigate the constraint yet cannot fully replace scarce expertise.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Market share data show Solutions at 65% in 2024, yet the Services arm is expanding faster at 11.8% CAGR. The risk analytics market size tied to consulting, implementation, and managed operations grows as banks confront AI governance, climate stress testing, and quantum-risk modeling. Service firms help integrate advanced engines with legacy cores while aligning outputs to jurisdictional templates. In parallel, core software evolves toward low-code configurability, natural language front-ends, and quantum-resistant libraries.

Ongoing regulatory change keeps customers reliant on external specialists for model inventory curation, documentation, and validation. Managed services covering data quality, scenario libraries, and real-time monitoring reduce overhead for mid-tier players. As a result, spending tilts toward recurring service contracts even where perpetual licenses remain in place. Vendors that fuse software upgrades with outcome-based service commitments guard renewals and upsell opportunities.

On-premises systems retain 67.6% share in 2024 as institutions guard sensitive data against extraterritorial access. Yet a 12.1% CAGR for cloud indicates decisive migration momentum, raising the risk analytics market value delivered via SaaS and platform-as-a-service models. Cloud deployments support elastic compute bursts for intraday stress testing, real-time fraud scoring, and high-frequency market-risk recalculations. Providers of sovereign-cloud zones ease data-residency objections in Europe, the Middle East, and Asia.

Hybrid architectures dominate transition roadmaps. Legacy credit engines remain on-premises while AI inference layers, visualization dashboards, and batch reporting shift to cloud micro-services. Clients use multi-cloud orchestrators to avoid lock-in and align workloads with latency, cost, and data-localization constraints. Solutions that embed workload-placement logic and cross-cloud cost analytics capture wallet share as institutions refine resource allocation strategies.

The Risk Analytics Market Report is Segmented by Component (Solution and Services), Deployment (On-Premises and Cloud), Risk Type (Credit, Operational, and More), Application (Fraud Detection and AML, Stress Testing and Scenario-Analysis, and More), End-User Industry (BFSI, Healthcare and Life-Sciences, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), and Geography.

North America held 38.6% of revenue in 2024, underpinned by strict supervisory regimes and early hyperscale-cloud adoption. The Federal Reserve's climate guidance and Basel III endgame rules sustain spending on capital optimization, stress testing, and data lineage solutions. U.S. institutions also pilot quantum-resistant encryption to future-proof payment rails, supported by IBM's multi-billion dollar quantum roadmap.

Europe commands significant share and shapes regulatory templates worldwide. Implementation of the Digital Operational Resilience Act in 2025 obliges banks to integrate ICT-risk analytics with traditional financial-risk metrics. The bloc's leadership on ESG rules propels climate-scenario spending, while BCBS 239 compliance pushes real-time data aggregation investments. Fragmented member-state rules raise demand for platforms that map multiple reporting schemas onto consistent data models.

Asia-Pacific is the fastest-growing region at 11.5% CAGR. India's Unified Payments Interface processes billions of monthly transfers, heightening real-time fraud needs. China deepens supply-chain finance analytics and readies digital currency risk frameworks. Southeast Asian markets accelerate credit-scoring for first-time borrowers using alternative data. Regulators adopt sandbox schemes that speed vendor approvals, fuelling rapid deployment of scalable cloud offerings adapted to local data-localization norms.