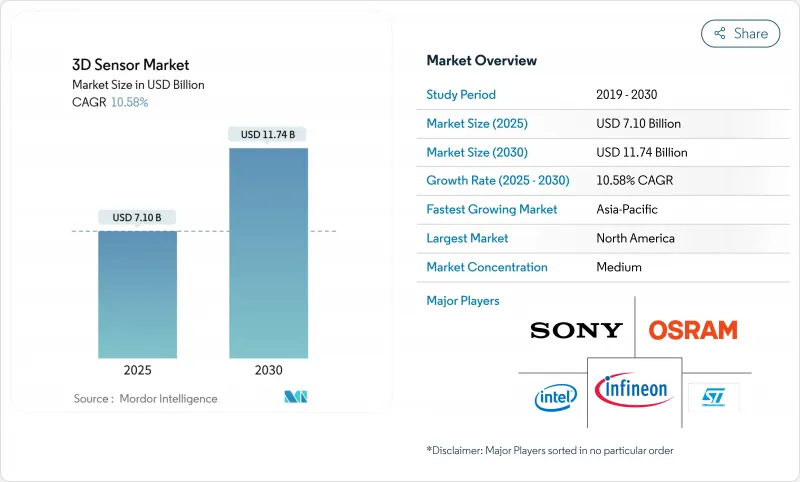

세계의 3D 센서 시장의 2025년 시장 규모는 71억 달러로, 2030년까지 117억 4,000만 달러에 이르고, CAGR 10.58%를 보일 것으로 예측됩니다.

소비자용 전자기기, 자동차 안전성, 산업 자동화, 신흥 복합 현실 플랫폼 등 공간 인식에 대한 수요 증가가 성장을 지원하고 있습니다. 광소자의 소형화, 온센서 엣지 처리의 통합, 단가 하락이 용도의 대응 가능한 베이스를 확대하고 있습니다. 지역적인 기세는 아시아태평양에서 가장 강하고, 아시아태평양에서는 일렉트로닉스의 제조 능력이 높기 때문에 설계부터 생산까지의 사이클이 단축되고, 중동에서는 정부의 지원을 받은 스마트 시티에 대한 투자가 채용을 가속시키고 있습니다. 경쟁사와의 차별화는 이산 하드웨어 사양에서 임베디드 환경에서의 대기 시간과 전력 소비를 줄이는 센싱 + 소프트웨어 스택 통합으로 전환하고 있습니다.

아시아의 프리미엄 휴대전화는 2026년까지 3D 얼굴 인증 장착률이 65%를 돌파해 3D 센서 시장 최대의 단일 용도 기반을 굳힐 것으로 예측됩니다. 구조 광 모듈과 비행 시간 모듈은 현재 다양한 조명 하에서 신뢰할 수 있는 서브밀리미터 깊이 맵을 생성하여 안전한 결제, 아바타 생성 및 개인화된 UI를 가능하게 합니다. 아시아 OEM은 견고성을 희생하지 않고 간구를 절약하기 위해 센서를 디스플레이 아래로 이동시킵니다. 휴대폰 단말기의 대량 생산은 웨어러블 단말기와 스마트 홈 단말기 등 인접 분야의 부품 비용을 낮추고 수요의 선순환을 강화하고 있습니다.

유럽 자동차 제조업체는 2026년 NCAP에서 의무화된 보행자 자동 긴급 브레이크에 앞서 LiDAR 기반 ADAS를 도입했습니다. 솔리드 스테이트 설계는 최대 200m에서 센티미터 수준의 정확도를 제공하며 까다로운 자동차 신뢰성 테스트를 충족하는 동시에 재료 비용을 절감합니다. 유럽에서의 규제 강화의 움직임은 북미에서의 자발적인 이니셔티브와 호응하며, 세계의 Tier 1 센서 공급자에게 이익을 가져오는 균질한 요건 프로파일을 만들어 내고 있습니다. 비용 곡선이 감소함에 따라, LiDAR의 채택은 프리미엄 모델에서 미드부문 차량으로 연결되어 시장 세분화의 대응 가능한 수량이 확대될 것으로 예측됩니다.

VCSEL 이미터는 이전보다 더 작은 실적으로 높은 광 출력을 달성하기 위해 근접하게 배치되기 때문에 어레이의 중심 요소는 주변 온도보다 50°C 더 높을 수 있습니다. 접합부 온도의 상승은 효율을 감소시키고 치명적인 고장을 유발할 위험이 있습니다. 디바이스 제조업체는 분할된 구동회로와 열에 민감한 광학계에 도달하기 전에 구리층에 횡방향으로 인도하는 첨단 패키징을 시도하고 있습니다. 이러한 기술 혁신의 채택은 소형 소비자 디바이스 내부의 성능을 유지함으로써 3D 센서 시장에 대한 현재의 발판을 완화시킬 것으로 보입니다.

이미지 센서는 2024년 매출의 62%를 차지해 3D 센서 시장에서의 기본적인 역할을 뒷받침하고 있습니다. 서브밀리미터 정밀도로 5m 범위에 이르는 고해상도 깊이 맵에 의존하는 스마트폰, 산업 검사, 로봇으로부터 강한 수요가 발생하고 있습니다. 멀티 스택 후면 조사 아키텍처와 온칩 HDR 파이프라인은 S/N 비율을 계속 개선하고 있습니다. 주요 공급업체는 300mm 웨이퍼 라인으로 이동하여 메가픽셀당 비용을 낮추는 수율 개선을 추진하고 있습니다.

제스처 인식 센서는 인포테인먼트 콘솔, 인터랙티브 키오스크, 헬스케어 기기에 터치리스 인터페이스가 침투함에 따라 2030년까지 연평균 복합 성장률(CAGR)이 14.8%로 가장 빠르게 확대됩니다. 새로운 모듈은 ToF 깊이, 밀리미터파 레이더 및 AI 추론을 단일 기판에 융합하여 조명이 변화하는 환경에서도 복잡한 손 포즈를 인식할 수 있습니다. 아시아태평양의 숙련된 OEM 설계 팀은 개발 사이클을 더욱 단축하고 이 분야가 3D 센서 시장에서 높은 점유율을 얻는 데 기여하고 있습니다.

위치 센서, 관성 측정 장치(IMU) 및 서모파일 소자는 광학식으로 한계가 있는 특정 정확도 및 환경 요구 사항에 대응합니다. 공급업체 간의 교차 라이선스로 IP가 통합되어 시스템 설계자가 멀티벤더에서 사용할 수 있습니다.

이미지 센서의 하위 카테고리는 2024년 시장 규모가 44억 달러로 가장 크고 2030년까지 연평균 복합 성장률(CAGR)은 한 자리 대 중반으로 예상됩니다. 이 범주에서는 뒷면 조사형 적층 CMOS 아키텍처가 출하의 약 50%를 차지하고 저소비 전력으로 보다 높은 다이나믹 레인지를 실현하는 움직임이 현저합니다. 제스처 인식 모듈은 베이스가 작음에도 불구하고 공공 공간과 개인 공간이 표면에서의 공유 접촉을 최소화하려고 하기 때문에 2030년까지 16억 달러의 매출 증가에 기여할 것으로 예측됩니다. 이 급증은 다양한 폼 팩터가 3D 센서 시장 전체의 성장세를 강화하고 있음을 보여줍니다.

비행 시간 센서는 2024년 총 매출의 46%를 차지했는데, 이는 비용과 정밀도의 균형이 양호하다는 것을 반영합니다. 성숙한 VCSEL 이미터와 간단한 단일 광자 애벌란시 다이오드(SPAD) 수신기는 간접 ToF가 민생 장비를 지배합니다. 피코초의 타이밍 분해능을 가진 직접 ToF는 보다 긴 작동 거리를 필요로 하는 로봇 공학과 산업 자동화로 선도하고 있습니다. 포토다이오드와 동일한 다이에 용량성 깊이 계산 엔진을 통합하면 대기 시간을 줄이고 호스트 프로세서로의 왕복 없이 에지 AI 모델에 전원을 공급할 수 있습니다.

LiDAR 솔루션은 현재 출하량이 적은 자동차 자율화 프로그램 및 인프라의 디지털 트윈 프로젝트에 힘입어 2030년까지 13.61%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다. 솔리드 스테이트 스캐닝, 마이크로 전기 기계식 빔 스티어링 및 주파수 변조 연속파 아키텍처는 가동 매수를 줄이면서 범위를 향상시킵니다. 이러한 진보는 점군당 비용을 절감하고 고급 차량 이외의 3D 센서 시장을 확대합니다.

구조화된 광원은 얼굴 잠금 해제 및 산업 측정과 같은 근거리에서 고화질 캡처를 수행하는 경우 여전히 바람직한 옵션입니다. 스테레오 비전과 초음파는 특정 틈새 분야에서 비계를 유지합니다. 스테레오는 능동적인 조명을 필요로 하지 않는 렌즈 기반 대안을 제공하며, 초음파는 광로가 먼지나 액체에 의해 방해되는 경우에 성공합니다.

3D 센서 시장 점유율 보고서는 제품별(위치 센서, 이미지 센서 등), 기술별(구조화광, 비행 시간형 등), 최종 사용자 업계별(가전, 자동차 등), 컴포넌트별(IR VCSEL 이미터 등), 지역별(북미, 유럽, 아시아 등)으로 분류됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

아시아태평양은 2024년 세계 수익의 38%를 차지했습니다. 이 지역의 밀집 반도체 팹, 숙련된 광학 작업자, 수직 통합 공급망을 반영합니다. 이 지역의 매출의 약 40%는 중국이 차지하고 있으며, 이는 자사제 심도 모듈을 적극적으로 채용하고 있는 국내 스마트폰 OEM에 지지되고 있습니다. 일본은 정밀 유리 성형과 웨이퍼 레벨 광학 부품이 뛰어나 산업용 로봇용 고정밀 센서를 공급하고 있습니다. 한국은 첨단 패키징의 노하우를 활용하여 로직과 센싱을 단일 기판에 통합하여 소형 모듈의 열 성능을 향상시키고 있습니다.

중동은 저수준에서 시작되었지만 2030년까지 연평균 복합 성장률(CAGR)은 12.87%에 이를 전망입니다. 각국의 스마트 시티 로드맵은 깊이를 감지하는 스트리트 패니처, 자동 소매 키오스크, AI 대응 헬스케어 화상 처리 장치의 설치에 자금을 제공합니다. 걸프 협력 회의의 국내 시스템 통합사업자는 유럽 및 아시아 컴포넌트 공급업체와 협력하여 기후 및 언어 요구 사항을 충족하는 솔루션을 현지화합니다. 소매 업계에서는 신속한 조달주기로 테스트 운영부터 생산까지의 일정이 빨라지고 3D 센서 시장에 단기적인 상승을 가져옵니다.

북미는 여전히 LiDAR RandD의 진원지이며 활기찬 벤처 생태계와 국방 주도 연구 보조금에 의해 지원됩니다. 북미의 자동차 부품 제조업체는 칩 스케일 빔 스티어링의 추진을 주도하고 있습니다. 유럽은 엄격한 데이터 보호법에도 불구하고 자동차 및 산업 자동화 분야에서 수요를 유지하고 가장자리에서 개인 데이터를 처리하는 센서 설계에 박차를 가하고 있습니다. 남미에서는 보안과 아그리텍의 조기 도입을 볼 수 있지만, 아프리카에서의 도입은 주로 견고한 센싱 솔루션을 필요로 하는 물류 거점이나 채굴 작업에 한정되어 있습니다.

The 3D sensor market is valued at USD 7.1 billion in 2025 and is forecast to reach USD 11.74 billion by 2030, advancing at a 10.58% CAGR.

Growth is anchored in rising demand for spatial awareness across consumer electronics, automotive safety, industrial automation, and emerging mixed-reality platforms. Miniaturization of optical components, integration of on-sensor edge processing, and falling unit costs are enlarging the addressable base of applications. Regional momentum is strongest in Asia-Pacific, where deep electronics manufacturing capacity shortens design-to-production cycles, while government-backed smart-city spending is accelerating adoption in the Middle East. Competitive differentiation is now moving from discrete hardware specifications toward complete sensing-plus-software stacks that reduce latency and power consumption in embedded environments.

Premium handsets in Asia are expected to pass a 65% attachment rate for 3D facial recognition by 2026, consolidating the 3D sensor market's largest single application base. Structured-light and Time-of-Flight modules now generate sub-millimeter depth maps reliable under varied lighting, enabling secure payments, avatar creation, and personalized UI. Asian OEMs have moved sensors beneath the display to save frontage without sacrificing robustness. Volume scaling in handset production is lowering component costs for adjacent sectors such as wearables and smart-home devices, reinforcing a virtuous demand cycle.

European automakers are installing LiDAR-based ADAS ahead of the 2026 NCAP mandate for pedestrian automatic emergency braking. Solid-state designs deliver centimeter-level accuracy at up to 200 m, meeting stringent automotive reliability tests while shrinking bill-of-materials. The regulatory push in Europe is echoed by voluntary commitments in North America, creating a homogeneous requirements profile that benefits global tier-one sensor suppliers. As cost curves decline, LiDAR uptake is expected to cascade from premium models into mid-segment vehicles, enlarging the 3D sensor market addressable volume.

As VCSEL emitters are packed closer to achieve higher optical power in ever-smaller footprints, central elements in an array can run 50 °C hotter than ambient. Elevated junction temperatures degrade efficiency and risk catastrophic failure. Device makers are experimenting with segmented drive circuits and advanced packaging that routes heat laterally to copper layers before it reaches sensitive optics. Adoption of these innovations will moderate the current drag on the 3D sensor market by preserving performance inside compact consumer devices.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Image Sensors accounted for 62% of 2024 revenue, confirming their foundational role in the 3D sensor market. Robust demand arises from smartphones, industrial inspection, and robotics that depend on high-resolution depth maps spanning 5 m ranges with sub-millimeter precision. Multi-stack backside-illuminated architectures and on-chip HDR pipelines continue to improve signal-to-noise ratios. Leading suppliers have shifted to 300 mm wafer lines, driving yield improvements that lower cost per megapixel.

Gesture-Recognition Sensors record the fastest expansion, advancing at a 14.8% CAGR to 2030 as touchless interfaces penetrate infotainment consoles, interactive kiosks, and healthcare devices. New modules fuse ToF depth, millimeter-wave radar, and AI inference on a single substrate, enabling recognition of complex hand poses under variable lighting. Upskilled OEM design teams in Asia-Pacific further shorten development cycles, helping this segment accumulate a higher share of the 3D sensor market.

Position Sensors, Inertial Measurement Units, and Thermopile elements round out the portfolio, each addressing specific accuracy or environmental requirements where optical methods face limits. Cross-licensing among suppliers is consolidating IP, ensuring multi-vendor availability for system designers.

The image-sensor subcategory represents the largest 3D sensor market size at USD 4.4 billion in 2024 and is on course for a mid-single-digit CAGR through 2030. Within this category, back-illuminated stacked CMOS architectures commanded roughly 50% of shipments, underscoring the move toward higher dynamic range at lower power. Gesture-recognition modules, despite a smaller base, are set to contribute USD 1.6 billion incremental revenue by 2030 as public and private spaces look to minimize shared-surface contact. This surge illustrates how diversified form factors collectively reinforce growth momentum across the 3D sensor market.

Time-of-Flight sensors generated 46% of total revenue in 2024, reflecting their favorable cost-to-accuracy balance. Indirect ToF dominates consumer devices thanks to mature VCSEL emitters and simple single-photon avalanche diode (SPAD) receivers. Direct ToF variants, with picosecond timing resolution, lead in robotics and industrial automation requiring longer working distances. Integration of capacitive depth-computation engines on the same die as photodiodes slashes latency, feeding edge-AI models without round-trips to host processors.

LiDAR solutions, though smaller in today's shipment volumes, are growing at a 13.61% CAGR through 2030, propelled by automotive autonomy programs and infrastructure digital-twin projects. Solid-state scanning, micro-electro-mechanical beam steering, and frequency-modulated continuous-wave architectures are improving range while lowering moving-part counts. These advances reduce cost per point cloud and, by extension, broaden the 3D sensor market beyond premium vehicles.

Structured-light remains a preferred choice for close-range, high-detail capture such as facial unlocking and industrial metrology. Stereo vision and ultrasound maintain footholds in specific niches-stereo offers a lens-based alternative without active illumination, while ultrasound succeeds where optical paths are obstructed by dust or fluid.

3D Sensor Market Share Report is Segmented by Product (Position Sensors, Image Sensors and More), Technology (Structured Light, Time-Of-Flight and More), End-User Vertical (Consumer Electronics, Automotive and More), Component (IR VCSEL Emitters, and More), and Geography (North America, Europe, Asia and More). The Market Forecasts are Provided in Terms of Value (USD).

Asia-Pacific commanded 38% of global revenue in 2024, reflecting the region's dense semiconductor fabs, skilled optics workforce, and vertically integrated supply chains. China accounts for about 40% of regional sales, bolstered by domestic smartphone OEMs that are aggressively adopting in-house depth modules. Japan excels in precision glass molding and wafer-level optics, feeding high-accuracy sensors for industrial robotics. South Korea leverages advanced packaging know-how to integrate logic and sensing into single substrates, improving thermal performance in compact modules.

The Middle East, though starting from a low base, is on course for a 12.87% CAGR through 2030. National smart-city roadmaps fund installations of depth-sensing street furniture, automated retail kiosks, and AI-enabled healthcare imaging suites. Domestic system integrators in the Gulf Cooperation Council are forging partnerships with European and Asian component vendors to localize solutions that meet climatic and linguistic requirements. Rapid procurement cycles in the retail sector are accelerating pilot-to-production timelines, providing near-term upside for the 3D sensor market.

North America remains the epicenter of LiDAR RandD, supported by a vibrant venture ecosystem and defense-driven research grants. Tier-one automotive suppliers here lead the push toward chip-scale beam steering. Europe sustains demand in automotive and industrial automation despite rigorous data-protection laws, spurring sensor designs that process personal data at the edge. South America shows early adoption in security and agritech, while Africa's deployments are mainly confined to logistics hubs and mining operations that require rugged sensing solutions.