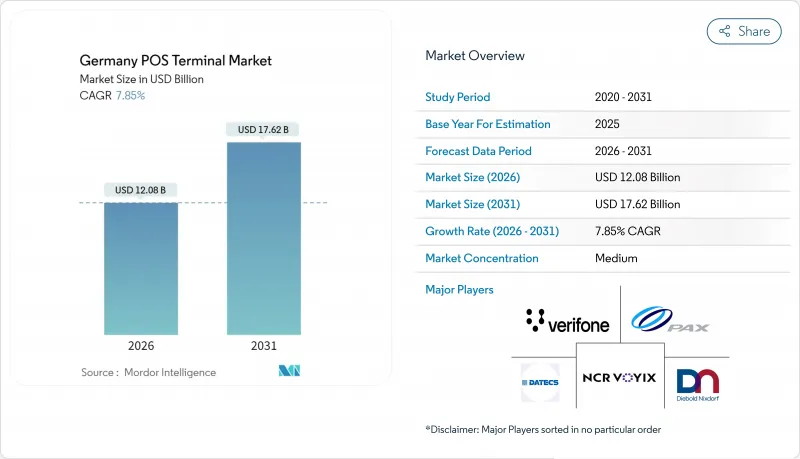

독일의 POS 단말기 시장 규모는 2026년에는 120억 8,000만 달러로 추정되고, 2025년 112억 달러에서 성장이 예상됩니다. 2031년까지 176억 2,000만 달러에 달할 것으로 예측되며, 2026-2031년 CAGR 7.85%로 확대될 전망입니다.

이 견조한 전망은 현금 결제로부터의 전환 가속, 비접촉 결제의 보급, 기로카드 결제 및 향후 디지털 유로 대응을 위한 단말 현대화를 의무화하는 규제 동향에 지지되고 있습니다. 스마트폰 보급률 상승, 강력한 광대역망, 소매업의 옴니 채널 전략은 NFC 대응 단말기, 클라우드 소프트웨어, 부가가치 결제 서비스에 대한 수요를 더욱 뒷받침하고 있습니다. 기존 기업은 원격 업데이트 아키텍처와 AI 구동형 분석으로 대응하는 한편, 신규 참가 기업은 모바일 POS 리더와 사업자용 월렛을 번들화해 기존 가격 미만의 전략을 전개하고 있습니다. 이에 따른 거래 데이터의 급증은 사기 방지 및 고객 인사이트에서 새로운 기회를 창출하고 공급자에게 추가 수익원을 제공합니다.

2024년 12월까지 girocard를 통한 비접촉 거래는 87%를 넘어, 이 급성장에 의해 가맹점은 토큰화와 멀티 월렛 기능을 갖춘 NFC 대응 리더의 도입이 요구되고 있습니다. 소비자는 점점 '탭 및 고'의 편리성을 기대하고 있으며, 18%가 선호하는 디지털 결제 수단을 이용할 수 없는 경우 거부감을 안기 때문에 미대응 점포의 근대화가 촉진되고 있습니다. 독일에서의 PCI DSS v4.0의 도입은 디바이스 레벨에서의 보다 강력한 암호화와 인증을 의무화함으로써 긴급성을 높이고 있습니다. 이러한 요인이 함께 최신 단말의 도입 기반이 확대되어 독일의 POS 단말기 시장의 기세를 유지하고 있습니다.

SumUp 및 Zettle의 모바일 POS 번들은 35유로 미만의 하드웨어 가격과 1% 미만의 투명한 Girocard 수수료로 도입 비용을 절감하고 소규모 소매점과 독립 카페에도 전자 결제를 도입 가능하게 하고 있습니다. 간소화된 도입 프로세스와 '성장에 따라 지불하는' 모델에 의해 계약상의 복잡성이 해소되어, 점포 거래에 있어서 캐쉬리스 결제의 수용율이 81%로 20포인트 상승하는 것에 직접 공헌하고 있습니다. 접객 사업자에게는 테이블 사이드 결제나 칩 기능의 편리성이, 팝업 소매업체에게는 고정 단말기를 회피할 수 있는 스마트폰 접속성이 활용되고 있습니다. 이러한 동향은 독일의 POS 단말기 시장에서 잠재 고객 기반의 확대로 이어지고 있습니다.

Visa와 Mastercard 직불카드 결제에서는 특히 모바일 월렛을 통해 국제결제망이 기본이 되는 경우 국내 girocard 레이트를 몇 배 넘는 가맹점 수수료가 발생하는 경우가 많습니다. 소규모 소매업체의 경우 수수료 증가는 순이익을 크게 압박하기 때문에 추가 요금 징수, 결제 상한 설정 또는 자동으로 저비용 결제 수단을 선택하는 단말 라우팅 로직의 도입을 검토할 수밖에 없습니다. 규제 당국은 경쟁 중립성을 추진하고 있지만, 단기적으로는 일부 단말에서의 거래 성장을 둔화시키고 독일의 POS 단말기 시장에서의 잠재 수익을 축소시키는 효과를 가져오고 있습니다.

비접촉 결제는 2025년 매장 결제의 65.18%를 차지하였고, CAGR 9.96%로 확대를 이어가고 있으며, 이 궤적은 예측 기간을 통해 탭앤고 단말기에 연결되는 독일 POS 단말기 시장 규모를 밀어올릴 전망입니다. 이 확대는 Girocard의 거의 보편적인 NFC 대응, 스마트 워치 월렛의 보급, 위생적인 비접촉 결제에 대한 소비자 신뢰감 증가를 반영합니다. 또한 거래 속도가 증가함에 따라 수입자 수수료 풀이 증가하고 있는 것도 이 부문의 성장에 기여하고 있습니다.

고액 구매, 비접촉 결제 상한액을 초과하는 PIN 입력이 필요한 흐름, 연료 소매 등의 업종에서는 접촉식 결제가 계속되지만 그 상대적인 점유율은 저하됩니다. 향후 실시 예정인 디지털 유로 시험 운용은 프로그램 가능한 CBDC 지갑이 신속한 소액 결제를 목적으로 하기 때문에 비접촉 결제의 정착을 더욱 촉진합니다. 이에 따라 가맹점은 오프라인 CBDC와 온라인 카드 인증 모두에 대응할 수 있는 듀얼 인터페이스 단말기를 도입하여 필드 업그레이드에 의한 대응을 진행시킵니다. 무선으로 펌웨어 다운로드를 간소화하는 공급업체는 금전 등록기의 작동 중지 시간을 최소화하기 때문에 더 선호되는 경향이 있습니다.

Germany POS Terminal Market size in 2026 is estimated at USD 12.08 billion, growing from 2025 value of USD 11.20 billion with 2031 projections showing USD 17.62 billion, growing at 7.85% CAGR over 2026-2031.

This solid outlook rests on the accelerated shift away from cash, the dominance of contactless transactions, and a regulatory agenda that obliges merchants to modernize terminals for girocard routing and forthcoming digital-euro acceptance. Rising smartphone penetration, strong broadband coverage, and retail omnichannel strategies further reinforce demand for NFC-ready devices, cloud software, and value-added payment services. Market incumbents are responding with remote-update architectures and AI-driven analytics, while new entrants bundle mobile POS readers with merchant wallets to undercut traditional pricing. The accompanying surge in transaction data unlocks opportunities in fraud prevention and customer insight, giving providers additional revenue streams.

Contactless transactions processed via girocard surpassed 87% by December 2024, a leap that requires merchants to install NFC-capable readers with tokenization and multi-wallet functionality. Consumers increasingly expect tap-and-go convenience, and 18% experience rejection when a favorite digital option is unavailable, pushing hold-outs to modernize. Germany's PCI DSS v4.0 roll-out adds urgency by mandating stronger encryption and authentication at the device level. Together, these factors expand the installed base of modern terminals and sustain the Germany POS terminal market's momentum.

Mobile POS bundles from SumUp and Zettle lower entry costs with hardware priced below EUR 35 and transparent sub-1% girocard fees, bringing electronic acceptance to micro-retailers and independent cafes. The simplified onboarding and pay-as-you-grow model remove contractual complexity, directly contributing to a 20-point rise in cashless acceptance to 81% of in-store transactions. Hospitality operators benefit from tableside checkout and tipping features, while pop-up retailers leverage smartphone connectivity to avoid fixed terminals. These patterns are expanding the addressable customer base for the Germany POS terminal market.

Visa and Mastercard debit routing often carries merchant service charges several multiples above domestic girocard rates, particularly when transactions originate from mobile wallets that default to international rails. For small retailers, higher fees cut deeply into net margins, prompting them to weigh surcharges, acceptance limits, or terminal routing logic that automatically selects lower-cost instruments. Although regulators promote competitive neutrality, the near-term effect dampens transaction growth on some devices, trimming addressable revenue for the Germany POS terminal market.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Contactless transactions accounted for 65.18% of in-store payments in 2025 and are on track to advance at a 9.96% CAGR, a trajectory that will raise the Germany POS terminal market size attached to tap-and-go devices throughout the forecast window.This expansion reflects near-universal NFC support on girocards, the popularity of smartwatch wallets, and rising consumer confidence in hygienic, no-touch checkout. The segment's growth also benefits from higher transaction velocities that uplift acquirer fee pools.

Contact-based methods persist for larger-ticket purchases, PIN-required flows above the contactless limit, and verticals such as fuel retail, yet their relative share declines. Upcoming digital-euro pilots will further entrench contactless behavior, as programmable CBDC wallets target rapid low-value settlement. Accordingly, merchants procure terminals capable of dual-interface acceptance, field-upgradeable to handle both offline CBDC and online card authorizations. Vendors that streamline firmware downloads over-the-air gain favor because they minimize cashier downtime.

The Germany POS Terminal Market Report is Segmented by Mode of Payment Acceptance (Contact-Based and Contactless), POS Type (Fixed Point-Of-Sale Systems, Mobile/Portable Point-Of-Sale Systems), End-User Industry (Retail, Hospitality, Healthcare, Transportation and Logistics, and More). The Market Forecasts are Provided in Terms of Value (USD).