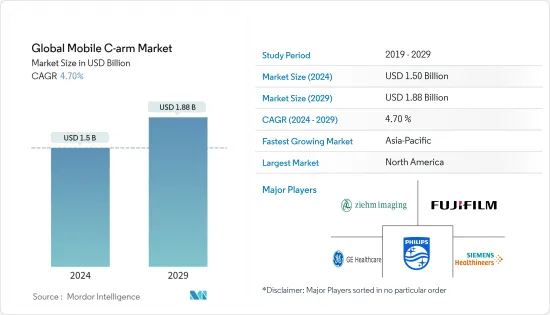

세계의 이동식 C암 시장 규모는 2024년 15억 달러로 추정되고, 2029년까지 18억 8,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 4.70%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다.

COVID-19는 이동식 C암 시장의 성장에 전례없는 영향을 미쳤습니다. COVID-19의 감염자 수 급증과 함께 많은 예정 수술이 당분간 중단되거나 연기되었습니다. 예를 들어, 2021년 7월에 발행된 'COVID-19 감염의 팬데믹이 대기 수술 환자의 대기 시간에 미치는 영향 : 다시설 연구'라는 제목의 PLOS ONE 저널 기사에서는 첫 COVID-19의 발병시 대기 수술의 발생률이 급속히 감소했다고 보고하고 있습니다. 또한 2020년 5월 이후에는 11월까지 대기 시간이 길어지고 대기 수술의 월간 증가율은 7%와 34% 사이에서 변화했다고 보고되었습니다. 게다가 2020년에는 소화기 질환, 비뇨 생식기 질환, 신생물 수술의 대기 시간이 길어졌습니다. C암은 주로 대기적이며 COVID-19의 영향으로 연기된 이미지 유도 수술에 사용되기 때문에 대기 수술의 이러한 지연은 시장 성장에 영향을 미칩니다.

만성질환 부담 증가, 영상처리 능력 기술 진보, 시장 신제품 출시 등의 요인이 시장 성장을 가속하고 있습니다. 만성 질환과 수술 부담 증가도 시장 성장을 가속하고 있습니다. 예를 들어, 2021년 6월에 발행된 흉부 심장혈관 외과 저널의 기사 '독일 심장 외과 보고서 2020 : 독일 흉부 심장혈관 외과 학회의 연례 갱신 레지스트리'라는 제목의 기사에서는 심장혈관 수술로 분류되었습니다. 수술은 총 92,809건이었습니다. 고전적인 의미에서 29,444건이 단독 관상 동맥 우회 이식 수술, 35,469건이 단독 심장 판막 수술이었습니다. 그러므로 세계에서 수많은 심장 치료와 수술이 이루어지고 있으며, 이는 이동식 C암 시장의 성장을 가속할 것으로 예상됩니다.

게다가 시장 관계자들은 제품의 진보를 통해 시스템의 효율성과 워크플로우를 개선하는 데 점점 더 많은 관심을 기울여 시장 성장을 가속하고 있습니다. 예를 들어, 2020년 7월, Philips 헬스케어는 제니션 이동식 C암 플랫폼에 두 가지 주요 혁신을 보고했습니다. 여기에는 새로운 테이블 사이드 사용자 인터페이스와 혈관내 초음파(IVUS)를 통합한 확장 기능이 포함되어 있습니다. 테이블 사이드 사용자 인터페이스 변경으로 임상의는 멸균 현장에서 C암을 조작하거나 말초 혈관 치료를 위해 IVUS를 조작 할 수 있으며 수술실에서의 작업과 워크 플로우가 간소화될 수 있습니다. 이러한 진보도 시장의 성장을 뒷받침하고 있습니다.

그러나 절차 및 장비 비용이 높고 숙련된 전문가 부족으로 인해 예측 기간 동안 시장 성장이 방해될 수 있습니다.

미니 C암 부문은 교통 부상, 외상, 정형외과 질환 부담 증가, 의료 영상 기술의 발전 등의 요인으로 인해 예측 기간 동안 상당한 성장을 보일 것으로 예상됩니다. 미니 C암의 장점은 시장 관계자가 이 부문에 주목을 끌고 있습니다.

미니 C암은 최소 복용량 수준에서 사지 투시를 수행하는 이상적인 솔루션 중 하나입니다. 이 시스템은 경량이므로 좁은 공간이나 수술실에서도 취급하기 쉽고 검사실 간의 이동도 용이합니다. 미니 C암의 이러한 장점은 가까운 미래에이 부문의 성장을 가속할 것으로 예상됩니다.

또한 규제 당국의 승인은 시장 부문의 성장을 뒷받침하고 있습니다. 예를 들어, 2021년 5월, 터너 이미징 시스템즈는 Smart-C Mini C-Arm 휴대용 투시 X선 영상 장치에서 CE 마크를 획득했습니다. 이 승인으로 Smart-C는 영국뿐만 아니라 EU 국가 전체에 배포되는 세계 최초의 휴대성이 뛰어난 미니 C암 중 하나가 되었습니다.

또한 시장 관계자간의 판매 계약도 이 부문의 성장을 추진하고 있습니다. 예를 들어, Turner Imaging Systems는 2020년 7월 마스터 리셀러 계약을 체결하고 Siemens Healthineers의 방사선 및 이미징 제품 포트폴리오에 Smart-C Mini C-Arm을 추가합니다. 이 계약을 통해 Siemens Healthners는 병원 시장의 프리미엄 파트너 리셀러가 되어 미국 병원, IDN, GPO 및 군 고객에게 Smart-C를 제공하는 데 주력하게 됩니다. 이러한 협정은 세계 확대에 도움이 되고 시장 부문의 성장을 가속합니다. 따라서 위의 요인으로 인해 시장 부문은 예측 기간 동안 상당한 성장을 예측할 수 있습니다.

북미는 만성 질환 부담 증가, 의료 영상 기술의 발전과 잘 발달한 건강 관리 인프라 등의 요인으로 시장에서 큰 점유율을 차지하고 있습니다.

이 지역의 만성질환 부담 증가도 시장 성장을 가속하고 있습니다. 예를 들어 2021년 3월에 발표된 질병관리 예방센터(CDC)의 기사 '미국의 만성신장병, 2021년'에서는 미국 성인 7명 중 1명 이상이 만성신장병으로 추정되고 있다고 보고했습니다. 이는 미국 성인의 거의 15%, 즉 3,700만 명에 해당합니다. 이동식 C암은 신장 배출을 시각화하는 데 도움이 되므로 이러한 질병으로 인한 높은 부담이 시장 성장을 가속할 것으로 예상됩니다.

미국 식품의약국과 캐나다 보건부 등 규제 당국의 기술적으로 선진적인 제품 승인도 이 지역 시장 성장을 가속하고 있습니다. 예를 들어, 2021년 1월, Siemens Healthners는 Cios Flow에 대한 식품의약국(FDA)의 승인을 받았습니다. 이것은 다양한 학제 간 기능과 강력한 수준의 사이버 보안을 갖춘 이동식 C암으로 안전하고 효율적인 수술실을 구현하는 데 도움이 됩니다.

또한 지리적 존재감을 높이기 위한 협업과 판매 계약 등 시장 기업이 취한 전략적 노력도 시장 성장을 가속하고 있습니다. 예를 들어, 2021년 4월, Carestream Health는 Ziehm Imaging과의 제휴하에 Ziehm Vision RFD C암으로 알려진 성장하는 혁신적인 제품 포트폴리오에 이동식 C암을 추가했다고 보고했습니다. 계약에 따라 Ziehm Vision RFD 시스템은 미국과 캐나다의 Carestream을 통해 판매 및 서비스를 제공합니다. 따라서 위의 요인으로 인해 이동식 C암 시장은 예측 기간 동안 북미에서 견조한 성장을 유지할 것으로 예상됩니다.

이동식 C암 시장은 여러 선도 기업들로 구성된 적당히 세분화된 시장입니다. 시장 점유율에 관해서는 다국적 기업이 큰 점유율을 차지하고 있습니다. 시장 침투를 높이기 위해 시장 관계자는 항상 제품 개발, 협업, 파트너십 및 제휴에 관여합니다. 이 시장의 주요 기업로는 seimens Healthineers, GE Healthcare, Fujifilm Holding Corporation, Ziehm Imaging GmbH, Koninklijke Philips NV 등이 있습니다.

The Global Mobile C-arm Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 1.88 billion by 2029, growing at a CAGR of 4.70% during the forecast period (2024-2029).

COVID-19 has had an unprecedented impact on the growth of the mobile c-arms market. As with the upsurge in COVID-19 cases, many elective surgeries were halted or postponed for the time being. For instance, the PLOS ONE Journal article titled "The Impact of the COVID-19 pandemic on waiting times for elective surgery patients: A Multicenter Study" published in July 2021 reported that elective procedure incidence decreased rapidly at the onset of the first COVID-19 wave in March 2020. It was also reported that in May 2020 and thereafter until November, waiting times were longer, with monthly increases varying between 7% and 34% in elective surgeries. Further, the waiting times were longer in 2020 for gastrointestinal and genitourinary diseases and neoplasm surgeries. Since C-arms are used in image-guided procedures that are mostly elective and were postponed due to COVID-19, such a delay in elective surgeries has impacted the growth of the market.

Factors such as the growing burden of chronic diseases, technological advancement in imaging capabilities, and the launch of new products in the market are propelling the growth of the market. The growing burden of chronic disease and surgeries is also propelling the growth of the market. For instance, Thoracic Cardiovascular Surgery Journal article titled "German Heart Surgery Report 2020: The Annual Updated Registry of the German Society for Thoracic and Cardiovascular Surgery", published in June 2021, there was a total of 92,809 operations classified as heart surgery procedures in the classical sense, of which 29,444 were isolated coronary artery bypass grafting procedures, 35,469 were isolated heart valve procedures. Thus, a high number of heart procedures and operations are being performed around the world, which is expected to drive the growth of the mobile C-arms market.

Additionally, the increasing focus of market players on improving the efficiency and workflow of the system through the advancements in the products is also propelling the growth of the market. For instance, in July 2020, Philips Healthcare reported two major innovations to its Zenition mobile C-arm platform, which now includes a new Table Side User Interface and an extension integrating intravascular ultrasound (IVUS). With the change to the Table Side User Interface, clinicians will be able to operate the C-arm inside a sterile field and IVUS for peripheral vascular procedures, potentially streamlining activity and workflow in the operating room. Such advancements are also boosting the growth of the market.

However, the high procedural and equipment costs and a lack of skilled professionals may hinder the growth of the market over the forecast period.

The mini c-arms segment is expected to show significant growth over the forecast period, owing to factors such as the rising burden of road injuries, trauma, and orthopedic diseases, technological advancement in medical imaging; and increasing focus by market players on the segment due to the advantages of mini c-arms.

The Mini C-arms are one of the ideal solutions for fluoroscopy of the extremities at minimized dose levels. Due to their lightweight, the systems are easy to handle in small spaces and operating rooms and guarantee ease of transfer between exam rooms. Such advantages of the mini c-arms are expected to propel the growth of the segment in the near future.

Additionally, the approval from the regulatory authority is also boosting the growth of the market segment. For instance, in May 2021, Turner Imaging Systems received the CE Mark for its Smart-C Mini C-Arm portable fluoroscopy x-ray imaging device. With the approval, the Smart-C will be one of the world's first highly portable mini c-arms to be distributed throughout the EU countries as well as the United Kingdom.

Furthermore, the distribution agreements among the market players are also driving the growth of the segment. For example, Turner Imaging Systems signed a Master Resellers agreement in July 2020 that will add the Smart-C Mini C-Arm to Siemens Healthineers' portfolio of radiology and imaging products. With this agreement, Siemens Healthineers becomes the premium partner reseller for the hospital market and will focus on delivering the Smart-C to their hospital, IDN, GPO, and military customers in the United States. Such agreements help in global expansion and thus boost the growth of the market segment. Thus, owing to the above-mentioned factors, the market segment is expected to project significant growth over the forecast period.

The North American region holds the major share in the market owing to factors such as the growing burden of chronic diseases, technological development in medical imaging coupled with well-developed healthcare infrastructure, and others.

The growing burden of chronic diseases in the region is also driving the growth of the market. For instance, the Centre for Disease Control and Prevention (CDC) article titled "Chronic Kidney Disease in the United States, 2021", released in March 2021, reported that more than 1 in 7 adults in the United States are estimated to have chronic kidney disease. That accounts for nearly 15% of United States adults or 37 million people. Since mobile c-arms help in visualizing kidney drainage, the high burden of such diseases is expected to drive the growth of the market.

The approval of technologically advanced products by regulatory authorities such as the United States Food and Drug Administration and Health Canada is also propelling the growth of the market in the region. For instance, in January 2021, Siemens Healthineers received Food and Drug Administration (FDA) clearance for Cios Flow. It is a mobile C-arm with broad multidisciplinary functionality as well as a robust level of cybersecurity to help enable a secure, efficient operating room.

Furthermore, the strategic initiatives taken by the market players, such as collaboration and distribution agreements to increase their geographical presence, are also augmenting the growth of the market. For instance, in April 2021, Carestream Health reported the addition of a mobile C-arm to its growing innovative product portfolio known as the Ziehm Vision RFD C-arm under a partnership with Ziehm Imaging. As per the agreement, Ziehm Vision RFD systems will be available for sale and service through Carestream in the United States and Canada. Thus, owing to the abovementioned factors, the mobile c-arms market is expected to project robust growth in the North American region over the forecast period.

The mobile C-arm market is a moderately fragmented market consisting of several major players. In terms of market share, multinational players have a larger share. To increase market penetration, market players are constantly involved in product development, collaborations, partnerships, and alliances. Some of the key market players in this market include Seimens Healthineers, GE Healthcare, Fujifilm Holding Corporation, Ziehm Imaging GmbH, and Koninklijke Philips NV.