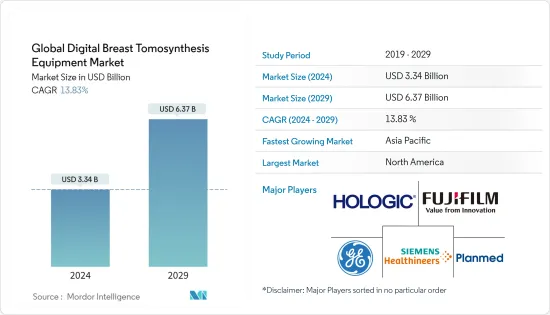

세계 디지털 유방 토모신세시스 장비 시장 규모는 2024년 33억 4,000만 달러로 추정되고, 2029년까지 63억 7,000만 달러에 이를 것으로 예측되고 있으며, 예측 기간 동안 복합 연간 성장률(CAGR) 13.83%로 성장할 전망입니다.

COVID-19의 발달은 유행 기간 동안 디지털 유방 토모 신세시스 장치 시장에 큰 영향을 미쳤습니다. 유행에 의해 세계 유방암 검진, 암 관리 방문, 암 치료가 크게 감소했습니다. 예를 들어, 2022년 6월에 Journal of the American College of Radiology에 게재된 연구에서 암 진단률은 유행성 피크 시점에서 50% 가까이 감소하고, 신형 코로나 바이러스 감염 이전의 비율로 완전히 회복 하지 않았다고 말했습니다. 엄격한 잠금 및 정책은 건강 관리 종사자 및 물자의 이전을 초래하고, 건강 관리 종사자는 주로 이 갑작스런 유행 긴급 상황에 집중하게 되며, 디지털 유방 토모 신세시스와 같은 다른 비긴급 의료 서비스가 연기되었습니다. 하지만 유행 후 록다운 제한 완화와 암 진단의 재개는 시장 성장에 기여할 것으로 예상됩니다.

시장을 견인할 것으로 예상되는 성장 요인은 세계 유방암의 유병률 증가, 유방 영상 처리 분야의 기술 진보, 디지털 유방 토모 신세시스(DBT)의 사용에 대한 의식 증가입니다. 유방암의 유병률 증가로 고도의 진단 수요가 높아지고 연구 시장이 가속될 것으로 예상됩니다. 예를 들어, 2022년 7월에 MDPI에 게재된 기사에서는 2021년에 아시아에서 유방암 사례의 45.4%가 진단되었습니다고 말하고 있습니다. 게다가 2022년 8월에 공표된 유방암 조직의 데이터에서는 유방암이 세계에서 가장 일반적인 암이라고 밝혀져 연간암 증례의 12.5%. 보고서는 또한 2022년 여성에서 진단된 모든 암의 약 30%가 유방암일 수 있다고 추정된다고 밝혔습니다. 유방암 유병률의 상승은 진단의 진보에 의해 디지털 유방 토모신세시스 장비 수요를 촉진할 것으로 예상되어, 그에 의해 유방암에 공헌할 것으로 예상되고 있습니다. 시장 성장에 기여합니다.

한편, 다양한 주요 시장 선수들의 제품 출시 증가도 예측 기간 동안 시장 성장에 기여할 것으로 예상됩니다. 예를 들어, FUJIFILM Medical Systems는 2021년 8월에 디지털 유방 토모 신디시스(DBT)를 탑재한 ASPIRE Cristalle 유방촬영 시스템을 출시했습니다. 이 시스템은 미국에서 2D 및 3D 유방 X선 촬영용 Fusion Artificial Intelligence(AI)가 장착된 ScreenPoint Medical의 미국 FDA 인증을 받은 새로운 Transpara를 제공합니다. 주. 또한 유방암에 대한 의식의 보급에 노력하는 다양한 조직에 의한 의식 향상 캠페인은 시장 성장에 중요한 역할을 할 것으로 예상됩니다. 예를 들어(2021년) 10월에는 유방암 관련 질문에 답하기 위해 통합된 채팅 모듈을 사용하여 핑크 봇 유방암 계발 캠페인이 시작되었습니다. 이것은 유방암에 대한 의식을 높이기 위해 P 구한 박사와 그의 팀의 최신 노력입니다. 마찬가지로 마운트 사이나이 헬스 시스템은 2022년 5월에 유방 조영술을 시작했으며, 일년에 한 번의 유방 촬영 일정을 설정하여 여성이 유방 건강을 관리 할 수있게했습니다. 이 캠페인의 목적은 유방암의 조기 발견과 치료에서 유방 조영술의 중요성에 대한 의식을 높이고 유방암에 의해 악화된 유방암 검진의 감소에 대처하는 것입니다.

따라서 앞서 언급한 이유로 시장은 예측 기간 동안 상당한 성장을 보일 것으로 예상됩니다. 그러나 시스템의 고비용과 방사선 노출에 따른 부작용으로 인해 예측 기간 동안 성장이 둔화될 수 있습니다.

2D/3D 병용 유방 조영술 시스템 부문은 3D 유방 조영술과 2D 유방 조영술 또는 합성 2D 유방 조영술을 결합하는 것이 2D 유방 조영술 단독에 비해 더 많은 유방암을 검출할 수 있기 때문에 시장 성장을 이끌 것으로 예상됩니다. 2D/ 3D 유방 X 선 촬영 시스템은 후속 이미징의 필요성이 적고 표준 유방 Xerox 단독보다 더 많은 암을 검출하여 밀도가 높은 유방 조직에서 유방암 검출을 향상시킵니다. 높은 검출률, 2D/3D 병용 유방촬영 시스템에 대한 사람들의 의식이 높아지고 유방암 유병률 증가가 이 분야를 추진하는 주요 요인입니다. 예를 들어, 2022년 4월에 Journal of Oncology and Radiology에 게재된 기사에서는 2D-3D 맘모그램은 2D 맘모그램 단독보다 비촉지 악성 종양에 대한 민감도가 높다고 보고되었습니다.

2022년 1월에 Egyptian Journal of Radiology and Nuclear Medicine에 게재된 논문에서는 디지털 유방 토모신세시스(DBT)와 디지털 유방 조영술(DM)을 결합하여 보다 높은 진단 정확도, 감도, 양성 중률(PPV) 얻을 수 있다고 보고했습니다. 또한 동일한 출처는 2D 유방 조영술만으로 총 313 개의 종양이 검출되었지만 2D와 3D 유방 조영술이 결합 된 경우 361 개의 병변이 검출되었습니다고보고하고 2D/ 3D 유방 조영술 조합은 병변의 시각화를 향상시키는 것으로 나타났습니다. 유방암 진단에 있어서 2D/3D 유방촬영 시스템의 이러한 높은 효율은 연구 분야의 성장을 가속할 것으로 예상됩니다.

또한 기술적으로 고급 제품의 출시도 이 부문의 성장을 가속할 것으로 예상됩니다. 예를 들어 후지필름은 2021년 4월 부도덕 유방촬영 시스템 'AMULET'의 'Harmony' 버전을 출시했습니다. 이것은 3D 파워와 2D 판독 속도를 결합한 합성 2D 이미지를 제공하여 궁극적으로 유방 유방 조영술의 고급 토모 합성을 실현합니다.

따라서 이러한 시스템의 높은 효능과 혁신적인 제품 출시 증가로 예측 기간 동안 조사 대상 부문의 성장이 촉진될 것으로 예상됩니다.

북미는 진보된 진단 제품에 대한 높은 수요와 조기 및 효과적인 진단에 대한 수요가 증가함에 따라 세계 디지털 유방 토모 신세시스(DBT) 장비 시장에서 큰 시장 점유율을 유지할 것으로 예상됩니다. 유방암의 이환율 증가, 유방암 치료에 있어서의 중요한 연구 개발, 유방 화상 진단법의 진보가, 이 지역 시장의 주된 추진력이 되고 있습니다. 예를 들어, 2022년 1월, 미국 암 협회는 유방암이 미국 여성에서 가장 흔한 암이며 약 3명 중 1명의 여성이 유방암으로 진단되었습니다고 보고했습니다. 또한 미국암협회는 2022년 미국 여성에서 새롭게 약 2,87,850명의 침윤성 유방암 증례가 보고될 것으로 추정하고 있습니다. 게다가 2022년 5월에 발표된 캐나다암 협회의 데이터에서는 추정 28,600명의 캐나다인 여성이 침윤성 유방암으로 진단되고 있다고 보고하고 있습니다. 유방암. 북미 국가에서 유방암의 이러한 높은 부담은 디지털 유방 토모 신디시스 장치 수요를 촉진하여 시장 성장을 가속할 것으로 예상됩니다.

또한 이 지역의 기술 진보, 연구개발, 주요 시장 기업의 신제품 출시로 이 지역 시장이 확대될 것으로 예측되고 있습니다. 예를 들어, 2022년 5월에 iCAD, Inc.는 디지털 유방 토모신세시스(DBT)를 위한 ProFound AI를 지원하는 새로운 조사를 시작했습니다. 이 회사는 딥러닝 유방암 검출, 밀도 평가, 위험 평가 솔루션의 전체 제품군을 다음 이벤트에서 전시할 예정입니다. 유방 이미지 학회(SBI/ ACR) 유방 이미지 심포지엄.

따라서 유방암 증례 증가나 제품 발매 증가 등의 앞서 언급한 요인에 의해 이 지역 시장은 예측기간 중에 큰 성장을 보일 것으로 예상됩니다.

디지털 유방 토모 신세시스 장비 시장은 적당히 통합되어 있으며 소수의 주요 기업으로 구성되어 있습니다. 디지털 유방 토모 신세시스(DBT) 장비 시장에서 활동하는 유명한 기업은 Hologic, Inc, GE Healthcare, Fujifilm Holdings Corporation, Siemens Healthineers, General Medical Merate SpA(IMS GIOTTO SPA), Analogic Corporation, Trivitron Healthcare, Metaltronica Spa, Varex Imaging Corporation, PerkinElmer Inc.(Dexela Ltd.) 및 Planmed OY. 등입니다.

The Global Digital Breast Tomosynthesis Equipment Market size is estimated at USD 3.34 billion in 2024, and is expected to reach USD 6.37 billion by 2029, growing at a CAGR of 13.83% during the forecast period (2024-2029).

COVID-19 outbreak has significantly impacted the Digital Breast Tomosynthesis Equipment Market during the pandemic period. The pandemic resulted in substantial reductions in breast cancer screening, cancer management visits, and cancer procedures across the globe. For instance, a study published in the Journal of the American College of Radiology in June 2022 stated that cancer diagnoses dropped by nearly 50% in the peak-pandemic period and have not entirely rebounded to the pre-COVID rate. The strict lockdown and the policies led to the relocation of medical healthcare providers and material resources, which led the healthcare providers to focus primarily on this abrupt pandemic emergency, thereby postponing other non-emergency medical services such as digital breast tomosynthesis. However, the relaxation of the lockdown restrictions and the resumption of cancer diagnostics during the post-pandemic period are expected to contribute to the market's growth.

The growth factors expected to drive the market are the increasing prevalence of breast cancer worldwide, technological advancements in the field of breast imaging, and rising awareness about the use of digital breast tomosynthesis (DBT). The increasing prevalence of breast cancer cases is expected to drive the demand for advanced diagnosis, fueling the studied market. For instance, the article published in MDPI in July 2022 mentioned that 45.4% of breast cancer cases were diagnosed in Asia in 2021. Additionally, the Breast Cancer Organization data published in August 2022 mentioned that breast cancer is the most common cancer globally, accounting for 12.5% of cancer cases annually. The report also mentioned that it is estimated that about 30% of all diagnosed cancer in women might be breast cancer in 2022. The rising prevalence of breast cancer is expected to drive the demand for digital breast tomosynthesis equipment owing to the advanced diagnosis, thereby contributing to the market's growth.

On the other hand, the increasing product launches by various key market players is also expected to contribute to the market's growth over the forecast period. For instance, in August 2021, FUJIFILM Medical Systems launched its ASPIRE Cristalle mammography system with Digital Breast Tomosynthesis (DBT) that offers ScreenPoint Medical's new, US FDA-cleared Transpara powered by Fusion Artificial Intelligence (AI) for 2D and 3D mammography in the United States. Moreover, rising awareness campaigns by various organizations working towards spreading awareness about breast cancer are expected to play a vital role in the market's growth. For instance, in October 2021, the Pink Bot breast cancer awareness campaign was initiated with a chat module integrated to answer queries on breast cancer, the latest initiative from Dr. P Guhan and his team to raise awareness of it. Similarly, in May 2022, Mount Sinai Health System initiated Mammogram May to empower women to take charge of their breast health by scheduling an annual mammogram. The goals of the campaign are to raise awareness of the importance of mammography in early breast cancer detection and treatment and to address a decline in breast screenings worsened by the pandemic.

Thus, due to the aforesaid mentioned reasons, the market is expected to show significant growth over a forecast period. However, the high costs of the systems and side effects associated with radiation exposure may slow down its growth over the forecast period.

2D/3D combination mammography systems segment is expected to drive market growth as 3D mammography combined with 2D mammography or synthetic 2D mammography can detect more cases of breast cancer as compared to 2D mammography alone. 2D/3D mammography systems require less follow-up imaging, detect more cancers than standard mammography alone, and improve breast cancer detection in dense breast tissues. The high detection rate, rising awareness among people about 2D/3D combination mammography systems, and increasing prevalence of breast cancer are the key factors driving this segment. For instance, in April 2022, an article published in the Journal of Oncology and Radiology reported that 2D-3D mammograms had better sensitivity for non-palpable malignancies than 2D mammograms alone.

An article published in the Egyptian Journal of Radiology and Nuclear Medicine in January 2022, reported that the combination of digital breast tomosynthesis (DBT) with digital mammography(DM) led to higher diagnostic accuracy, sensitivity, and positive predictive value (PPV). The same source also reported that a total of 313 masses were picked up on 2D mammography alone while 2D and 3D mammography combined picked up 361 lesions thus showing that the combination of 2D/3D mammography improves lesion visualization. Such higher efficiency of the 2D/3D mammography systems in the diagnosis of breast cancer is expected to drive the growth of the studied segment.

Additionally, the launch of technologically advanced products is also expected to drive the growth of the segment. For instance, in April 2021, Fujifilm launched the "Harmony" version of its AMULET immorality mammography system. This offers a synthetic 2D image that combines 3D power and 2D reading speed, ultimately offering advanced tomosynthesis of breast mammography.

Thus, the high efficacy of these systems and increasing innovative product launches are expected to drive the growth of the studied segment in the forecast period.

North America is expected to hold a major market share in the global digital breast tomosynthesis (DBT) equipment market due to the high demand for advanced diagnostic products, and increasing demand for early and effective diagnosis. The growing prevalence of breast cancer, significant R&D in breast cancer therapies, and advancements in breast imaging modalities are the primary drivers of the market in this region. For instance, in January 2022, the American Cancer Society reported that breast cancer is the most common cancer in women in the United States, with about 1 in every 3 women being diagnosed with breast cancer. American Cancer Society has also estimated about 2,87,850 new cases of invasive breast cancer to be reported in women in the United States in 2022. Additionally, the Canadian Cancer Society data published in May 2022, reported that an estimated 28,600 Canadian women are diagnosed with breast cancer. Such a high burden of breast cancer in North American Countries is also expected to drive the demand for digital breast tomosynthesis equipment, thereby boosting the growth of the market.

Furthermore, technological advancements, research and development, and new product launches by key market players, in the region are projected to boost the market region. For instance, in May 2022, iCAD, Inc. launched its new research supporting ProFound AI for Digital Breast Tomosynthesis (DBT), the company will be showcasing its complete suite of deep-learning breast cancer detection, density assessment, and risk evaluation solutions at the Society of Breast Imaging (SBI/ACR) Breast Imaging Symposium.

Thus, due to the aforesaid mentioned factors such as rising breast cancer cases, and rising product launches, the market is expected to show significant growth over the forecast period in the region.

The digital breast tomosynthesis equipment market is moderately consolidated and consists of a few major players. Some of the prominent players operating in the digital breast tomosynthesis (DBT) Equipment market are Hologic, Inc, GE Healthcare, Fujifilm Holdings Corporation, Siemens Healthineers, General Medical Merate SpA (IMS GIOTTO SPA), Analogic Corporation, Trivitron Healthcare, Metaltronica Spa, Varex Imaging Corporation, PerkinElmer Inc. (Dexela Ltd.), and Planmed OY.