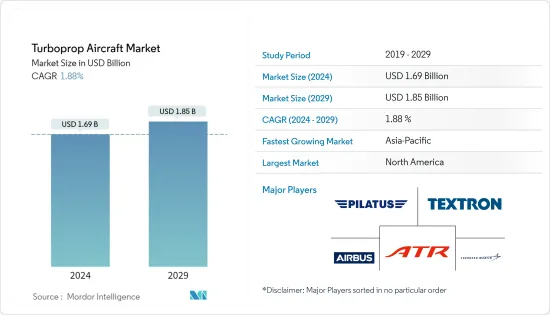

터보프롭 항공기 시장 규모는 2024년 16억9,000만 달러로 추정되고, 2029년까지 18억 5,000만 달러에 이를 것으로 예측되며, 예측기간(2024년-2029년) 동안 복합 연간 성장률(CAGR) 1.88%로 성장할 전망입니다.

COVID-19의 유행은 터보프롭 항공기 시장에 큰 영향을 미쳤으며 2020 년에는 상업 및 일반 항공 부문에 대한 납품이 감소했습니다. 하지만 상업 및 일반 항공 부문이 유행에서 회복되었기 때문에 2021년 납품이 증가했습니다.

터보프롭 항공기는 단거리 및 저공 비행으로 매우 수익성이 높습니다. 이러한 장점은 이러한 항공기가 지역 항공 여객 운송에 대응하기 위해 선호되고 있으며, 새로운 지역 노선의 도입과 함께 수요가 증가하고 있습니다. 항공기 사업자의 이러한 노선 네트워크 확대 계획은 향후 수년간 시장 성장을 가속할 것으로 예상됩니다.

군사 분야에서는 다양한 군가 노후화된 수송기와 훈련기를 신세대 항공기로 대체함으로써 항공기 근대화에 투자하고 있습니다. 이로 인해 예측 기간 동안 시장 성장이 가속될 것으로 예상됩니다.

2021년에는 군사 부문이 주요 시장 점유율을 차지했는데, 이는 주로 A400M이나 C-130J 항공기 등의 대형 터보프롭 항공기의 납품에 의한 것입니다. 에어버스 A400M 아틀라스는 트랜올 C-160과 록히드 C-130 허큘리스와 같은 유럽의 오래된 수송기를 대체하기 위해 에어버스가 개발한 4발 엔진 터보프롭 수송기입니다. 2021년에는 8대의 A400M 항공기가 납품되어 2013년 이후 총 105대가 고객에게 납품되었습니다. 또한 각국의 공군은 Lockheed Martin C-130J 슈퍼 허큘리스와 에어 버스를 주문하여 수송기의 보유를 확대하고 있습니다. C295 형 기계. 수송기 외에도 터보프롭 기계의 일부 모델도 광범위한 전투 및 비전투 목적으로 배포됩니다. 예를 들어(2021년) 9월에 나이지리아 공군(NAF)은 A-29 슈퍼 투카노 항공기를 배치했습니다. 이 항공기는 2018년에 12대의 A-29 슈퍼 투카노 항공기를 조달하는 5억 달러 상당의 주문의 일환으로 NAF로 인도되었습니다. 이 항공기는 비행 및 전투 훈련, 근접 항공 지원 작전, 반란 진압, 비정규전, 첩보,감시,정찰(ISR)을 포함한 폭넓은 임무를 지원하게 됩니다. 군에 의한 유사한 조달 프로그램은 함대의 현대화와 항공 능력의 강화가 시장 성장을 가속할 것으로 예상됩니다.

현재 북미는 시장을 독점하고 있으며, 주로 미국의 상업, 군사 및 일반 항공 분야에서 터보프롭기 수요가 증가함에 따라 예측 기간 동안에도 시장 우위가 지속될 것으로 예상됩니다. 여객 운송용으로 운항되는 터보프롭기는 비교적 적음에도 불구하고, 민간 항공기의 운항자는 화물 운송용으로 새로운 터보프롭기를 도입하고 있습니다. 예를 들어 엠파이어 항공은 2021년 6월 페덱스와의 CMI 계약에 따라 회사 최초의 신규 ATR72-600F 항공기를 도입했다고 발표했습니다. 엠파이어 항공은 미국에서 ATR72-600F 항공기의 대출 고객입니다. 이 외에도 미국 국방부(DoD)는 현재 항공기 현대화 프로그램의 일환으로 새로운 C-130J 항공기를 취득하고 있습니다. 2020년 Lockheed Martin은 최대 50대의 C-130J 슈퍼 허큐리를 미국 공군(USAF), 미국 해병대(USMC), 미국 해안 경비대에 납품하는 30억 달러의 다년 계약을 획득했습니다. 국방부는 21대의 C-130J 최초의 트랜치에 15억 달러를 부여했습니다. 이 회사는 총 24대의 HC-130J와 MC-130J를 미국 공군에, 20대의 KC-130을 미국 해병대에 납입하는 계약을 맺고 있지만, 미국 연안 경비대에는 6대의 HC- 130J를 구입하는 옵션이 있습니다. 납품은 2021년부터 2025년 사이에 이루어질 예정입니다. 이러한 발전으로 향후 수년간 시장 성장이 가속될 것으로 예상됩니다.

터보프롭 항공기 시장은 세분화되어 있으며 일부 기업은 큰 시장 점유율을 차지합니다. 조사 대상이 되는 시장의 유명한 기업로는 ATR(에어버스와 레오나르도의 공동 파트너십), 에어버스 SE, 텍스트 론 에비에이션, 필라투스 에어크래프트사, Lockheed Martin사 등이 있습니다. ATR은 COVID-19 감염의 유행에 의해 가장 큰 영향을 받은 항공기 OEM 기업 중 하나입니다. 2020년 항공기 납품과 주문은 2019년 납품 68대와 주문 79대에 비해 각각 10대와 3대로 감소했습니다. 그러나 민간항공이 회복되기 시작했기 때문에 2021년에는 항공기 납품과 주문은 각각 31기와 35기로 증가했습니다. 새로운 항공기 모델의 소개는 항공기 OEM 시장 점유율 확대를 지원할 것으로 예상됩니다. 시안비기공업공사는 현재 쌍발 중거리 터보프롭기 'MA700'의 개발에 임하고 있습니다. 이 항공기의 좌석 정원은 약 70명으로 2022년까지 취항할 예정입니다. 중국항공공업총공사(AVIC)에 따르면, 이 항공기는 285기 주문되었습니다. 새로운 시장 선수의 소개, 예측 기간 동안 기존 OEM 간의 경쟁이 심화 될 수 있습니다.

The Turboprop Aircraft Market size is estimated at USD 1.69 billion in 2024, and is expected to reach USD 1.85 billion by 2029, growing at a CAGR of 1.88% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the turboprop aircraft market, with deliveries for commercial and general aviation sectors decreasing in 2020. However, deliveries in 2021 increased as the commercial and general aviation sectors recovered from the pandemic.

Turboprop aircraft are highly profitable for short-distance and low altitude flying. Due to this advantage, these aircraft are preferred to cater to regional air passenger traffic, and their demand is growing with the introduction of new regional routes. Such route network expansion plans of aircraft operators are expected to propel the market's growth over the coming years.

In the military sector, various armed forces are investing in fleet modernization by replacing their aging transport and training aircraft fleet with new generation aircraft. This is anticipated to accelerate the market's growth during the forecast period.

The military segment accounted for a major market share in 2021, primarily due to the deliveries of large turboprop aircraft like A400M and C-130J aircraft. Airbus A400M Atlas is a four-engine turboprop transport aircraft developed by Airbus to replace older transport aircraft in the European region, like the Transall C-160 and the Lockheed C-130 Hercules. In 2021, eight A400M aircraft were delivered, and a total of 105 aircraft have been delivered to customers since 2013. Also, various countries' air forces have been expanding their fleet of transport aircraft with orders for Lockheed Martin C-130J Super Hercules and Airbus C295 aircraft. In addition to the transport aircraft, some models of turboprop aircraft are also deployed for a wide range of combat and non-combat purposes. For instance, in September 2021, the Nigerian Air Force (NAF) inducted the A-29 Super Tucano aircraft into service. The aircraft was delivered to NAF as part of an order placed in 2018 worth USD 500 million for the procurement of 12 A-29 Super Tucano aircraft. The aircraft will support a wide range of missions, including flight and combat training, close air support operations, counterinsurgency, irregular warfare, and intelligence, surveillance, and reconnaissance (ISR). Similar procurement programs by the armed forces to modernize their fleet and enhance their aerial capabilities are anticipated to propel the market's growth.

North America currently dominates the market and is expected to continue its market dominance over the forecast period primarily due to the growing demand for turboprop fleets in the United States for the commercial, military, and general aviation sectors. Despite the relatively fewer turboprop aircraft in service for passenger transport, commercial aircraft operators are acquiring new turboprop aircraft for cargo transportation. For instance, Empire Airlines, in June 2021, announced that the airline had taken its first new-build ATR72-600F aircraft under a CMI agreement with FedEx. Empire Airlines is the launch customer of ATR72-600F aircraft in the United States. In addition to this, the US Department of Defense (DoD) is currently acquiring new C-130J aircraft as a part of its fleet modernization program. In 2020, Lockheed Martin won a USD 3 billion multiyear contract to deliver up to 50 C-130J Super Hercules to the US Air Force (USAF), US Marine Corps (USMC), and US Coast Guard. The DoD awarded USD 1.5 billion for the first tranche of 21 C-130Js. In total, the company is contracted to deliver a mix of 24 HC-130Js and MC-130Js to the USAF, and 20 KC-130s to the USMC, while the US Coast Guard has an option to buy six HC-130Js. The deliveries will take place between 2021 and 2025. Such developments are anticipated to accelerate the market's growth over the coming years.

The turboprop aircraft market is fragmented, with several players accounting for a significant market share. Some of the prominent players in the market studied are ATR (a joint partnership between Airbus and Leonardo), Airbus SE, Textron Aviation, Pilatus Aircraft Ltd, and Lockheed Martin Corporation. ATR was one of the most affected aircraft OEMs due to the COVID-19 pandemic. In 2020, its aircraft deliveries and orders decreased to 10 and three, respectively, compared to 68 aircraft deliveries and 79 orders in 2019. However, as commercial aviation began recovering, aircraft deliveries and orders increased to 31 and 35, respectively, in 2021. The introduction of a new aircraft model is expected to support aircraft OEMs in increasing their share in the market. Xi'an Aircraft Industry Corporation is currently working on developing the MA700, a twin-engine medium-range turboprop aircraft. The aircraft has a seating capacity of about 70 passengers and is expected to enter service by 2022. According to the Aviation Industry Corporation of China (AVIC), the aircraft has 285 aircraft orders. The introduction of new market players may increase the competition among the existing OEMs during the forecast period.