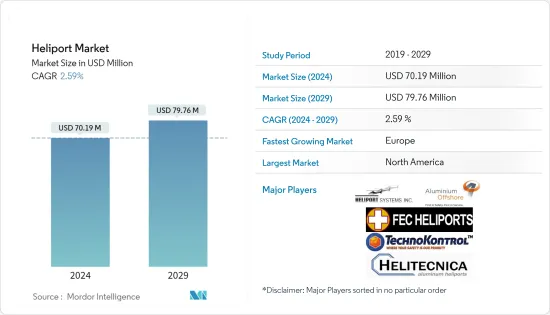

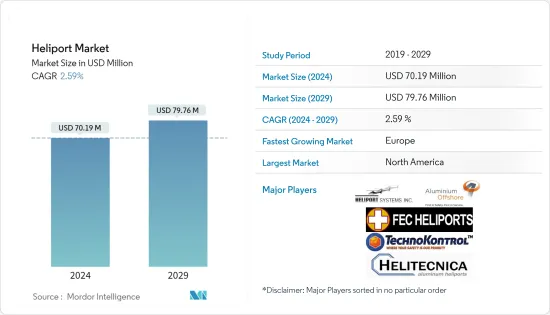

헬리포트 시장 규모는 2024년에 7,019만 달러로 추정되고, 2029년까지 7,976만 달러에 이를 것으로 예측되며, 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 2.59%로 성장할 전망입니다.

일반 항공은 예측 기간 동안 최고의 복합 연간 성장률(CAGR)을 나타낼 것으로 예상됩니다. 이는 주로 VIP 운송, 개인 운송 및 관광을 위한 헬리콥터 서비스 증가 때문입니다. 관광객과 헬리콥터에 의한 개인 이동 증가에 따라 초고층 빌딩의 옥상 헬리콥터 건설에 대한 수요가 높아지고 있습니다. 예를 들어, 2015년에는 20개의 고층 건물에 상업용 및 개인용 헬리콥터를 건설할 수 있는 권한이 부여되었습니다. 이러한 승인은 이 지역에서의 헬리콥터 서비스의 성장을 뒷받침했으며, 그 결과 2018년 3월 시내에서 Thumbby Aviation의 헬리택시 서비스가 시작되어 일렉트로닉 시티와 방갈로르 국제공항을 연결했습니다. 비슷한 서비스가 미국에서도 시작되었습니다. 주와 유럽의 일부 국가에서는. 이러한 서비스 수요가 증가함에 따라 옥상 헬리콥터 수요도 증가하여 시장 부문의 성장이 촉진되고 있습니다.

현재 북미는 시장에서 최고의 점유율을 차지하고 있습니다. 이 지역에서 헬리콥터 서비스가 증가함에 따라 시장은 예측 기간 동안 점차 성장할 것으로 예상됩니다. 2018년 11월 현재 미국에는 5,660개의 헬리콥터(모두 공공용으로 사용되는 것은 아님)와 9,750개의 민간 헬리콥터가 있습니다. 그러나 수색구조, 헬리콥터 응급의료서비스(HEMS), 법 집행 등 공공 및 준공공 임무에 대한 헬리콥터의 적응이 증가하고 있기 때문에 헬리포트 수요가 증가할 것으로 예상됩니다. 최근에는 2019년 7월에 우버콥터가 맨해튼에서 JFK 공항까지 헬리콥터 운송 서비스를 시작하여 이러한 서비스를 더 많은 고객(현재 플래티넘 및 다이아몬드 회원만 이용 가능) 및 기타 도시에 배포할 계획을 발표했습니다. 이러한 노력이 진행 중이기 때문에 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

헬리포트(건설) 시장은 지역에 많은 선수가 있기 때문에 매우 세분화되어 있습니다. 헬리포트 시장에서 유명한 선수는 Heliport Systems Inc., Aluminum Offshore Pte Ltd, FEC Heliports, Tecnokontrol Global Ltd 및 Helitecnica입니다. 헬리포트 건설에는 특별한 규제가 없기 때문에 기존 건설 회사의 진입이 용이합니다. 예를 들어, 2019년 9월 영국에 본사를 둔 토목 계약자인 존스 브라더스 시빌 엔지니어링 유나이티드 킹덤은 배로우 인 퍼니스에 545만 달러를 들여 헬리포트 기지 건설을 완료했습니다. 이 헬리포트 기지는 헬리콥터에 의한 기술자의 운송을 지원할 것입니다. 그리고 월니 익스텐션 해상 풍력 발전 프로젝트에서. 마찬가지로 Colas Ltd와 Eurovia UK Ltd의 합작 투자인 South West Highways Ltd(고속도로, 다리, 해안 구조물의 유지보수 서비스 제공)가 델리포드 헬리패드 건설에 선정되었습니다. 이 프로젝트는 개선된 헬리콥터 착륙 시설을 제공하기 위해 플리머스 병원 NHS 트러스트에 의해 실시되었으며 계약 금액은 199만 달러였습니다(2015년 완료). 다수의 건설사들이 시장에 관여하고 있으며 세계에서 새로운 헬보고서에 대한 수요가 증가하고 있기 때문에 시장의 경쟁력은 향후 수년간 증가할 것으로 예상됩니다.

The Heliport Market size is estimated at USD 70.19 million in 2024, and is expected to reach USD 79.76 million by 2029, growing at a CAGR of 2.59% during the forecast period (2024-2029).

General aviation is anticipated to register the highest CAGR during the forecast period. This is mainly due to the increasing helicopter services for VIP transportation, personal transportation, and tourism. With increasing tourism and personal transportation through helicopters, there is an increasing demand for building rooftop heliports on skyscrapers. For instance, in 2015, 20 high-rise buildings were given the clearance to build helipads for commercial and personal use. Such approvals supported the growth of the helicopter services in the region, which resulted in the launch of heli-taxi services by Thumby Aviation in the city, connecting Electronic City to Bangalore International Airport, in March 2018. Similar services were also launched in the United States and in some of the European countries. With the increasing demand for such services, the demand for rooftop heliports is increasing, thereby, boosting the growth of the market segment.

The North American region currently holds the highest share of the market. The market is anticipated to witness a gradual growth during the forecast, owing to the increasing helicopter services in the region. As of November 2018, there were 5,660 heliports (not all are for public use) and 9,750 civil helicopters in the United States. However, the demand for heliports is anticipated to increase, owing to the increasing adaptation of helicopters for public and para-public missions, like search and rescue, helicopter emergency medical services (HEMS), and law enforcement. Recently, in July 2019, Uber Copter launched its helicopter transportation services from Manhattan to JFK Airport and announced its plan to roll out these services to more customers (currently available for Platinum and Diamond members only) and across other cities. With such initiatives being underway, the market is anticipated to witness growth during the forecast period.

The market for heliports (construction) is highly fragmented, as there are many regional players. The prominent players in the heliport market are Heliport Systems Inc., Aluminium Offshore Pte Ltd, FEC Heliports, Technokontrol Global Ltd, and Helitecnica. As there are no specific regulations for heliport construction, the market entry for established construction companies is easier. For instance, in September 2019, Jones Bros Civil Engineering United Kingdom, a United Kingdom-based civil engineering contractor, completed the construction of USD-5.45-million heliport base in Barrow-in-Furness, which will support the helicopters in transporting technicians to and from the Walney Extension offshore wind farm project. Similarly, South West Highways Ltd, a joint venture between Colas Ltd and Eurovia UK Ltd (provides maintenance services for highways, bridges, and coastal structures), was selected for the Derriford Helipad construction. This project was conducted by the Plymouth Hospital NHS Trust, to deliver an improved helicopter landing facility, with a contract value of USD 1.99 million (completed in 2015). With a large number of construction companies involved in the market, along with the increasing demand for new heliports across the world, the market competitiveness is anticipated to grow over the coming years.