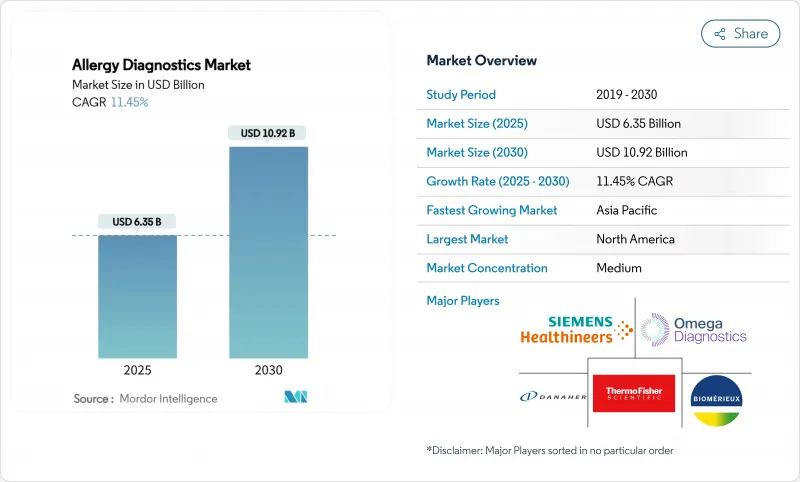

세계의 알레르기 진단 시장 규모는 2025년 63억 5,000만 달러, 2030년에는 109억 2,000만 달러에 이르고, 2025-2030년의 CAGR은 11.45%로 추이할 것으로 예측되고 있습니다.

강력한 상환 정책, 기후 변화에 따른 꽃가루 비산시기의 장기화, 자동화 멀티플렉스 검사 플랫폼의 급속한 보급이 이 성장 궤도를 지원하고 있습니다. 소아의 다양성 증가, 포인트 오브 케어용 미세 유체 장치에 대한 광범위한 액세스, 원격 면역학의 주류화는 의료 제공업체에게 새로운 기회를 창출합니다. 시장의 기존 기업은 제품의 지속적인 업그레이드, 경쟁 정보 대응 해석 소프트웨어, 전략적 판매 제휴를 통해 경쟁력을 강화하고 있습니다. 동시에 신흥지역에서 훈련된 알레르기 전문의 부족과 클라우드 접속 기기에 대한 데이터 프라이버시 요건이 당면의 확대를 억제하고 있지만, 세계적으로 확대되는 알레르기 부담을 관리하는데 있어서 진단이 필수적인 역할을 담당하고 있기 때문에 전체적인 전망은 계속 밝습니다.

학령기 소아는 현재 40-50%의 다중 감작률을 기록하고 있으며, 임상의는 단일 알레르겐 검사를 그만두고 호흡기, 음식, 환경의 트리거를 커버하는 다중 패널 검사를 선택하지 않을 수 없게 되었습니다. 멀티플렉스 IgE 분석은 채혈과 진료 횟수를 줄이고 치료 시작까지의 대기 시간을 단축합니다. 성분 분해 진단 방법은 개별 면역 요법의 지침이 되는 단백질 수준의 감작 물질을 분리하여 소아 의료를 더욱 정교하게 만듭니다. 최근, 소아 아나필락시스의 진찰률이 147% 상승하고, 그 동향이 과민감 환자에 집중하고 있기 때문에 의료 시스템은 이러한 패널을 적극적으로 채용하고 있습니다. 조기 진단이 응급 외래 비용 절감과 장기적인 QOL 향상에 직결되기 때문에 소아과에 강한 관심을 가지는 것은 지속적인 진료량 증가로 이어집니다.

OECD 국가의 지불 기관은 확립된 CPT 코드 하에서 자동화된 특이적 IgE 면역 측정법의 적용 범위를 확대하여 검사 기관 및 장비 제조업체에 대한 예측 가능한 수입원을 확보합니다. 메디케어가 패치 테스트와 분자 알레르기학 패널을 통합함으로써 민간 보험 회사도 이에 추종하게 되어 의사에 의한 도입이 가속하고 있습니다. 진료 보상이 명확해짐으로써, 1차 케어의 의사가 진료의 시점에서 직접 검사를 주문하게 되어, 전문의의 병목이 줄어들었습니다. 자동화된 플랫폼은 턴어라운드 시간을 단축하고 노동 생산성을 향상시킵니다. 공급자는 정확한 진단이 통제 불가능한 알레르기 반응으로 인한 병원 진찰을 줄임으로써 하류 비용을 억제한다고 강조합니다.

많은 신흥국에서는 알레르기 전문의의 수가 인구 100만명당 1명 미만이며, 최신 분석장치가 있어도 해석의 갭이 생깁니다. 전문의의 네트워크가 제한되어 복잡한 멀티플렉스 패널의 채용이 지연되고 있습니다. 원격 상담은 잠정적인 구제책을 제공하지만 라이선싱 제약과 일관성이 없는 광대역은 규모를 제한합니다. 정부와 NGO는 일반 개업의를 위한 단기 알레르기 관리 프로그램에 자금을 제공하기 시작했지만 그 효과는 여전히 미미합니다. 장비 제조업체는 인공지능의 해석 지침을 분석 장비에 통합하고 인간의 전문 지식에 대한 의존도를 줄임으로써 대응합니다.

흡입 알레르겐 부문은 도시 대기 오염과 관련된 지속적인 호흡기 질환을 배경으로 2024년 알레르기 진단 시장 점유율의 51.51%를 유지했습니다. 잔디, 나무, 잡초 및 곰팡이 포자를 다루는 멀티플렉스 패널은 중앙 연구소에 안정적인 경상 수익을 제공합니다. 그러나 식품 알레르겐 범주는 학부모, 학교, 규제 당국이 안전 기준을 높이면서 CAGR 13.65%로 가속화되고 있습니다. 이 속도는 2030년까지 40억 7,000만 달러 시장 규모가 예상되는 알레르기 진단에 반영됩니다.

정밀 성분 분해 진단제는 양성 교차 반응과 위험한 감작을 구별하여 임상 가치를 강화하고 보다 광범위한 지불자의 적용을 촉진합니다. 곤충 독 패널과 약물 알레르겐 패널은 기후 변화에 의해 매개 곤충의 서식 지역이 확대되고 약물 치료의 복잡성이 증가함에 따라 틈새 시장이지만 성장하는 스트림을 추가합니다. 라텍스 검사는 비 라텍스 장갑으로 전환한 건강 관리 환경에서 꾸준히 감소하고 있지만 산업 노출은 잔여 시장을 유지하고 있습니다. 전반적으로, 알레르겐의 구성은 개인화 치료가 널리 사용되는 식품 및 의약품 범주로 점점 기울어지고 있습니다.

2024년 알레르기 진단 시장 규모에서는 검사량이 많고 시약의 안정적인 사용을 반영하여 소모품이 62.53%의 점유율을 차지하고 매출을 독점하고 있습니다. 핸즈프리 조작, 액면 센싱, 바코드에 의한 추적 가능성를 특징으로 하는 고처리량 분석기로의 업그레이드에 뒷받침되었습니다. 그 결과, 설치 기반이 확대됨에 따라 공급업체는 수년 주기로 시약 판매를 고정화하여 수익 전망을 원활하게 할 수 있습니다.

차세대 장비는 치료 효과를 모니터링하는 사이토카인 패널을 포함하여보다 광범위한 분석 메뉴를 실행하여 장비 당 라이프 타임 가치를 확장합니다. SaaS 플랫폼은 원격 캘리브레이션, 업타임 모니터링, AI를 통한 판독을 번들로 꾸준한 구독 수익을 창출합니다. 환자 근처에서 사용되는 마이크로플루이딕스 카트리지와 같은 보조 소모품은 1차 케어 클리닉이 포인트 오브 케어 형식을 채택함에 따라 관련성이 증가하고 있습니다.

북미는 2024년 알레르기 진단 시장 점유율의 38.15%를 차지하며 성숙한 상환제도와 임상의의 높은 의식이 배경에 있습니다. 대규모 레퍼런스 실험실은 완전 자동화된 멀티플렉스 플랫폼을 도입하여 증거 기반 관리 가이드라인을 지원하는 호흡기 패널과 식품 패널을 당일 제공합니다. 규제의 명확화는 지속적인 제품 혁신을 촉진하고 비강 스프레이 아나필락시스 치료제의 최근 출시는이 지역의 치료 및 진단 시너지 효과를 강조합니다.

유럽은 체외 진단 규제의 조화로 인한 혜택을 받고 있으며 품질 기준을 높이고 국경을 넘은 거래를 촉진하고 있습니다. 보험 상환은 다양하지만 독일과 프랑스와 같은 주요 시장에서는 1차 케어에서 종합적인 IgE 검사가 지지되어 완만한 성장을 유지하고 있습니다. 브렉시트(EU 이탈) 관련 괴리로 인해 영국 공급업체는 컴플라이언스에 대한 단계적인 대응을 촉구하고 있지만, 수요의 펀더멘털은 유지되고 있습니다.

아시아태평양은 급속한 도시화, 가처분 소득 증가, 대기 오염 격화를 배경으로 2030년까지 연평균 복합 성장률(CAGR) 14.35%로 성장하여 가장 급성장하는 지역으로 떠올랐습니다. 인도와 중국의 대도시 지역은 증가하는 호흡기 알레르기와 음식 알레르기를 관리하기 위해 관민 파트너십을 통해 현대적인 검사 시설 인프라에 투자하고 있습니다. 지방 정부는 조기 발견을 우선시하고 학교와 직장 결근으로 이어지는 간접 경제 손실을 억제하고 있습니다.

남미에서는 특히 브라질, 멕시코, 칠레에서 민간 보험 회사가 다중 IgE 검사의 적용 범위를 확대하고 꾸준한 보급을 기록하고 있습니다. 공공기관의 프로그램은 늦었지만 중류계급 수요가 높아지면서 자동분석장치를 설치하는 민간검사실 체인을 지지하고 있습니다. 중동 및 아프리카에서는 아직 막 시작되었지만 관심이 가속화되고 있습니다. 걸프 협력 회의 국가들은 경제 다양화와 국민 건강 증진을 위한 광범위한 노력의 일환으로 진단제에 많은 예산을 할당하고 있습니다. 사하라 이남의 아프리카에서는 전문의 부족이 그 진전을 제약하고 있지만, 시험적 원격 면역학 프로그램은 농촌 지역으로의 아웃리치에서 확장 가능한 모델을 시사합니다.

The allergy diagnostics market size stands at USD 6.35 billion in 2025 and is forecast to reach USD 10.92 billion by 2030, advancing at an 11.45% CAGR over 2025-2030.

Strong reimbursement policies, longer pollen seasons linked to climate change, and the rapid adoption of automated multiplex testing platforms anchor this growth trajectory. Rising polysensitization among children, broader access to point-of-care microfluidic devices, and the mainstreaming of tele-immunology create fresh opportunities for providers. Market incumbents strengthen competitive positions through continuous product upgrades, artificial-intelligence-enabled interpretation software, and strategic distribution alliances. At the same time, shortages of trained allergists in emerging regions and data-privacy requirements for cloud-connected instruments temper near-term expansion, although the overall outlook remains positive due to the essential role of diagnostics in managing a widening global allergy burden.

School-age children now record polysensitization rates between 40% and 50%, forcing clinicians to abandon single-allergen testing in favor of multiplex panels that cover respiratory, food, and environmental triggers. Multiplex IgE assays lower the number of blood draws and clinic visits, a shift that cuts waiting times for treatment initiation. Component-resolved diagnostics further refine pediatric care by isolating protein-level sensitizers that guide individualized immunotherapy. Health systems adopt these panels proactively because pediatric anaphylaxis visits climbed 147% in recent years, a trend concentrated among polysensitized patients. The strong pediatric focus translates into durable volume growth because early diagnosis ties directly to reduced emergency-department costs and better long-term quality-of-life outcomes.

OECD payers broaden coverage for automated specific IgE immunoassays under established CPT codes, cementing predictable revenue streams for laboratories and device makers alike. Medicare's inclusion of patch testing and molecular allergology panels has prompted private insurers to follow suit, accelerating physician adoption. Reimbursement clarity encourages primary-care physicians to order tests directly at the point of care, reducing specialist bottlenecks. An expanded payer mix also shields laboratories from price erosion because automated platforms shorten turnaround times and improve labor productivity. Providers emphasize that precise diagnosis curbs downstream costs by lowering hospital visits for uncontrolled allergic reactions.

Many emerging economies have fewer than one allergist per million residents, causing interpretation gaps even when modern analyzers are present. Limited specialist networks slow adoption of complex multiplex panels because primary-care physicians defer testing they cannot fully decode. Tele-consultation offers interim relief, yet licensing constraints and inconsistent broadband limit scale. Governments and NGOs have begun funding short-course allergy-management programs for general practitioners, but impact remains modest. Device makers respond by embedding AI-driven interpretation guidance within analyzers to reduce reliance on human expertise.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

The inhaled-allergen segment retained 51.51% of allergy diagnostics market share in 2024 on the back of persistent respiratory conditions linked to urban air pollution. Multiplex panels covering grass, tree, weed, and mold spores generate stable, recurring revenue for central laboratories. Yet the food-allergen category is accelerating at 13.65% CAGR as parents, schools, and regulators elevate safety standards. That pace translates into a projected USD 4.07 billion slice of allergy diagnostics market size by 2030, supported by recent FDA approval of omalizumab for multi-food desensitization.

Precision component-resolved diagnostics strengthen clinical value by distinguishing between benign cross-reactions and hazardous sensitization, encouraging broader payor coverage. Insect-venom and drug-allergen panels add niche but growing streams as climate change expands vector ranges and pharmacotherapy complexity rises. Latex testing steadily declines in healthcare settings that switch to non-latex gloves, although industrial exposure maintains a residual market. Overall, the allergen mix increasingly tilts toward food and drug categories where personalized therapies are gaining traction.

Consumables dominated revenue with 62.53% share of allergy diagnostics market size in 2024, reflecting high test volumes and steady reagent usage. Yet instruments represent the fastest-expanding line at 12.85% CAGR, propelled by labs upgrading to high-throughput analyzers featuring hands-free operation, liquid-level sensing, and barcode-driven traceability. As a result, installed-base expansion positions vendors for locked-in reagent sales over multiyear cycles, smoothing revenue visibility.

New-generation instruments run broader assay menus, including cytokine panels that monitor treatment efficacy, thereby enlarging lifetime value per device. Software-as-a-service platforms bundle remote calibration, uptime monitoring, and AI-assisted interpretation, creating sticky subscription revenue. Ancillary disposables, such as microfluidic cartridges for near-patient applications, gain relevance as primary-care practices adopt point-of-care formats.

The Allergy Diagnostics Market Report is Segmented by Allergen (Inhaled Allergens, Food Allergens, Drug Allergens, Insect Venom Allergens, and More), Product (Instruments, Consumables, and Software & Services), Test Type (In Vivo Tests and in Vitro Tests), End-User (Diagnostic Laboratories, Hospitals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

North America held 38.15% of allergy diagnostics market share in 2024, backed by mature reimbursement and high clinician awareness. Large reference laboratories deploy fully automated multiplex platforms, offering same-day respiratory and food panels that support evidence-based care guidelines. Regulatory clarity encourages continued product innovation, and recent launches of nasal-spray anaphylaxis treatments underscore the region's therapeutic-diagnostic synergy.

Europe benefits from harmonization under the In Vitro Diagnostic Regulation, which raises quality standards and facilitates cross-border commerce. While reimbursement varies, key markets such as Germany and France support comprehensive IgE testing in primary care, sustaining moderate growth. Brexit-related divergence imposes incremental compliance steps for UK suppliers, but demand fundamentals remain intact.

Asia-Pacific emerges as the fastest-growing region, advancing at 14.35% CAGR through 2030 on the back of rapid urbanization, rising disposable incomes, and intensifying air pollution. Major metropolitan areas in India and China invest in modern laboratory infrastructure, often via public-private partnerships, to manage mounting respiratory and food allergies. Local governments prioritize early detection to curb indirect economic losses linked to missed school and workdays.

South America records steady adoption as private insurers expand coverage for multiplex IgE testing, particularly in Brazil, Mexico, and Chile. Public-sector programs lag, but rising middle-class demand supports private laboratory chains installing automated analyzers. The Middle East and Africa witness nascent but accelerating interest. Gulf Cooperation Council states allocate significant budgets to diagnostics as part of broader efforts to diversify economies and improve population health. Sub-Saharan Africa's progress is constrained by specialist shortages, yet pilot tele-immunology programs hint at a scalable model for rural outreach.