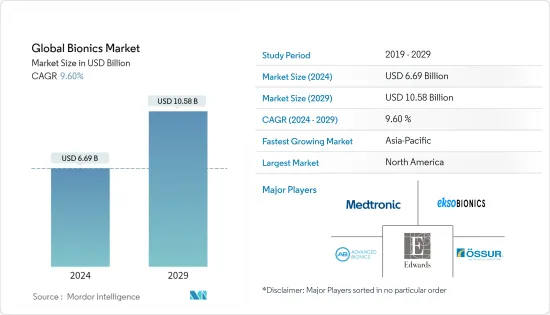

바이오닉스(Bionics) 시장 규모는 2024년 66억 9,000만 달러로 추정되며, 2029년 105억 8,000만 달러에 이를 것으로 예측 되며, 예측 기간 중(2024-2029년) CAGR은 9.60%로 추이하며 성장할 것으로 예상됩니다.

COVID-19는 바이오닉스 시장에 부정적인 영향을 미쳤습니다. 팬데믹으로 인해 장애와 장기 부전을 앓고 있는 환자들에게 추가적인 어려움이 발생했습니다. 사회적 거리두기로 인해 많은 병원은 비선택적 시술과 수술에 제한을 받았고, 대신 시장 성장의 한계를 극복하기 위해 장애인 환자에게 화상 회의를 제공했습니다. 예를 들어, 2021년 9월에 발표된 Harper L. Wilson 등의 연구에 따르면 COVID-19 팬데믹 기간 동안 성인 인공와우 사용자와 지방에 거주하는 사람들은 팬데믹 대비와 의료 서비스 이용 등 더 큰 어려움에 직면했으며, 이는 연구 중인 시장에 악영향을 미쳤습니다. 그러나 지속적인 백신 접종과 COVID-19 사례의 감소로 인해 연구 중인 시장은 예측 기간 동안 잠재력을 최대한 발휘할 것으로 예상됩니다.

시장의 성장 요인으로는 장애 및 장기 부전 발생률 증가, 기술 발전, 절단으로 이어지는 교통 사고의 높은 발생률 등이 있습니다. 예를 들어, 2021년 10월 세계보건기구가 발표한 데이터에 따르면 약 22억 명의 사람들이 실명 또는 시각 장애를 앓고 있으며, 이 중 최소 10억 명은 전 세계적으로 해결되지 않았거나 예방 가능한 질환을 앓고 있는 것으로 나타났습니다. 또한 2020년에는 모든 연령대의 근시 인구가 26억 명에 달합니다. 연령 관련 황반변성은 2020년에 30세에서 97세 사이의 1억 5,960만 명에게 영향을 미쳤습니다. 이처럼 대상 장애의 유병률이 증가함에 따라 향후 몇 년 동안 시장은 더 빠른 속도로 성장할 것으로 보입니다.

또 다른 주요 요인은 기증 장기의 부족입니다. 이식할 수 있는 잠재적 장기가 부족하다는 것이 큰 문제였습니다. 장기 기증자에 대한 수요는 증가하고 있으며 실제 공급에 비해 매우 높은 수준입니다. 바이오닉스는 장기 이식 및 교체가 필요한 사람들의 요구를 충족시킬 수 있습니다. 손상된 장기의 기능을 복제할 수 있습니다. 복제는 거의 동일합니다. 이러한 수준의 장기 희소성은 인공 장기와 바이오닉스 산업에 큰 도움이 되고 있습니다.

이 업계의 제품 인증 증가와 기술 진보도 향후 수년간 시장 성장을 가속할 것으로 보입니다. 예를 들어, 2020년 Edwards Lifesciences Corporation은 회사의 KONECT RESILIA 대동맥 판막형 도관(AVC)이 미국 식품의약국(FDA)으로부터 바이오 벤톨 시술용 즉시 이식 가능한 최초의 솔루션으로 승인을 받았다고 발표했습니다. 또한 2020년 3월에는 와이드윅스는 모멘트 보청기를 출시했습니다. 와이드윅스 모먼트는 '클래식' 와이드윅스 신호 경로에 플랫폼에 추가 기어링을 추가하는 두 번째 초고속 신호 경로가 결합된 제품입니다.

그러나 장비의 오작동과 그 결과에 대한 우려, 장비의 높은 비용, 불투명한 상환 시나리오 등 요인은 시장 성장에 영향을 줄 수 있습니다.

인공 와우는 전기 신호를 뇌로 전달하고 소리를 전기 신호로 변환하여 청력을 회복시켜 손상된 달팽이관의 기능을 수행합니다. 경도에서 심한 난청자가 청각 생명체로 사용하고 있습니다.

인공 와우는 합리적인 가격이므로 높은 지지를 얻고 있습니다. 예를 들어, 2021년 3월에 발표된 "인공와우의 비용 편익 분석 : 사회적 관점"이라는 제목으로 2021년 3월 PubMed에 발표된 연구에 따르면 일측 인공와우 이식(CI)과 진행성 중증 난청을 가진 성인과 노인은 각각 27만 5,000 유로와 7만 6,000 유로의 경제적 순이익이 있다고 결론지었습니다. 건강상의 이점을 고려하지 않더라도 특히 어린이와 노동 인구가 사회적 영향으로부터 혜택을 받았습니다.

향후 몇 년동안 노인의 청각 장애 부담이 상대적으로 큰 것이 시장 성장을 뒷받침할 것으로 예상됩니다. 예를 들어, 2021년 6월에 JAMA Network에 게재된 'Association of Age-Related Hearing Impairment With Physical Functioning Among Community-Dwelling Older Adults in the US'라는 제목의 조사에서는 미국의 노인 2,956명을 대상으로 한 집단 기본 코호트 조사에서 973명(33%)이 정상 청력 장애, 1,170명(40%)이 경도 청력 장애, 692명(23%)이 중등도 청력 장애, 121명(4%)이 중증 청력 장애였습니다. 그 결과 노인 인구가 증가함에 따라 인공 와우 수요도 증가할 것으로 예상됩니다.

그러나 주요 시장 기업의 기술적으로 첨단 제품의 소개는 시장 확대를 지원합니다. 예를 들어, 2022년 1월 Cochlear Limited는 한쪽 난청(UHL) 또는 편측 난청(SSD) 치료용 인공 와우(Cochlear Nucleus Implants)의 미국 식품의약국(미국 FDA)의 승인을 받았습니다.

이 때문에 이 분야는 상기 요인에 따라 예측기간 동안 크게 성장할 것으로 예상됩니다.

현재 북미가 바이오닉스 시장을 독점하고 있으며 앞으로도 그 아성은 계속될 것으로 예상됩니다. 북미에서는 미국이 가장 큰 시장 점유율을 차지합니다. 만성 질환의 유병률이 상승하고 비침습적인 수술 수요가 증가하고 있는 것은 바이오닉스 시장에서 북미의 우위성을 뒷받침하고 있습니다.

이 지역의 장애인 커뮤니티는 특히 COVID-19 팬데믹의 영향을 강하게 받고 있습니다. COVID-19의 봉쇄는 이 지역의 장애인 인구, 예를 들어 시각과 청각에 장애가 있는 사람들의 삶을 특히 엄격하게 만듭니다. 따라서 미국 등에서는 2020년 장애인 포함 기금(DIF)이 COVID-19의 영향과 관련된 장애인의 요구를 지원하기 위해 20만 달러의 신속 대응 기금을 시작할 것이라고 발표했습니다.

2021년 10월에 발표된 캐나다 통계국의 보고서에 따르면, 전체적으로 청력 측정으로 인한 난청, 이명 또는 둘 다의 증상은 19세부터 79세까지 캐나다인의 60%에 영향을 미 있었습니다. 남성은 여성보다 청력 상실과 이명을 경험할 가능성이 높습니다. 또한, 북미의 바이오닉스 시장은 난청의 발생률과 유병률의 높이, 청각 바이오닉스의 보급에 의해 예측 기간 동안 미국이 지배적이라고 예측되고 있습니다. 미국 국립청각장애연구소(National Institute on Deafness and Other Communication Disorders)의 2021년 3월 최신 정보에 따르면, 미국에서는 신생아 1,000명 중 2-3명이 한 귀 또는 양귀에 검출 가능한 수준의 난청 를 가지고 있으며, 2020년에는 이 국가의 성인(18세 이상)의 15%(3,750만명)가 어떠한 청각 문제를 안고 있다고 보고하고 있습니다.

2021년 11월, Advanced Bionics(AB)는 캐나다 보건부의 승인을 받아 Advanced Bionics의 인공 귀 착용자에게 마블 청각 기술을 제공할 것이라고 발표했습니다. 2021년 11월에 새로운 나이다 CI 마블 사운드 프로세서(성인용), 스마트폰으로 간단하게 조정할 수 있는 새로운 어드밴스드 바이오닉스 리모트 앱 등을 발표하고 있습니다. 이 소프트웨어는 삽입 위치를 안내하기 위해 외과 의사에게 실시간 피드백을 제공합니다.

바이오닉스 시장의 경쟁은 치열하며 다양한 선도 기업들이 진입하고 있습니다. 시장 점유율 측면에서 현재 일부 선도 기업들은 바이오닉스 시장을 독점하고 있습니다. 의료용 바이오닉스 채택이 증가하고 장기를 필요로 하는 사람이 증가하고 있기 때문에 다른 중소기업도 시장에 진입할 것으로 예상됩니다. 시장의 선두 기업은 Medtronic PLC, Edward Lifesciences Corporation, Ekso Bionics, Ossur(Touch Bionics) 등이 있습니다.

The Global Bionics Market size is estimated at USD 6.69 billion in 2024, and is expected to reach USD 10.58 billion by 2029, growing at a CAGR of 9.60% during the forecast period (2024-2029).

COVID-19 negatively impacted the bionics market. The pandemic caused added challenges for patients who are having some form of disabilities and organ failures. Due to social distancing, many hospitals were restricted to non-elective procedures and surgeries, and they were instead offering patients video conferencing with disabilities to overcome the limitations of the market growth. For instance, according to the research study published in September 2021 by Harper L. Wilson et al., during the COVID-19 pandemic, adult users of cochlear implants and people living in rural areas faced greater difficulties, including pandemic preparedness and access to healthcare, which has a detrimental effect on the market under study. However, the market under study is anticipated to reach its full potential over the forecast period due to ongoing vaccinations and a decline in COVID-19 cases.

Factors that are responsible for the growth of the market include increased incidence of disabilities and organ failures, technological advancements, and high incidence of road accidents leading to amputations. For instance, as per the data published by the World Health Organization in October 2021, approximately 2.2 billion people were affected with blindness or vision impairment, out of which at least 1 billion people had unaddressed or preventable conditions worldwide. Moreover, in 2020, there are 2.6 billion myopic individuals of all ages. Age-related macular degeneration has affected 195.6 million people between the ages of 30 and 97 in 2020. Thus the increasing prevalence of targeted disabilities, the market is likely to grow at a faster pace in upcoming years.

Another primary factor is the scarcity of donor organs. The lack of availability of potential organs to transplant has been a major issue. The demand for organ donors is increasing and is very high compared to the actual supply. Bionics are able to cater to the needs of those in need of organ transplantations and replacements. It can replicate the function of damaged organs. The replication is almost the same. This level of scarcity of organs has turned into a boon for artificial organs and the bionics industry.

Rising product approval and technological advancement in this industry are also likely to fuel the market growth in upcoming years. For instance, in 2020, Edwards Lifesciences Corporation announced that its KONECT RESILIA aortic valved conduit (AVC) received approval from the United States Food and Drug Administration (FDA) as the first ready-to-implant solution for bio-Bentall procedures. Additionally, in March 2020, Widex launched the Moment hearing device. The Widex Moment has the 'classic' Widex signal pathway, which is paired with a second ultra-fast signal pathway that adds extra gearing to the platform.

However, the factors such as the fear of device malfunction and its consequences, high cost of devices, and uncertain reimbursement scenarios, among others, may impact market growth.

The cochlear implant performs the function of damaged cochlea parts by transmitting the electrical signals to the brain, converting sound into electrical signals, and restoring hearing. People with mild to severe hearing loss use it as hearing bionics.

Due to their affordability, cochlear implants are highly favored. For instance, according to a research study titled "Cost-benefit Analysis of Cochlear Implants: A Societal Perspective" published in PubMed, in March 2021, concluded that the adults and seniors with unilateral cochlear implantation (CI) and progressive severe hearing loss had a net economic benefit of EUR 275,000 and EUR 76,000, respectively. Even without taking health benefits into account, children and those in the workforce, in particular, benefited from the societal impact.

In the upcoming years, market growth is anticipated to be aided by the older population's relatively high burden of hearing impairment. For instance, a research study titled "Association of Age-Related Hearing Impairment With Physical Functioning Among Community-Dwelling Older Adults in the US" published in JAMA Network, in June 2021, a population-based cohort study involving 2,956 older Americans found that 973 (33%) had normal hearing, 1,170 (40%) had mild hearing impairment, 692 (23%) had moderate impairment, and 121 (4%) had a severe impairment. As a result, it is anticipated that the demand for cochlear implants will rise along with the population of elderly people.

The key market players' introduction of technologically advanced products, however, support the market's expansion. For instance, in January 2022, Cochlear Limited, obtained United States Food and Drug Administration (U.S. FDA) approval for Cochlear Nucleus Implants for the treatment of unilateral hearing loss (UHL) or single-sided deafness (SSD).

The segment is therefore anticipated to experience significant growth over the course of the forecast period as a result of the factors listed above.

Currently, North America dominates the market for bionics, and it is expected to continue its stronghold for a few more years. In the North American region, the United States holds the largest market share. The rising prevalence of chronic diseases and increasing demand for non-invasive surgical procedures are helping in the dominance of the North American region in the bionics market.

The disabled community around the region is affected especially hard by the COVID-19 pandemic. Coronavirus lockdown has made life especially tough for the region's disabled population, such as people having the vision, hearing impaired population. Thus, in countries, such as the United States, in 2020, the Disability Inclusion Fund (DIF) announced the launch of a USD 200,000 rapid response fund to support the needs of people with disabilities related to the impact of COVID-19.

According to the report of Statistics Canada published in October 2021, Overall, audiometrically measured hearing loss, tinnitus, or both conditions affected 60% of Canadians between the ages of 19 and 79. Men were more likely than women to experience hearing loss and tinnitus. Furthermore, North America's bionics market is anticipated to be dominated by the United States during the forecast period due to the country's high incidence and prevalence of hearing loss as well as its widespread use of hearing bionics. According to the March 2021 update from the National Institute on Deafness and Other Communication Disorders, in the United States, 2 to 3 out of every 1,000 newborns have a detectable level of hearing loss in one or both ears, and 15% of adults (18 and older) in the country (37.5 million) report having some hearing issues in 2020.

The presence of developed healthcare infrastructure and major market players focussing on various market strategies so as to gain a competitive edge is also expected to propel the market. in November 2021, Advanced Bionics (AB), received Health Canada approval and announces it is bringing Marvel hearing technology to Advanced Bionics cochlear implant wearers. This includes: New Naida CI Marvel sound processor for adults, New Advanced Bionics Remote app for easy adjustments via smartphone, and others. The software provides real-time feedback to the surgeon to guide the insertion placement.

Thus, due to the factors mentioned above, the segment is expected to witness significant growth over the forecast period.

The bionics market is moderately competitive and consists of various major players. In terms of market share, some of the major players currently dominate the bionics market. Owing to the rising adoption of medical bionics and an increasing number of people in need of organs, few other smaller players are expected to enter the market. Some of the major players of the market are Medtronic PLC, Edward Lifesciences Corporation, Ekso Bionics, and Ossur (Touch Bionics), among others.