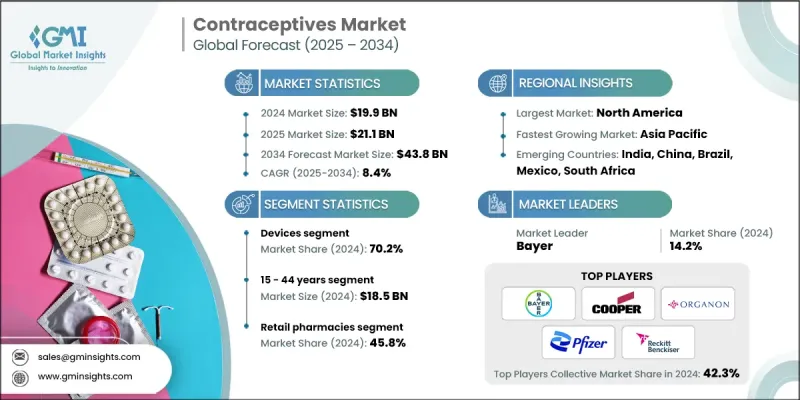

Global Market Insights Inc.가 발행한 최신 보고서에 따르면 세계의 피임약 시장은 2024년에 199억 달러로 평가되었고, CAGR은 8.4%를 나타낼 것으로 예측되며 2025년 211억 달러에서 2034년에 438억 달러로 성장할 전망입니다.

생식권 및 가족 계획에 관한 공중 보건 캠페인과 교육이 확대되면서 피임에 대한 인식과 수용도가 높아지고 있습니다. 비정부기구(NGO)와 정부 기관(예 : UNFPA, WHO)은 선진국과 개발도상국 모두에서 현대적 피임법 접근성을 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 199억 달러 |

| 예측 금액 | 438억 달러 |

| CAGR | 8.4% |

장치 부문은 2024년 장기 작용 및 가역적 피임 옵션에 대한 수요 증가에 힘입어 상당한 점유율을 차지했습니다. 자궁 내 장치(IUD), 콘돔, 임플란트와 같은 제품들은 효과와 편의성으로 인해 점점 더 선호되고 있습니다. 이 중 호르몬 및 구리 기반 IUD는 높은 성공률과 장기적 보호 효과로 여전히 최우선 선택지입니다. 시장 참여자들은 더 넓은 고객층을 확보하기 위해 제품 혁신, 향상된 착용감, 사용 기간 연장에 주력하고 있습니다.

15-44세 부문은 생식 연령대이며 가족 계획에 적극적으로 참여합니다.는 점에서 2024년 상당한 점유율을 차지했습니다. 이 부문은 임신 지연 욕구와 청소년 및 젊은 성인층의 성 건강 인식 제고 필요성에 의해 촉진됩니다. 교육 확대, 디지털 헬스 플랫폼, 타깃 마케팅 캠페인이 이 인구 집단에서 피임법 사용을 정상화하는 데 기여하고 있습니다. 기업들은 라이프스타일 적합성, 사용 편의성, 접근성을 강조하여 이 고객층과 공감할 수 있는 메시지를 맞춤화하고 있습니다. 구독 모델과 비밀 배송 서비스도 이 부문의 사생활 보호 의식이 높은 사용자를 유치하기 위해 도입되었습니다.

소매 약국 부문은 편의성, 접근성, 소비자 익명성 덕분에 2025-2034년 동안 상당한 연평균 성장률(CAGR)을 기록할 것입니다. 경구 피임약과 응급 피임약의 일반 판매 확대에 힘입어 이 부문은 꾸준한 성장세가 있습니다. 이 부문은 또한 연장된 약국 운영 시간, 준도시 지역에서의 점유율 확대, 생식 건강 상담에서 약사의 역할 증가로 혜택을 받고 있습니다. 제약사들은 입지를 강화하기 위해 주요 소매 체인점과 파트너십을 체결하고, 프로모션 할인을 제공하며, 제품의 지속적인 공급을 보장하고 있습니다.

북미의 피임약 시장은 높은 소비자 인식, 유리한 보험 적용 정책, 견고한 의료 인프라를 뒷받침으로 2024년 상당한 매출을 기록했습니다. 호르몬 피임약, 자궁 내 장치(IUD), 응급 피임약의 광범위한 채택으로 미국이 이 지역을 주도하고 있습니다. 최근 추정치에 따르면 북미 시장은 80억 달러 이상으로 평가되었으며, 디지털 처방전 및 소비자 직접 텔레헬스 서비스의 가용성 증가와 함께 꾸준히 성장할 것으로 예상됩니다. 이 지역에서 운영되는 기업들은 변화하는 소비자 행동에 부응하기 위해 FDA 승인, 제품 다각화, 온라인 판매 플랫폼 확대에 주력하고 있습니다.

피임약 시장의 주요 기업은 HLL Lifecare(인도), 화이자, LifeStyles 건강 관리, 처치 & 드와이트, Exeltis, Reckitt, CooperSurgical, Medintim(케셀), Organon, Pregna International, Evofem Biosciences, Mayne Pharma, Agile Therapeu

피임약 시장 기업들은 입지를 유지하고 성장시키기 위해 제품 혁신, 지역 확장, 고객 중심 전략을 복합적으로 활용하고 있습니다. 가장 두드러진 전략 중 하나는 비호르몬 및 남성용 피임 옵션을 포함해 더 안전하고 효과적인, 그리고 사용자 친화적인 제품 개발을 위한 연구개발(R&D) 투자입니다. 또한 브랜드들은 편의성 수요를 충족시키기 위해 텔레헬스 상담 및 온라인 주문 처리 서비스를 제공하며 디지털 플랫폼을 통한 직접적 고객 접점을 확대하고 있습니다.

The global contraceptives market was estimated at USD 19.9 billion in 2024 and is expected to grow from USD 21.1 billion in 2025 to USD 43.8 billion by 2034, at a CAGR of 8.4%, according to the latest report published by Global Market Insights Inc.

Growing public health campaigns and education around reproductive rights and family planning are increasing awareness and acceptance of contraceptives. NGOs and government initiatives (e.g., UNFPA, WHO) are promoting access to modern contraceptives in both developed and developing regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.9 Billion |

| Forecast Value | $43.8 Billion |

| CAGR | 8.4% |

The devices segment held a notable share in 2024, driven by the growing demand for long-acting and reversible contraceptive options. Products such as intrauterine devices (IUDs), condoms, and implants are increasingly favored for their efficacy and convenience. Among these, hormonal and copper-based IUDs remain the top choices due to their high success rates and long-term protection. Market players are focusing on product innovation, enhanced comfort, and extended duration of use to attract a wider customer base.

The 15-44 years segment held a sizeable share in 2024 owing to their reproductive age and active participation in family planning. This segment is driven by the desire to delay pregnancies and the rising need for sexual health awareness among adolescents and young adults. Increased educational outreach, digital health platforms, and targeted marketing campaigns are helping to normalize contraceptive use among this demographic. Companies are tailoring their messaging to resonate with this audience by emphasizing lifestyle compatibility, ease of use, and access. Subscription models and discreet delivery services have also been introduced to appeal to privacy-conscious users in this segment.

The retail pharmacies segment will grow at a decent CAGR during 2025-2034, backed by convenience, accessibility, and anonymity to consumers. With the growing over-the-counter availability of oral contraceptives and emergency pills, this segment is witnessing steady growth. The segment also benefits from extended pharmacy hours, growing penetration in semi-urban areas, and pharmacists' increasing role in reproductive health counseling. To strengthen their presence, pharmaceutical companies are forming partnerships with major retail chains, offering promotional discounts, and ensuring consistent product availability.

North America contraceptives market generated significant revenues in 2024, supported by high consumer awareness, favorable reimbursement policies, and robust healthcare infrastructure. The United States leads the region due to the widespread adoption of hormonal contraceptives, IUDs, and emergency contraceptive pills. As of recent estimates, the market in North America was valued at over USD 8 billion and is projected to grow steadily with the increasing availability of digital prescriptions and direct-to-consumer telehealth services. Companies operating in this region are focused on FDA approvals, product diversification, and expanding their online sales platforms to meet evolving consumer behavior.

Major players in the contraceptives market are HLL Lifecare (India), Pfizer, LifeStyles Healthcare, Church & Dwight, Exeltis, Reckitt, CooperSurgical, Medintim (Kessel), Organon, Pregna International, Evofem Biosciences, Mayne Pharma, Agile Therapeutics, Bayer, HRA Pharma / Perrigo (OTC).

To maintain and grow their position, companies in the contraceptives market are employing a mix of product innovation, regional expansion, and customer-centric initiatives. One of the most prominent strategies involves investing in R&D to develop safer, more effective, and user-friendly products, including non-hormonal and male contraceptive options. Additionally, brands are leveraging digital platforms for direct engagement, offering telehealth consultations and online fulfillment services to meet the demand for convenience.