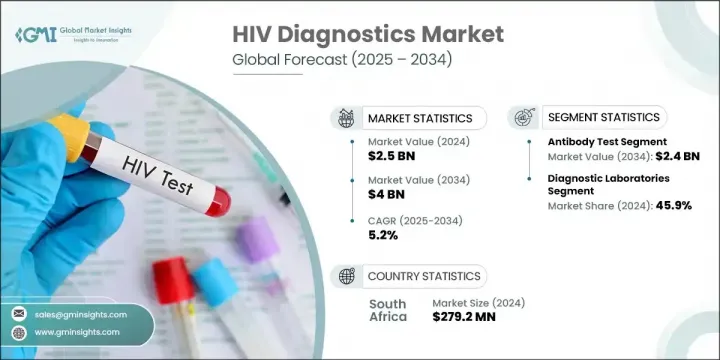

세계의 HIV 진단 시장은 2024년 25억 달러로 평가되었으며 CAGR 5.2%로 성장해 2034년에는 40억 달러에 이를 것으로 추정됩니다.

이러한 증가 추세는 중저소득 지역에서 HIV 이환율이 증가하고 보다 신뢰성이 높고 사용하기 쉬운 진단 방법에 대한 수요에 의해 뒷받침됩니다. 세계 캠페인을 통해 HIV 검사에 대한 의식이 높아짐에 따라, 공적 및 사적 의료 시스템의 양쪽에서 고도의 검사 솔루션의 도입이 진행되고 있습니다. POC(Point of Care) 진단법은 신속성, 편의성 및 인프라의 제한된 지역에서의 적합성으로 인해 기세가 증가하고 있습니다.

HIV 감염을 확인하는 데 사용되는 진단 기술은 조기 개입, 환자 모니터링 및 적절한 치료 경로 결정에 중심적인 역할을 합니다. 다양한 세계의 보건 활동과 자금 지원 이니셔티브는 사용하기 쉬운 HIV 검사 솔루션에 대한 수요를 지속적으로 창출하고 있습니다. 건강 관리에 대한 접근과 건강 리터러시가 개선됨에 따라, 특히 충분한 서비스를 받지 못한 지역사회에서 HIV 검사 키트의 채용은 증가의 길을 따라가고 있습니다. 기술 혁신과 보다 빠르고 비용 효율적인 검사 솔루션은 공중 보건 활동과 임상 현장 모두에서의 보급을 더욱 강화하고 있습니다. 정책 지원, 일반 시민의 의식 향상, 신속한 진단의 진보가 함께 세계적으로 HIV 진단의 상황은 계속 변화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 25억 달러 |

| 예측 금액 | 40억 달러 |

| CAGR | 5.2% |

항체 검사 분야는 비용 효과, 간편성, 빠른 결과 제공 능력으로 2024년 시장을 선도하고 최대 점유율을 차지했습니다. 자기검사 키트에서의 이용이 확대되고 있는 것도, 특히 저자원 환경에서의 보급에 기여하고 있습니다. 이러한 검사는 복잡한 의료 환경을 필요로 하지 않으며 사용하기 쉽고 구현하기 쉽기 때문에 집단 스크리닝에 이상적입니다. 특히 헬스케어에 대한 편견이나 진료소에 대한 접근 제한이 우려되는 지역에서는 프라이버시를 중시한 자기검사법을 선택하는 개인이 늘고 있으며, 그 관련성은 계속 증가하고 있습니다.

진단 검사 시설 부문은 2024년 45.9%의 점유율을 차지했습니다. 이러한 시설은 대량의 검사를 효율적으로 관리하기 위한 설비가 갖추어져 있기 때문에 HIV 검사에 바람직한 선택이 되고 있습니다. HIV 유병률이 증가함에 따라 정확하고 높은 처리량 검사에 대한 요구가 커지고 있습니다. 검사 시설은 첨단 장비와 자동화 시스템을 활용하여 신뢰할 수 있는 검사 결과를 제공하기 위해 공중 보건 프로그램과 대규모 검사 캠페인을 지원하는 데 필수적입니다.

중동 및 아프리카의 2024년 HIV 진단 시장 점유율은 30.1%였습니다. 이 지역의 감염률 증가는 더욱 효과적이고 사용하기 쉬운 진단 도구에 대한 수요를 지속적으로 촉진하고 있습니다. HIV의 만연을 관리하기 위해 더 많은 의식과 자원이 향해지고 있는 가운데, 확장 가능하고 정확한 검사 솔루션의 필요성이 계속 시장을 견인하고 있습니다.

HIV 진단 시장의 주요 기업으로는 Bioneer, Hologic, Genlantis Diagnostics, Qiagen, ChemBio Diagnostics, OraSure Technologies, Becton, Dickinson and Company(BD), F. Hoffmann-La Roche, Abbott Laboratories, Biomerieux, Cepheid 등이 있습니다. HIV 진단 분야의 주요 기업은 검사 포트폴리오의 확충, 포인트 오브 케어 플랫폼의 강화, 연구 개발에 대한 투자에 의해 시장에서의 존재감을 강화하고 있습니다. 많은 기업들이 속도, 휴대성, 정확성을 우선시하고 분산된 건강 관리 환경을 지원하는 차세대 진단 키트를 출시합니다.

의료기관, NGO, 정부와의 제휴는 기업이 대규모 공급 계약을 확보하는데 도움을 주고, 지역 제휴에 의한 지역 확대는 유통을 강화합니다. 경쟁력을 유지하기 위해 일부 기업은 디지털 툴을 검사 키트에 통합하여 실시간 데이터 추적 및 원격 모니터링을 가능하게 합니다. 또한 HIV 이환율이 상승하고 있는 미개척 지역에서 시장 진입을 가속하기 위해 규제 당국의 승인이나 인증에 주력하고 있는 기업도 있습니다.

The Global HIV Diagnostics Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 4 billion by 2034. This upward trend is supported by rising HIV incidence in lower- and middle-income regions, combined with the demand for more reliable and accessible diagnostic methods. As awareness surrounding HIV testing grows through global campaigns, both public and private healthcare systems are increasingly adopting advanced testing solutions. Point-of-care diagnostics are gaining momentum due to their speed, convenience, and suitability in regions with limited infrastructure.

Diagnostic technologies used to identify HIV infections play a central role in early intervention, patient monitoring, and determining suitable treatment paths. Various global health efforts and funding initiatives continue to create demand for accessible HIV testing solutions. As access to healthcare and health literacy improve, the adoption of HIV testing kits, especially in underserved communities, continues to rise. Technological innovation and faster, cost-efficient testing solutions are further supporting widespread adoption across both public health initiatives and clinical settings. The combination of policy support, increasing public awareness, and rapid diagnostic advancements continues to reshape the HIV diagnostics landscape globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4 Billion |

| CAGR | 5.2% |

The antibody tests segment led the market in 2024 and held the largest share due to their cost-effectiveness, simplicity, and ability to deliver quick results. Their growing use in self-testing kits has also contributed to widespread adoption, particularly in low-resource environments. These tests are ideal for mass screening as they are both accessible and easy to administer without requiring complex medical settings. Their relevance continues to grow as more individuals opt for privacy-driven self-testing methods, especially in regions where healthcare stigma or limited access to clinics is a concern.

The diagnostic laboratories segment held 45.9% share in 2024. These facilities remain the preferred choice for HIV testing because they are equipped to manage a large volume of tests efficiently. With growing HIV prevalence, the need for accurate and high-throughput testing is expanding. Laboratories utilize sophisticated instruments and automated systems to deliver reliable results, making them essential for supporting public health programs and large-scale testing campaigns.

Middle East and Africa HIV Diagnostics Market held 30.1% share in 2024. Rising infection rates in this region continue to fuel demand for more effective and accessible diagnostic tools. As more awareness and resources are directed toward managing the spread of HIV, the need for scalable and accurate testing solutions continues to drive the market forward.

Leading companies in the HIV Diagnostics Market include Bioneer, Hologic, Genlantis Diagnostics, Qiagen, ChemBio Diagnostics, OraSure Technologies, Becton, Dickinson and Company (BD), F. Hoffmann-La Roche, Abbott Laboratories, Biomerieux, and Cepheid. Major players in the HIV diagnostics sector are reinforcing their market presence by expanding testing portfolios, enhancing point-of-care platforms, and investing in R&D. Many are launching next-generation diagnostic kits that prioritize speed, portability, and accuracy, tailored for decentralized healthcare settings.

Collaborations with healthcare agencies, NGOs, and governments help companies secure large-scale supply contracts, while regional expansion through local partnerships strengthens distribution. To remain competitive, several firms are integrating digital tools with testing kits, enabling real-time data tracking and remote monitoring. Others focus on regulatory approvals and certifications to accelerate market entry in underserved regions with rising HIV incidence.