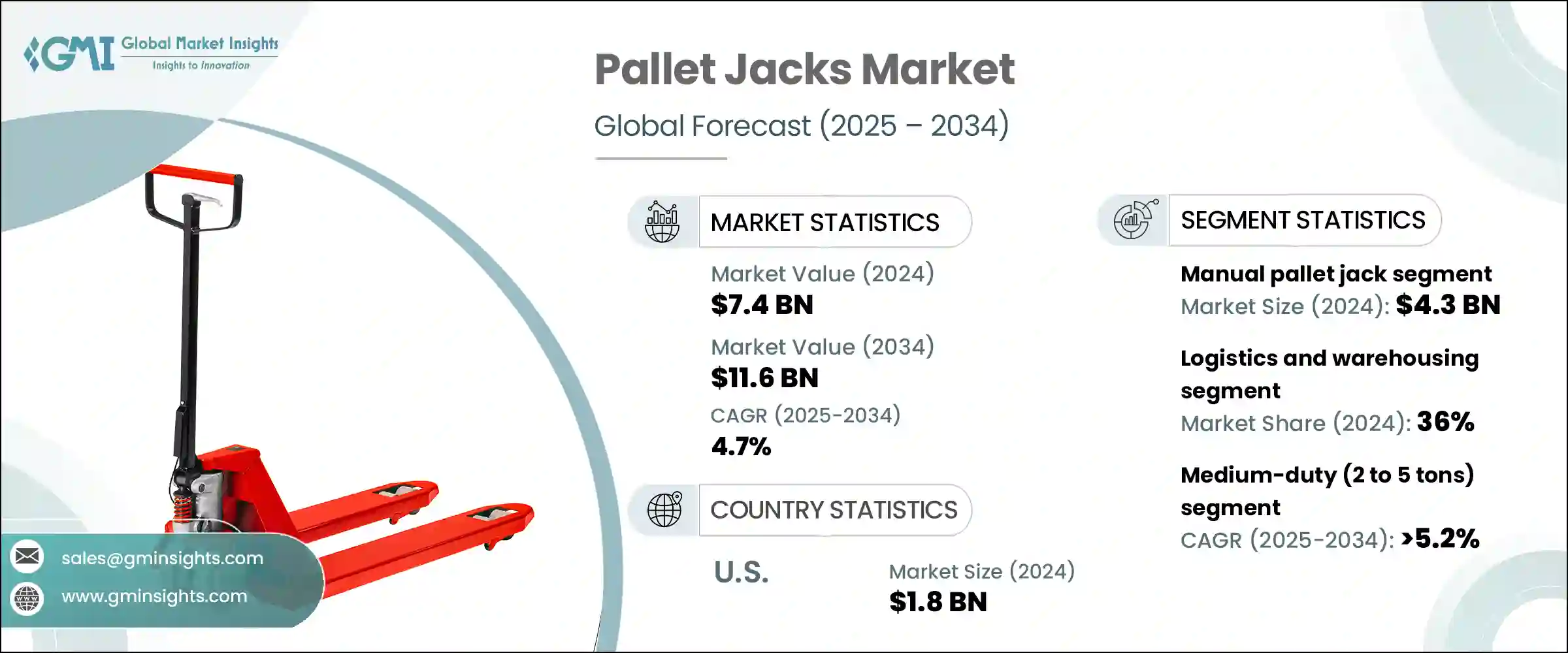

세계의 팔레트 잭 시장은 2024년에는 74억 달러로 평가되었으며 CAGR 4.7%로 성장하여 2034년에는 116억 달러에 이를 것으로 추정됩니다.

이 성장은 자재 관리 기기에 대한 수요 증가와, 특히 신흥시장에서의 창고나 배송 센터의 급속한 확대에 의해 주로 발생합니다.

예를 들어, 아일랜드에서는 경제 확대가 계속되고 있으며 기업이 사업 규모를 확대하여 국내외 시장의 확대하는 요구에 부응하려고 노력하므로 창고 공간 수요가 높아지고 있습니다. 이는 많은 창고에 대한 수요를 창출할 뿐만 아니라 보다 부드럽고 효율적인 유통 프로세스를 확보하기 위한 물류와 공급 체인 매니지먼트의 혁신도 촉진하고 있습니다. 기업들은 새로운 무역 규제와 공급망의 과제에 대응하기 위해 국경 내의 창고나 배송 센터에 대한 투자를 우선시하고 있습니다. 영국의 물류 부문은 유럽에서 가장 성숙한 선진 부문 중 하나이며, 이러한 과제에 대응하여 빠른 성장을 이루고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 74억 달러 |

| 예측금액 | 116억 달러 |

| CAGR | 4.7% |

물류 및 창고 분야는 2024년에 36%의 점유율을 차지하였고 2025년부터 2034년에 걸쳐 CAGR 5%를 보일 것으로 예측됩니다. 이 성장의 주요 요인은 세계적인 무역 급증, 제3자 물류공급자의 확대, 효율적인 자재 처리 솔루션에 대한 요구 증가입니다. 팔레트 잭은 공급망의 최적화, 업무 효율의 개선, 그리고 이러한 성장 분야에서의 수작업의 삭감에 필수적인 요소가 되고 있습니다.

처리능력별로 미디엄듀티(2-5톤) 팔레트 잭 부문은 2025년부터 2034년에 걸쳐 CAGR 5.2%를 보일 것으로 예측되고 있습니다. 또, 이러한 팔레트 잭에 전동 시스템을 통합하여 조작 성능의 향상, 수작업의 경감, 사용자의 편리성 향상도 실현할 수 있습니다.

미국의 팔레트 잭 시장은 2024년에 82%의 점유율을 차지했으며 18억 달러를 창출했습니다. 기업은 활황을 보이는 시장에서 경쟁력을 유지하기 위해 팔레트 잭과 같은 선진적인 자재 관리 장비에 대한 투자를 늘리고 있습니다.

세계의 팔레트 잭 시장의 주요 기업은 Howard Handling, Junheinrich, CUBLIFT, Toyota Material Handling, Doosan, Linde Material Handling, Hyster-Yale Materials Handling, Allman, Raymond Corporation, Vestil, Crown Equipment Corporation, RICO, HU-LIFT, Mobile Industrial Robots 등이 있습니다. 시장에서의 존재감을 강화하기 위해 팔레트 잭 업계의 기업은 다양한 전략을 채용하고 있습니다.

주요 물류공급자 가운데 특히 제3자 물류공급자와의 제휴와 협력은 기업의 유통 채널을 강화하는 데 도움이 됩니다. 신흥시장으로의 진출과 현지생산에 의한 제조능력 강화도 확대하는 수요를 끌어들이기 위한 전략적인 동향입니다.

The Global Pallet Jacks Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 11.6 billion by 2034. This growth is largely driven by the increasing demand for material handling equipment and the rapid expansion of warehouses and distribution centers, particularly in emerging markets. As businesses seek to improve operational efficiency and reduce lead times, the need for advanced material handling solutions, including pallet jacks, is on the rise. The global warehousing industry, particularly in regions such as the UK and Ireland, is undergoing a significant transformation.

For example, Ireland's ongoing economic expansion is driving an increased demand for warehousing space, as businesses look to scale their operations and meet the growing needs of both domestic and international markets. The expansion is not only fueling the demand for more storage but also encouraging innovations in logistics and supply chain management to ensure smoother, more efficient distribution processes. As companies adapt to new trade regulations and supply chain challenges, they are prioritizing investments in warehouses and distribution centers within their borders. This shift has had a profound effect on the logistics landscape, pushing businesses to secure more resilient, self-sufficient supply chains. The UK's logistics sector, one of the most established and advanced in Europe, has seen accelerated growth in response to these challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 4.7% |

The logistics and warehousing segment held a 36% share in 2024 and is forecasted to grow at a CAGR of 5% from 2025 to 2034. This growth is primarily fueled by the surge in global trade, the expansion of third-party logistics providers, and the increasing need for efficient material handling solutions. Pallet jacks are becoming indispensable in optimizing supply chains, improving operational efficiency, and reducing the need for manual labor in these growing sectors. Additionally, the continuous expansion of the e-commerce industry is driving significant demand for enhanced logistics and warehousing operations worldwide.

Regarding product categories, the medium-duty (2 to 5 tons) pallet jacks segment is expected to grow at a CAGR of 5.2% from 2025 to 2034, primarily due to its versatility in handling a variety of loads across different industries. The incorporation of electric-powered systems into these pallet jacks is also expected to drive adoption further, as they improve operational performance, reduce manual effort, and enhance user convenience.

U.S. Pallet Jacks Market held an 82% share and generated USD 1.8 billion in 2024. This dominance is largely attributed to the rapid expansion of warehouses and distribution centers worldwide. With the growing demand for faster inventory turnover and more efficient storage solutions, businesses are increasingly investing in advanced material handling equipment, like pallet jacks, to stay competitive in a booming market. The demand for pallet jacks is also driven by the broader trends of automation and digitization within the U.S. logistics industry.

Key players in the Global Pallet Jacks Market include Howard Handling, Jungheinrich, CUBLIFT, Toyota Material Handling, Doosan, Linde Material Handling, Hyster-Yale Materials Handling, Allman, Raymond Corporation, Vestil, Crown Equipment Corporation, RICO, HU-LIFT, and Mobile Industrial Robots. To strengthen their market presence, companies in the pallet jacks industry are adopting a variety of strategies. These include expanding their product portfolios to include electric-powered and automated pallet jacks, as well as focusing on product innovation to meet the evolving needs of customers.

Partnerships and collaborations with key logistics players, especially third-party logistics providers, help companies enhance their distribution channels. Additionally, investments in research and development are enabling companies to offer more efficient, cost-effective solutions. Expanding into emerging markets and strengthening their manufacturing capabilities through local production are other strategic moves to tap into growing demand. Marketing strategies that emphasize the operational benefits of pallet jacks, including reduced labor costs and increased efficiency, also play a crucial role in boosting their market position.