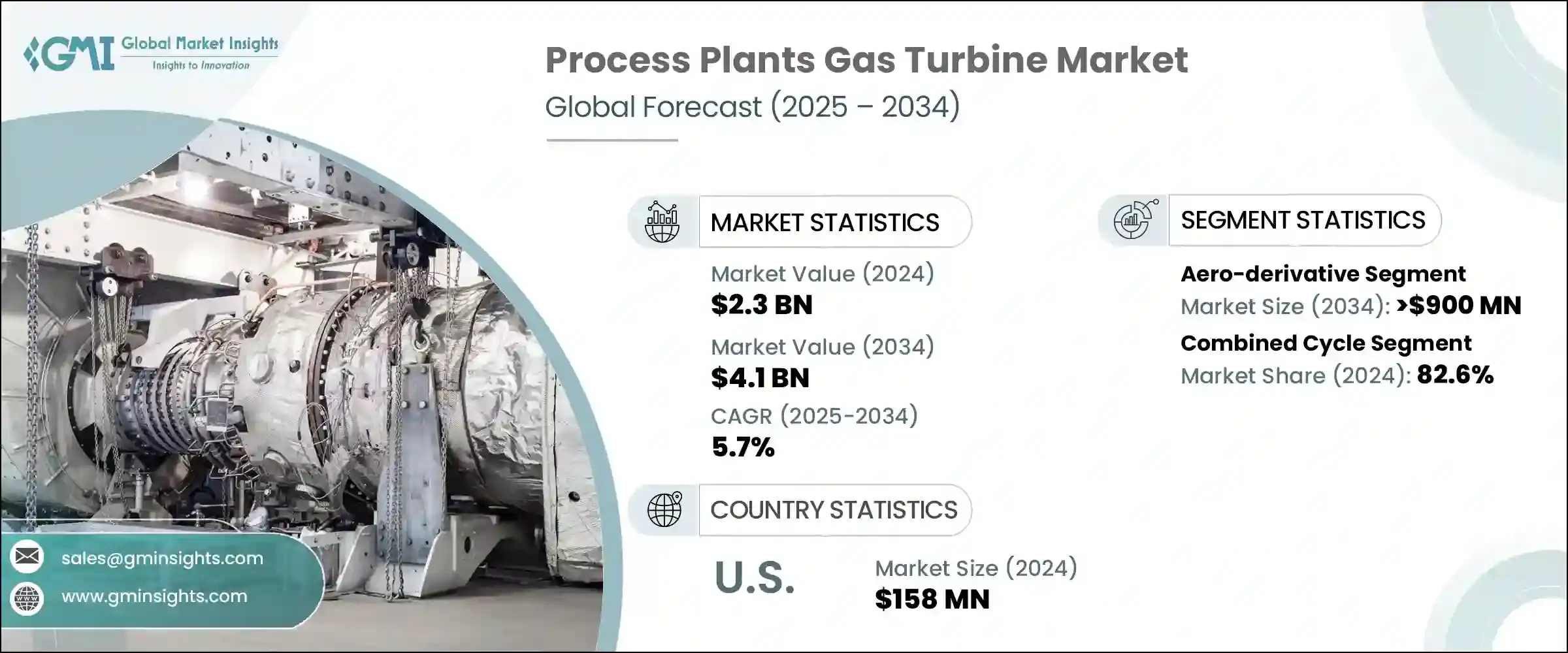

세계의 공정 플랜트 가스 터빈 시장 규모는 2024년에 23억 달러에 달하였고, CAGR 5.7%로 성장하여 2034년에는 41억 달러에 이를 것으로 예측됩니다.

공정산업에서는 특히 전력 장애가 자주 발생하는 지역에서 신뢰성이 낮은 송전망 인프라에 대한 의존을 줄이기 위해 자가발전용으로 가스 터빈을 선택하는 경우가 늘어나고 있습니다. 이 시스템은 열병합발전(CHP) 구성에서 일반적으로 사용되며 전력과 증기를 동시에 발생시켜 플랜트 전체의 효율을 높입니다.

중소규모의 공정 시설에서는 신속한 배치를 가능하게 하고 대규모 토목 공사의 필요성을 억제하는 컴팩트한 모듈식 터빈 패키지에 대한 수요가 높아지고 있습니다. 시멘트, 유리, 석유화학 등의 분야에서는 기계시스템에 전력을 공급하거나 특수한 기능을 위해 열에너지를 공급하기 위해 제조 공정에 직접 내장되어 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 23억 달러 |

| 예측금액 | 41억 달러 |

| CAGR | 5.7% |

대형 가스 터빈 분야는 2034년까지 연평균 복합 성장률(CAGR) 5.5%를 보일 것으로 예측됩니다. 이 터빈은 베이스로드의 전력 수요가 지속되는 제철소, 시멘트시설, 석유화학공장 등 중공업 환경에 널리 설치되어 있습니다.

오픈사이클 부문은 2034년까지 연평균 복합 성장률(CAGR) 5.5%를 보일 것으로 예측됩니다.

미국의 2024년 공정 플랜트 가스 터빈 시장 규모는 1억 5,800만 달러를 달성하였습니다. 미국은 산업 전동화에 힘을 쏟고 있으며 노후화된 복합화력발전설비를 현대화할 필요성으로 인해 가스 터빈 환경과 재생가능에너지의 통합이 진행되고 있습니다.

세계의 공정 플랜트 가스 터빈 시장의 주요 기업은 MAN Energy Solutions, Mitsubishi Heavy Industries, Siemens Energy, Baker Fuse, Rolls-Royce, GE Vernova 등이 있습니다. 공정 플랜트 가스 터빈 시장의 주요 기업은 제품 최적화, 현지 생산 커스터마이징에 중점을 둡니다. 각사는 플랜트 운영기업과 적극적으로 파트너십을 맺어 턴키 터빈 패키지와 장기 서비스 계약을 제공합니다.

The Global Process Plants Gas Turbine Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 4.1 billion by 2034. Process industries are increasingly choosing gas turbines for on-site power generation to reduce dependence on unreliable grid infrastructure, particularly in areas with frequent power disturbances. The growing use of these turbines in captive power applications supports uninterrupted operations and safeguards against production losses, contributing directly to market expansion. These systems are commonly used in combined heat and power (CHP) setups, where they simultaneously generate electricity and steam, enhancing overall plant efficiency. This dual functionality is a critical factor driving gas turbine installations across industrial facilities.

Small and mid-sized process facilities are fueling demand for compact and modular turbine packages that offer rapid deployment and limit the need for extensive civil works. Turbines are also being deployed in temporary or remote sites, including mobile chemical or pipeline operations, where conventional infrastructure is not viable. These turbines are directly integrated into manufacturing processes to power mechanical systems or deliver heat energy for specialized functions in sectors such as cement, glass, and petrochemicals. The heat from exhaust gases is increasingly being utilized for drying, calcining, or steam cracking, offering added efficiency benefits to process industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.7% |

Heavy-duty gas turbines segment is forecasted to grow at a CAGR of 5.5% through 2034. These turbines are widely installed in heavy industrial environments such as steelworks, cement facilities, and petrochemical complexes, where base-load power demand is continuous. Their integration with cogeneration solutions supports the simultaneous delivery of electricity and thermal energy, providing an efficient energy loop at large industrial hubs and reinforcing long-term growth in this segment.

The open cycle segment is expected to grow at a CAGR of 5.5% through 2034. These configurations are favored for their ability to start rapidly, making them suitable for peak load and backup applications. Industries facing unstable power supply are turning to open-cycle gas turbines to secure operations and prevent power interruptions, which continues to strengthen market dynamics.

U.S. Process Plants Gas Turbine Market was valued at USD 158 million in 2024. The nation's focus on industrial electrification and the need to modernize aging combined cycle assets are encouraging the integration of gas turbines with renewable sources. Regulatory measures from environmental agencies are further accelerating the replacement of outdated turbine systems in segments such as fertilizers and chemical manufacturing, pushing U.S. adoption forward.

Key players in the Global Process Plants Gas Turbine Market include MAN Energy Solutions, Mitsubishi Heavy Industries, Siemens Energy, Baker Hughes, Rolls Royce, GE Vernova, and several others. Leading companies in the process plants gas turbine market are focused on product optimization, expanding localized manufacturing, and deepening application-specific customization. Investments in R&D are aimed at developing turbines with lower emissions, enhanced fuel flexibility, and greater modularity. Many players are actively forming partnerships with EPC contractors and process plant operators to offer turnkey turbine packages and long-term service agreements. To cater to evolving industrial demands, manufacturers are integrating digital diagnostics and predictive maintenance capabilities into turbine platforms. Expanding production footprints in regions such as Asia-Pacific and the Middle East also remains a strategic priority.