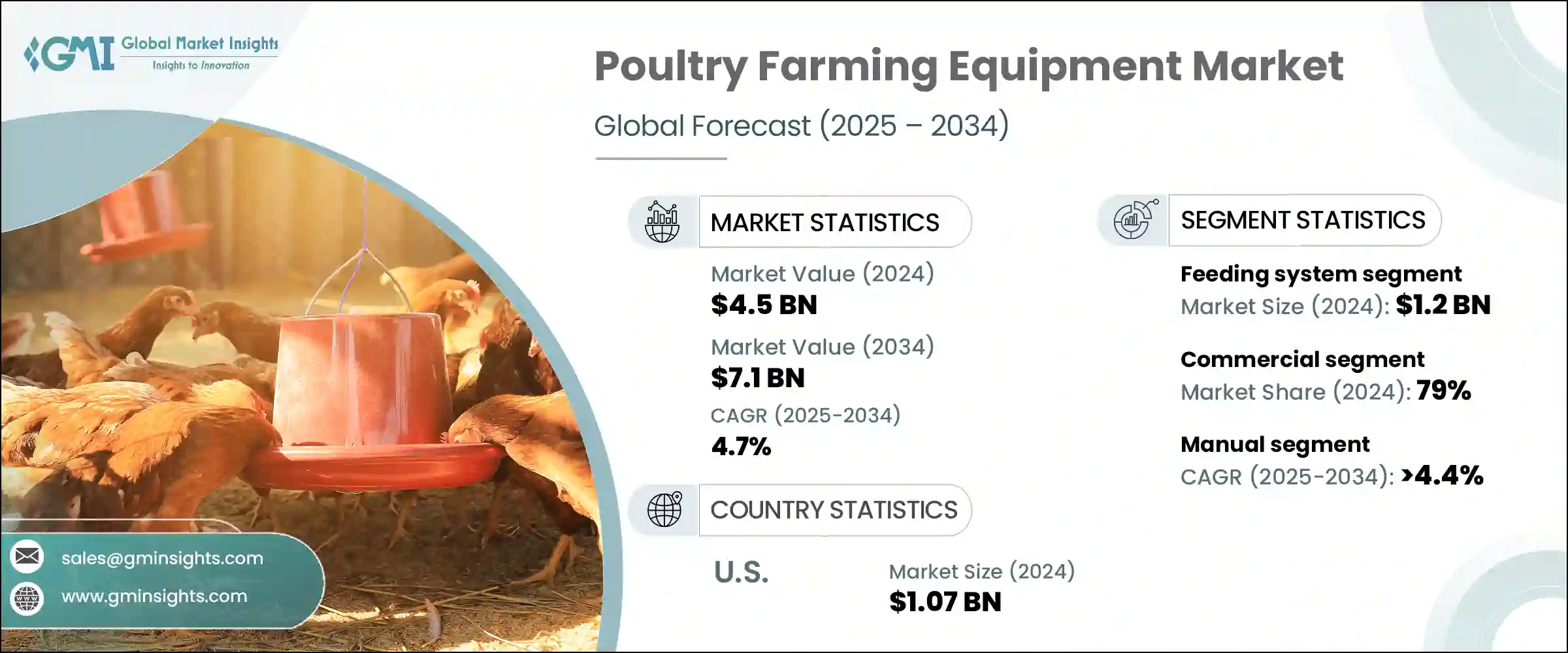

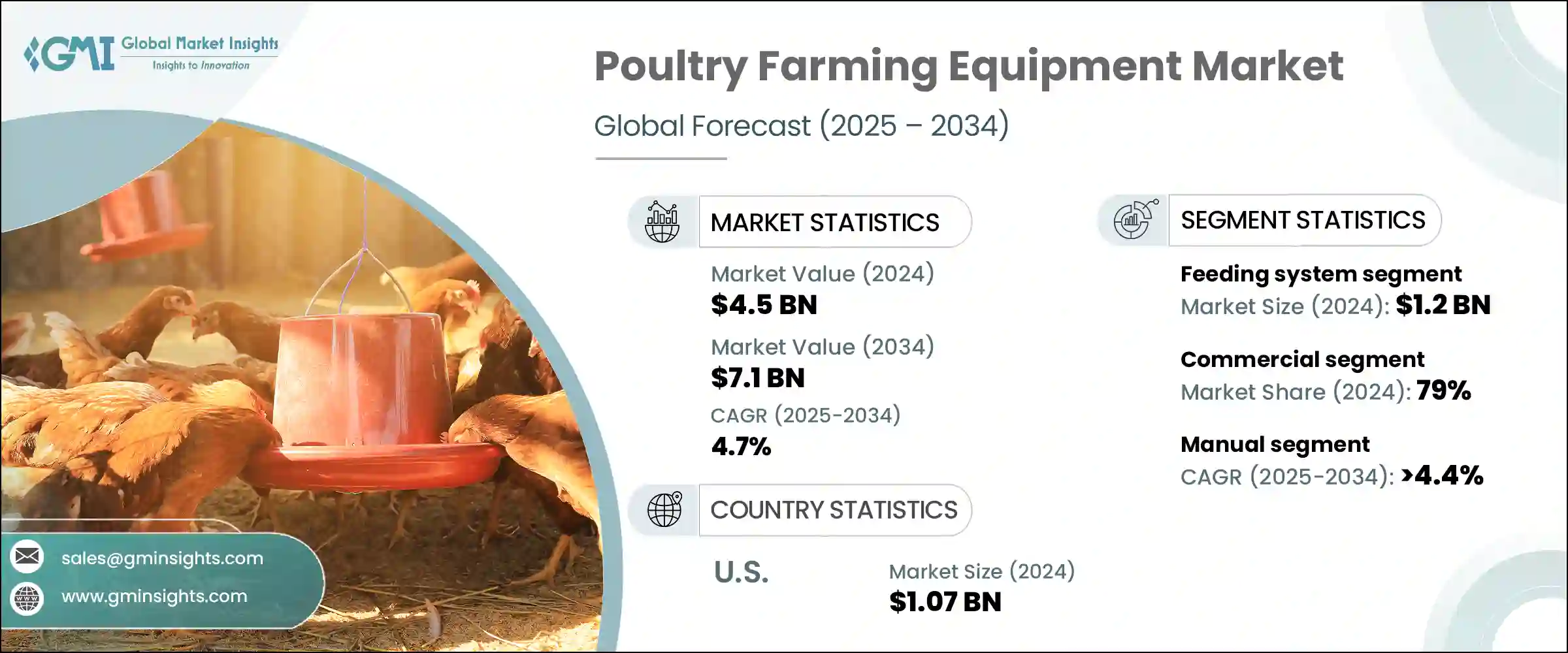

세계의 양계 설비 시장은 2024년에는 45억 달러로 평가되었고 CAGR 4.7%로 성장하여 2034년까지는 71억 달러에 이를 것으로 추정되고 있습니다. 이러한 수요의 급증은 소득 증가와 급속한 도시화가 닭고기 제품의 소비를 촉진하고 있는 개발도상국가에서 두드러집니다.

디지털 커머스 플랫폼의 확장은 공급망을 단순화하고 자동화된 확장 가능한 양계 설비 수요를 간접적으로 밀어올리고 있습니다. 양계 설비는 건강한 사육 조건과 최적화된 사료 급여 시스템을 지원합니다. 정밀 농업에 대한 동향과 보다 높은 생산성을 요구하는 움직임은 보다 선진적인 설비 솔루션으로의 전환을 강화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 45억 달러 |

| 예측금액 | 71억 달러 |

| CAGR | 4.7% |

2024년 사료 급여 시스템 분야는 12억 달러를 창출하였고 2034년까지 연평균 복합 성장률(CAGR) 4.7%를 보일 것으로 예측됩니다. 자동 사료 급여 시스템은 원활한 운영과 인건비 감축을 목표로 하는 양계업자에 의해 급속히 채용되고 있습니다. 정밀 사료 급여기술의 개발은 이 범주에 대한 추가 수요를 촉진하고 있습니다. 증가하는 소비자 우려 또한 최신 케이지 시스템의 채택을 추진하고 있습니다. 이 시스템은 양계장 내부의 고품질 환경 관리에 대한 수요가 증가함에 따라 고급 환경제어기술의 성장을 이끌고 있습니다.

상업 농업 부문은 2024년에 79%의 점유율을 차지하였으며, 2025년부터 2034년까지의 CAGR은 4.9%를 보일 것으로 예측됩니다. 첨단 기계는 인건비 절감에 도움이 되며, 생산자는 보다 효율적으로 수요를 충족시킬 수 있습니다.

유럽의 양계 설비 시장은 2024년에 8억 달러를 창출하였고 2034년까지 연평균 복합 성장률(CAGR) 4.2%를 보일 것으로 예측됩니다. 혁신적인 기술 도입을 촉진하는 정부의 지원 프로그램과 정책 이니셔티브도 시장 확대에 기여하고 있습니다.

업계를 형성하는 주요 기업으로는 SKA, Qingdao Huabo, Hellmann Poultry, Potters Poultry, Valco Industries, Zucami Poultry Equipment, Texha, Officine Facco, PEP Poultry Equipment Plus, AGICO, Roxell, Big Dutchman, Hightop, Tecno Poultry Equipment, Tavsan 등이 있습니다. 이러한 주요 기업은 제품 혁신과 전략적 성장을 통해 시장을 성장시키는 데 중요한 역할을 하고 있습니다. 상업 양계장과의 파트너십 및 협업을 통해 각 기업은 특정 운영요구에 맞는 솔루션을 제공할 수 있습니다.

The Global Poultry Farming Equipment Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 7.1 billion by 2034. Demand for poultry products like eggs and meat continues to rise worldwide as consumers increasingly shift toward protein-rich diets. This surge in demand is notably prominent in developing countries, where rising incomes and rapid urbanization are driving the consumption of poultry products. The growing influence of fast-food chains and increased availability of ready-to-eat poultry items are compelling producers to invest in high-efficiency farming equipment.

The expansion of digital commerce platforms is also simplifying the supply chain, indirectly pushing the demand for automated, scalable poultry farming tools. Modern technologies designed to improve operational efficiency and animal welfare are gaining traction. Innovative solutions are being implemented to balance space efficiency and automation, supporting healthier bird-rearing conditions and optimized feeding systems. The trend toward precision farming and the push for higher productivity is reinforcing the shift toward more advanced equipment solutions. Enhanced comfort, sanitation, and automation within farming facilities are now becoming essential components of successful poultry operations, supporting a more sustainable and efficient poultry farming ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 4.7% |

In 2024, the feeding system segment generated USD 1.2 billion in 2024 and is anticipated to grow at a 4.7% CAGR throughout 2034. Automatic feeding solutions are rapidly being adopted by poultry producers looking to streamline operations and reduce manual labor. The use of timed distribution systems and precision-engineered hoppers is helping farmers control feed portions and optimize growth outcomes. Developments in precision feeding technologies are fostering further demand in this category. Increasing consumer concern for ethically raised poultry and growing regulatory standards around animal welfare are pushing the adoption of modern cage systems. These systems, combined with the increasing demand for high-quality environmental management within poultry houses, are driving the growth of advanced climate control technologies.

The commercial farming sector held a 79% share in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The global appetite for poultry products in large volumes pushes commercial operators to invest heavily in automated farming equipment. These advanced machines help reduce labor expenses and allow producers to meet demand more efficiently. As poultry becomes a key protein source across regions, commercial farms are prioritizing productivity, consistency, and hygiene, driving the continued reliance on smart and scalable solutions.

Europe Poultry Farming Equipment Market generated USD 0.8 billion in 2024 and is projected to grow at a CAGR of 4.2% through 2034. The expansion of commercial farms across the region is accelerating demand for durable and high-capacity equipment management operations at scale. Government support programs and policy initiatives promoting the adoption of innovative agricultural technology are also contributing to market expansion. These incentives are encouraging producers to embrace cutting-edge machinery to improve yield and efficiency, enabling them to cater to the evolving demands of the poultry sector.

Leading companies shaping the industry include SKA, Qingdao Huabo, Hellmann Poultry, Potters Poultry, Valco Industries, Zucami Poultry Equipment, Texha, Officine Facco, PEP Poultry Equipment Plus, AGICO, Roxell, Big Dutchman, Hightop, Tecno Poultry Equipment, and Tavsan. These key players are playing an instrumental role in pushing the market forward through product innovation and strategic growth. To enhance their position in the poultry farming equipment industry, top manufacturers are actively expanding product lines by integrating automation, energy efficiency, and animal welfare features into their equipment. Partnerships and collaborations with commercial poultry farms allow companies to tailor solutions to specific operational needs. Investment in R&D enables the development of user-friendly and precision-based technologies to improve farm management.