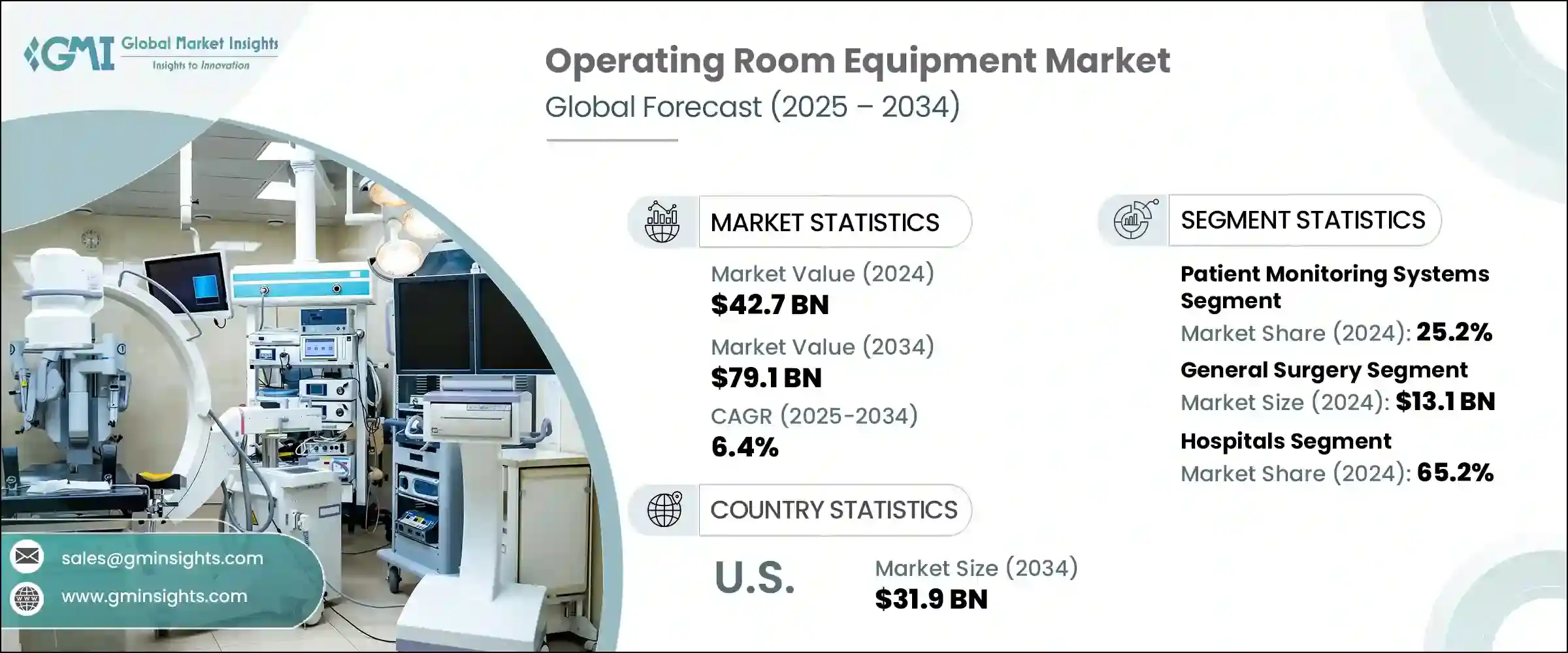

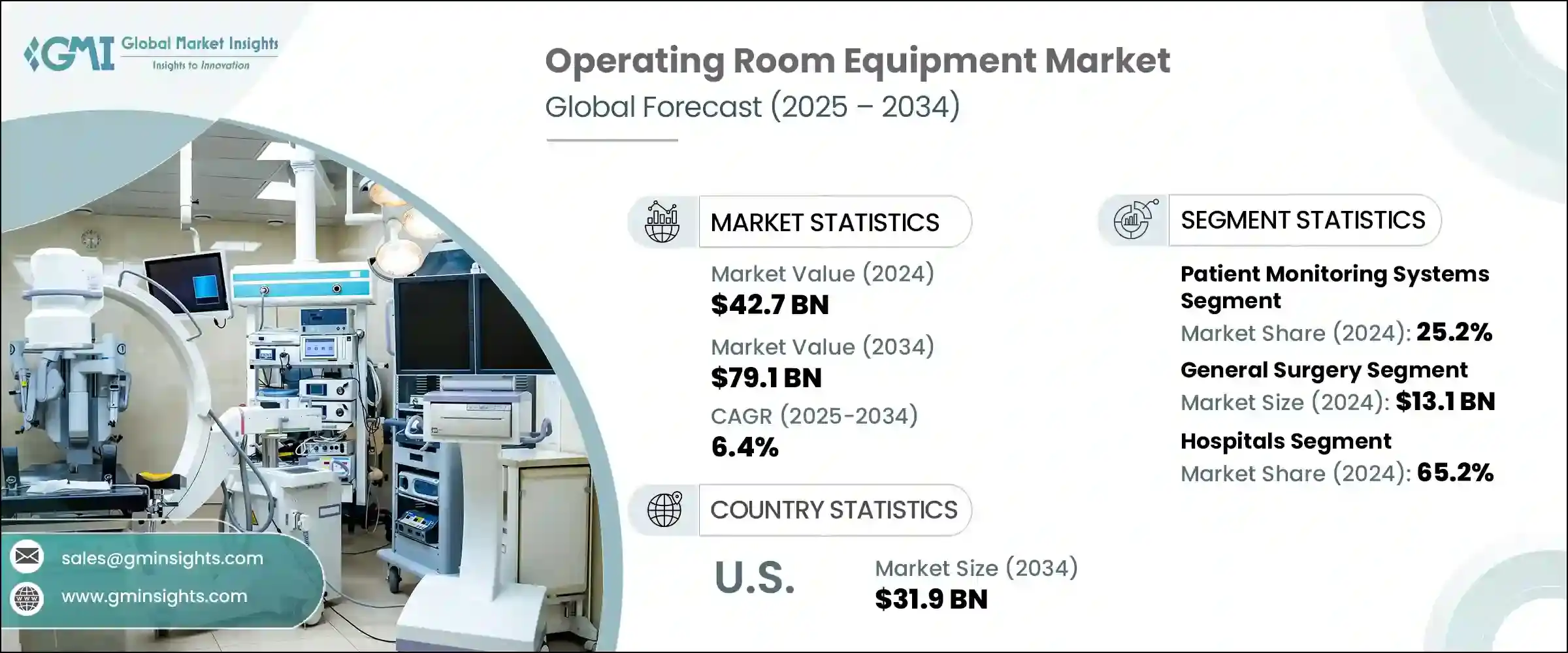

세계의 수술실 장비 시장은 2024년 427억 달러로 평가되었으며 CAGR 6.4%로 성장하여 2034년까지 791억 달러에 이를 것으로 추정됩니다.

이 시장에는 안전하고 효과적인 수술을 촉진하는 데 필수적인 도구, 기계, 시스템, 인프라가 광범위하게 포함되어 있습니다. 첨단 수술 절차로의 전환은 주요 성장요인입니다. 병원은 특히 복잡한 사례에 대한 수술의 정확성, 안전성, 효율성을 높이기 위해 차세대 솔루션에 투자하고 있습니다.

이러한 시스템을 통한 시각화와 데이터 정확성 향상은 보다 나은 임상판단과 신속한 회복을 지원하고 고품질의 의료에 대한 보편적인 접근을 확대하는 광범위한 목표에 부합하는 것입니다. 또한 수술 결과를 개선하고 합병증의 가능성을 줄일 수 있습니다. 고화질 이미지, 통합 소프트웨어 플랫폼, 그리고 인공지능을 통한 분석은 보다 정확한 진단과 수술 계획의 수립에 기여합니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 427억 달러 |

| 예측금액 | 791억 달러 |

| CAGR | 6.4% |

다양한 제품 범주 중에서 환자 모니터링 시스템 분야는 2024년에 25.2%의 점유율을 차지했습니다. 알람 설정 및 데이터 트렌드 기능을 갖춘 고급 모니터링 장치는 환자의 안전을 보장하고 일분일초가 중요한 환경에서 임상결정을 지원하기 위해 널리 채택되었습니다. 수술 절차가 복잡해짐에 따라 신뢰성 높은 수술 모니터링은 합병증을 줄이고 수술 결과를 향상시키는 데 도움이 되므로 고성능 모니터링 솔루션에 대한 수요가 증가하고 있습니다.

일반 수술 분야는 2024년에 131억 달러를 창출해 계속 장비 수요의 주요 견인 역할을 하고 있습니다. 통상적인 수술에 대한 지속적인 수요로 전체적으로 일관적인 수요에 기여하고 있습니다. 이 안정적인 수요는 마취 시스템, 수술대, 전기수술기기, 수술용 조명 등 수술실에 필수적인 장비에 대한 정기적인 투자를 촉진합니다. 병원이 증례의 지연을 줄이고 수술 스케줄을 최적화하는 것을 목표로 하고 있기 때문에 수술실의 생산성 향상에 대한 압박이 높아지고 있습니다.

미국의 수술실 장비 시장 규모는 2024년에 174억 달러를 달성하였고, 2034년에는 319억 달러에 이를 것으로 추정되고 있습니다. 이러한 성장은 비만, 암, 심혈관 질환 등의 만성 질환의 만연으로 발생한 것입니다. 학술의료센터에서 대규모 의료 네트워크에 이르기까지 의료기관은 수술 인프라 업그레이드 및 확장에 많은 자본 예산을 할당하고 있습니다.

이 업계의 발전에 기여하는 주요 기업은 Getinge, Stryker, Olympus, Medtronic, GE HealthCare, Philips, Karl Storz, Smith & Nephew, Siemens Healthineers, Dragerwerk, Zimmer Biomet, B. Braun, Johnson & Johnson, Baxter International, Mindray 등입니다. 강력한 경쟁력을 유지하기 위해 OR 기기 시장에서 사업을 전개하는 기업은 다양한 표적 전략을 채용하고 있습니다. 많은 기업들은 병원과 수술센터와의 제휴에 주력하여 일괄 솔루션과 턴키 수술실 설치를 제공하고 있으며, 저침습 툴과 AI 탑재 시스템의 연구개발에 대한 투자도 스마트한 수술환경에 대한 요구의 고조에 대응하고 있습니다.

The Global Operating Room Equipment Market was valued at USD 42.7 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 79.1 billion by 2034. This market encompasses a broad range of essential tools, machines, systems, and infrastructure used to facilitate safe and effective surgical procedures. A steady rise in surgeries fueled by the global burden of chronic illnesses-such as orthopedic conditions, cancers, and heart diseases-is significantly accelerating market expansion. The increasing focus on healthcare infrastructure modernization and a shift toward more technologically advanced surgical techniques are key growth contributors. Hospitals are investing in next-generation solutions to enhance surgical precision, safety, and efficiency, particularly for complex cases. Modern surgical suites now incorporate robotic systems, integrated OR platforms, and imaging technologies to minimize invasiveness and improve outcomes.

Enhanced visualization and accurate data through these systems support better clinical decisions and faster recovery, aligning with the broader goal of expanding universal access to quality care. These advanced technologies allow surgeons and medical staff to monitor vital signs and internal structures in real time, significantly improving procedural outcomes and reducing the likelihood of complications. High-definition imaging, integrated software platforms, and AI-powered analytics contribute to more precise diagnostics and surgical planning. This level of insight not only reduces the invasiveness of procedures but also shortens hospital stays, minimizes readmission rates, and supports tailored post-operative care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.7 Billion |

| Forecast Value | $79.1 Billion |

| CAGR | 6.4% |

Among various product categories, patient monitoring systems segment held a 25.2% share in 2024. Surgeons and anesthesiologists rely heavily on these systems for real-time tracking of vital signs like oxygen saturation, ECG, and blood pressure during surgical procedures. The demand is strong for high-risk surgeries such as cardiac, neurological, and organ transplants, where accuracy and continuous feedback are critical. Advanced monitoring devices equipped with alarm settings and data trend capabilities are being widely adopted to ensure patient safety and support clinical decision-making in time-sensitive environments. As surgical procedures become more complex, reliable intraoperative monitoring helps in reducing complications and improving surgical outcomes, thus boosting the demand for high-performance monitoring solutions.

The general surgery segment generated USD 13.1 billion in 2024 and continues to be a major driver of equipment demand. Routine procedures such as hernia repairs, gallbladder removals, and appendectomies contribute to a consistent procedural volume across global markets. This steady demand fuels recurring investments in essential operating room tools including anesthesia systems, surgical tables, electrosurgical units, and surgical lighting. As hospitals aim to reduce case delays and optimize surgical scheduling, there is greater pressure to enhance operating room productivity. General surgery departments, which handle a high volume of procedures with varying durations, are particularly focused on replacing outdated infrastructure and adopting systems that facilitate rapid case turnaround and better resource utilization.

U.S. Operating Room Equipment Market generated USD 17.4 billion in 2024 and is estimated to reach USD 31.9 billion by 2034. The country's high surgical procedure rate is primarily driven by its aging population and widespread chronic diseases such as obesity, cancer, and cardiovascular issues. The growing procedural demand has compelled hospital systems and surgical centers to invest in advanced operating room technologies. Institutions ranging from academic medical centers to large healthcare networks allocate significant capital budgets to upgrade or expand their surgical infrastructure. This enables them to improve care quality, reduce surgical wait times, and keep pace with evolving clinical standards. The consistent modernization of OR environments continues to drive robust growth across the U.S. market landscape.

Leading players contributing to the development of this industry include Getinge, Stryker, Olympus, Medtronic, GE HealthCare, Philips, Karl Storz, Smith & Nephew, Siemens Healthineers, Dragerwerk, Zimmer Biomet, B. Braun, Johnson & Johnson, Baxter International, and Mindray. To maintain a strong competitive edge, companies operating in the OR equipment market are adopting a range of targeted strategies. These include expanding product portfolios through innovation in imaging, integration, and robotic technologies. Many are focusing on partnerships with hospitals and surgical centers to offer bundled solutions or turnkey operating room installations. Investments in R&D for minimally invasive tools and AI-powered systems are also helping players meet the growing need for smart surgical environments.