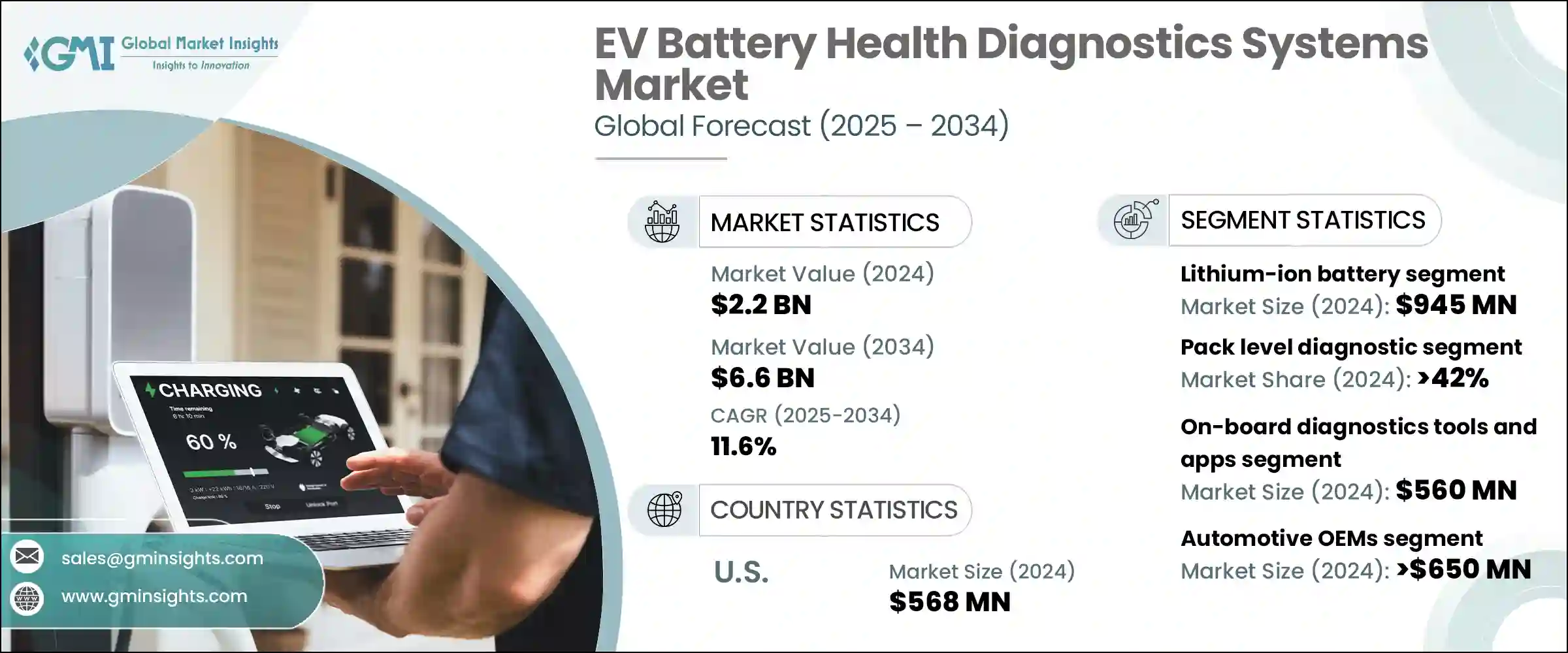

세계의 EV 배터리 상태 진단 시스템 시장 규모는 2024년에 22억 달러에 달하였고, CAGR 11.6%로 성장하여 2034년에는 66억 달러에 이를 것으로 추정됩니다.

이 성장의 주요 원동력은 배터리의 안전성, 성능, 수명에 대한 우려가 높아짐에 따라, 개인 및 상업 수송 부문에서의 전기자동차(EV)가 급속하게 확대되면서 발생합니다.

EV에서 배터리 분야는 고액의 투자이기 때문에 배터리의 안정성과 성능을 모니터링하는 실시간 진단은 불가피합니다. EV 배터리 상태 진단 시스템은 배터리의 상태, 성능 및 효율성을 실시간으로 모니터링할 수 있으며, 적시 개입과 예측 유지보수를 가능하게 합니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 22억 달러 |

| 예측금액 | 66억 달러 |

| CAGR | 11.6% |

또한 이러한 스마트 진단 시스템은 배터리의 안정성과 성능에 대한 정확한 데이터를 제공함으로써 보증 관리를 간소화하고 플릿 오퍼레이터와 제조업체가 보증 클레임을 효과적으로 관리할 수 있도록 합니다.

리튬이온 배터리 분야는 40%의 점유율을 차지했으며, 2024년 시장 규모는 9억 4,500만 달러였습니다. 이러한 인기로 충전상태(SOC), 안정성상태(SOH), 열성능 등의 주요 성능지표를 모니터링하는 고도 진단기술의 채용이 증가하고 있습니다.

팩레벨 진단 분야는 2024년에 42%의 점유율을 차지하였고, 양산 EV와 상용 EV 모두에 대응하는 비용 효율성과 확장성이 뛰어난 진단 솔루션이 견인하여 2025-2034년의 CAGR은 10.5%를 보일 것으로 예측됩니다. 해당 솔루션은 온도, 전류 흐름 등 중요한 매개변수를 추적하고 배터리 상태를 전반적으로 파악합니다.

미국의 EV 배터리 상태 진단 시스템 시장은 2024년에 75%의 점유율을 차지해 5억 6,800만 달러를 창출했습니다. 시장은 더욱 성장하는 태세를 갖추고 있으며, 안전성과 신뢰성뿐만 아니라 배터리 성능의 투명성을 요구하는 소비자 수요가 정확하고 시기적절한 진단의 필요성을 높이고 있습니다. 또한 정책적인 우대조치가 배터리 생산과 2차 이용 용도에 대한 자금 지원과 함께 진단 시스템에서 특히 클라우드 기반과 AI를 활용한 기술의 혁신을 더욱 뒷받침하고 있습니다.

EV 배터리 상태 진단 시스템 시장의 상위 기업은 AVL, Mahle, Exide Technologies, Forvia Hella, Cox Automotive, LG Energy Solutions, Delphi 등이 있습니다. EV 배터리 진단 시장에서의 지위를 강화하기 위해 각 회사는 AI, IoT, 클라우드 기반 플랫폼 등의 선진 기술을 솔루션에 통합하는 데 주력하고 있습니다. 이러한 통합을 통해 배터리의 성능과 수명을 향상시키는 정확한 실시간 진단이 가능하게 됩니다.

자동차 제조업체 및 운행 관리회사와의 제휴를 통해 이러한 기업은 특정 고객의 요구에 맞는 맞춤형 솔루션을 개발할 수 있습니다. 각 기업은 개발 속도를 높이기 위해 R & D에 많은 투자를 실시했습니다. 마지막으로 종합적인 애프터서비스를 제공하고 직접판매 채널을 통해 강력한 고객 관계를 구축하는 것이 시장 발판을 강화하는 데 필수적인 전략입니다.

The Global EV Battery Health Diagnostics System Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 6.6 billion by 2034. This growth is primarily driven by the rapid expansion of electric vehicles (EVs) across personal and commercial transport sectors, alongside growing concerns about battery safety, performance, and longevity. As EV adoption accelerates, the importance of ensuring battery health has become critical for automotive manufacturers, fleet operators, and consumers alike.

With the high cost of batteries being a significant investment for EVs, real-time diagnostics to monitor battery health and performance is essential. Advanced diagnostic systems, powered by AI and IoT technologies, play a pivotal role in reducing the overall maintenance costs associated with electric vehicles (EVs). These systems enable real-time monitoring of battery health, performance, and efficiency, allowing for timely interventions and predictive maintenance. By detecting potential issues before they escalate into major problems, these diagnostic tools help optimize the longevity of EV batteries, thereby cutting down on expensive repairs and replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 11.6% |

Moreover, these smart diagnostics systems streamline warranty management by providing precise data on battery health and performance, making it easier for fleet operators and manufacturers to manage warranty claims effectively. The ability to track and diagnose potential issues remotely ensures faster response times and more accurate claim assessments.

The lithium-ion battery segment held a 40% share and was valued at USD 945 million in 2024. Lithium-ion batteries have gained widespread use due to their superior energy density, longer cycle life, and exceptional performance compared to other battery chemistries. This popularity has led to the increased adoption of advanced diagnostics technologies that monitor key performance metrics like state of charge (SOC), state of health (SOH), and thermal performance. Additionally, their compatibility with AI-based cloud platforms and over-the-air (OTA) diagnostics has strengthened their dominance in the market.

The pack-level diagnostics segment held a 42% share in 2024 and is expected to grow at a CAGR of 10.5% during 2025-2034, driven by the cost-effective and scalable diagnostic solutions for both mass-market and commercial EVs. Pack-level diagnostics track critical parameters such as voltage, temperature, and current flow, offering an overall view of the battery's condition. This approach is vital for detecting early-stage failures, such as thermal runaway, voltage imbalances, and energy misuse, all of which are crucial for vehicle safety, efficiency, and range.

U.S. EV Battery Health Diagnostics System Market held a 75% share and generated USD 568 million in 2024. With rapid developments in the EV ecosystem and federal support aimed at electrifying fleets, the U.S. market is poised for further growth. Consumer demand for transparency in battery performance, as well as safety and reliability, is driving the need for accurate and timely diagnostics. The U.S. government's incentives, such as The Inflation Reduction Act, combined with funding for battery production and secondary use applications, have further fueled the push for innovation in diagnostics systems, especially cloud-based and AI-powered technologies.

The top companies in the EV Battery Health Diagnostics System Market include AVL, Mahle, Exide Technologies, Forvia Hella, Cox Automotive, LG Energy Solutions, and Delphi. To strengthen their position in the EV battery diagnostics market, companies are focusing on integrating advanced technologies such as AI, IoT, and cloud-based platforms into their solutions. This helps to provide real-time, precise diagnostics that enhance battery performance and lifespan. Companies are also expanding their product offerings, including advanced pack-level and cell-level diagnostics, to meet the evolving needs of OEMs and fleet operators.

Partnerships with automakers and fleet management companies allow these players to develop customized solutions tailored to specific customer needs. Furthermore, companies are investing heavily in R&D to innovate in battery diagnostics and improve system accuracy, scalability, and efficiency. Finally, offering comprehensive after-sales services and building strong customer relationships through direct sales channels have become essential strategies for strengthening the market foothold.