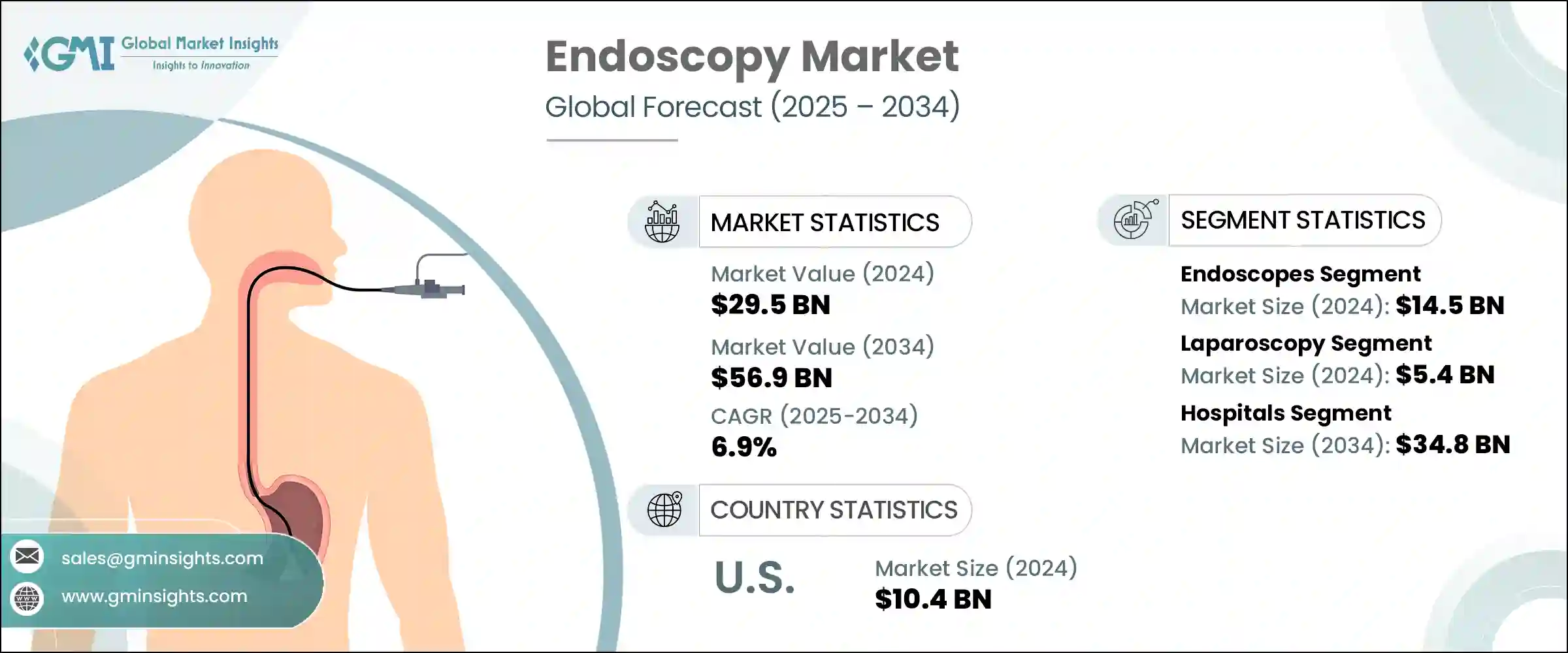

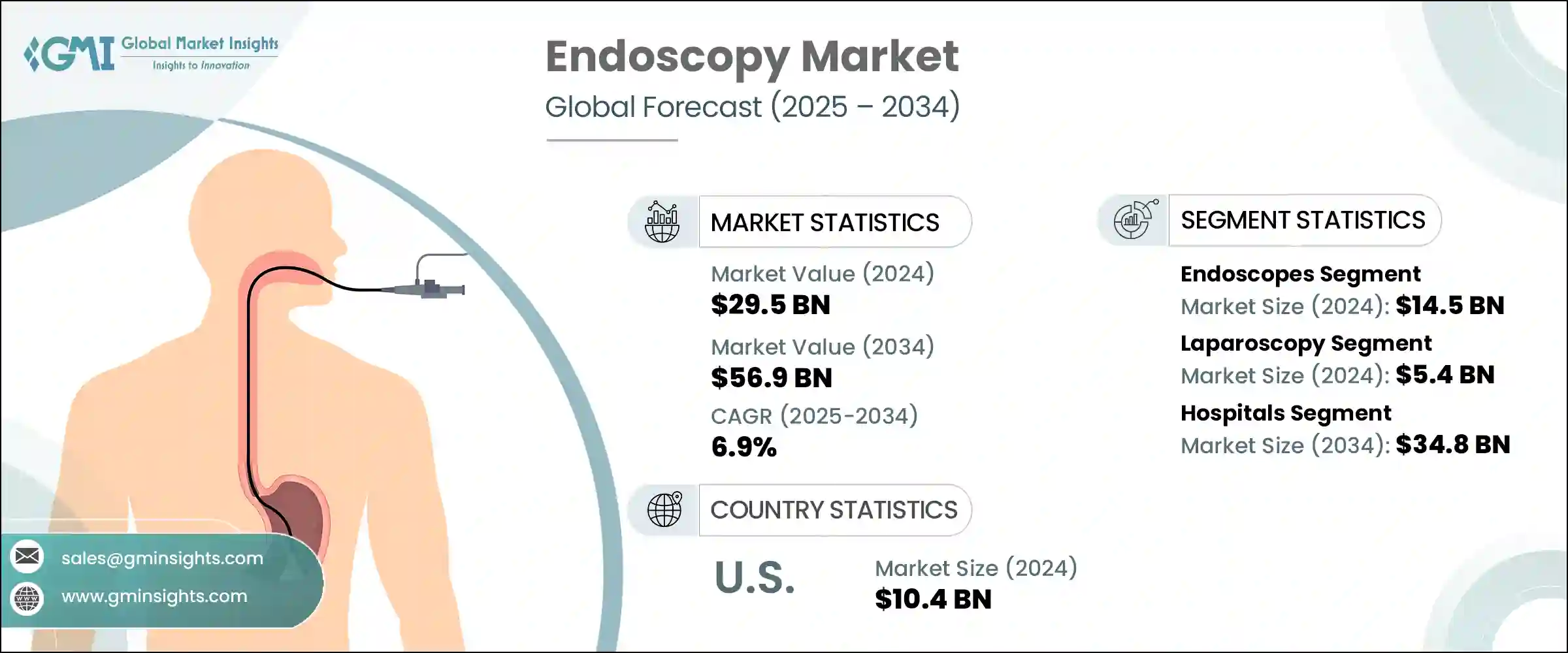

세계의 내시경검사 시장은 2024년에는 295억 달러에 달하며, CAGR 6.9%로 성장하며, 2034년에는 569억 달러에 달할 것으로 예측됩니다.

시장 성장은 의학의 발전, 헬스케어 우선순위 변화, 전 세계 질병 발생률 증가 등에 의해 형성되고 있습니다. 덜 침습적인 치료 옵션에 대한 수요 증가와 진단 및 치료 목적으로 내시경 검사의 사용 증가는 시장 확대에 크게 기여하고 있습니다. 의료비 지출 증가, 인구 고령화, 만성질환 및 소화기 질환의 전 세계 유병률 증가로 인해 시장은 지속적인 모멘텀을 보이고 있습니다. 또한 조기 진단으로의 전환과 예방 의료에 대한 관심이 높아지면서 공공 및 민간 의료 환경에서 내시경 시술의 채택률이 증가하고 있습니다. 전 세계 의료 시스템은 정확한 진단, 환자의 조기 회복, 입원 비용 절감을 위해 첨단 내시경 기술에 투자하고 있습니다.

2024년에는 내시경 부문이 가장 높은 시장 점유율을 차지하여 145억 달러의 매출을 기록했습니다. 고성능 영상 진단 및 시술 장비에 대한 수요는 시각적 선명도, 조작성 향상, 로봇 공학 및 AI와 같은 스마트 기능의 통합에 힘입어 계속 가속화되고 있습니다. 이러한 기술 발전은 의사가 내진하는 방식을 변화시켜 보다 빠르고 정확한 진단을 가능하게 하고 있습니다. 작고 유연하며 가벼운 내시경은 이전에는 도달할 수 없었던 해부학적 부위에 도달할 수 있으므로 전문의들이 선호하고 있습니다. 사용 편의성 향상, 환자 불편감 감소, 우수한 임상 결과로 인해 내시경은 일상 진료에서 내시경의 입지가 더욱 강화되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작 금액 | 295억 달러 |

| 예측 금액 | 569억 달러 |

| CAGR | 6.9% |

또 다른 요인은 외래 환자 및 외래 환경에서 일회용 내시경 기기에 대한 선호도가 높아지고 있다는 점입니다. 이러한 기기는 감염 위험을 줄이고 복잡한 멸균 과정을 거치지 않고도 감염 위험을 줄일 수 있습니다. 특히 일회용 내시경은 비용 효율성과 환자와 의료진 모두의 안전성을 향상시키는 능력으로 인해 기관지 내시경과 비뇨기과에서 큰 호응을 얻고 있습니다.

세계에서 암, 특히 소화기암과 대장암의 발병률이 증가함에 따라 내시경 시술이 암의 발견, 모니터링 및 치료를 위한 최전선 솔루션으로 각광받고 있습니다. 내시경 기술은 종양 제거, 생검 채취 및 상태 추적에 널리 사용되고 있습니다. 조기 암 진단의 이점에 대한 인식이 높아짐에 따라 첨단 내시경 검사 솔루션에 대한 수요가 급증하고 있습니다.

용도별로 복강경 검사는 2024년 54억 달러 시장 가치를 가지며 2025-2034년간 연평균 6.5%의 성장률을 보일 것으로 예측됩니다. 복강경과 같은 최소침습적 기술은 입원 기간 단축, 외과적 외상 감소, 회복 기간 단축과 관련하여 더 널리 받아들여지고 있습니다. 담낭 절제술에서 비만 수술에 이르기까지 환자와 외과의사 모두 이러한 접근법을 선호하는 경향이 뚜렷해지고 있습니다. 전 세계에서 비만율이 증가함에 따라 체중 감량 수술 건수도 증가하고 있으며, 복강경 장비에 대한 수요를 더욱 촉진하고 있습니다. 더 많은 의사들이 시뮬레이션 프로그램 및 장비 제조업체와의 제휴를 통해 복강경 수술에 대한 교육을 받고 있으며, 숙련된 전문가의 가용성이 향상되고 있으며, 이는 전 세계에서 복강경 수술의 채택을 더욱 촉진하고 있습니다.

최종사용자별로 보면 2024년에는 병원이 압도적인 위치를 차지하고 있으며, 2034년에는 348억 달러에 달할 것으로 예측됩니다. 병원은 진단 및 수술에 대한 수요 증가에 대응하기 위해 최첨단 내시경 시스템을 갖추고 있습니다. 이들 기관은 특히 위장 및 암 검진의 경우 질병의 조기 발견을 위해 내시경 검사를 채택하도록 장려하는 정책적 인센티브와 보험 적용을 통해 이익을 얻고 있습니다. 병원은 운영 비용을 최적화하면서 환자의 예후를 개선하기 위해 지속적으로 인프라를 업그레이드하고 있습니다. 장기 입원의 필요성을 줄여주는 내시경 검사는 이러한 목적에 부합합니다. 직원 교육 및 기술 업데이트에 투자함으로써 병원은 내시경 시술의 최신 개발에 적응하면서 높은 수준의 의료 서비스를 유지할 수 있습니다.

미국 내시경 검사 시장은 지속적인 성장세를 보이고 있으며, 2021년 92억 달러에서 2024년 104억 달러로 증가했으며, 2025-2034년 연평균 6.1%의 성장률을 보일 것으로 예측됩니다. 만성질환의 높은 유병률과 정확한 진단 툴의 필요성이 이러한 성장의 주요 원동력이 되고 있습니다. 소화기 질환으로 진단받는 환자가 증가함에 따라 보다 진보되고 덜 침습적인 솔루션에 대한 필요성이 증가하고 있습니다. 미국 시장은 의료 서비스 프로바이더들이 비용 효율성을 유지하면서 시술 결과를 개선하기 위해 노력함에 따라 계속 진화하고 있습니다.

경쟁 구도는 기술 혁신, 제휴, 제품의 다양화에 의해 정의됩니다. Stryker Corporation, Olympus Corporation, Boston Scientific, Karl Storz, Medtronic 등의 기업이 시장 점유율 약 42-45%를 차지하고 있습니다. 이들 업계 선두주자들은 AI, 로봇공학, 첨단 영상처리 기술을 통합한 차세대 내시경 플랫폼에 적극적으로 투자하여 임상적 성능을 향상시키고 있습니다. 전략적 제휴와 인수합병은 세계 진출과 진화하는 의료기기 시장에서 입지를 강화하기 위한 중요한 전략으로 자리매김하고 있습니다.

The Global Endoscopy Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 56.9 billion by 2034. Market growth is being shaped by a combination of medical advancements, changing healthcare priorities, and rising disease burdens across the globe. The rising demand for less invasive treatment options and increased utilization of endoscopy for both diagnostic and therapeutic purposes are contributing significantly to market expansion. The market is witnessing consistent momentum due to growing healthcare spending, aging populations, and the rising incidence of chronic and gastrointestinal illnesses worldwide. Moreover, a shift toward early diagnosis and the growing focus on preventive care have led to higher adoption of endoscopic procedures in both public and private healthcare settings. Healthcare systems across the globe are investing in advanced endoscopic technologies that support accurate diagnostics, faster patient recovery, and lower hospitalization costs.

In 2024, the endoscopes segment accounted for the highest market share, generating USD 14.5 billion in revenue. The demand for high-performance imaging and procedural tools continues to accelerate, driven by improvements in visual clarity, maneuverability, and integration of smart features like robotics and AI. These technological advancements are transforming how physicians perform internal examinations, enabling quicker and more precise diagnoses. Compact, flexible, and lightweight endoscopes are now preferred by specialists for reaching anatomical areas that were previously inaccessible. Enhanced usability, reduced patient discomfort, and superior clinical outcomes are strengthening the position of endoscopes in routine practice.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $56.9 Billion |

| CAGR | 6.9% |

Another contributing factor is the growing preference for single-use and disposable endoscopic tools, which are becoming popular in outpatient and ambulatory settings. These devices help limit the risk of infection and eliminate the need for complex sterilization processes. Single-use endoscopes, in particular, are gaining traction in bronchoscopy and urology due to their cost-efficiency and ability to improve safety for both patients and practitioners.

The rising global burden of cancer, particularly gastrointestinal and colorectal cancers, is driving the need for endoscopic procedures as a frontline solution for detection, monitoring, and treatment. Endoscopic techniques are widely used for tumor removal, biopsy collection, and condition tracking. As awareness about the benefits of early cancer diagnosis grows, the demand for advanced endoscopy solutions continues to surge.

Among the various applications, laparoscopy held a market value of USD 5.4 billion in 2024 and is projected to grow at a CAGR of 6.5% between 2025 and 2034. Minimally invasive techniques like laparoscopy are gaining broader acceptance due to their association with shorter hospital stays, lower surgical trauma, and faster recovery periods. Patients and surgeons alike are showing a clear preference for these approaches in procedures ranging from gallbladder removal to bariatric surgeries. With the increasing rate of obesity worldwide, the number of weight-loss surgeries is rising, further supporting the demand for laparoscopic instruments. As more practitioners receive training in laparoscopy through simulation programs and partnerships with device manufacturers, the availability of skilled professionals is improving, which further drives adoption on a global scale.

In terms of end users, hospitals held the dominant position in 2024 and are projected to reach USD 34.8 billion by 2034. Hospitals are increasingly equipped with state-of-the-art endoscopic systems to meet the rising demand for diagnostics and surgical procedures. These institutions benefit from policy incentives and insurance coverage that promote the adoption of endoscopy for early disease detection, especially in cases of gastrointestinal and cancer screenings. Hospitals are continuously upgrading their infrastructure to enhance patient outcomes while optimizing operational costs. Endoscopy procedures, which reduce the need for extended hospital stays, align well with this objective. Investments in staff training and technology updates ensure that hospitals maintain high standards of care while adapting to the latest developments in endoscopic procedures.

The endoscopy market in the United States has shown consistent growth, rising from USD 9.2 billion in 2021 to USD 10.4 billion in 2024. It is expected to grow at a CAGR of 6.1% from 2025 to 2034. The high prevalence of chronic diseases and the need for precise diagnostic tools are major drivers behind this growth. An increasing number of patients are being diagnosed with gastrointestinal disorders, prompting the need for more advanced and less invasive solutions. The U.S. market continues to evolve as healthcare providers seek to improve procedural outcomes while maintaining cost efficiency.

The competitive landscape is defined by innovation, partnerships, and product diversification. Companies like Stryker Corporation, Olympus Corporation, Boston Scientific, Karl Storz, and Medtronic command approximately 42%-45% of the market share. These industry leaders are actively investing in next-gen endoscopic platforms that integrate AI, robotics, and advanced imaging to elevate clinical performance. Strategic collaborations and acquisitions remain key tactics for broadening global reach and strengthening their position in the evolving medical device landscape.