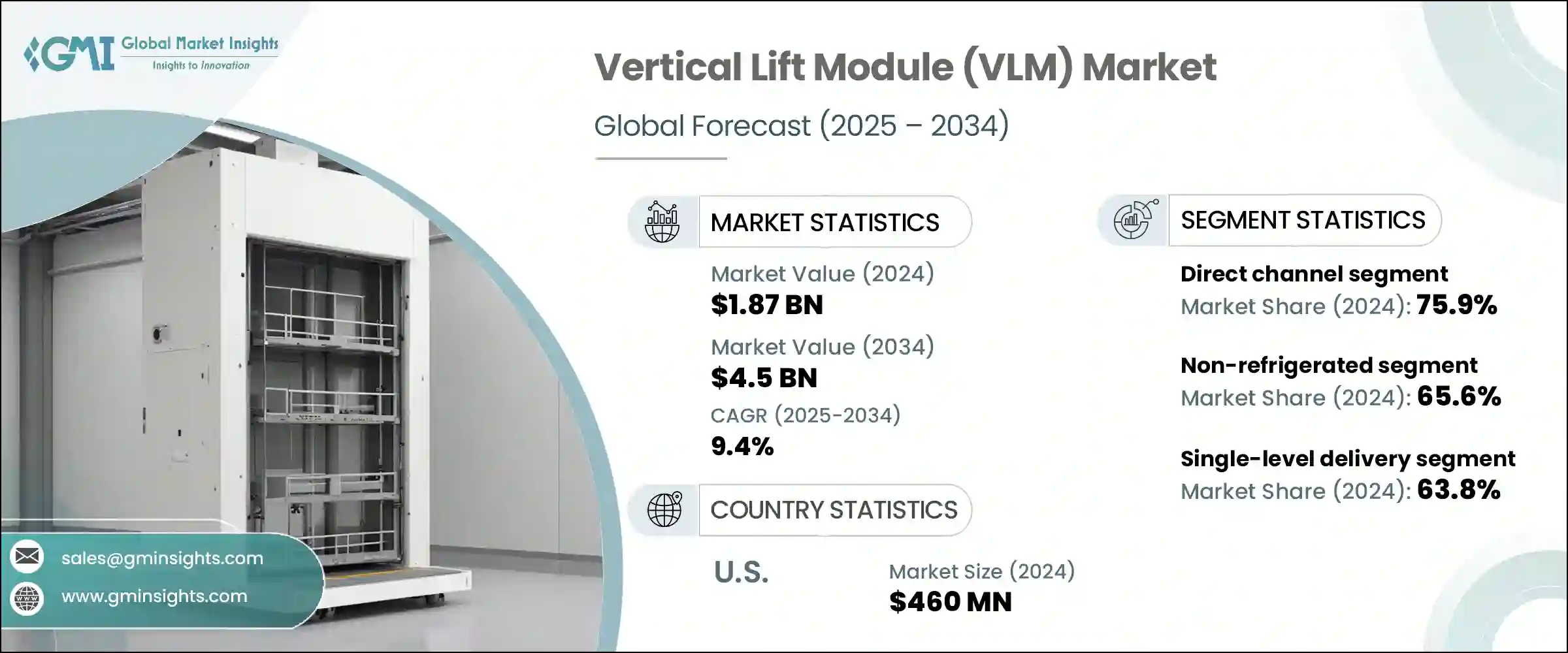

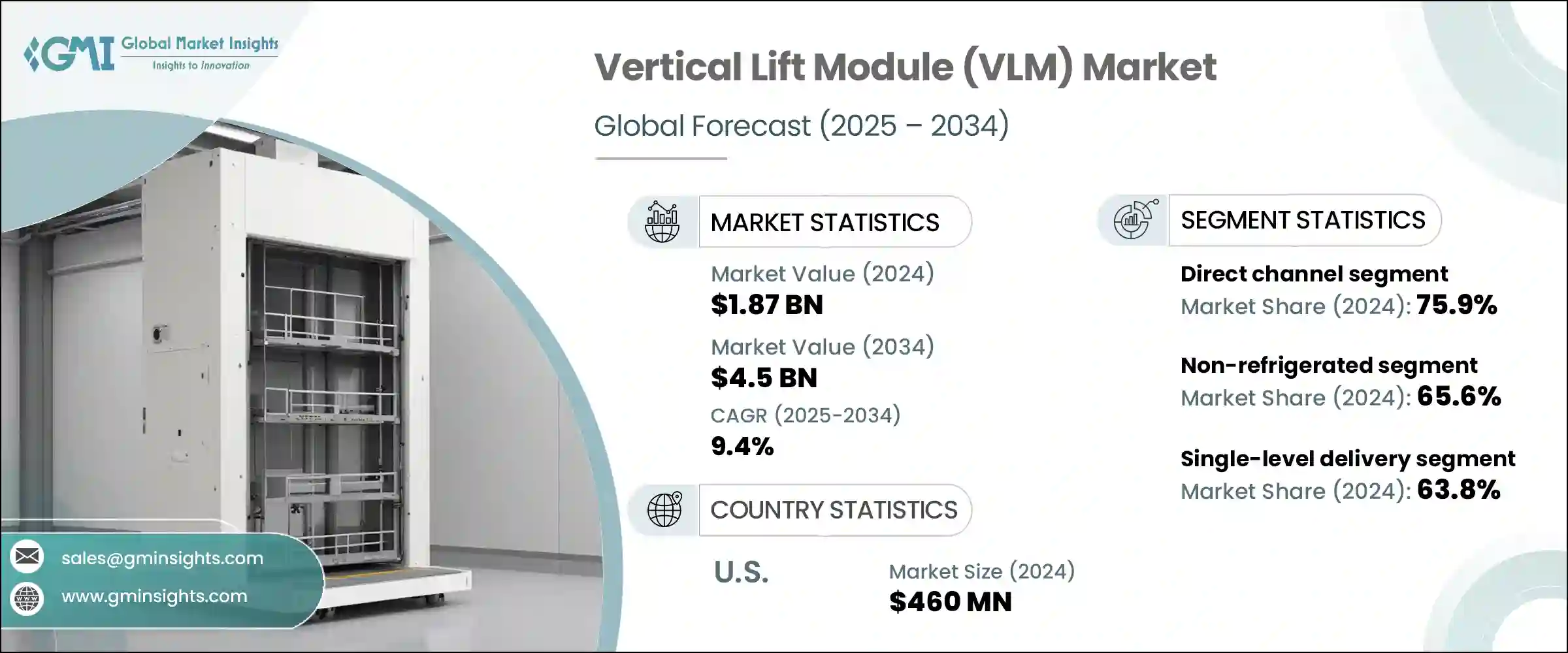

수직 리프트 모듈(VLM) 세계 시장은 2024년에는 18억 7,000만 달러로 평가되었고, CAGR 9.4%로 성장하여 2034년에는 45억 달러에 이를 것으로 예측됩니다.

이 시장은 효율적이고 공간 절약적인 보관 및 검색 솔루션을 찾는 산업이 증가함에 따라 강력한 성장세를 보이고 있습니다. 자동차, 제약, 전자상거래 등의 분야에서 재고 관리 강화, 피킹 작업 간소화, 전반적인 생산성 향상을 위해 VLM 도입이 빠르게 진행되고 있습니다. 특히 스마트 창고의 부상으로 소형, 고속 스토리지에 대한 수요가 급증하고 있으며, VLM은 주문 정확도를 높이고 수작업에 대한 의존도를 낮추며 자동화와 린 생산으로 향하는 세계적인 추세에 부합합니다.

기업들은 인더스트리 4.0 환경에 적합한 첨단 소프트웨어, 실시간 추적, 비접촉식 인터페이스를 갖춘 시스템을 구축하는 데 주력하고 있습니다. 도시화의 진전과 한정된 창고 공간도 수직 보관 시스템에 대한 수요를 촉진하고 있습니다. 최근 수직 리프트 모듈(VLM) 기술의 발전은 환경적 책임에 초점을 맞추었습니다. 제조업체들은 에너지 효율이 높은 모터와 작동 중 에너지를 회수하여 전체 전력 소비를 줄이는 회생 구동 시스템을 도입하고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 개시 금액 | 18억 7,000만 달러 |

| 예측 금액 | 45억 달러 |

| CAGR | 9.4% |

모듈식 구조의 채택은 폐기물을 최소화하면서 확장 가능한 설치가 가능하며, 가볍고 재활용 가능한 재료의 사용은 순환 경제의 원칙을 지원합니다. 많은 VLM은 현재 수요에 따라 에너지 사용량을 자동으로 조정하는 지능형 전력 관리 시스템을 통합하여 지속가능성을 더욱 향상시키고 있습니다. 이러한 기술 혁신은 기업이 친환경 목표를 달성하는 데 도움이 될 뿐만 아니라 산업계의 탄소 배출량을 줄이는 세계 목표와도 일치하기 때문에 VLM은 운영 효율성과 생태적 효율성을 향상시키려는 최신 창고 및 스마트 제조 환경에서 선호되는 선택이 되고 있습니다.

2024년 비냉동 VLM의 점유율은 65.6%로 평가되었고, 2034년까지 연평균 복합 성장률(CAGR)은 8.7%로 예상됩니다. 비냉장형 VLM의 우위는 자동차, 전자기기, 산업 제조 등 공조 관리가 필요하지 않은 분야에서 널리 사용되고 있기 때문입니다. 이러한 시스템은 구성이 간단하고 냉각 장치가 없기 때문에 도입 및 유지보수가 용이합니다. 또한, 인프라 예산이 한정된 기업에게는 운영 비용과 에너지 비용을 절감할 수 있다는 장점도 있습니다.

단일 레벨 운반 부문은 2024년 63.8%의 점유율을 차지했으며, 2025-2034년간 CAGR 8.9%를 보일 것으로 예측됩니다. 모든 산업 분야의 기업들이 인체공학적 디자인과 사용 편의성 때문에 이 디자인을 선호하고 있습니다. 작업자는 물품이 일정한 높이로 운반되기 때문에 신체적 부담을 줄이고 워크플로우의 효율성을 높일 수 있다는 이점이 있습니다. 이 유닛은 최소한의 교육이 필요하며, 직원 교체가 잦은 시설에 적합합니다. 특히 중소기업은 저렴한 가격과 확장성에 매료되어 신뢰성이 요구되는 고속, 고처리량 환경에 적합하며, 특히 중소기업에 적합합니다.

미국의 수직 리프트 모듈(VLM) 시장은 87.3%의 점유율을 차지하며 2024년 4억 6,000만 달러 시장 규모를 형성했습니다. 미국은 산업 인프라가 발달하고 제조업과 창고업의 자동화 도입이 활발해 이 시장을 독점하고 있습니다. 특히 인건비 상승을 감안할 때, 공간 최적화와 업무 효율화는 이 지역 기업들에게 최우선 과제입니다. 자동화에 대한 투자, 스마트 제조에 대한 정부의 인센티브, 성숙한 솔루션 제공업체 네트워크는 모두 이 지역의 VLM 도입 리더십에 기여하고 있습니다.

세계 수직 리프트 모듈(VLM) 시장을 주도하는 기업으로는 AutoCrib, Kardex, Vidmar, Modula GROUP, Weland Solutions, Vidir Solutions, Inc. Rabatex Group, ELF Automation, Hanel Buro, Ferretto SpA, Conveyor Handling Company, LISTA, Mecalux, S.A. 등이 있습니다. 주요 VLM 제조업체들은 AI 기반 재고 최적화, 터치리스 운영, 클라우드 기반 시스템 진단 등을 통합하여 제품 라인을 지속적으로 혁신하고 있으며, 시장에서의 입지를 확대하기 위해 다양한 전략적 조치를 취하고 있습니다.

개발 기업들은 또한 전자상거래 및 물류 업체들과 협력하여 맞춤형 보관 솔루션을 개발하고 있습니다. R&D 투자는 시스템의 모듈성을 높이고, 에너지 소비를 줄이고, 처리량을 늘리는 데 우선순위를 두고 있습니다. 많은 업체들이 주요 시장에 현지 생산 및 지원 시설을 설립하여 세계 진출을 확대하고 있습니다. 맞춤형 제안과 유연한 임대 모델은 중소기업의 요구에 부응하는 데 도움이 되고 있습니다.

The Global Vertical Lift Module (VLM) Market was valued at USD 1.87 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 4.5 billion by 2034. The market is seeing robust growth as industries increasingly seek efficient, space-saving storage and retrieval solutions. Sectors such as automotive, pharmaceuticals, and e-commerce are rapidly embracing VLMs to enhance inventory management, streamline picking operations, and boost overall productivity. The demand for compact and high-speed storage is surging, particularly with the rise of smart warehousing practices. VLMs contribute to improved order accuracy and reduced reliance on manual labor, aligning with global shifts toward automation and lean manufacturing.

Companies are focusing on building systems equipped with advanced software, real-time tracking, and contactless interfaces, making them suitable for Industry 4.0 environments. Growing urbanization and limited warehouse space are also driving demand for vertical storage systems. Recent advancements in vertical lift module (VLM) technology are placing a strong emphasis on environmental responsibility. Manufacturers are introducing energy-efficient motors and regenerative drive systems that recover energy during operation, reducing overall power consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.87 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 9.4% |

The adoption of modular construction allows for scalable installations with minimal waste, while the use of lightweight, recyclable materials supports circular economy principles. Many VLMs now integrate intelligent power management systems that automatically adjust energy usage based on demand, further improving sustainability. These innovations not only help businesses meet their green targets but also align with global goals for reducing industrial carbon footprints, making VLMs a preferred choice in modern warehouses and smart manufacturing environments aiming for operational and ecological efficiency.

In 2024, the non-refrigerated VLMs segment accounted for a 65.6% share and is anticipated to grow at a CAGR of 8.7% through 2034. Their dominance stems from widespread use in sectors like automotive, electronics, and industrial manufacturing, where climate-controlled environments are not required. These systems are easier to deploy and maintain due to their simpler configuration and absence of cooling units. They also appeal to companies with limited infrastructure budgets while offering lower operating and energy costs.

The single-level delivery VLM segment held a 63.8% share in 2024 and is expected to grow at a CAGR of 8.9% from 2025 to 2034. Businesses across industries prefer this design for its ergonomic design and ease of use. Operators benefit from items being delivered at a consistent height, reducing physical strain and improving workflow efficiency. These units require minimal training and are ideal for facilities with frequent staff turnover. Small and mid-size enterprises are especially drawn to their affordability and scalability, making them suitable for fast-paced, high-throughput environments that demand reliability.

United States Vertical Lift Module (VLM) Market held an 87.3% share, generating USD 460 million in 2024. The U.S. dominates the space due to its advanced industrial infrastructure and strong embrace of automation in manufacturing and warehousing. Space optimization and operational efficiency are top priorities for regional players, especially given rising labor costs. Investments in automation, government incentives for smart manufacturing, and a mature network of solution providers all contribute to the region's leadership in VLM adoption.

Companies driving the Global Vertical Lift Module (VLM) Market include AutoCrib, Kardex, Vidmar, Modula GROUP, Weland Solutions, Vidir Solutions, Inc., ICAM S.p.A., SSI SCHAFER, Rabatex Group, ELF Automation, Hanel Buro, Ferretto SpA, Conveyor Handling Company, LISTA, and Mecalux, S.A. Leading VLM manufacturers are implementing a range of strategic actions to expand their market footprint. They are consistently innovating product lines by integrating AI-based inventory optimization, touchless operations, and cloud-based system diagnostics.

Companies are also forming collaborations with e-commerce and logistics players to develop tailored storage solutions. R&D investments are being prioritized to improve system modularity, reduce energy consumption, and boost throughput. Many players are expanding their global footprint by establishing localized production and support facilities in key markets. Customization offerings and flexible leasing models help address the needs of small and medium-sized businesses.