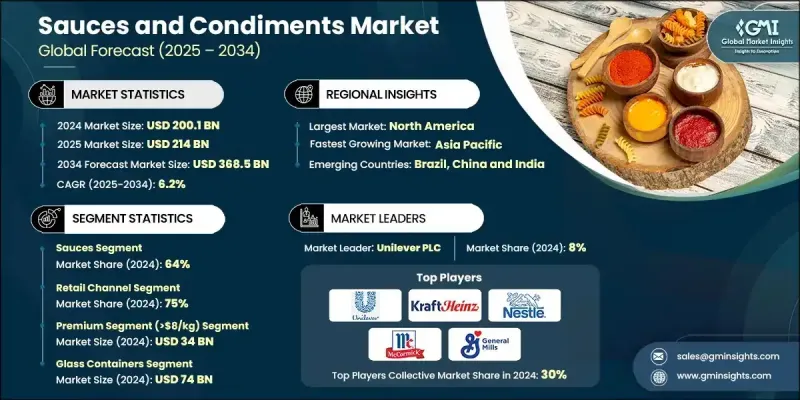

세계의 소스 및 조미료 시장은 2024년에 2,001억 달러, 2034년까지 연평균 복합 성장률(CAGR) 6.2%로 성장하여 3,685억 달러에 달할 것으로 예측되고 있습니다.

이러한 성장은 소비자의 편의성에 대한 선호도 증가와 더 풍부한 식단 경험을 추구하는 경향에 의해 견인됩니다. 바쁜 라이프 스타일과 세계적인 미각의 다양화에 따라, 많은 소비자가 간편하게 식사를 풍부하게 하는 즉석 소스나 조미료를 좋아하게 되었습니다. 가정 요리와 식사 준비 증가 동향이 더욱 수요를 뒷받침하고 있으며, 제조업체는 보다 좋은 맛과 건강 효과를 위한 레시피의 재구축, 신소재의 탐구, 진화하는 소비자의 요구에 맞춘 포장의 개선이라고 하는 혁신을 촉진되고 있습니다. 이러한 요인이 시장을 전진시키고 있습니다. 그러나 신흥 브랜드와 전통 기업의 경쟁 격화로 적극적인 가격 설정, 참신한 제품, 강력한 마케팅 전략으로 시장 진출기업이 늘어남에 따라 이익률에 압력이 가해지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 기간 | 2025-2034년 |

| 시작 금액 | 2,001억 달러 |

| 예측 금액 | 3,685억 달러 |

| CAGR | 6.2% |

게다가 프라이빗 브랜드 제품의 보급으로 저가 옵션을 요구하는 예산에 중점을 둔 소비자층이 확대되고 있으며, 브랜드 소스 제조업체는 시장 점유율과 수익성 유지에 어려움을 겪고 있습니다. 이러한 프라이빗 브랜드는 가격 경쟁뿐만 아니라 품질·맛·포장의 개선에 주력해 확립된 브랜드와의 차이를 줄이고 있습니다. 소매업체는 자사 제품 라인에 많은 선반 공간과 가시성을 제공하여 프로모션과 로열티 인센티브를 통해 고객의 상점 브랜드 조미료 선호를 촉진하고 있습니다. 그 결과 기존 기업은 제품 차별화, 제품 라인 혁신, 풍미 프로파일 향상, 보다 깨끗한 원재료 표시, 지속 가능한 포장을 통해 프리미엄 가격 설정의 정당화를 촉구하고 있습니다. 프라이빗 브랜드의 존재감 증가는 경쟁 구도를 바꾸고 있으며, 전통적인 브랜드는 변화하는 가격에 민감한 시장에서 자신의 포지셔닝 전략을 재검토하는 것을 강요하고 있습니다.

소스 부문은 2024년에 64%의 점유율을 차지했고, 2034년까지 연평균 복합 성장률(CAGR)은 5.4%를 보일 것으로 예측됩니다. 소스 및 조미료 시장은 계속해서 강한 기세를 유지하고 있어 현재는 주로 「소스」와 「조미료」의 2대 카테고리로 분류되고 있습니다. 소스 부문은 다양하고 대담한 맛 경험을 요구하는 소비자 수요가 증가함에 따라 많은 혁신이 탄생했습니다. 편의성도 주요 촉진요인이며, 보다 많은 가정과 외식산업 관계자가 조리를 간소화하는 세계 각국의 맛을 재현한 즉석 소스를 선택하고 있습니다. 마리네와 그레이비 소스부터 파스타 소스, 볶음용 소스에 이르기까지 이러한 제품은 최소한의 수고로 국제적인 요리를 탐구하면서 일상 식사를 격상하고 싶은 현대 소비자에게 필수 식품고의 정평품이 되고 있습니다.

소매 채널은 2024년에 75%의 점유율을 얻었으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 6.9%의 성장이 예상됩니다. 세계적으로 소스와 조미료 업계는 소매와 외식 산업의 채널로 구분되며, 모두 시장의 전반적인 방향성을 형성하는데 중요한 역할을 하고 있습니다. 소비자가 편의, 구색 및 프리미엄 상품 선택을 점점 더 추구하는 동안 소매는 여전히 주요 구매 경로입니다. 슈퍼마켓 및 하이퍼마켓, 온라인 플랫폼은 다양한 음식의 취향과 식사 요구에 부응하는 광범위한 소스 및 조미료에 대한 주요 액세스 포인트가 되었습니다. 전자상거래와 온라인 식료품 구매의 대두는 브랜드가 도달범위를 확대하고, 상품 제공을 개인화하고, 타겟팅된 디지털 마케팅 전략을 통해 고객과 참여할 수 있게 함으로써 소매 매출을 크게 강화했습니다.

북미의 소스 및 조미료 시장은 2024년에 26%의 점유율을 차지했습니다. 다문화 인구, 세계적인 여행 및 미디어 소비의 보급으로 국제적인 맛의 인기가 높아지고 있습니다. 이 추세는 다양한 매운 과감한 조미료 소비 증가에 반영됩니다. 소셜 미디어가 요리 트렌드에 미치는 영향력이 급증함에 따라 미국 소비자들에게 국제 소스에 더 쉽게 접근하고 선호하게 되면서 새롭고 이국적인 맛에 대한 수요가 가속화되고 있습니다.

세계적인 소스 및 조미료 시장을 선도하는 주요 기업은 Conagra Brands, Nestle, McCormick & Company, The Kraft Heinz Company, Mars, Incorporated, Berner Foods, Kikkoman Corporation, Unilever, Bay Valley, Casa Fiesta, Fuchs Gewurze GmbH, Lee Foods 등이 있습니다. 소스 및 조미료 업계의 기업은 시장에서의 존재감을 강화하기 위해 몇 가지 전략적 접근법을 채택하고 있습니다. 제품 혁신은 최우선 과제이며, 각 회사는 변화하는 소비자의 취향에 부응하기 위해 더 건강하고 모든 천연의 특수 소스를 지속적으로 개발하고 있습니다. 또한 환경 목표에 따라 환경 의식이 높은 구매자에게 호소하기 위해 지속 가능하고 환경 친화적인 포장 솔루션에 많은 투자를하고 있습니다. 전통적인 소매 채널과 전자상거래 채널을 통해 유통 네트워크를 확장하면 보다 광범위한 시장에 도달하고 액세스할 수 있습니다.

The Global Sauces and Condiments Market was valued at USD 200.1 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 368.5 billion by 2034.

This growth is driven by consumers' increasing preference for convenience and enhanced culinary experiences. With hectic lifestyles and expanding global palates, many consumers now favor ready-to-use sauces and condiments that enrich meals quickly and easily. The rising trend of home cooking and meal preparation has further fueled demand, prompting manufacturers to innovate by reformulating recipes for better taste and health benefits, exploring new ingredients, and improving packaging to align with evolving consumer needs. These factors are propelling the market forward. However, intensified competition from emerging brands and well-established companies alike is putting pressure on profit margins, as more players enter the market with aggressive pricing, novel products, and robust marketing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $200.1 Billion |

| Forecast Value | $368.5 Billion |

| CAGR | 6.2% |

Additionally, the proliferation of private-label brands is attracting budget-conscious consumers with lower-priced options, challenging branded sauce manufacturers to maintain their market share and profitability. These private labels are not only competing on price but are increasingly focusing on improving quality, taste, and packaging, closing the gap with well-established brands. Retailers are giving more shelf space and visibility to their product lines, offering promotions and loyalty incentives that drive customer preference toward store-brand condiments. As a result, established players are under pressure to differentiate their offerings, innovate product lines, and justify premium pricing through enhanced flavor profiles, cleaner ingredient labels, and sustainable packaging. The intensifying presence of private labels is shifting the competitive landscape, forcing traditional brands to rethink their positioning strategies in an evolving, price-sensitive market.

The sauces segment held 64% share in 2024 and is projected to grow at a CAGR of 5.4% through 2034. The sauces and condiments market continues to experience strong momentum, now broadly divided into two key categories: sauces and condiments. The sauces segment accounts for many innovations, fueled by consumers' growing desire for diverse and bold flavor experiences. Convenience is another major driver, as more households and foodservice operators are opting for ready-to-use, globally inspired sauces that simplify meal preparation. From marinades and gravies to pasta and stir-fry sauces, these products have become essential pantry staples for modern consumers seeking to explore international cuisines with minimal effort while elevating everyday meals.

The retail channel captured a 75% share in 2024 and is anticipated to grow at a CAGR of 6.9% during 2025-2034. Globally, the sauces and condiments industry is segmented into retail and foodservice channels, both playing vital roles in shaping the market's overall trajectory. Retail remains the preferred purchasing avenue as consumers increasingly seek convenience, variety, and premium options. Supermarkets, hypermarkets, and online platforms serve as key access points for a wide range of sauces and condiments catering to diverse culinary preferences and dietary needs. The rise of e-commerce and online grocery shopping has significantly strengthened retail sales by enabling brands to expand reach, personalize offerings, and engage customers through targeted digital marketing strategies.

North America Sauces and Condiments Market held a 26% share in 2024. The rising popularity of international flavors is fueled by a multicultural population and widespread global travel and media consumption. This trend is reflected in the growing consumption of diverse spicy and bold condiments. The surge in social media's influence on culinary trends has made international sauces more accessible and desirable to American consumers, accelerating demand for new and exotic flavors.

Leading companies in the Global Sauces and Condiments Market include Conagra Brands, Nestle, McCormick & Company, The Kraft Heinz Company, Mars, Incorporated, Berner Foods, Kikkoman Corporation, Unilever, Bay Valley, Casa Fiesta, Fuchs Gewurze GmbH, Lee Kum Kee, Hormel Foods Corporation, and Huy Fong Foods. To solidify their market presence, companies in the sauces and condiments industry adopt several strategic approaches. Product innovation remains at the forefront, with firms continuously developing healthier, all-natural, and specialty sauces to meet shifting consumer preferences. They also invest heavily in sustainable and eco-friendly packaging solutions to align with environmental goals and appeal to eco-conscious buyers. Expanding distribution networks through both traditional retail and e-commerce channels enables broader market reach and accessibility.