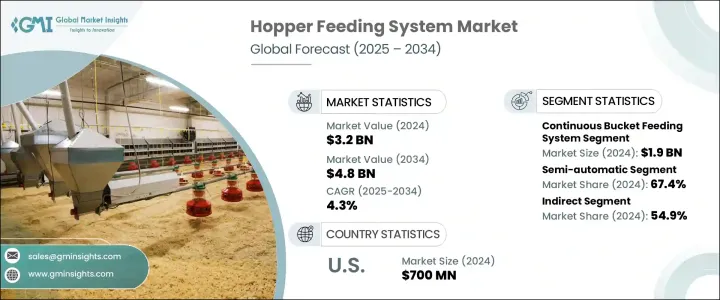

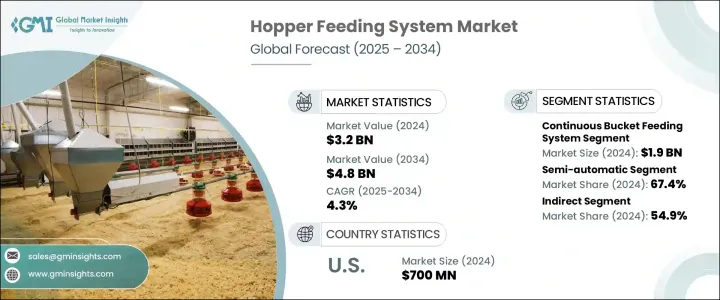

세계의 호퍼 피딩 시스템 시장은 2024년 32억 달러로 평가되었으며 CAGR 4.3%로 성장해 2034년까지 48억 달러에 이를 것으로 추정됩니다.

산업 자동화가 각 분야에서 점점 널리 보급됨에 따라 효율적인 자재관리 솔루션에 대한 수요가 급속히 증가하고 있습니다. 생산성과 운영의 일관성이 점점 더 중시되고 있는 가운데, 산업계는 다운타임과 인적 실수를 최소화하기 위해 이러한 시스템을 생산 라인에 통합하고 있습니다.

센서와 컴퓨터 제어 기능을 갖춘 최신 호퍼 피딩 시스템은 원활한 재료 공급과 믹서, 컨베이어, 포장 시스템과 같은 자동화된 장비와의 통합을 가능하게 합니다. 다양한 프로세스 자동화 설정과의 호환성으로 인해 처리량 최적화 및 규제 준수 유지에 중점을 둔 제조업체에게는 매력적인 투자가 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 32억 달러 |

| 예측 금액 | 48억 달러 |

| CAGR | 4.3% |

제품 유형별로 시장은 연속식 버킷 피딩 시스템과 간헐식 버킷 피딩 시스템으로 구분됩니다. 이러한 시스템은 재료를 일정 속도로 공급할 수 있도록 설계되어 있어, 파우더, 과립, 펠렛 제조 등 안정적인 투입에 의존하는 자율주행에 이상적입니다.

운영 모드별로 시장은 반자동 시스템과 완전 자동 시스템으로 나뉩니다. 프로세스의 일관성을 향상시키고 노동력에 대한 의존도를 줄이고 싶은 업무에 특히 적합합니다.

시장은 또한 유통 채널에 의해 직접 판매와 간접 판매로 구분됩니다. 정규 대리점, 리셀러, 시스템 통합자 등의 간접 채널은 보다 폭넓은 고객층에 도달하는 데 중요한 역할을 하고 있습니다. 따라서 고객의 요구에 맞는 솔루션과 탁월한 지원을 제공할 수 있습니다. 이들의 확립된 네트워크는 제조업체가 직접 판매 인프라에 엄청난 투자 없이 도달범위를 확대하는 데 도움이 되며 간접 판매를 매우 효과적인 Go-to-Market 전략으로 만듭니다.

지역별로는 미국이 북미 호퍼 피딩 시스템 시장에서 큰 점유율을 차지하고 있으며, 2024년의 평가액은 7억 달러였습니다. 스마트 팩토리 프레임워크와 디지털화된 생산 시스템의 채용이 증가하고 있는 것도, 정밀도의 향상과 조업 중단의 삭감을 목표로 하는 기업에 있어서, 시장의 성장을 더욱 뒷받침하고 있습니다.

세계 호퍼 피딩 시스템 시장을 형성하는 주요 기업은 Eriez Manufacturing, Coperion, Festo, GEA Group, Hapman, Gericke, K-Tron, Novatec, Piab, Movacolor, Schenck Process, Spiroflow, Thayer Scale-Bul Systems, Volkmann 등입니다. 이들 기업은 시장에서의 존재를 확대하고 신흥국 시장 수요에 부응하기 위해 기술 혁신, 제품 개발, 전략적 판매 제휴에 주력하고 있습니다.

The Global Hopper Feeding System Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.8 billion by 2034. As industrial automation becomes increasingly widespread across sectors, the demand for efficient material handling solutions is growing rapidly. Hopper feeding systems are emerging as key components in this transformation, offering automated and streamlined mechanisms for feeding bulk materials without manual intervention. With growing emphasis on productivity and operational consistency, industries are integrating these systems into their production lines to minimize downtime and human error. These systems have become especially important in sectors where maintaining material flow with high precision is essential for quality control and operational continuity.

Modern hopper feeding systems, equipped with sensors and computer controls, enable seamless material dosing and integration with automated equipment such as mixers, conveyors, and packaging systems. By facilitating uninterrupted material transfer and offering real-time control, these systems help companies maintain a high level of operational efficiency and reduce material waste. Their compatibility with various process automation setups makes them an attractive investment for manufacturers focusing on optimizing throughput and maintaining regulatory compliance. With rising labor costs and increasing demand for consistent quality, hopper feeding systems are becoming a strategic asset in process manufacturing environments globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 4.3% |

In terms of product type, the market is segmented into continuous and intermittent bucket feeding systems. Among these, the continuous bucket feeding system segment accounted for USD 1.9 billion in 2024 and is projected to register a CAGR of 4.7% through 2034. These systems are designed to deliver material at a constant rate, making them ideal for automated operations that rely on steady input, such as in the production of powders, granules, and pellets. Their ability to maintain uninterrupted flow aligns with the needs of high-volume manufacturing setups. Moreover, their adaptability to intelligent controls and full integration into digital production environments further enhance their appeal for companies prioritizing automation and scalability.

When categorized by mode of operation, the market is divided into semi-automatic and fully automatic systems. In 2024, the semi-automatic segment led the market with a 67.4% share and is expected to grow at a CAGR of 3.7% during the forecast period. These systems strike a balance between manual effort and automation, offering a practical solution for small and medium-sized enterprises. Their affordability and ease of use make them particularly suitable for operations that don't require full automation but still seek to improve process consistency and reduce labor dependency. Due to their lower cost and reduced maintenance requirements, semi-automatic hopper feeding systems are widely adopted in markets where budget constraints limit access to fully automated technology. Their growing popularity can be linked to the global expansion of SMEs, which make up the majority of businesses worldwide.

The market is also segmented by distribution channel into direct and indirect sales. The indirect distribution segment dominated in 2024, accounting for 54.9% of total revenue, and is anticipated to grow at a CAGR of 4.8% between 2025 and 2034. Indirect channels such as authorized distributors, resellers, and system integrators play a vital role in reaching a broader customer base. These intermediaries often possess deep knowledge of local market dynamics, technical requirements, and regulatory environments, enabling them to provide tailored solutions and superior support. Their established networks help manufacturers expand their reach without significant investment in direct sales infrastructure, making indirect sales a highly effective go-to-market strategy.

Regionally, the United States held a significant share in the North American hopper feeding system market, with a valuation of USD 700 million in 2024. The country is witnessing steady growth in demand due to its advanced industrial infrastructure and rising adoption of automation technologies. Regulatory standards around manufacturing efficiency and workplace safety are also pushing industries toward automated solutions like hopper feeding systems. The increasing adoption of smart factory frameworks and digitalized production systems further supports market growth, as companies look to improve precision and reduce operational disruptions. With a solid industrial base and a proactive shift toward intelligent automation, the U.S. continues to lead the region's market for hopper feeding systems.

Key players shaping the global hopper feeding system market landscape include Eriez Manufacturing, Coperion, Festo, GEA Group, Hapman, Gericke, K-Tron, Novatec, Piab, Movacolor, Schenck Process, Spiroflow, Thayer Scale-Hyer Industries, Simatek Bulk Systems, and Volkmann. These companies are focused on innovation, product development, and strategic distribution partnerships to expand their market presence and cater to evolving industry demands.