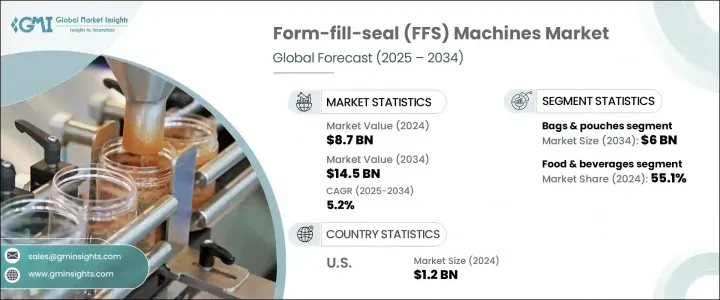

세계의 FFS(Form-Fill-Seal) 머신 시장은 2024년 87억 달러로 평가되었으며, CAGR 5.2%로 성장해 2034년까지 145억 달러에 이를 것으로 예측됩니다.

이 성장은 환경에 유해한 재료를 단계적으로 폐지하고 지속 가능한 대체 패키징으로 이행하는 규제 압력 증가에 의해 크게 뒷받침되고 있습니다. 규제가 강화되고 환경 의식이 높아지는 가운데 기업은 컴플라이언스를 유지하고 지속가능성을 높이기 위해 FFS 기술의 업그레이드에 대한 투자로 대응하고 있습니다.

특히 식품, 의약품, 소비재 업계에서는 생산성 향상, 인건비 최소화, 제품 안전성 확보를 목적으로 한 FFS 솔루션에 대한 의존도가 높아지고 있습니다. 특히 유통기한, 내탬퍼성, 제품의 무결성이 가장 중요시되는 분야에서는 엄격한 위생 요건이 요구되는 대량 포장에 대응할 수 있는 적응성과 능력에 의해 제조업체는 계속 FFS 시스템을 지지하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 87억 달러 |

| 예측 금액 | 145억 달러 |

| CAGR | 5.2% |

가방 및 파우치 분야는 39.1%의 점유율을 차지해, 2034년까지 60억 달러를 만들어 내는 것으로 추정되고 있습니다. FFS 시스템이 진보함에 따라, 제어된 대기 밀봉이나 기밀 배리어 등의 혁신을 지원하게 되어, 유통 기한의 연장에 도움이 됩니다.

식음료 부문은 2024년에 55.1%의 점유율을 차지했으며 예측 기간 중 우위성을 유지할 것으로 예측됩니다. E-Commerce의 영향력 상승, 경량으로 높은 보호성, 커스터마이즈 가능한 패키징 수요 상승으로, FFS 머신은 품질이나 성능에 타협하지 않고 재료 사용량의 삭감을 목표로 하는 많은 제조업체에 있어서, 최적의 솔루션이 되고 있습니다.

미국 폼필 씰링 기계 시장은 2024년 12억 달러를 창출했으며 2034년까지 연평균 복합 성장률(CAGR) 5.4%를 보일 것으로 예측됩니다. 식품, 의약품, 퍼스널케어 분야의 급속한 개발이 유연하고 고성능 패키징 수요를 촉진하고 있습니다.

세계 FFS(Form-Fill-Seal) 머신 시장에서 활약하는 유력 기업은 ULMA Packaging, ProMach, All-Fill Inc., Bosch Packaging Technology, WeighPack Systems Inc., Coesia Group, Matrix Packaging Machinery, Barry-Wehmiller Group, PFM Packaging, Ilapak, Syy Packaging, IMA Group, BW Flexible Systems 등이 있습니다. 선두 업체는 속도, 정밀도, 기계 성능을 향상시키기 위해 자동화, AI를 활용한 제어, IoT 기능을 도입하여 제품 라인을 진화시키고 있습니다.

대부분은 퇴비화 가능한 재료와 재활용 가능한 재료를 개발하기 위한 연구에 투자하고 있으며, 고객이 세계의 지속가능성 기준을 충족할 수 있도록 돕고 있습니다. 마이즈도 핵심 전략의 하나로 각사는 독자적인 제품 유형이나 포장 형태에 맞춘 FFS 시스템을 설계하고 있습니다.

The Global Form-Fill-Seal Machines Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 14.5 billion by 2034. This growth is largely propelled by increasing regulatory pressure to phase out environmentally harmful materials and move toward sustainable packaging alternatives. FFS machines are evolving to process recyclable and biodegradable materials, aligning with global efforts to curb plastic waste. As regulations tighten and environmental awareness rises, companies are responding with investments in upgraded FFS technology to remain compliant and enhance their sustainability credentials. In addition to environmental compliance, the rise in automation is playing a major role in boosting the demand for FFS systems.

Packaging operations, especially in the food, pharmaceutical, and consumer goods industries, are becoming increasingly reliant on FFS solutions to improve output, minimize labor costs, and ensure product safety. These machines offer long-term value by increasing speed, accuracy, and consistency in packaging while reducing human error. Manufacturers continue to favor FFS systems due to their adaptability and ability to handle high-volume packaging with strict hygiene requirements, particularly in sectors where shelf life, tamper resistance, and product integrity are paramount.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 billion |

| Forecast Value | $14.5 billion |

| CAGR | 5.2% |

The bags and pouches segment held a 39.1% share and is estimated to generate USD 6 billion by 2034. The rising consumption of ready-to-eat foods and beverages is fueling demand for flexible, portable, and hygienic packaging solutions. The expansion of health-focused food markets is pushing manufacturers to adopt packaging technologies that help preserve freshness and product quality. As form-fill-seal systems advance, they now support innovations such as controlled atmosphere sealing and airtight barriers, helping to extend shelf life. The growing need for packaging that meets environmental standards has also led to the use of compostable and biodegradable substrates, further reinforcing the shift toward sustainable FFS technologies.

The food & beverage segment held a 55.1% share in 2024 and is expected to maintain its dominance throughout the forecast period. FFS machines are increasingly used to package solids, powders, and liquids into a wide range of pouch types, including flat, stand-up, and spouted variations. The versatility of FFS systems allows them to handle a wide spectrum of product formats using eco-conscious films. The rising influence of e-commerce and the growing demand for lightweight, protective, and customizable packaging have made FFS machines the go-to solution for many manufacturers aiming to cut down on material use without compromising quality or performance.

United States Form-Fill-Seal Machines Market generated USD 1.2 billion in 2024 and is forecast to grow at a CAGR of 5.4% through 2034. Rapid developments in the food, pharmaceutical, and personal care sectors are fueling the demand for flexible, high-performance packaging. The shift in consumer preference toward eco-friendly solutions is pushing companies in the U.S. to invest in next-generation FFS equipment that can deliver speed, compliance, and sustainability.

Prominent companies active in the Global Form-Fill-Seal Machines Market include ULMA Packaging, ProMach, All-Fill Inc., Bosch Packaging Technology, WeighPack Systems Inc., Coesia Group, Matrix Packaging Machinery, Barry-Wehmiller Group, PFM Packaging, Ilapak, Syntegon, Triangle Package Machinery Co., Bossar Packaging, IMA Group, and BW Flexible Systems. Leading manufacturers are advancing their product lines by incorporating automation, AI-powered controls, and IoT capabilities to improve speed, precision, and machine performance.

Many are investing in research to develop machines compatible with compostable and recyclable materials, helping customers align with global sustainability standards. Strategic alliances, mergers, and acquisitions are being pursued to expand geographical presence and strengthen distribution channels. Customization is another core strategy, with companies designing FFS systems tailored to unique product types and packaging formats. These efforts allow brands to offer versatile, scalable solutions to meet evolving industry requirements while staying ahead in a highly competitive market.