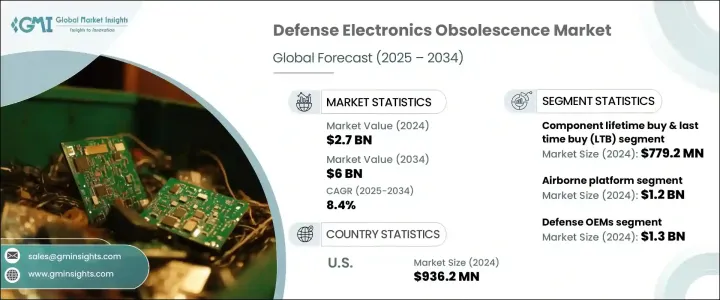

세계의 방위 전자 장비 노후화 시장 규모는 2024년에는 27억 달러로, 세계의 방위 예산 증가, 디지털 트윈 기술 및 예측 분석 이용 증가로 2034년에는 60억 달러에 달할 것으로 예측되며, CAGR 8.4%로 성장할 전망입니다.

군이 오랜 기간 사용된 플랫폼에 크게 의존하면서 현대화를 진행함에 따라, 노후화된 전자 부품이 포함된 노후화된 시스템을 지원해야 할 필요성이 매우 중요해졌습니다. 지속 가능성, 시스템 업그레이드, 부품 호환성 향상을 위한 노력은 강화되고 있으며, 이는 수명 주기 관리 및 노후화 완화 솔루션에 대한 수요를 촉진하고 있습니다. 동시에, 산업 기반 탄력성을 강화하기 위한 조달 개혁 및 전략은 방위 산업 전반에서 국내 조달과 디지털 전환을 장려하고 있습니다.

수년간 구조적 현대화 전략과 유산 시스템의 지속적인 사용은 노후화된 전자 장비의 유지보수 및 지원에 대한 관심을 높였습니다. 선제적 라이프사이클 관리를 장려하는 정책은 전자 부품 노후화 예측에 대한 유연하고 기술적으로 진보된 접근 방식을 이끌어냈습니다. 플랫폼의 장기 사용에 대한 강조는 강력한 DMSMS(제조 원천 감소 및 재료 부족 관리) 프로그램을 이끌어냈습니다. 방위 플랫폼이 수십 년간 운영됨에 따라 부품의 짧은 수명 주기와 시스템의 긴 수명 사이의 불일치는 노후화 관리가 필수적임을 보여줍니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 27억 달러 |

| 예측 금액 | 60억 달러 |

| CAGR | 8.4% |

컴포넌트별로 수명 및 마지막 구매(LTB) 부문은 2024년에 7억 7,920만 달러로 평가되었습니다. 이러한 전략은 특히 상용 부품(COTS)이 방위 플랫폼 전반에 사용됨에 따라 레거시 시스템 지원을 확보해야 하는 요구가 증가함에 따라 도움이 됩니다. 전자 부품의 수명은 대개 5-10년으로 제한되어 있기 때문에, 수명 및 마지막 구매는 40년 이상 사용될 수 있는 플랫폼과의 격차를 해소하는 데 도움이 됩니다. 지정학적 불확실성, 수출 제한, 반도체 부족으로 인해 공급 중단을 방지하기 위한 LTB 전략에 대한 의존도가 높아지고 있습니다.

항공 플랫폼 부문은 2024년에 12억 달러로 평가되었습니다. 항공 플랫폼의 서비스 수명 연장 수요 증가로 항공 전자 장비, 레이더 시스템, 전자전(EW) 업그레이드에 대한 투자가 증가했습니다. 기존 시스템에 신규 기술을 통합할 때 발생하는 호환성 문제는 형상-적합-기능(form-fit-function) 교체 및 레거시 부품 에뮬레이션의 필요성을 높였습니다. 또한 무인항공기(UAV)와 지원 항공기는 비용 효율성을 위해 COTS 부품을 의존해 조기 노후화 위험에 노출되며, 강력한 사후 시장 조달에 의존하게 됩니다.

미국의 방위 전자 장비 노후화 시장 규모는 2024년에 9억 3,620만 달러였습니다.

이 시장의 유력 기업은 Lynx, RTX, Thales Group, SMT Corp, Mercury Systems, Leonardo, Northrop Grumman, Boeing Defense, Teledyne Technologies, TT Electronics, Lockheed Martin, Saab RDS, L3Harris Technologies, Rheinmetall, AT Engine Controls, and Bae Systems. 등이 있습니다. 방위 전자 장비 노후화 시장은 시장 지위를 강화하기 위해 여러 핵심 전략을 채택하고 있습니다. 이에는 장기 정부 계약 확보와 부품 공급 안정성을 위해 수명 주기 및 최종 구매에 중점을 두는 것이 포함됩니다. 많은 기업은 AI 기반 예측 및 디지털 트윈과 같은 디지털 도구에 대규모 투자를 진행해 노후화 예측을 개선하고 있습니다. 공급망 전반에서의 협력을 강화해 외국 의존도를 줄이는 노력도 진행 중입니다.

The Global Defense Electronics Obsolescence Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 6 billion by 2034, driven by a rising global defense budget and the increasing use of digital twin technology and predictive analytics. As military forces continue modernizing while relying heavily on long-serving platforms, the need to support aging systems with obsolete electronic components has become critical. Efforts toward sustainability, system upgrades, and component compatibility have intensified, prompting demand for lifecycle management and obsolescence mitigation solutions. In parallel, procurement reforms and strategies aimed at reinforcing industrial base resilience are encouraging domestic sourcing and digital transformation across the defense sector.

Over the years, structural modernization strategies and the continued use of legacy systems have prompted increased focus on maintaining and supporting older electronics. Policies promoting proactive lifecycle management have led to a more agile and technologically advanced approach to forecasting electronic component obsolescence. The emphasis on platform longevity has resulted in robust DMSMS (Diminishing Manufacturing Sources and Material Shortages) programs. As defense platforms remain active for decades, the mismatch between short component life cycles and long system lifespans has made obsolescence management essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6 Billion |

| CAGR | 8.4% |

The component lifetime and last-time buy (LTB) segment was valued at USD 779.2 million in 2024. These strategies help address the growing need to secure legacy system support, especially as commercial off-the-shelf (COTS) parts are used across defense platforms. With electronic component lifecycles often limited to 5-10 years, lifetime and last-time buys help bridge the gap with platforms that may remain in service for over four decades. Geopolitical uncertainties, restricted exports, and semiconductor shortages accelerate reliance on LTB strategies to avoid supply disruptions.

The airborne platform segment was valued at USD 1.2 billion in 2024. Increased demand for extended service life of air platforms has fueled investments in avionics, radar systems, and electronic warfare (EW) upgrades. Compatibility challenges with integrating newer technologies into existing systems have amplified the need for form-fit-function replacements and legacy component emulation. Additionally, UAVs and support aircraft depend on COTS parts for affordability, making them vulnerable to early obsolescence and dependent on strong aftermarket sourcing.

United States Defense Electronics Obsolescence Market generated USD 936.2 million in 2024 driven by an aging military fleet that requires constant support for outdated electronic systems. Investments in sustainment programs and modernization initiatives, alongside the rapid implementation of predictive analytics and digital twin technologies by defense agencies, are pushing the market forward.

The prominent players in the market include Lynx, RTX, Thales Group, SMT Corp, Mercury Systems, Leonardo, Northrop Grumman, Boeing Defense, Teledyne Technologies, TT Electronics, Lockheed Martin, Saab RDS, L3Harris Technologies, Rheinmetall, AT Engine Controls, and Bae Systems. To strengthen its market foothold, the Defense Electronics Obsolescence Market is adopting several key strategies. These include securing long-term government contracts and emphasizing lifetime and last-time buys to ensure component availability. Many are investing heavily in digital tools like AI-powered forecasting and digital twins to improve obsolescence prediction. Collaborations across supply chains are being strengthened to reduce dependency on foreign sources.