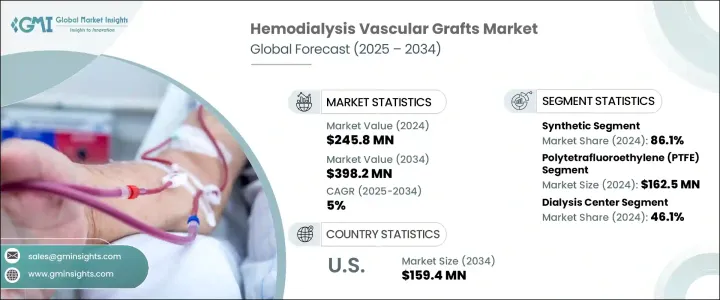

세계의 혈액투석용 인공혈관 시장은 2024년에 2억 4,580만 달러로 평가되었고 2034년에는 3억 9,820만 달러에 달할 것으로 예측되며, CAGR 5%로 성장할 전망입니다.

이러한 의료 기기는 혈액 투석을 받는 환자, 특히 동정맥루에 적합하지 않은 말기 신장 질환(ESRD) 환자에게 혈관 접근을 제공하는 데 중요한 역할을 합니다. 당뇨병, 고혈압, 인구 고령화로 촉진된 ESRD의 전 세계적 부담이 증가하면서 혈액 투석 치료에 대한 필요성이 증가하고 있습니다. 또한, 생체 공학 및 하이브리드 재료의 개발과 같은 이식 기술의 혁신은 이러한 이식물의 내구성, 유연성 및 생체 적합성을 향상시켜 합병증을 줄이고 이식물의 개통을 연장하며 선진국과 신흥 시장 모두에서 임상적 채택을 확대하고 있습니다.

만성 신장 질환(CKD) 및 ESRD의 증가는 전 세계 인구의 고령화와 관련이 있습니다. 혈관 접근이 제한적인 경우가 많은 노인 환자들은 합성 또는 생물학적 인공혈관에 더 많이 의존하기 때문에 이식편 기반 투석 접근에 대한 수요가 더욱 증가하고 있습니다. 개발도상국에서 투석 센터가 증가하고 의료 서비스 접근성이 향상됨에 따라 인공혈관의 사용도 증가하고 있습니다. 신장 치료에 대한 정부 정책과 투자 증가도 첨단 이식편 기술을 보다 저렴하고 접근하기 쉽게 만들어 전 세계 신장 의료 인프라의 성장을 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 2억 4,580만 달러 |

| 예측 금액 | 3억 9,820만 달러 |

| CAGR | 5% |

2024년에는 합성 이식편 부문이 86.1%의 상당한 점유율로 시장을 주도했습니다. 합성 혈액 투석 이식편은 성숙에 몇 주가 걸리는 동정맥루와 달리 즉시 사용할 수 있습니다. 이 즉시 사용 가능성은 급성 또는 응급 혈액투석 상황에서 합성 이식편을 필수적으로 만듭니다. 또한 확장형 폴리테트라플루오로에틸렌(ePTFE)과 폴리우레탄과 같은 합성 재료는 이 이식편의 성능, 유연성, 내구성을 향상시켰습니다. 표면 처리 및 헤파린 결합 코팅은 혈전증과 감염 위험을 줄여 합성 이식편을 장기 혈액투석 치료에 더 효과적으로 만듭니다. 특히 병원 및 응급 상황에서 응급 혈액 투석 접근에 대한 수요가 증가함에 따라 성숙 시간이 더 짧고 생물학적 이식편보다 선호되는 합성 이식편의 채택이 증가하고 있습니다.

투석 센터 부문은 2024년에 46.1%의 점유율을 차지했습니다. 전 세계적으로 만성 신장 질환 및 말기 신장 질환 사례가 증가함에 따라 투석 센터가 급속히 성장하고 있습니다. 이러한 시설이 더 많은 환자를 수용하기 위해 확장됨에 따라 혈액 투석 이식편과 같은 혈관 접근 솔루션에 대한 수요가 증가하고 있습니다. 대량 투석 센터는 환자를 위해 신뢰할 수 있고 효과적인 혈관 접근 옵션이 필요합니다. 동정맥루에 비해 성숙 시간이 짧은 합성 혈액 투석 이식편은 이러한 환경에서 특히 유용하기 때문에 선호되는 옵션입니다. 그 결과, 투석 센터는 합성 이식편을 자주 재고로 보관하고 있으며, 이는 이 부문의 성장에 기여하고 있습니다.

미국의 혈액투석용 인공혈관 시장은 2034년까지 1억 5,940만 달러에 달할 전망입니다. 미국은 만성 신장 질환 및 말기 신장 질환의 주요 원인인 당뇨병과 고혈압의 발병률이 높습니다. 이러한 질환의 발병률이 증가함에 따라 장기 투석이 필요한 환자가 늘어나고 있으며, 이로 인해 혈관 접근 솔루션에 대한 수요가 촉진되고 있습니다. 메디케어 및 기타 연방 의료 보험 프로그램은 투석 치료와 혈관 접근 절차에 대한 포괄적인 보험 혜택을 제공하여 혈액투석 이식재의 접근성을 높이고 있습니다. 이러한 보상 정책은 의료 제공자가 고급 이식재 기술을 채택하도록 유도하여 시장 성장을 더욱 촉진하고 있습니다.

세계의 혈액투석용 인공혈관 업계의 주요 시장 기업으로는 Artivion, Becton Dickinson and Company, BIOVIC, Cook Medical, CryoLife, Getinge, Laminate Medical Technologies, LeMaitre, Merit Medical Systems, ParaGen Technologies, Proteon Therapeutics, Terumo Medical, Vascudyne, Vascular Genesis 및 W.L. Gore & Associates 등이 있습니다. 혈액투석 인공혈관 시장 기업들은 시장 지위를 강화하기 위해 여러 핵심 전략을 채택하고 있습니다. 이 전략에는 이식재 성능, 생체적합성, 수명을 개선하기 위한 연구 개발에 대한 대규모 투자 등이 포함됩니다. 제조업체들은 또한 환자 요구사항을 충족시키기 위해 고급 재료와 하이브리드 이식재를 도입해 제품 포트폴리오를 확장하는 데 집중하고 있습니다. 의료 기관, 병원, 투석 센터와의 협력은 기업들이 신규 시장에 진출하고 제품 접근성을 개선하는 데 도움을 주고 있습니다. 시장 점유율을 더욱 강화하기 위해 기업들은 투석 서비스 수요가 증가하는 신흥 시장에 진출해 지리적 범위를 확대하고 있습니다.

The Global Hemodialysis Vascular Grafts Market was valued at USD 245.8 million in 2024 and is estimated to grow at a CAGR of 5% to reach USD 398.2 million by 2034. These medical devices play a vital role in providing vascular access for patients undergoing hemodialysis, particularly those with end-stage renal disease (ESRD) who are not suitable candidates for arteriovenous fistulas. The increasing global burden of ESRD, driven by diabetes, hypertension, and aging populations, is contributing to a growing need for hemodialysis treatments. Moreover, innovations in graft technology, such as the development of bioengineered and hybrid materials, are enhancing the durability, flexibility, and biocompatibility of these grafts, which results in fewer complications, prolonged graft patency, and broader clinical adoption in both developed and emerging markets.

The rise in chronic kidney disease (CKD) and ESRD correlates with an aging global population. Elderly patients, who often have limited vascular access, rely more on synthetic or biological vascular grafts, further boosting the demand for graft-based dialysis access. The growth of dialysis centers in developing countries, along with enhanced healthcare service access, is increasing the utilization of vascular grafts. Government initiatives and rising investments in renal care also contribute to making advanced graft technologies more affordable and accessible, supporting global growth in renal healthcare infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $245.8 Million |

| Forecast Value | $398.2 Million |

| CAGR | 5% |

In 2024, the synthetic graft segment led the market with a significant share of 86.1%. Synthetic hemodialysis grafts offer immediate use, unlike arteriovenous fistulas, which require weeks for maturation. This immediate availability makes synthetic grafts essential for acute or emergency dialysis situations. Furthermore, synthetic materials such as expanded polytetrafluoroethylene (ePTFE) and polyurethane have improved the performance, flexibility, and durability of these grafts. Surface treatments and heparin-bonded coatings reduce the risk of thrombosis and infection, making synthetic grafts more effective for long-term dialysis therapies. The growing demand for emergency hemodialysis access, especially in hospitals and emergency settings, is increasing the adoption of synthetic grafts, which have shorter maturation times and are often preferred over their biological counterparts.

The dialysis centers segment held a 46.1% share in 2024. The rise in chronic kidney disease and end-stage renal disease cases worldwide has spurred the rapid growth of dialysis centers. As these facilities expand to accommodate more patients, the demand for vascular access solutions such as hemodialysis grafts increases. High-volume dialysis centers require reliable, effective vascular access options for their patients. Synthetic hemodialysis grafts, with their shorter maturation times compared to arteriovenous fistulas, are particularly beneficial in these settings, making them a preferred option. As a result, dialysis centers are frequently stocking synthetic grafts, contributing to the segment's growth.

U.S. Hemodialysis Vascular Grafts Market will reach USD 159.4 million by 2034. The U.S. faces a high prevalence of diabetes and hypertension, which are leading causes of chronic kidney disease and end-stage renal disease. The increasing incidence of these conditions means more patients require long-term dialysis, thereby driving demand for vascular access solutions. Medicare and other federal healthcare programs offer comprehensive coverage for dialysis treatments and vascular access procedures, which makes hemodialysis grafts more accessible to patients. These reimbursement policies incentivize healthcare providers to adopt advanced graft technologies, further fueling the market's growth.

Key market players in the Global Hemodialysis Vascular Grafts Industry include Artivion, Becton Dickinson and Company, BIOVIC, Cook Medical, CryoLife, Getinge, Laminate Medical Technologies, LeMaitre, Merit Medical Systems, ParaGen Technologies, Proteon Therapeutics, Terumo Medical, Vascudyne, Vascular Genesis, and W.L. Gore & Associates. Companies in the hemodialysis vascular grafts market are employing several key strategies to enhance their market position. These strategies include significant investments in research and development to improve graft performance, biocompatibility, and longevity. Manufacturers are also focusing on expanding their product portfolios by introducing advanced materials and hybrid grafts to meet the diverse needs of patients. Collaborations with healthcare providers, hospitals, and dialysis centers are helping companies penetrate new markets and improve product accessibility. To further strengthen their foothold, companies are increasing their geographic reach by entering emerging markets with growing demand for dialysis services.