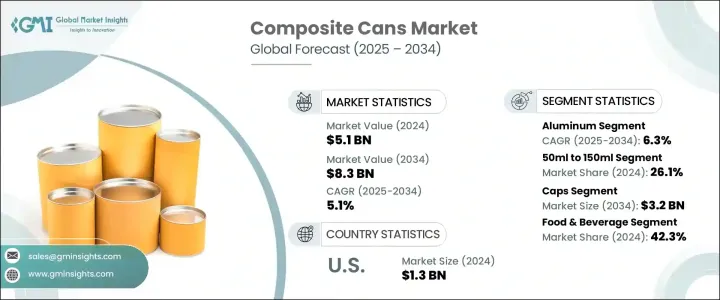

세계의 복합 캔 시장은 2024년에는 51억 달러로 평가되었고, 스낵 식품, 즉석 식품, 영양 기능성 식품 분야의 급속한 확장에 힘입어, 2034년에는 83억 달러에 달할 것으로 예측되며, CAGR 5.1%로 성장할 전망입니다.

도시화 가속화, 가처분 소득 증가, 소비자 생활 방식의 변화는 내구성, 편의성, 연장된 유통기한을 결합한 포장재에 대한 수요를 촉진하는 주요 요인입니다. 다층 구조를 갖춘 복합 캔은 우수한 수분 및 산소 차단 성능을 제공하여 민감한 제품의 신선도와 품질을 유지하는 데 이상적입니다.

수입 알루미늄 및 철강에 적용되는 관세와 같은 무역 관련 정책은 미국 복합 캔 제조업체의 가격 및 소싱 미래를 혼란에 빠뜨렸습니다. 이러한 변화로 인해 비용이 증가하고 자재 조달에 어려움이 발생하여 생산 업체들은 공급망을 재평가하게 되었습니다. 이에 대응하여 많은 기업들이 수익성을 유지하고 미래의 위험을 완화하기 위해 국내 원자재 및 현지화 생산 전략으로 전환하고 있습니다. 이 리쇼어링(국내 생산 전환) 움직임은 무역 혼란을 극복하는 데 도움을 주는 동시에 지속 가능성과 회복력 강화라는 광범위한 목표와도 일치합니다. 생산 기지 근처에서 원자재를 조달함으로써 기업들은 납품 기간을 단축하고 물류 비용을 절감하며 품질 관리와 현지 규제 준수 능력을 강화할 수 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 51억 달러 |

| 예측 금액 | 83억 달러 |

| CAGR | 5.1% |

재료 중 알루미늄 기반 복합 캔은 경량성, 내식성, 재활용성 등 유리한 특성으로 2034년까지 연평균 6.3%의 성장률을 보일 것으로 예상됩니다. 이러한 특성은 식품 및 음료 부문에서 지속 가능한 포장에 대한 선호도가 높아지는 추세와 잘 부합합니다. 알루미늄은 습기, 공기 및 빛으로부터 제품을 보호하는 능력이 뛰어나 유통 기한이 긴 제품에 이상적인 선택입니다. 또한, 환경 친화적인 관행과 순환 경제에 대한 정부의 지원이 이 부문을 강화하여 제조업체들이 기존의 플라스틱에서 보다 지속 가능한 금속 기반 포장 솔루션으로 전환하도록 장려하고 있습니다.

용량 기준으로, 50-150ml 부문의 복합 캔은 2024년에 26.1%의 점유율을 차지했습니다. 이 크기는 건강 보조제, 화장품 및 시험용 제품 등 소형 포장재에 대한 수요가 증가하면서 주목을 받고 있습니다. 도시 인구 증가, 바쁜 생활 방식, 프리미엄 단일 용량 제품에 대한 소비자의 관심은 이 부문의 성장을 계속 뒷받침하고 있습니다. 이 캔은 휴대성과 편리함을 제공하여 여행용 제품 및 충동 구매에 이상적입니다. 브랜드는 혁신적인 포장 디자인으로 시각적 매력을 강화하여 개인화 및 미적 매력에 대한 소비자의 요구를 충족하고 있습니다.

미국의 복합 캔 2024년 시장 규모는 13억 달러로 평가되었습니다. 플라스틱의 지속 가능하고 재활용 가능한 대안에 대한 수요가 소비자 및 제조업체의 행동에 큰 영향을 미쳤습니다. 음료, 스낵, 보충제 분야에서 친환경 포장재 수요가 증가하며 미국 시장 동향을 형성하고 있으며, 특히 환경 의식이 높은 소비자들이 주도하고 있습니다. 기업들은 생분해성 소재, 쉬운 재활용성, 탄소 배출량 감소를 강조한 제품 라인으로 대응하고 있습니다.

세계의 복합 캔 산업의 주요 기업에는 Smurfit Kappa Group, Irwin Packaging, Sonoco Products, Corex Group, Mondi Group이 포함됩니다. 시장 지위를 강화하기 위해 선도 기업들은 지속 가능한 재료 통합과 고급 제조 기술을 통한 제품 혁신에 집중하고 있습니다. 식품 및 음료 브랜드와의 전략적 파트너십, 친환경 디자인 투자, 수요가 높은 지역에서의 생산 능력 확장은 제조업체들이 변화하는 고객 요구를 충족시키며 경쟁력을 유지하는 데 기여하고 있습니다.

The Global Composite Cans Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 8.3 billion by 2034, fueled by the rapid expansion of the snack food, ready-to-eat meals, and nutraceutical sectors. Rising urbanization, growing disposable incomes, and a shift in consumer lifestyles are key drivers of demand for packaging that combines durability, convenience, and extended shelf life. Composite cans, with their multi-layer construction, offer excellent moisture and oxygen barriers, making them ideal for preserving the freshness and quality of sensitive products.

Trade-related policies, such as the tariffs applied to imported aluminum and steel, have disrupted the pricing and sourcing landscape for composite can manufacturers in the U.S. These shifts have resulted in cost increases and material sourcing challenges, prompting producers to reevaluate their supply chains. In response, many companies are shifting towards domestic raw materials and localized production strategies to maintain profitability and mitigate future risks. This movement toward reshoring is not only helping manufacturers navigate trade disruptions aligns with broader sustainability and resilience goals. By sourcing materials closer to production hubs, firms are reducing lead times, lowering logistics costs, and enhancing their control over quality and compliance with local regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 5.1% |

Among materials, aluminum-based composite cans are expected to grow at a CAGR of 6.3% through 2034, driven by favorable properties such as light weight, corrosion resistance, and recyclability. These characteristics align well with the rising preference for sustainable packaging in food and beverage segments. Aluminum's ability to protect against moisture, air, and light makes it an ideal choice for products requiring extended shelf life. Additionally, government support for environmentally friendly practices and circular economies strengthens this segment, encouraging manufacturers to switch from conventional plastics to more sustainable metal-based packaging solutions.

Based on capacity, composite cans in the 50ml to 150ml segment held a 26.1% share in 2024. This size is gaining traction in compact packaging needs across health supplements, cosmetic products, and trial-size offerings. Growing urban populations, on-the-go lifestyles, and consumer interest in premium, single-serve products continue to support segment growth. These cans offer portability and convenience, making them ideal for travel-friendly goods and impulse buys. Brands enhance their visual appeal with innovative packaging designs, tapping into consumer demand for personalization and aesthetic appeal.

U.S. Composite Cans Market was valued at USD 1.3 billion in 2024. The push for sustainable and recyclable alternatives to plastic has significantly influenced consumer and manufacturer behavior in the country. Growing demand for eco-friendly packaging in beverages, snacks, and supplements shapes U.S. market dynamics, especially among environmentally conscious consumers. Companies are responding with product lines that highlight compostable components, easy recyclability, and reduced carbon footprints.

Key players in the Global Composite Cans Industry include Smurfit Kappa Group, Irwin Packaging, Sonoco Products, Corex Group, and Mondi Group. To enhance market positioning, leading companies focus on product innovation through sustainable material integration and advanced manufacturing technologies. Strategic partnerships with food and beverage brands, investments in eco-friendly design, and capacity expansions in high-demand regions are helping manufacturers meet evolving customer needs while staying competitive.