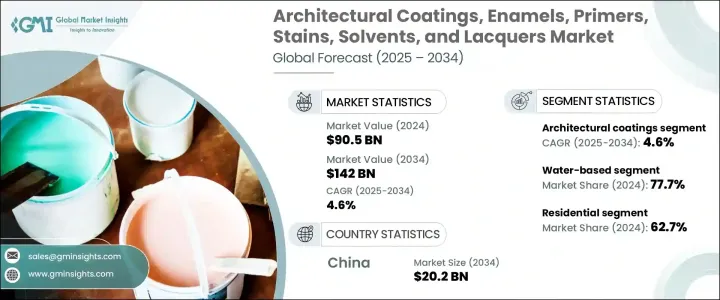

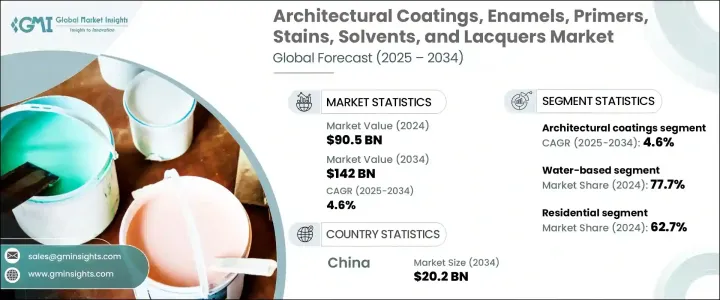

세계의 건축용 코팅, 에나멜, 프라이머, 스테인, 용제, 래커 시장은 2024년에는 905억 달러로 평가되었고, 에나멜, 프라이머, 스테인, 용제, 래커가 다양한 산업에서 특정 미적·기능적 요구에 부응하기 때문에 CAGR 4.6%를 나타내 2034년에는 1,420억 달러에 달할 것으로 추정됩니다.

시장의 성장은 특히 신흥 국가의 급속한 도시화와 성숙 시장의 개축과 유지 보수 활동 증가가 주요 요인이 되고 있습니다. 스테인, 코팅, 에나멜, 프라이머, 스테인, 용제, 래커 시장은 낮은 VOC(휘발성 유기 화합물) 처방으로의 전환을 목격하고 있습니다.

게다가, 코팅 기술의 진보에 의해 주택이나 상업시설에 자주 보이는 고습도나 장시간의 자외선 노출과 같은 가혹한 조건하에서의 성능이 향상하고 있습니다. 그러면 도시로의 이주자가 늘어남에 따라 새로운 주택과 상업시설, 공공 인프라에 대한 요구가 높아지고 있으며, 이들 모두가 고품질의 페인트에 대한 수요를 뒷받침하고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 905억 달러 |

| 예측 금액 | 1,420억 달러 |

| CAGR | 4.6% |

건축용 코팅 분야는 2024년에 905억 달러를 창출했고 주택과 상업시설 모두에서 널리 사용되고 있기 때문에 앞으로도 확대가 계속될 것으로 예측됩니다. 정부와 소비자 모두 지속가능성을 선호하기 때문에 환경 친화적인 수성 페인트와 낮은 VOC 페인트에 대한 수요는 특히 강합니다.

주택 분야는 2024년에 62.7%의 점유율을 차지했습니다. 이 동향의 배경에는 아시아태평양을 중심으로 한 신흥국에서의 주택 수요의 확대가 있습니다. 페인트와 같은 심미적인 범용성을 향상시킨 페인트에 대한 수요는 계속 증가하고 있으며, 주택 분야의 성장을 더욱 뒷받침하고 있습니다.

2024년 중국의 건축용 코팅, 에나멜, 프라이머, 스테인, 용제, 래커 시장 규모는 126억 달러였는데, 이는 주로 이 나라의 급속한 도시 개척에 기인합니다. 소비자의 선호도가 진화함에 따라 셀프 클리닝과 항균성을 포함한 프리미엄 코팅 시장이 확대되고 있습니다.

Sherwin-Williams, PPG Industries, AkzoNobel, Asian Paints 등 건축용 코팅, 에나멜, 프라이머, 스테인, 용제, 래커 시장 주요 기업은 시장 점유율을 강화하기 위해 M&A 등의 전략을 채용하고 있습니다. 소비자의 요구에 대응하는 새로운 솔루션을 도입하기 위해 연구개발에 많은 투자를 하고 있습니다.

참고 : 위의 무역 통계는 주요 국가에 대해서만 제공됩니다.

The Global Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market was valued at USD 90.5 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 142 billion by 2034 as enamels, primers, stains, solvents, and lacquers, cater to specific aesthetic and functional needs across various industries. The market growth is largely driven by rapid urbanization, particularly in developing countries, and increased renovation and maintenance activities in mature markets. As the demand for eco-friendly solutions continues to rise, the architectural coatings, enamels, primers, stains, solvents, and lacquers market is witnessing a shift towards low-VOC (volatile organic compound) formulations. This growing preference for sustainable products is driven by increasing awareness of environmental impact and consumer concerns about indoor air quality.

Moreover, advancements in coating technologies have enhanced performance under extreme conditions, such as high humidity and prolonged UV exposure, which are common in both residential and commercial buildings. These innovations are expanding the range of applications and improving the longevity and durability of coatings, making them more attractive to both consumers and industry professionals. As more people in these regions migrate to urban areas, there is a corresponding need for new housing, commercial spaces, and public infrastructure, all of which drive demand for high-quality coatings. The region's focus on construction and renovation projects, paired with a cultural shift towards modern, sustainable living, positions Asia-Pacific as the fastest-growing market for architectural coatings globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.5 Billion |

| Forecast Value | $142 Billion |

| CAGR | 4.6% |

The architectural coatings segment generated USD 90.5 billion in 2024, and it is projected to continue its expansion due to its widespread use in both residential and commercial buildings. These coatings are valued not only for their aesthetic appeal but also for their ability to protect surfaces from wear, moisture, and environmental factors. The demand for water-based and low-VOC coatings, which are considered more eco-friendly, is particularly strong, as governments and consumers alike prioritize sustainability. Additionally, innovations in fast-drying, multi-surface paints have contributed to an increased preference for these products, offering both convenience and performance.

The residential segment held a 62.7% share in 2024. The expanding demand for housing in emerging economies, particularly in the Asia-Pacific region, is a key factor behind this trend. Furthermore, consumer preferences are evolving, with a stronger focus on versatile, high-performance coatings that are both durable and eco-friendly. The demand for coatings with improved aesthetic versatility, such as multi-functional paints that can be applied to various surfaces, continues to rise, further fueling growth in the residential sector. As urban housing construction accelerates, particularly in rapidly developing regions, the need for sustainable and innovative coatings is expected to grow, creating new opportunities for industry players.

China Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market generated USD 12.6 billion in 2024, largely due to the country's rapid urban development. Increased consumption, particularly in tier-2 and tier-3 cities, is fueling demand for coatings with enhanced performance and aesthetic appeal. The market for premium coatings, including those with self-cleaning or antibacterial properties, is growing as consumer preferences evolve. Companies are responding by focusing on product innovation and expanding their distribution networks, aiming to capture a larger share of this highly competitive market.

Leading companies in Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market, including Sherwin-Williams, PPG Industries, AkzoNobel, and Asian Paints, are adopting strategies such as mergers and acquisitions to consolidate market share. Product innovation is also a key focus, with these companies investing heavily in research and development to introduce new solutions that meet changing consumer needs. Additionally, strategic partnerships and improved distribution networks are helping companies strengthen their presence, particularly in rapidly growing markets like China and India.

note: the above trade statistics will be provided for key countries only.