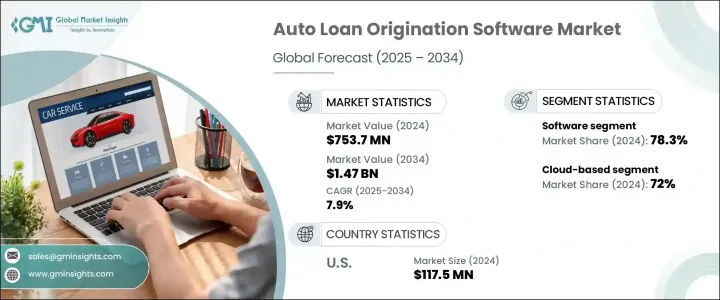

세계의 자동차 대출 개시 소프트웨어 시장 규모는 2024년에 7억 5,370만 달러로 평가되었고, CAGR 7.9%로 성장할 전망이며, 2034년에는 14억 7,000만 달러에 이를 것으로 예측됩니다.

더욱 효율적이고 정확하며 원활한 대출 프로세스에 대한 수요가 높아지는 가운데 금융기관은 디지털화가 진행되는 오늘날의 세계에서 소비자의 기대에 부응하기 위해 기술에 주목하고 있습니다. 자동차 대출 개시 소프트웨어는 신청접수, 서류확인, 신용평가, 최종승인 등의 복잡한 작업을 자동화하는 데 중요한 역할을 하며 금융기관에 엔드투엔드 디지털 대출 솔루션을 제공하고 있습니다. 이 시장은 대출자의 만족도를 향상시키면서 처리 시간과 업무상의 오버헤드를 줄이는 것을 목표로 하는 대출자가 늘어남에 따라 기세를 올리고 있습니다. 이 성장을 뒷받침하고 있는 주된 요인은 고객 체험에 대한 관심이 높아지고 있는 것입니다. 대출자는 오늘날 신속한 승인, 최소한의 사무처리, 개별화된 서비스를 기대하고 있으며, 대출 개시 플랫폼은 바로 그것을 가능하게 하고 있습니다. 이러한 솔루션은 간소화되고 투명하며 직관적인 디지털 대출 경험을 제공함으로써 금융기관이 점점 더 경쟁이 치열해지는 시장에서 고객을 유치하고 유지하는 데 도움을 줍니다. 금융기관은 또한 안전하고 확장성이 있으며 고도의 커스터마이징이 가능한 적응성이 높은 솔루션을 우선시하기 때문에 대출자의 행동이나 규제가 변화하는 가운데서도 민첩하게 대응할 수 있습니다. 대출 신청 디지털 채널의 보급에 따라 유연성이 높은 클라우드 기반 시스템의 필요성이 그 어느 때보다 중요해졌습니다.

시장은 구성요소에 따라 소프트웨어 및 서비스로 구분됩니다. 2024년 시장 점유율은 소프트웨어가 약 78.3%를 차지했으며, 예측 기간을 통해 CAGR 8.3% 이상으로 성장할 것으로 예측됩니다. 소프트웨어 플랫폼은 확장성, 유연성, 신청에서 승인까지의 대출 처리를 합리화하는 능력에서 선호되고 있습니다. 이들 시스템은 리스크 분석, 본인확인, 신용 스코어링 등 시간이 많이 걸리는 작업을 자동화하여 기존 금융 인프라에 원활하게 통합할 수 있도록 설계되었습니다. 금융기관들은 AI 기반의 스코어링 모델, CRM 시스템, 실시간 신청 추적 등 고급 기능을 결합한 지능형 플랫폼을 선택하는 경향이 강해지고 있습니다. 이러한 통합 솔루션은, 융자 실행 프로세스를 신속화할 뿐만 아니라, 보다 안전하고 컴플리언스에 준거한 융자 에코 시스템에도 공헌하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 7억 5,370만 달러 |

| 예측 금액 | 14억 7,000만 달러 |

| CAGR | 7.9% |

전개별로 볼 때 시장은 온프레미스 및 클라우드 기반 플랫폼으로 나뉩니다. 2024년에는 클라우드 기반 배포가 72%라는 압도적인 점유율로 시장을 선도했으며, 2034년까지 8.4% 이상의 성장률을 유지할 것으로 예상되고 있습니다. 금융 기관은 동적 스케일링, 실시간 업데이트 및 시스템 간의 원활한 통합을 지원하는 능력을 통해 클라우드 솔루션을 점점 더 선호합니다. 클라우드를 활용함으로써 금융 기관은 인프라 비용을 줄이고 정기적인 보안 패치의 혜택을 누리고 직원과 고객 모두에게 더 나은 액세스를 제공할 수 있습니다. 또한 이러한 플랫폼은 데이터 프라이버시를 강화하고 국내외 규제에 대한 컴플라이언스를 원활하게 하기 위해 데이터 중심의 금융이라는 현재 상황에서 특히 매력적입니다.

용도별로 시장은 승용차용 대출과 상용차용 대출로 나뉩니다. 승용차용 부문은 용도별 내역으로 리드하고 있어, 이 카테고리로 처리되는 자동차 대출의 양이 많기 때문에 향후도 우위성이 계속될 것으로 예측됩니다. 개인용 자동차 대출을 찾는 대부분의 대출자는 쉽고 빠른 디지털 프로세스를 요구하고 있으며, 이러한 플랫폼은 이를 실현하기에 충분한 시설을 갖추고 있습니다. 개인 소비자들 사이에서는 간소화된 모바일 퍼스트 대출 신청 시스템에 대한 수요가 특히 강하고, 금융기관은 개시 소프트웨어를 채용 또는 업그레이드할 때 승용차 부문을 우선하는 경향이 있습니다.

지역적으로는 북미가 세계의 자동차 대출 개시 소프트웨어 시장을 선도하고 있으며, 미국은 2024년에 약 1억 1,750만 달러의 매출을 계상해 지역 점유율의 약 79.6%를 차지했습니다. 이 나라의 자동차 구입 대수가 많은 것, 자동차 융자를 위한 크레딧의 보급, 고도의 금융 인프라가 이 우위성에 기여하고 있습니다. 미국의 금융기관은 또, AI 대응 시스템, 디지털 문서 처리, 실시간 분석을 급속히 도입하고 있어, 이 나라를 자동차 융자 기술에 있어서 중요한 이노베이터로서 자리매김하고 있습니다.

시장이 진화함에 따라 소프트웨어 제공업체는 데이터 보안 및 투명성에 대한 필요성을 높일 수 있기 때문에 엔드 투 엔드 암호화, 실시간 부정 감지, 자동 컴플라이언스 검사 등의 기능을 우선시하고 있습니다. 인공지능 및 기계학습은 현재 신용위험 분석, 대출 의사결정, 포트폴리오 최적화의 중심이 되고 있습니다. 보험회사, 딜러, 규제기관을 포함한 서드파티 생태계와의 통합은 실시간 협업과 통일된 대출 경험을 더욱 가능하게 하고 있습니다. 이러한 테크놀로지의 변혁은 자동차 융자를 보다 신속하고 효율적인, 고객 중시의 프로세스로 재구축하고 있습니다.

The Global Auto Loan Origination Software Market was valued at USD 753.7 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 1.47 billion by 2034. As demand rises for more efficient, accurate, and seamless lending processes, financial institutions are turning to technology to meet consumer expectations in today's digitally driven world. Auto loan origination software plays a vital role in automating complex tasks such as application intake, document verification, credit evaluation, and final approval, offering lenders an end-to-end digital lending solution. The market is gaining momentum as more lenders aim to cut down on processing time and operational overhead while improving borrower satisfaction. A key factor fueling this growth is the rising focus on customer experience. Borrowers today expect quick approvals, minimal paperwork, and personalized services, and loan origination platforms are enabling exactly that. By providing streamlined, transparent, and intuitive digital lending journeys, these solutions help financial institutions attract and retain customers in an increasingly competitive market. Institutions are also prioritizing secure, scalable, and adaptive solutions that offer a high degree of customization, allowing them to remain agile amid changing borrower behaviors and evolving regulations. With the growing popularity of digital channels for loan applications, the need for flexible and cloud-based systems has become more critical than ever.

The market is segmented based on components into software and services. In 2024, the software category held a dominant market share of approximately 78.3% and is projected to grow at a CAGR exceeding 8.3% throughout the forecast period. Software platforms are gaining preference for their scalability, flexibility, and ability to streamline loan processing from application to approval. These systems are engineered to automate time-intensive tasks such as risk analysis, identity validation, and credit scoring, integrating seamlessly into existing financial infrastructure. Financial organizations are increasingly opting for intelligent platforms that combine advanced functionalities, including AI-based scoring models, CRM systems, and real-time application tracking. These integrated solutions not only speed up the origination process but also contribute to a more secure and compliant lending ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $753.7 Million |

| Forecast Value | $1.47 Billion |

| CAGR | 7.9% |

Deployment-wise, the market is split into on-premises and cloud-based platforms. In 2024, cloud-based deployment led the market with a commanding 72% share and is expected to maintain a growth rate of over 8.4% through 2034. Lenders are increasingly favoring cloud solutions due to their ability to support dynamic scaling, real-time updates, and seamless integration across systems. By leveraging the cloud, institutions can cut down on infrastructure costs, benefit from regular security patches, and enable better access for both employees and customers. These platforms also enhance data privacy and facilitate smoother compliance with local and international regulations, making them particularly attractive in the current landscape of data-driven finance.

In terms of application, the market is divided between loans for passenger cars and commercial vehicles. The passenger car segment leads the application breakdown and is forecasted to continue its dominance due to the large volume of auto loans processed in this category. Most borrowers looking for personal vehicle financing seek easy and quick digital processes, which these platforms are well-equipped to deliver. The demand for simplified, mobile-first loan application systems is particularly strong among individual consumers, pushing lenders to prioritize the passenger vehicle segment when adopting or upgrading their origination software.

Geographically, North America leads the global auto loan origination software market, with the United States contributing around USD 117.5 million in revenue and accounting for roughly 79.6% of the regional share in 2024. The country's large volume of vehicle purchases, widespread use of credit for auto financing, and advanced financial infrastructure have contributed to this dominance. Financial institutions in the U.S. are also rapidly embracing AI-enabled systems, digital document handling, and real-time analytics, positioning the nation as a key innovator in auto lending technology.

As the market evolves, software providers are prioritizing features such as end-to-end encryption, real-time fraud detection, and automated compliance checks to meet the growing need for data security and transparency. Artificial intelligence and machine learning are now central to credit risk analysis, loan decisioning, and portfolio optimization. Integration with third-party ecosystems-including insurance firms, dealerships, and regulatory bodies-is further enabling real-time collaboration and a unified loan experience. This technology transformation is reshaping auto lending into a more responsive, efficient, and customer-focused process.