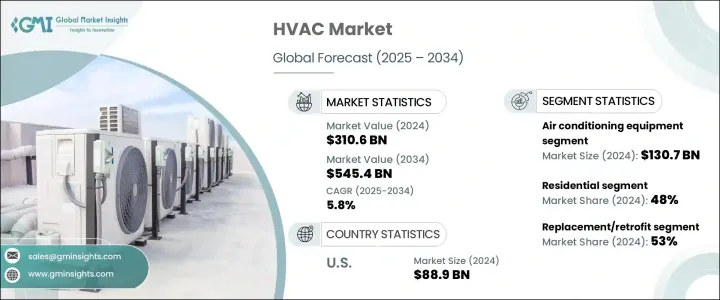

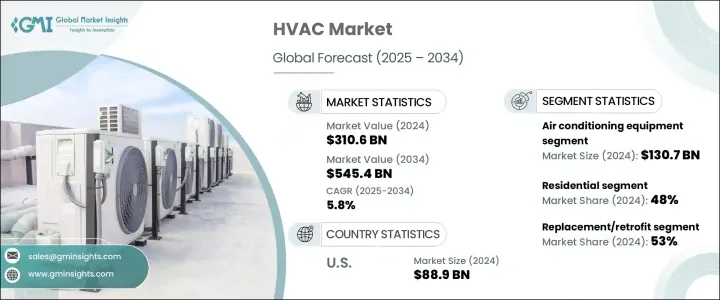

세계의 HVAC 시장 규모는 2024년에 3,106억 달러에 달했고, CAGR 5.8%를 나타내 2034년에는 5,454억 달러에 이를 것으로 예측됩니다.

이 성장을 지원하는 주요 요인 중 하나는 선진국과 개발도상국 모두에서 에너지 효율이 높고 환경 친화적인 냉각 기술에 대한 수요가 높아지고 있다는 점입니다. 첨단 HVAC 시스템의 혁신과 개발에 힘쓰고 있습니다. 이러한 선호도의 변화는 보다 뛰어난 성능과 운전 비용 절감을 제공하는 스마트 공조 시스템과 가변속 공조 시스템의 채용을 가속화하고 있습니다. 는 주택, 상업시설, 산업용 응용 분야에서 점점 더 매력적이 되고 있습니다. 또한, 기후 변화와 세계의 온도 상승으로 더 많은 지역에서 일관된 냉각 시스템의 사용이 추진되어 고성능 HVAC 장치에 대한 요구가 더욱 커지고 있습니다.

신흥 시장의 급속한 도시화는 집합 주택, 상업 공간, 산업 인프라의 건설 증가와 함께 시장에도 박차를 가하고 있습니다. 세계 각국의 정부는 새로운 개발에 에너지 효율적인 공조 제어 솔루션의 사용을 의무화하는 건축 기준을 시행하고 있습니다. 자동 온도 제어, 스마트 센서, IoT 연결 등의 기능을 갖춘 HVAC 시스템 수요에 크게 기여하고 있습니다. 2024년 HVAC 시장 전체에서 차지하는 후부/교환 부문의 비율은 53%로 레거시 시스템이 아직 사용되고 있는 시장에서 강한 기세를 나타내고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 3,106억 달러 |

| 예측 금액 | 5,454억 달러 |

| CAGR | 5.8% |

제품 유형별로 보면 HVAC 시장에는 공기조화기, 난방기기, 환기시스템, 냉동기, 냉각탑이 포함되어 있습니다. 에너지 효율적인 냉각 솔루션에 대한 의식이 커지고 있는 것이 큰 요인이 되고 있습니다. 한편, 난방 기기 분야는 비용 효율적인 저배출 가스 난방 시스템에 대한 수요 증가에 힘입어 2025년부터 2034년에 걸쳐 약 5.7%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

시장의 최종 용도 세분화에는 주택, 상업, 공업 부문이 포함됩니다. 기후제어시스템에 대한 투자를 늘리고 있는 중류계급의 인구 증가를 배경으로 하고 있습니다.에 대한 수요가 높아지고 있습니다.이 시설은 공기의 질, 쾌적성, 업무 효율을 우선하고 있어 스마트하고 커넥티드인 HVAC 기술의 도입을 촉진하고 있습니다.

지역적으로는 미국이 HVAC 시장의 주요 공헌자이자 북미 점유율의 약 79%를 차지하며, 2024년에는 889억 달러의 수익을 창출했습니다. 최신의 에너지 효율적인 대체품으로 교환할 때 세액 공제를 제공하는 프로그램은 주택과 상업 빌딩 모두에서 시스템 업그레이드를 가속화하고 있으며, 그 결과 고급 연결성, 에너지 관리 개선, 환경 부하 저감을 특징으로 하는 HVAC 시스템에 대한 수요가 급증하고 있습니다.

일부 유명 기업들은 제품 혁신과 전략적 파트너십을 통해 HVAC의 전망을 적극적으로 형성하고 있습니다. Electronics, Mitsubishi Electric, Rheem Manufacturing Company, Panasonic, Trane Technologies 등입니다. 이러한 기업은 진화하는 소비자의 기대와 규제 요건에 대응하기 위해 지속적으로 연구 개발에 투자하고 있으며, 보다 스마트하고 환경 친화적이고 효율적인 HVAC 솔루션을 향해 시장을 견인하고 있습니다.

The Global HVAC Market was valued at USD 310.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 545.4 billion by 2034. One of the major factors supporting this growth is the rising demand for energy-efficient and eco-friendly cooling technologies across both developed and developing countries. As global focus intensifies on sustainability and environmental protection, manufacturers are being encouraged to innovate and develop advanced HVAC systems that consume less energy and produce fewer emissions. Regulatory bodies are implementing various energy efficiency programs that promote the use of such systems, which is prompting both businesses and consumers to opt for energy-conscious HVAC solutions. This shift in preference is accelerating the adoption of smart and variable-speed air conditioning systems, which offer better performance and lower operational costs. The growing need to reduce power consumption, particularly in climate control systems, has made energy-efficient HVAC technologies increasingly attractive across residential, commercial, and industrial applications. Additionally, climate change and rising global temperatures are pushing more regions toward consistent use of cooling systems, further amplifying the need for high-performance HVAC units.

Rapid urbanization in emerging markets, combined with increased construction of residential complexes, commercial spaces, and industrial infrastructure, is also fueling the market. Modern buildings are being designed with smart systems and integrated HVAC technologies that comply with the latest energy standards. Governments around the world are enforcing building codes that mandate the use of energy-efficient climate control solutions in new developments. The push for smarter, more connected buildings has significantly contributed to the demand for HVAC systems equipped with features like automated temperature control, smart sensors, and IoT connectivity. In addition, retrofit installations are gaining traction, especially in older buildings that require upgrades to meet updated regulatory standards and sustainability goals. The retrofit/replacement segment accounted for 53% of the total HVAC market in 2024, showing strong momentum in markets where legacy systems are still in use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $310.6 Billion |

| Forecast Value | $545.4 Billion |

| CAGR | 5.8% |

When broken down by product type, the HVAC market includes air conditioning equipment, heating equipment, ventilation systems, chillers, and cooling towers. In 2024, air conditioning equipment was the dominant category, generating revenue of USD 130.7 billion. Its continued growth is largely driven by increased awareness of energy-efficient cooling solutions, particularly in urban areas where air quality and rising temperatures are a growing concern. On the other hand, the heating equipment segment is poised to grow at a CAGR of approximately 5.7% from 2025 to 2034, supported by growing demand for cost-effective and low-emission heating systems.

End-use segmentation of the market includes residential, commercial, and industrial sectors. The residential segment comprised 48% of the market in 2024, backed by rapid urban expansion and a growing middle-class population that is increasingly investing in air conditioning and climate control systems for personal comfort. Commercial spaces, such as office buildings, retail outlets, and hospitality venues, are also witnessing heightened demand for advanced HVAC systems. These facilities prioritize air quality, comfort, and operational efficiency, driving the installation of smart and connected HVAC technologies. The commercial segment is further benefitting from infrastructure upgrades and compliance with stricter environmental standards, which are pushing building owners to retrofit older systems with modern, energy-efficient solutions.

Geographically, the United States remained a leading contributor to the HVAC market, accounting for approximately 79% of the North American share and generating revenue of USD 88.9 billion in 2024. The market growth in the US is being fueled by federal mandates and incentives that promote energy efficiency in heating and cooling systems. Programs offering tax credits for replacing older HVAC units with modern, energy-efficient alternatives are supporting the acceleration of system upgrades in both residential and commercial buildings. As a result, there has been a strong uptick in demand for HVAC systems that feature advanced connectivity, improved energy management, and reduced environmental impact.

Several prominent companies are actively shaping the HVAC landscape through product innovation and strategic partnerships. Key industry players include Carrier, Bosch, Daikin Industries, GREE Electric Appliances, Danfoss, Haier, Johnson Controls, Hisense HVAC Equipment, Lennox International, Midea, LG Electronics, Mitsubishi Electric, Rheem Manufacturing Company, Panasonic, and Trane Technologies. These companies are continually investing in R&D to meet evolving consumer expectations and regulatory requirements, helping to drive the market toward smarter, greener, and more efficient HVAC solutions.