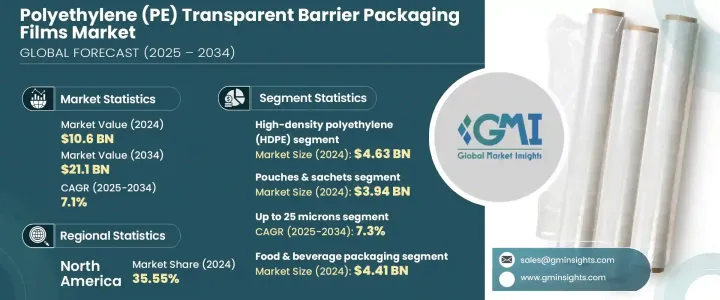

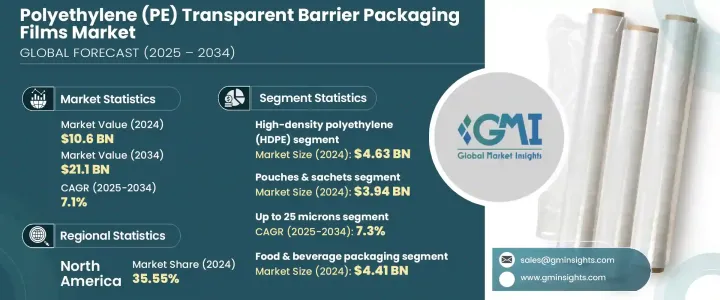

세계의 폴리에틸렌(PE) 투명 배리어 포장 필름 시장은 2024년에 106억 달러로 평가되었고, 고성능 포장 솔루션을 필요로 하는 편리하고 내구성 있는 포장 상품에 대한 수요가 증가함에 따라 2034년에는 211억 달러에 달할 것으로 예측되며, CAGR 7.1%로 성장할 전망입니다.

지속 가능하고 가볍고 비용 효율적인 포장에 대한 소비자 선호도가 높아지면서 산업 전반에서 폴리에틸렌(PE) 투명 배리어 필름으로의 전환이 가속화되고 있습니다. 식음료, 화장품, 제약 업계에서 유통기한 연장 및 제품 무결성을 더욱 강조하면서 고급 포장 솔루션에 대한 수요가 빠르게 증가하고 있습니다. PE 투명 배리어 필름은 제품의 가시성과 유연성을 유지하면서 습기, 산소 및 오염 물질에 대한 탁월한 보호 기능을 제공합니다.

금속 및 유리와 같은 기존 소재와 달리 운송 비용 절감, 환경 발자국 감소, 재활용성 향상 등 상당한 이점을 제공하기 때문에 미래 지향적인 브랜드에게 최고의 선택이 되고 있습니다. 또한 친환경적이고 재활용 가능한 소재의 사용을 장려하는 엄격한 글로벌 규제로 인해 업계는 순환 경제 목표에 맞춰 포장 디자인을 혁신하고 있습니다. 지속 가능성이 기업의 주요 의제로 떠오르면서 제조업체들은 성능이 우수하고 재활용이 용이한 단일 소재 솔루션을 제공하는 데 점점 더 집중하고 있습니다. 환경 문제에 대한 소비자들의 인식이 높아지는 것 또한 예측 기간 동안 시장의 견고한 성장 궤도를 촉진하는 주요 촉매제입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 106억 달러 |

| 예측 금액 | 211억 달러 |

| CAGR | 7.1% |

시장은 유형별로 메탈로센 폴리에틸렌(mPE), 선형 저밀도 폴리에틸렌(LLDPE), 저밀도 폴리에틸렌(LDPE), 고밀도 폴리에틸렌(HDPE)으로 세분화됩니다. 2024년 HDPE는 46억 3,000만 달러의 시장 가치로 이 부문을 주도했습니다. 뛰어난 내구성과 우수한 차단 저항성으로 잘 알려진 HDPE는 특히 식품 및 제약 부문에서 민감한 제품을 포장하는 데 선호되는 소재입니다. 화학 및 산소 차단 기능이 뛰어나 식품 안전과 유통 안정성을 향상시키는 데 필수적입니다. 시장이 지속 가능성에 크게 기울면서 재활용성을 높이고 재료 단순화 노력을 지원하는 공압출 HDPE 필름을 채택하는 추세가 탄력을 받고 있습니다.

두께에 따라 100미크론 이상, 50-100미크론, 25-50미크론, 최대 25미크론의 시장이 있습니다. 최대 25미크론 카테고리는 2025년부터 2034년까지 7.3%의 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다. 이러한 초박막 필름은 탁월한 수분 및 가스 차단 특성으로 인해 스낵, 제빵 제품 및 의약품 포장에 점점 더 선호되고 있습니다. 기업들은 엄격한 환경 기준을 준수하는 동시에 비용 효율성과 제품 신선도를 보장하기 위해 이 두께 범위의 단일 소재 필름을 채택하는 방향으로 빠르게 움직이고 있습니다.

독일의 폴리에틸렌 투명 배리어 포장 필름 시장은 2034년까지 32.77%라는 놀라운 연평균 성장률로 확장되어 가장 빠르게 성장하는 지역 시장 중 하나로 부상할 것으로 예상됩니다. 이러한 놀라운 성장은 독일 포장법에 따른 독일의 진보적인 재활용 법에 힘입어 분류 및 재활용을 단순화하는 단일 소재 폴리에틸렌 필름의 광범위한 채택을 촉진하고 있습니다. 지속 가능한 산업 관행에 대한 독일의 리더십과 강력한 규제 추진은 시장의 미래를 위한 속도를 높이고 있습니다.

세계의 폴리에틸렌 투명 배리어 포장 필름 시장에서 주요 기업은 Berry Global Inc, Jindal Poly Films Ltd, Sealed Air Corporation, Amcor Plc등이 있습니다. 이들은 고성능 단일 재료 필름을 개발하고 공압출 기술을 통해 생산 공정을 최적화하는 데 집중함으로써 글로벌 시장 입지를 강화하는 동시에 진화하는 규제 요구 사항을 충족하고 있습니다.

The Global Polyethylene Transparent Barrier Packaging Films Market was valued at USD 10.6 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 21.1 billion by 2034, driven by the rising demand for convenient, durable packaged goods that require high-performance packaging solutions. Growing consumer preference for sustainable, lightweight, and cost-effective packaging is accelerating the transition toward polyethylene (PE) transparent barrier films across industries. With businesses across food, cosmetics, and pharmaceuticals placing a stronger emphasis on shelf life extension and product integrity, the demand for advanced packaging solutions is rapidly escalating. PE transparent barrier films deliver excellent protection against moisture, oxygen, and contaminants while maintaining product visibility and flexibility.

Unlike traditional materials like metal and glass, these films offer significant advantages such as lower transportation costs, reduced environmental footprint, and better recyclability, making them a top choice for forward-looking brands. In addition, stricter global regulations promoting the use of eco-friendly and recyclable materials are pushing industries to innovate packaging designs in line with circular economy goals. As sustainability continues to dominate corporate agendas, manufacturers are increasingly focused on delivering mono-material solutions that are both high-performing and easily recyclable. The growing awareness among consumers about environmental issues is also a major catalyst, propelling the market's robust growth trajectory through the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 7.1% |

The market is segmented by type into metallocene polyethylene (mPE), linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), and high-density polyethylene (HDPE). HDPE led the segment in 2024 with a market value of USD 4.63 billion. Known for its excellent durability and superior barrier resistance, HDPE is a preferred material for packaging sensitive products, especially in the food and pharmaceutical sectors. Its chemical and oxygen barrier capabilities make it vital for enhancing food safety and shelf stability. As the market leans heavily toward sustainability, the trend of adopting co-extruded HDPE films is gaining momentum, offering better recyclability and supporting material simplification efforts.

In terms of thickness, the market includes above 100 microns, 50-100 microns, 25-50 microns, and up to 25 microns. The up to 25 microns category is projected to grow at a CAGR of 7.3% from 2025 to 2034. These ultra-thin films are increasingly favored for packaging snacks, baked goods, and pharmaceuticals due to their exceptional moisture and gas barrier properties. Companies are rapidly moving toward adopting mono-material films in this thickness range to align with strict environmental standards while ensuring cost-effectiveness and product freshness.

Germany's Polyethylene Transparent Barrier Packaging Films Market is projected to expand at a staggering CAGR of 32.77% by 2034, emerging as one of the fastest-growing regional markets. This impressive growth is fueled by the country's progressive recycling laws under the German Packaging Act, driving widespread adoption of mono-material polyethylene films that simplify sorting and recycling. Germany's leadership in sustainable industrial practices and strong regulatory push is setting the pace for the market's future.

Leading players in the Global Polyethylene Transparent Barrier Packaging Films Market include Berry Global Inc., Jindal Poly Films Ltd., Sealed Air Corporation, and Amcor Plc. These companies are investing heavily in advanced manufacturing technologies, expanding their portfolios with recyclable and biodegradable films, and forming strategic partnerships to drive innovation. A sharp focus on developing high-performance mono-material films and optimizing production processes through co-extrusion techniques is helping them strengthen global market positions while meeting evolving regulatory demands.