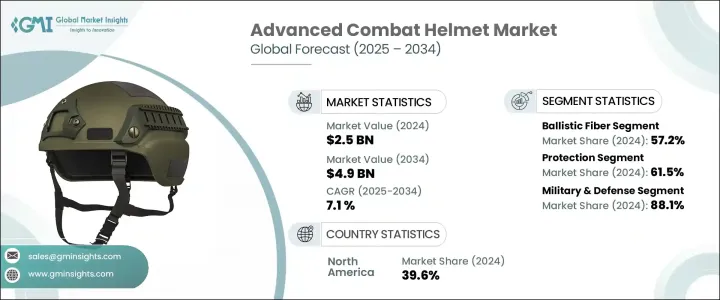

세계의 진화형 전투 헬멧 시장은 2024년에는 25억 달러로 평가되었으며 CAGR 7.1%를 나타내 2034년에는 49억 달러에 이를 것으로 추정됩니다.

이 확장은 방위군이 진화하는 전장의 위협에 대응하기 위해 군인의 보호구를 업그레이드하는 것을 우선하고 있기 때문에 다양한 지역에서 군사비가 증가하고 있는 것이 주요 요인입니다. 각국 정부가 군의 생존 능력과 작전 준비 태세의 강화를 목표로 하고 있는 중, 기술적으로 선진적인 헬멧에 대한 수요는 계속 증가하고 있습니다.

지정학적 긴장과 예측 불가능한 분쟁 지역은 군사 기관에 차세대 보호 헤드 기어에 대한 투자를 더욱 촉진하고 있습니다. 세금 부과는 공급망을 혼란시키고 헬멧 제조에 사용되는 필수 부품의 비용을 증가 시켰습니다. 이를 유지하기 위해 새로운 방위계약을 이행하고 있습니다. 방위기관이 다양한 작전 환경에 맞춘 장비를 요구하는 가운데, 특정 전투 시나리오에 맞춘 커스터마이즈와 성능 최적화가 중요한 초점이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 25억 달러 |

| 예측 금액 | 49억 달러 |

| CAGR | 7.1% |

소재별로 시장은 가변 섬유, 열가소성 플라스틱, 금속으로 구분됩니다. 2024년에는 바리스틱 섬유가 시장 점유율의 57.2%를 차지했습니다. 이 소재는 뛰어난 내충격성, 경량 특성, 가혹한 조건 하에서의 신뢰성에 의해 많은 제조업체에 선택되어 계속되고 있습니다. 제조업체 각 회사는 이러한 섬유의 강도 대 중량비를 개선하는 새로운 방법을 계속 찾고 있으며, 군인의 민첩성을 손상시키지 않고 최종 제품이 최대한의 보호를 제공할 수 있도록 하고 있습니다.

용도별로 보면 시장은 보호, 통신, 시각 지원으로 나뉩니다. 2024년에는 보호 카테고리가 61.5%의 점유율을 차지하며 이 부문을 지배했습니다. 탄도탄의 위협과 비대칭 전쟁에 대한 우려 증가는 견고한 방어 메커니즘을 제공하는 헬멧에 대한 수요를 강화하고 있습니다. 최신 전투용 헬멧은 현재 다양한 유형의 탄약과 폭발물의 충격을 견디며 다양한 지형에서도 기능을 유지할 수 있도록 설계되었습니다. 쾌적성, 장착성, 다기능성이 개발의 핵심이며 예측 불가능하고 위험한 작전으로 군인을 지원합니다.

최종 용도의 세분화에는 군 및 방위, 법집행기관이 포함됩니다. 군 및 방위가 시장의 대부분을 차지했고, 2024년 점유율은 88.1%였습니다. 이 우위의 배경은 군인의 생존 능력을 향상시키고 임무를 성공적으로 성공시킬 필요가 있습니다. 헬멧에는 노이즈 캔슬링 통신 시스템, 암시 장치, 실시간 데이터 전송 등의 기능이 탑재되어 전장에서의 인식과 대응력이 강화되고 있습니다. 각 기관은 보호 기능뿐만 아니라 통합 시스템을 통해 운영 효율성을 높이는 장비를 계속 요구하고 있습니다.

지역별로는 북미가 2024년에 39.6%의 점유율로 시장을 리드해 높은 방위비와 최첨단 기술의 조기 도입에의 강한 지향에 지지되었습니다. 상승시키는 선진적인 헤드 기어에 적극적으로 투자하고 있습니다. 개발 중의 헬멧에는 디스플레이나 환경 센서가 탑재되어 인간공학에 근거해 개량된 것이 많아, 현대전의 요구에 응하고 있습니다.

미국만으로도 2034년까지 18억 달러에 이를 것으로 예측되고 있습니다.

경쟁 구도는 여전히 치열하며 상위 5개 기업에서 시장 전체의 약 55-60%를 차지하고 있습니다. 기간 공급 계약은 안정적인 주문량을 확보하고 시장에서의 포지셔닝을 높이기 위해 묶여 있습니다.

The Global Advanced Combat Helmet Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 4.9 billion by 2034. This expansion is largely driven by increased military expenditures across various regions as defense forces prioritize upgrading soldier protection gear to meet evolving battlefield threats. Advanced combat helmets are no longer just about head protection; they now serve as platforms for communication, situational awareness, and integration with other combat systems. As governments aim to enhance the survivability and operational readiness of their armed forces, demand for technologically advanced helmets continues to rise. These helmets are being reimagined to include features such as integrated heads-up displays, modular add-ons, and compatibility with augmented reality systems.

Geopolitical tensions and unpredictable conflict zones have further compelled military agencies to invest in next-generation protective headgear. However, external economic factors have also influenced market dynamics. Trade policy shifts, especially the imposition of tariffs on imported raw materials, have disrupted the supply chain and increased the cost of essential components used in manufacturing helmets. These disruptions have led to longer production timelines and rising procurement costs. Inflationary pressures add another layer of complexity, potentially slowing acquisition cycles and placing added strain on defense budgets. Despite these challenges, the market is expected to maintain steady growth, with companies focusing on innovation and fulfilling new defense contracts to maintain momentum. Customization and performance optimization for specific combat scenarios are becoming a key focus area as defense agencies seek gear tailored to diverse operational environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.1% |

Based on material, the market is segmented into ballistic fiber, thermoplastic, and metal. In 2024, ballistic fiber accounted for 57.2% of the market share. This material remains the preferred choice for many manufacturers due to its superior impact resistance, lightweight properties, and reliability under extreme conditions. Manufacturers continue to explore new ways to improve the strength-to-weight ratio of these fibers, ensuring the final product offers maximum protection without compromising soldier agility.

By application, the market is divided into protection, communication, and visual assistance. The protection category dominated the segment in 2024, holding a 61.5% share. Rising concerns over ballistic threats and asymmetric warfare have intensified the demand for helmets offering robust defense mechanisms. Modern combat helmets are now being designed to withstand various types of ammunition and explosive impacts while also remaining functional in different terrains. Comfort, wearability, and multi-functionality are core to their development, supporting soldiers in unpredictable and high-risk operations.

End-use segmentation includes military and defense, and law enforcement agencies. Military and defense made up the majority of the market, with an 88.1% share in 2024. The need to improve soldier survivability and ensure mission success underlies this dominance. Helmets are being equipped with features like noise-canceling communication systems, night vision readiness, and real-time data transmission to enhance battlefield awareness and responsiveness. Agencies continue to demand gear that not only offers protection but also enhances operational efficiency through integrated systems.

Regionally, North America led the market with a 39.6% share in 2024, supported by high defense spending and a strong inclination toward early adoption of cutting-edge technologies. Regional defense bodies are actively investing in advanced headgear that improves situational awareness and battlefield coordination. Helmets in development often feature mounted displays, environmental sensors, and upgraded ergonomics to meet the demands of modern warfare.

The market in the United States alone is projected to reach USD 1.8 billion by 2034. Continuous investment in defense modernization remains a key driver, with a focus on developing state-of-the-art helmets that combine comfort, protection, and technological enhancement. Military equipment upgrades are prioritized to ensure forces are well-equipped for evolving threats.

The competitive landscape remains intense, with the top five companies accounting for roughly 55-60% of the total market. Key players are channeling efforts into research and development to offer helmets that address the expanding list of requirements from global defense sectors. Strategic alliances and long-term supply contracts with international military organizations are being formed to secure consistent order volumes and enhance market positioning. As battlefield requirements become more complex, helmet manufacturers are keeping pace by delivering high-performance products that offer both safety and strategic advantages.