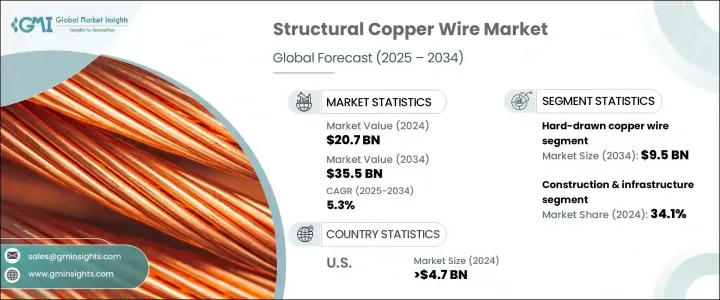

세계의 구조용 구리선 시장 규모는 2024년에는 207억 달러에 달했고, CAGR 5.3%를 나타내, 2034년에는 355억 달러에 이를 것으로 예측되고 있습니다.

표준 구리선과 달리 구조용 구리선은 물리적 스트레스, 기상 조건, 장기 노출에 견딜 수 있도록 설계되었으며 수요가 높은 환경에서 사용하기에 적합합니다. 대규모 인프라, 에너지 시스템의 근대화, 도시 경관의 전기화에 중점을 둔 부문에서의 수요가 급증하고 있습니다.

또한 지속 가능한 에너지 시스템으로의 전환은 특히 태양전지, 풍력 발전소 및 에너지 저장 시스템과 같은 재생 가능 에너지 프로젝트에서 구조용 구리선에 새로운 길을 열어줍니다. 전도성과 내구성은 장기적인 신뢰성이 불가결한 이러한 용도가 엄격한 환경에 이상적인 소재입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 207억 달러 |

| 예측 금액 | 355억 달러 |

| CAGR | 5.3% |

다양한 제품 카테고리 중에서 경구리선은 2024년에 가장 높은 수익을 올리고 56억 달러에 달했고, 2034년에는 95억 달러에 이를 것으로 예측됩니다. 그 구조는 접지, 배전, 강도나 내구성이 요구되는 배선 등 물리적인 변형을 수반하는 용도에 최적입니다.

건설 및 인프라 업계는 34.1%의 점유율을 차지하고 있으며 시장을 선도하고 있습니다. 도체의 직경을 작게 할 수 있기 때문에 설치나 스페이스의 최적화에 유리합니다.

2024년 미국의 구조용 구리선 시장 규모는 47억 달러로 평가되었고, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 5.5%를 나타낼 것으로 예측됩니다.

세계의 구조용 구리선 시장의 주요 기업은 General Cable Technologies Corporation, 스미토모 전기 공업, Prysmian Group, Nexans, Alan Wire 회사 등입니다. 이 시장의 주요 기업은 선진적 전략을 채택하고 있습니다. 까다로운 환경에서 성능을 향상시키기 위해 구리와 고급 합금을 결합하여 제품의 배합을 혁신하고 있습니다.

참고 : 위의 무역 통계는 주요 국가에만 제공됩니다.

The Global Structural Copper Wire Market was valued at USD 20.7 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 35.5 billion by 2034, driven by increasing demand for mechanically robust, corrosion-resistant wiring solutions across various critical sectors. Unlike standard electrical copper wire, structural copper wire is engineered to withstand physical stress, weather conditions, and long-term exposure, making it suitable for use in high-demand environments. With the expansion of smart infrastructure and rapid industrial development worldwide, these wires play a vital role in delivering both conductivity and durability. Demand is surging from sectors focused on large-scale infrastructure, modernization of energy systems, and the push toward electrification in urban landscapes. As countries focus on upgrading their infrastructure networks, strong and reliable copper wire solutions are becoming essential.

Additionally, the shift toward sustainable energy systems opens new avenues for structural copper wiring, particularly in renewable energy projects such as solar fields, wind farms, and energy storage systems. Copper's exceptional conductivity and durability make it ideal material for the demanding environments found in these applications, where long-term reliability is essential. In solar energy systems, copper wiring connects solar panels to the grid, ensuring efficient power transmission while withstanding the outdoor elements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.7 Billion |

| Forecast Value | $35.5 Billion |

| CAGR | 5.3% |

Among the different product categories, hard-drawn copper wire generated the highest revenue in 2024, reaching USD 5.6 billion, and is anticipated to hit USD 9.5 billion by 2034. These wires are chosen for their mechanical toughness and are more resistant to tension compared to softer alternatives. Their structure makes them ideal for applications involving physical strain, such as in grounding, power distribution, and wiring installations that demand strength and durability. Hard-drawn wires maintain their integrity under stress, providing a dependable solution for construction and infrastructure.

The construction and infrastructure industry led the market by accounting for 34.1% share. Copper's unmatched electrical conductivity and its strength-to-size efficiency make it the material of choice for building projects. Because copper allows for smaller-diameter conductors without sacrificing performance, it provides advantages in installation and space optimization. In wiring systems, more copper wires can fit into a single conduit compared to alternative materials, contributing to streamlined construction design.

United States Structural Copper Wire Market was valued at USD 4.7 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2034, driven by the growing adoption of copper wiring for high-performance electrical systems across commercial and institutional projects. Ongoing upgrades to existing electrical networks and rising energy efficiency regulations further drive the demand for copper, offering both regulatory compliance and energy-saving benefits.

Key players in the Global Structural Copper Wire Market include General Cable Technologies Corporation, Sumitomo Electric Industries, Prysmian Group, Nexans, and Alan Wire Company. Leading companies in this market are adopting forward-thinking strategies. These include investing in next-generation manufacturing technologies to enhance product durability and consistency, and forming strategic alliances to enter untapped regions. Firms are also innovating product formulations by combining copper with advanced alloys to improve performance in harsh environments. Emphasizing sustainability, many manufacturers are shifting to recyclable materials and energy-efficient processes to align with environmental regulations and meet customer expectations for greener solutions.

Note: The above trade statistics will be provided for key countries only