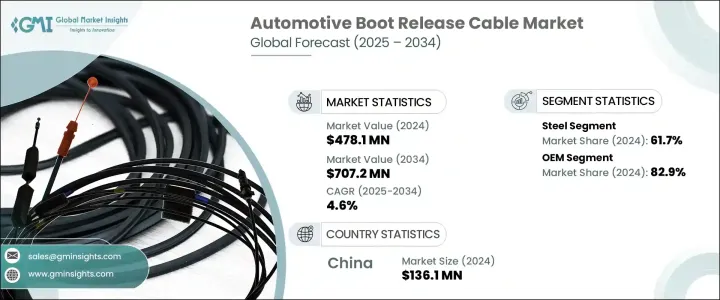

세계의 자동차용 부츠 릴리스 케이블 시장은 2024년에는 4억 7,810만 달러로 평가되었고, 2034년에는 CAGR 4.6%를 나타내 7억 720만 달러에 이를 것으로 예측되고 있습니다.

자동차의 설계가 진화하고 소비자가 자동차와의 보다 원활한 상호작용을 요구하게 됨에 따라 트렁크 액세스 시스템은 현저한 변모를 이루고 있습니다. 자동차 제조업체가 스마트 모빌리티와 전기자동차 기술을 채용하고 있는 가운데, 지능형 트렁크 시스템의 통합은 차량 설계에 있어서 중요한 특징이 되고 있습니다.

커넥티드 기술에 익숙한 자동차에 대한 선호도가 높아짐에 따라 자동차 제조업체가 트렁크 개구부와 같은 액세스 기능을 설계하는 방법을 형성하고 있습니다. 이러한 개발은 특히 전기자동차나 하이브리드 자동차에 있어서 현저하고, 효율성, 경량 설계, 스마트한 통합이 혁신의 최전선이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 4억 7,810만 달러 |

| 예측 금액 | 7억720만 달러 |

| CAGR | 4.6% |

진화하는 규격에 대응하기 위해 제조업체는 첨단재료의 사용과 보다 스마트한 엔지니어링 기법으로 시프트하고 있습니다. 그 중에서도 스틸이 여전히 최고의 선택이며, 2024년에는 시장의 약 61.7%의 점유율을 획득했으며, 2034년까지의 CAGR은 5%를 나타낼 것으로 예측됩니다.

유통 측면에서 2024년에는 OEM 부문이 82.9% 시장 점유율을 차지해 세계를 석권했고, 예측 기간 동안에도 리드를 유지할 것으로 예측됩니다. 보다 스마트하고 안전하며 최종 사용자에게 보다 직관적인 기능을 제공하는 차량 액세스의 미래를 따르는 기계와 전자의 하이브리드 솔루션에 대한 투자를 늘리고 있습니다.

중국은 가장 영향력 있는 지역 시장으로 대두하고 있으며, 2024년 세계 매출의 57.6%를 차지했고 2034년에는 1억 3,610만 달러에 이를 것으로 예측되고 있습니다. 중국의 선도적인 공급업체는 국제 표준과 수요를 충족하기 위해 고정밀도, 내식성 및 안전성을 강화한 케이블 시스템의 제조에 주력하고 있습니다.

THB Group, Universal Cable, Leoni AG, Nexans Auto Electric, Birla Cable, Kei Industry, TE Connectivity, Polycab, 스미토모 전기 산업, Sterlite 테크놀로지스 등의 대기업은 이 경쟁이 치열한 분야에서 우위를 차지하기 때문에 경량이고 다기능인 부트 릴리스 케이블 시스템의 설계에 주력하고 있습니다.

The Global Automotive Boot Release Cable Market was valued at USD 478.1 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 707.2 million by 2034, fueled by rising global vehicle production and the growing demand for advanced vehicle access solutions. As vehicle designs evolve and consumers demand more seamless interactions with their automobiles, trunk access systems have seen a notable transformation. Boot release cables, once simple mechanical components, are now playing a vital role in enabling smarter, more secure, and more efficient trunk access across a wide range of vehicle categories. As automakers continue to embrace smart mobility and electric vehicle technologies, the integration of intelligent trunk systems is becoming a critical feature in vehicle design. Consumers expect convenience and speed, and vehicle manufacturers are responding by deploying high-performance cable systems that blend mechanical reliability with cutting-edge electronics.

The increasing preference for connected, tech-savvy vehicles is shaping how automakers design access features like trunk openings. From gesture-based triggers to mobile app-based functionalities, today's consumers want more than manual levers-they want systems that work in harmony with their digital lifestyles. This demand is driving innovation in automotive boot release cable systems that offer enhanced security, comfort, and user experience. These developments are especially visible in electric and hybrid vehicles, where efficiency, lightweight design, and smart integration are at the forefront of innovation. Automakers are now leveraging technologies that can support high durability and performance even under frequent usage and challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $478.1 Million |

| Forecast Value | $707.2 Million |

| CAGR | 4.6% |

To meet the evolving standards, manufacturers are shifting toward the use of advanced materials and smarter engineering practices. Lightweight, corrosion-resistant, and high-tensile materials are becoming standard in boot release cable production. These materials not only improve product longevity but also enhance vehicle efficiency by reducing overall weight. Steel remains the top choice among materials, capturing nearly 61.7% share of the market in 2024 and projected to grow at a CAGR of 5% through 2034. Its strength, affordability, and resistance to fatigue make it ideal for parts subject to repetitive mechanical stress, especially in commercial and passenger electric vehicles that require frequent trunk access.

In terms of distribution, the OEM segment dominated the global landscape in 2024, accounting for an 82.9% market share, and is expected to maintain its lead through the forecast period. Vehicle manufacturers now treat advanced boot release systems as standard components, integrating them during production to enhance both security and convenience. OEMs are increasingly investing in hybrid mechanical-electronic solutions that align with the future of vehicle access-offering smarter, safer, and more intuitive features for the end user. This shift is particularly prominent among global automotive brands that aim to stay competitive by improving user experience from the first point of interaction.

China is emerging as the most influential regional market, representing 57.6% of global revenue in 2024, with projections hitting USD 136.1 million by 2034. The country's high volume of vehicle production, combined with its robust automotive components ecosystem, gives it a strategic edge in the global market. Leading suppliers in China are focusing on manufacturing high-precision, corrosion-resistant, and safety-enhanced cable systems to meet international standards and demand. Continuous investments in R&D and smart manufacturing practices further strengthen China's position as a global hub for advanced automotive cable technologies.

To stay ahead in this competitive space, major players like THB Group, Universal Cable, Leoni AG, Nexans Auto Electric, Birla Cable, Kei Industry, TE Connectivity, Polycab, Sumitomo Electric Industries, and Sterlite Technologies are focusing on designing lightweight, multi-functional boot release cable systems. These companies are expanding their global presence through strategic alliances and improving their manufacturing capabilities with automation and next-gen materials. Their collective focus on performance, durability, and compatibility with smart vehicle platforms ensures they remain aligned with the evolving needs of the automotive industry.