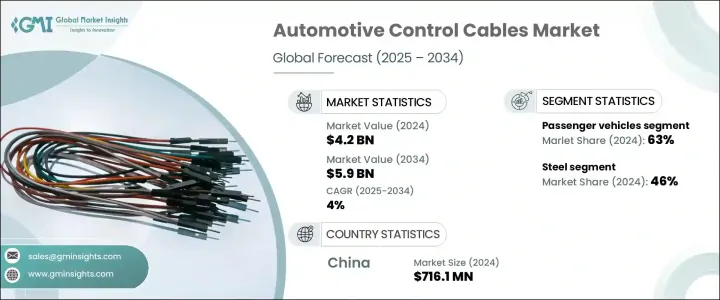

자동차용 컨트롤 케이블 세계 시장 규모는 2024년에는 42억 달러로 평가되었고, 특히 아시아태평양과 라틴아메리카의 신흥 경제권에서의 자동차 생산 증가에 견인되어 CAGR 4%로, 2034년에는 59억 달러에 달할 것으로 예측되고 있습니다.

자동차용 컨트롤 케이블은 클러치 맞물림, 브레이크, 기어 시프트, 스로틀 제어의 정밀도를 확보해, 자동차 성능의 중요한 부분을 형성하고 있습니다. 사용자 경험이 중시되어 케이블 기술의 혁신이 계속되고 있습니다. OEM은 선진적인 케이블 시스템을 통해 기계적 신뢰성과 응답성을 높이는 데 주력하고 있습니다.

전기자동차와 하이브리드 자동차에 대한 산업 축 다리는 제어 케이블의 용도를 재구성하고 있습니다. 시스템의 플랩 제어나 공기 분배, 배터리 컴파트먼트 액세스 기구, 좌석의 이동, 충전 인터페이스 제어 등, 다양한 기능을 서포트하기 위해서 적응하고 있습니다. 이와 같이 이용 사례가 진화하는 것으로, 제조업체가 혁신을 일으켜, 신세대의 자동차 수요에 응할 새로운 기회가 탄생하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 42억 달러 |

| 예측 금액 | 59억 달러 |

| CAGR | 4% |

소재의 유형에서는 스틸이 계속 자동차용 컨트롤 케이블 시장을 독점하고, 2024년에는 46%의 점유율을 차지했습니다. 수수료와 같은 경량 소재를 모색하고 있다고 해도, 스틸은 특히 고성능 모델이나 양판 모델에 있어서, 엄격한 조건하에서의 탄력성을 위해서 불가결한 존재가 계속되고 있습니다.

차종별로는 승용차가 시장을 리드하고, 2024년에는 63%의 점유율을 확보했고, 안정적인 성장 경향을 유지하고 있습니다. 급속한 도시화, 중산층 소득 확대, 인도 및 동남아시아 전역의 자동차 접근성 향상이 이러한 성장을 촉진하는 주요 요인입니다. 컨트롤 케이블은 수동 및 자동 기능을 모두 지원하며 전반적인 운전 경험과 안전성을 높이기 위해 이러한 자동차에 필수적입니다.

중국 자동차용 컨트롤 케이블 2024년 시장 규모는 7억1,610만 달러로 평가되었고, 2034년까지의 점유율은 39%를 차지할 것으로 예측되고 있습니다. 유리한 정부 정책과 확대하는 수출 네트워크는 자동차용 케이블 시스템의 기술 혁신을 한층 더 추진해, 자동차용 컨트롤 케이블 생산의 세계적 허브로서의 중국의 역할을 확고하게 하고 있습니다.

세계 자동차용 컨트롤 케이블 시장에서 사업을 전개하는 주요 기업 - Hi-Lex, Yazaki, Aptiv, Trelleborg, Cablecraft Motion Controls, Kongsberg Automotive, Lear, DURA Automotive Systems, TE Connectivity, Furukawa Electric은 세계 공급망의 확대, OEM과의 파트너십 강화, 경량 재료 기술 각 회사는 또한 EV 및 자율 주행 차량 시스템에 맞는 고급 케이블 솔루션을 개발하기 위한 R&D 노력도 강화하고 있습니다.

The Global Automotive Control Cables Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 5.9 billion by 2034, driven by rising vehicle production, particularly across emerging economies in Asia-Pacific and Latin America. Automotive control cables form a vital part of vehicular performance, ensuring precision in clutch engagement, braking, gear shifting, and throttle control. As the automotive sector evolves, a strong emphasis on vehicle efficiency, durability, and user experience continues to fuel innovation in cable technologies. Global automotive production is scaling up rapidly, especially in developing regions where improving economic conditions and urbanization drive automobile sales. Meanwhile, OEMs are focusing on enhancing mechanical reliability and responsiveness through advanced cable systems. Increasing consumer expectations around vehicle safety and performance further boosts demand for high-quality control cables. Additionally, stricter emissions regulations globally are pushing automakers to optimize vehicle systems, including mechanical components like control cables, to achieve better energy efficiency.

The industry's pivot to electric and hybrid vehicles is reshaping control cable applications. While electric vehicles (EVs) eliminate some traditional mechanical parts used in internal combustion engines, they introduce new and critical applications for control cables. As EV designs grow more complex, control cables are adapted to support various functions, such as flap control and air distribution in HVAC systems, battery compartment access mechanisms, seat movement, and charging interface controls. These evolving use cases are unlocking fresh opportunities for manufacturers to innovate and meet the demands of a new generation of vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 4% |

Among material types, steel continues to dominate the automotive control cables market, accounting for a 46% share in 2024. Its exceptional durability, tensile strength, cost-efficiency, and manufacturing ease make it the preferred choice for clutch, brake, and throttle applications. Even as industry players explore lighter materials like aluminum or composites to boost fuel economy, steel remains indispensable for its resilience under demanding conditions, especially in high-performance and mass-market models. OEMs and aftermarket suppliers favor steel for its affordability and widespread availability, ensuring a steady demand.

Passenger vehicles lead the market by vehicle type, securing a 63% share in 2024 and maintaining a steady growth trend. This leadership reflects high production volumes and a surging consumer appetite for compact, mid-size, and luxury vehicles worldwide. Rapid urbanization, expanding middle-class income, and better automotive access in countries like India and throughout Southeast Asia are major factors fueling this growth. Control cables are essential across these vehicles for supporting both manual and automated functions, enhancing the overall driving experience and safety.

China Automotive Control Cables Market generated USD 716.1 million in 2024 and captured a commanding 39% share through 2034. The country's strong manufacturing base, soaring domestic demand, and aggressive EV push are strengthening its leadership. Favorable government policies and an expanding export network are further propelling innovation in automotive cable systems, solidifying China's role as a global hub for automotive control cable production.

Key companies operating in the Global Automotive Control Cables Market-Hi-Lex, Yazaki, Aptiv, Trelleborg, Cablecraft Motion Controls, Kongsberg Automotive, Lear, DURA Automotive Systems, TE Connectivity, and Furukawa Electric-are sharpening their focus on expanding global supply chains, forging deeper partnerships with OEMs, investing in lightweight material technologies, and automating manufacturing processes. Companies are also ramping up R&D efforts to engineer advanced cable solutions tailored for EVs and autonomous vehicle systems.