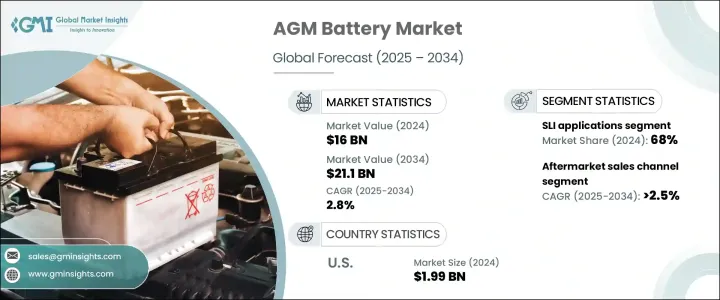

세계의 AGM 배터리 시장 규모는 2024년 160억 달러로 평가되었고, CAGR 2.8%를 나타내 2034년에는 211억 달러에 이를 것으로 추정됩니다. 드링스톱중에 엔진을 자동적으로 정지·재시동시키는 것으로 연료 소비를 삭감하는 스타트 스톱 시스템의 서포트에 불가결합니다.

애프터마켓 분야는 꾸준한 성장을 이루고 있으며, 2034년까지의 CAGR은 2.5%를 나타낼 것으로 전망됩니다. 한편, 상대방 상표 제품 제조업체는 AGM 배터리를 신형 자동차 모델의 표준 또는 옵션 부품으로 채택하여 가속적으로 통합하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 160억 달러 |

| 예측 금액 | 211억 달러 |

| CAGR | 2.8% |

2024년에는 SLI 용도 부문이 68%의 압도적 점유율을 차지했습니다. 분야도 에너지 저장 시스템에 대한 수요 증가로 안정적인 성장을 이루고 있습니다. 재생 가능 에너지가 보급됨에 따라 AGM 배터리는 백업 전원이나 오프 그리드 전원 시스템에 도입되어 안정성과 중단 없는 에너지 공급을 보장하고 있습니다.

미국의 AGM 배터리 시장은 2024년에 19억 9,000만 달러를 창출했습니다. 배출량 감소와 차량 성능 강화에 계속 초점을 맞추고 있는 가운데 AGM 배터리는 점점 더 많은 첨단 자동차 모델에서 표준이 되고 있습니다.

Exide Technologies, C& D Technologies, EnerSys, GS Yuasa International, Hoppecke Batterien, 후루카와 배터리, Mutlu Battery, Amara Raja Batteries, East Penn Manufacturing, Leoch International Technology, First National Battery, Crown Battery, Clarios, Shandong Sacre Sources등의 기업은 수직 통합, 연구개발 노력의 확대, 전략적 제휴에 주력하고 있습니다. 이러한 기업은 선진적인 배터리 화학에 투자해, 에너지 밀도를 높이고, 배터리의 라이프 사이클 성능을 향상시키고 있습니다.

The Global AGM Battery Market was valued at USD 16 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 21.1 billion by 2034. This market expansion is primarily driven by the increasing adoption of electric and hybrid vehicles, which demand advanced battery technologies to enhance performance. As automotive manufacturers focus on improving fuel efficiency and reducing emissions, AGM batteries have emerged as a key component in these efforts. They are especially crucial for supporting start-stop systems, which help vehicles cut down on fuel consumption by automatically shutting off and restarting engines during idle periods. This contribution to vehicle efficiency and sustainability is driving the popularity of AGM batteries across both automotive and industrial sectors. The growing investment in energy storage systems and environmentally friendly transportation solutions is further accelerating market growth.

The aftermarket segment is experiencing steady growth, projected to register a CAGR of 2.5% through 2034. The increasing need for dependable replacement batteries in older vehicles, particularly those equipped with start-stop systems, is fueling this demand. Meanwhile, original equipment manufacturers are incorporating AGM batteries at an accelerating pace, using them as standard or optional components in newer car models. As vehicle designs continue to prioritize energy efficiency, AGM batteries align with broader sustainability, performance, and regulatory goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 2.8% |

In 2024, the SLI applications segment accounted for a dominant 68% share. This segment benefits significantly from the widespread adoption of start-stop systems in modern vehicles, which require reliable, long-lasting power. AGM batteries are well-suited for this high-performance need, making them the preferred option in such applications. The stationary application segment is also experiencing consistent growth, driven by the increasing demand for energy storage systems. As renewable energy sources become more prevalent, AGM batteries are being deployed in backup and off-grid power systems, ensuring stability and an uninterrupted energy supply. Their low-maintenance and durable design further supports their growing use across commercial and residential energy infrastructures.

In the U.S., the AGM Battery Market generated USD 1.99 billion in 2024. This growth is bolstered by the rise in popularity of fuel-efficient and hybrid vehicles, as well as the ongoing need for reliable replacement batteries in older vehicles. With a continued focus on reducing carbon footprints and enhancing vehicle performance, AGM batteries are becoming standard in an increasing number of advanced vehicle models. The aftermarket segment remains robust, driven by consistent demand for battery replacements in high-usage regions.

Companies like Exide Technologies, C&D Technologies, EnerSys, GS Yuasa International, Hoppecke Batterien, The Furukawa Battery, Mutlu Battery, Amara Raja Batteries, East Penn Manufacturing, Leoch International Technology, First National Battery, Crown Battery, Clarios, and Shandong Sacred Sun Power Sources are focused on vertical integration, expanding their R&D efforts, and forming strategic alliances. These companies are investing in advanced battery chemistries, enhancing energy density, and improving battery lifecycle performance. Many are also forging OEM partnerships and expanding their global distribution networks while prioritizing sustainability through recycling programs and environmentally conscious manufacturing practices.