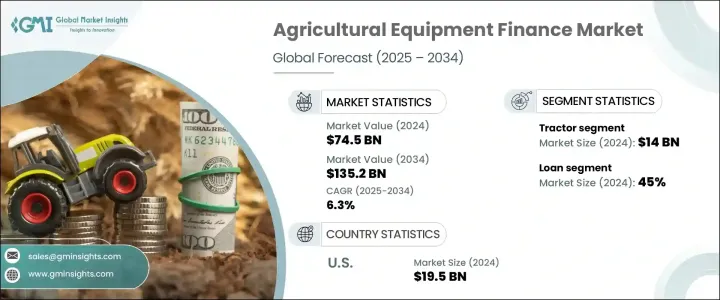

세계 농업기계 금융 시장은 2024년 745억 달러 규모로 평가되었고, 2025년부터 2034년까지 연평균 6.3%의 성장률을 보일 것으로 예측됩니다.

이러한 놀라운 성장은 주로 세계 인구의 지속적인 증가가 원동력이 되고 있으며, 이는 식량 생산에 대한 수요 증가와 직결됩니다. 식량 수요가 증가함에 따라 전 세계 농부들은 농업 생산량을 늘리기 위해 트랙터, 수확기, 관개 시스템, 정밀 농업 기술 등 첨단 기계에 크게 의존하고 있습니다. 그러나 최신 농기계 관련 기술의 발전과 비용 상승으로 인해 많은 농부들이 이러한 기계를 구입할 수 없는 실정입니다. 따라서 농부들이 초기 비용 부담 없이 첨단 기계를 이용할 수 있도록 하는 융자 솔루션이 중요해졌습니다.

농업기계 금융 시장은 농법의 현대화를 촉진하는 데 있어 매우 중요한 역할을 하고 있으며, 특히 신흥국 정부는 식량 안보를 보장하기 위해 기계화를 장려하고 있습니다. 또한, 수확량을 늘리고 자원 낭비를 최소화하기 위한 정밀 농업으로의 전환이 진행됨에 따라 첨단 농기구와 이를 조달하는 데 필요한 금융 지원에 대한 수요가 더욱 증가하고 있습니다. 기계화 농업의 이점에 대한 농부들의 인식이 높아지면서 농기계에 대한 보조금 및 세제 혜택과 같은 정부 지원책과 함께 이 시장의 성장에 큰 힘을 실어주고 있습니다. 기후 변화와 노동력 부족이 전 세계적으로 농업 부문에 계속 영향을 미치고 있는 가운데, 유연한 자금 조달 옵션으로 뒷받침되는 효율적인 고성능 기계의 필요성이 그 어느 때보다 중요해지고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 745억 달러 |

| 예상 금액 | 1,352억 달러 |

| CAGR | 6.3% |

농업 장비 시장은 트랙터, 수확기, 관개 시스템, 정밀 농업 기술 등 다양한 카테고리로 구분됩니다. 그 중에서도 트랙터는 2024년 140억 달러 규모 시장을 창출한 주요 부문입니다. 트랙터는 경작, 심기, 수확 등 다양한 농작업에 필수적이며 가장 인기 있는 기계 중 하나이며, GPS 지원 시스템, 자율 주행 기능, 연비 향상 등 트랙터 기술의 지속적인 발전으로 트랙터 가격은 지속적으로 상승하고 있습니다. 그 결과, 농부들은 이러한 필수적인 도구를 구입하기 위해 자금 조달 옵션에 점점 더 의존하고 있으며, 이는 농업기계 금융 솔루션에 대한 안정적인 수요를 주도하고 있습니다.

금융 옵션과 관련하여 농업 장비 금융 시장은 크게 대출, 리스, 임대 구매, 임대 구매 및 기타 옵션으로 나뉩니다. 이 중 대출 분야는 2024년 시장 점유율의 45%를 차지했습니다. 일반적으로 상업은행과 농업 전문 금융기관이 제공하는 농기계 대출은 개발도상국의 농부들에게 특히 인기가 있습니다. 이러한 대출은 유연한 상환 기간과 장기 소유의 이점을 제공하며, 지속 가능하고 효율적인 경영을 추구하는 농부들에게 이상적인 선택이 될 수 있습니다. 이러한 맞춤형 대출 상품을 통해 농부들은 생산성과 수익성을 높이기 위해 최첨단 기계에 투자할 수 있습니다.

지역별로는 북미 농업기계 금융 시장이 2024년 세계 시장 점유율의 35%를 차지했습니다. 탄탄한 농업 부문을 보유한 미국은 세계 최대의 농산물 생산 및 수출국 중 하나로 자리 잡고 있습니다. 국내 및 국제 식량 수요를 충족시키기 위해 미국 농부들은 현대적이고 대용량의 장비에 크게 의존하고 있으며, 이는 자금 조달 솔루션의 필요성을 크게 증가시키고 있습니다. 미국 농업은 세계 시장에서 경쟁력을 유지하기 위해 기술 업그레이드와 생산 효율성 향상을 우선시하고 있으며, 이러한 수요는 더욱 확대될 것으로 예측됩니다.

The Global Agricultural Equipment Finance Market generated USD 74.5 billion in 2024 and is projected to expand at a CAGR of 6.3% between 2025 and 2034. This remarkable growth is primarily driven by the continuously rising global population, which directly fuels an ever-growing demand for food production. As food demand escalates, farmers worldwide are compelled to boost their agricultural output, relying heavily on advanced machinery such as tractors, harvesters, irrigation systems, and precision farming technologies. However, with evolving technologies and higher costs associated with modern agricultural equipment, many farmers are unable to afford these machines outright. This is where financing solutions become critical, enabling farmers to access high-tech machinery without bearing the burden of full upfront costs.

The agricultural equipment finance market plays a crucial role in facilitating the modernization of farming practices, particularly as governments in emerging economies encourage mechanization to ensure food security. In addition, the ongoing shift toward precision agriculture, aimed at improving yields and minimizing resource wastage, further heightens the demand for sophisticated farming tools and the financial support necessary to procure them. Rising awareness among farmers regarding the benefits of mechanized farming, coupled with supportive government initiatives such as subsidies and tax benefits for agricultural equipment, adds significant momentum to the growth of this market. As climate change and labor shortages continue to impact the agriculture sector globally, the need for efficient, high-capacity machinery backed by flexible financing options becomes more critical than ever.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $74.5 Billion |

| Forecast Value | $135.2 Billion |

| CAGR | 6.3% |

The market for agricultural equipment is segmented into various categories, including tractors, harvesters, irrigation systems, and precision agriculture technologies. Among these, tractors remain a dominant segment, generating USD 14 billion in 2024. Tractors are indispensable for diverse farm operations like plowing, planting, and harvesting, making them one of the most sought-after machines. With constant advancements in tractor technology-such as GPS-enabled systems, autonomous functionality, and enhanced fuel efficiency-the price of tractors continues to rise. As a result, farmers increasingly depend on financing options to afford these essential tools, driving steady demand for agricultural equipment finance solutions.

When it comes to financing options, the agricultural equipment finance market is largely divided into loans, leasing, hire purchase, and other alternatives. Among these, the loan segment accounted for 45% of the market share in 2024. Loans for agricultural equipment, usually offered by commercial banks and specialized farm lenders, are especially popular among farmers in developing regions. These loans provide flexible repayment terms and the advantage of long-term ownership, making them an ideal choice for farmers aiming to build sustainable and efficient operations. The availability of such tailored loan products ensures that farmers can invest in cutting-edge machinery to boost productivity and profitability.

Regionally, North America Agricultural Equipment Finance Market held 35% of the global share in 2024. The United States, with its robust agricultural sector, stands out as one of the largest producers and exporters of agricultural goods worldwide. To keep pace with both domestic and international food demands, American farmers rely heavily on modern, high-capacity equipment, significantly driving the need for financing solutions. This demand is expected to grow further as U.S. agriculture continues to prioritize technological upgrades and enhanced production efficiency to remain competitive in the global market.