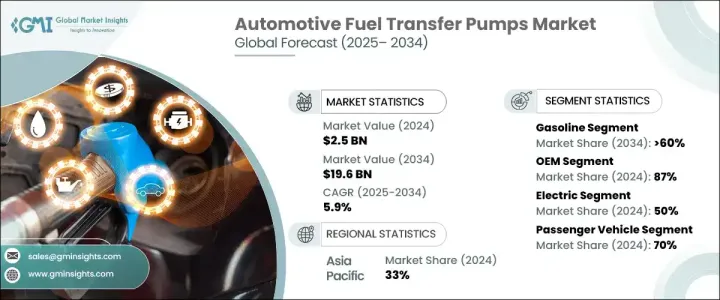

자동차 연료 이송 펌프 세계 시장은 2024년에는 25억 달러에 달했고, 2025-2034년 연평균 5.9% 성장할 것으로 예측됩니다.

자동차 생산량 증가와 연비 효율이 높은 솔루션에 대한 수요 증가로 인해 세계 자동차 산업이 확대되면서 시장을 주도하고 있습니다. 고성능 차량에 대한 선호도가 높아짐에 따라 제조업체들은 엔진 효율과 내구성을 향상시키는 첨단 연료 전달 펌프 기술에 집중하고 있습니다. 신흥 경제권, 특히 아시아와 라틴아메리카에서는 급속한 도시화, 가처분 소득 증가, 현지 자동차 제조를 장려하는 정부 정책으로 인해 자동차 판매가 급증하고 있습니다. 이는 자동차 제조업체들이 차량 효율성과 규제 준수를 중시하기 때문에 연료 이송 펌프의 채택 증가에 직접적으로 기여하고 있습니다. 또한, 전 세계적으로 엄격한 연비 규제가 강화되면서 연료 사용을 최적화하고 배기가스를 줄이는 혁신적인 연료 이송 솔루션에 대한 수요가 증가하고 있습니다.

자동차 연료 이송 펌프 시장은 가솔린과 디젤 연료로 구분되며, 2024년 시장 점유율은 가솔린 부문이 60%를 차지했으며, 이는 승용차 분야에서 가솔린의 존재감을 반영합니다. 가솔린 차량의 보급과 연비 향상 기술의 발전이 이 부문의 우위를 강화하고 있습니다. 소비자들은 많은 지역에서 특히 환경 규제가 자동차 선호도에 영향을 미치는 시장에서 저배출과 저렴한 연료 가격으로 인해 가솔린 엔진을 계속 선호하고 있습니다. 연비를 개선하고 탄소 배출량을 줄이기 위해 설계된 차세대 가솔린 엔진의 채택은 효율적인 연료 이송 펌프에 대한 수요를 더욱 증가시키고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 25억 달러 |

| 예상 금액 | 196억 달러 |

| CAGR | 5.9% |

자동차 연료 이송 펌프 시장에서는 OEM이 주도적인 위치를 차지하고 있습니다. 자동차 제조업체는 호환성, 신뢰성 및 우수한 성능으로 인해 OEM 부품에 의존하고 있으며, OEM과 주요 자동차 브랜드 간의 관계는 일관된 공급망을 보장하고 장기적인 계약을 촉진하며 OEM 공급업체의 우위를 강화합니다. 이송 펌프에 대한 신뢰는 엄격한 업계 표준을 충족하고 최신 자동차에 최적의 성능을 보장할 수 있는 능력에서 비롯됩니다.

아시아태평양의 자동차 연료 이송 펌프 시장은 2024년 33%의 점유율을 차지했으며, 자동차 생산량이 많은 국가에서 수요가 급증할 것으로 예측됩니다. 자동차 산업이 발달한 국가들은 생산량 증가로 인해 시장 확대를 주도하고 있으며, 연료 이송 펌프의 주요 소비 국가로 남아 있습니다. 국내 자동차 제조를 촉진하기 위한 정부의 인센티브는 이 지역의 성장을 더욱 가속화시키고 있습니다. 아시아태평양 전역의 인프라 개선은 자동차 공급망의 효율성을 높이고 다양한 자동차 부문에서 고급 연료 이송 펌프에 대한 수요를 뒷받침하고 있습니다.

The Global Automotive Fuel Transfer Pumps Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 5.9% between 2025 and 2034. The expanding global automotive industry, driven by rising vehicle production and increasing demand for fuel-efficient solutions, is propelling the market forward. With the growing preference for high-performance vehicles, manufacturers are focusing on advanced fuel transfer pump technologies that enhance engine efficiency and durability. Emerging economies, particularly in Asia and Latin America, are witnessing a surge in automobile sales due to rapid urbanization, rising disposable incomes, and government policies favoring local vehicle manufacturing. This has directly contributed to the increasing adoption of fuel transfer pumps as automakers emphasize vehicle efficiency and regulatory compliance. Additionally, the shift toward stringent fuel efficiency standards worldwide has created a demand for innovative fuel transfer solutions that optimize fuel usage and reduce emissions.

The automotive fuel transfer pumps market is segmented into gasoline and diesel fuel categories. The gasoline segment accounted for a 60% market share in 2024, reflecting its strong presence in the passenger vehicle sector. The widespread use of gasoline-powered cars, coupled with advancements in fuel efficiency technology, has strengthened the segment's dominance. Consumers continue to favor gasoline engines due to their lower emissions and affordable fuel prices in many regions, particularly in markets where environmental regulations influence vehicle preferences. The adoption of next-generation gasoline engines, designed for improved mileage and reduced carbon footprints, is further driving demand for efficient fuel transfer pumps.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 billion |

| Forecast Value | $19.6 billion |

| CAGR | 5.9% |

Original Equipment Manufacturers (OEMs) hold a leading position in the automotive fuel transfer pumps market. Automakers rely on OEM components due to their compatibility, reliability, and superior performance. Established relationships between OEMs and major automotive brands ensure a consistent supply chain, fostering long-term contracts and reinforcing the dominance of OEM suppliers. The trust in OEM-manufactured fuel transfer pumps stems from their ability to meet stringent industry standards, guaranteeing optimal performance in modern vehicles.

The Asia Pacific automotive fuel transfer pumps market commanded a 33% share in 2024, with demand surging in top vehicle manufacturing nations. Countries with robust automotive industries continue to be major consumers of fuel transfer pumps as increased production volumes drive market expansion. Government-backed incentives to promote domestic vehicle manufacturing further accelerate regional growth. Infrastructure developments across the Asia Pacific are enhancing automotive supply chain efficiency, supporting the demand for advanced fuel transfer pumps across various vehicle segments.