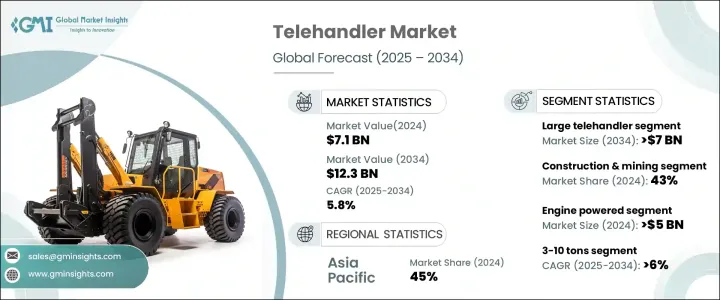

세계의 텔레핸들러 시장은 2024년에 71억 달러에 이르렀으며, 2025년부터 2034년에 걸쳐 CAGR 5.8%를 나타낼 것으로 예측됩니다.

고속도로, 대중교통시스템, 공항, 스마트시티 이니셔티브를 포함한 인프라 프로젝트에 대한 정부투자 증가가 수요를 견인하고 있습니다. 농업 기계화의 고조도 시장 성장을 뒷받침하는 중요한 요인이며, 텔레핸들러는 농업 자재의 들어 올리고, 적재, 적층에 널리 사용되고 있습니다. 이러한 기계는 무거운 짐을 다루면서 거친 지형도 이동할 수 있기 때문에 농업 작업에 빠뜨릴 수 없습니다.

텔레핸들러 시장은 제품별로 대형 모델과 콤팩트 모델로 구분됩니다. 컴팩트한 텔레핸들러는 특히 스페이스의 제약으로부터 기동성을 높인 기기가 필요한 도시 환경에서 지지를 모으고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 71억 달러 |

| 예측 금액 | 123억 달러 |

| CAGR | 5.8% |

용도별로는 렌탈, 건설 및 광업, 농업, 산업 등으로 분류됩니다. - 무거운 자재를 들어 올리고 기복이 많은 지형에서 작업하고 높은 곳의 작업 영역에 액세스할 수 있기 때문에 이러한 산업에서 널리 사용됩니다.

유형별로, 시장은 엔진식과 전동식으로 나뉘어져 있습니다. 디젤 엔진은 충전의 필요성을 없애고 오프로드와 원격지에서의 사용에 이상적입니다.

리프팅 용량에 따라 시장은 3톤 미만, 3-10톤, 10톤 이상으로 구분됩니다. 이 모델은 견고함과 민첩성 사이의 균형을 유지하여 물류 센터, 제조 공장 및 도시 프로젝트에 필수적인 모델입니다. 또, 농업에서는 사료의 운반, 건초의 쌓아 올리고, 곡물의 이동에 널리 사용되어, 창고에서는 재고 관리나 중량물의 들어올리기에 이용되고 있습니다.

2024년 세계 시장 점유율은 아시아태평양이 45%를 차지했고 중국이 이 지역을 리드했습니다. 정부 주도의 인프라 개발, 산업 확대, 자동화 동향이 수요의 주된 원동력이 되고 있습니다.

The Global Telehandler Market reached USD 7.1 billion in 2024 and is projected to grow at a CAGR of 5.8% between 2025 and 2034. Increased government investments in infrastructure projects, including highways, public transit systems, airports, and smart city initiatives, are driving demand. Large-scale developments often require state funding, leading to the adoption of advanced construction equipment. Telehandlers are benefiting from these trends, as they are crucial for material handling in infrastructure projects. The rise in agricultural mechanization is another key factor boosting market growth, with telehandlers being widely used for lifting, loading, and stacking farming materials. Unlike conventional tractors, these machines can navigate rough terrains while handling heavier loads, making them essential for farming operations. Their ability to function in tight spaces and under all weather conditions enhances their appeal across industries.

The telehandler market is segmented by product into large and compact models. Large telehandlers accounted for over 60% of the market share in 2024 and are expected to surpass USD 7 billion by 2034. These machines are in high demand for major construction, industrial, and mining operations due to their extended reach and lifting capacity. Compact telehandlers are gaining traction, particularly in urban settings where space constraints require equipment with enhanced maneuverability. Contractors favor these models for residential projects, indoor applications, and construction sites in densely populated areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.8% |

By application, the market is categorized into rental, construction & mining, agriculture, industrial, and others. The construction & mining segment held a significant 43% market share in 2024. Growing infrastructure projects, including bridges, commercial buildings, and residential complexes, are fueling demand. Telehandlers are widely used in these industries due to their ability to lift heavy materials, operate on uneven terrains, and access elevated work areas. In the mining sector, these machines are essential for transporting heavy loads, performing maintenance, and navigating challenging landscapes.

In terms of type, the market is divided into engine-powered and electric telehandlers. The engine-powered segment was valued at over USD 5 billion in 2024, with widespread usage in construction, mining, and large-scale agricultural operations. These machines are favored for their strong torque, long operational hours, and ability to perform in demanding environments. Their diesel engines eliminate the need for recharging, making them ideal for off-road and remote applications. Electric telehandlers are expected to witness rapid growth due to lower operational costs, minimal maintenance requirements, and advancements in battery technology that improve charging speeds and battery longevity.

By lifting capacity, the market is segmented into below 3 tons, 3-10 tons, and above 10 tons. The 3-10 tons category is set to grow at a CAGR of over 6% through 2034, driven by demand in construction, warehousing, and material handling. These models strike a balance between strength and agility, making them indispensable for logistics centers, manufacturing plants, and urban projects. They are also widely used in agriculture for transporting feed, stacking hay, and moving grain, while warehouses rely on them for inventory management and lifting heavy goods.

Asia Pacific dominated the global market with a 45% share in 2024, with China leading the region. Government-driven infrastructure developments, industrial expansion, and automation trends are key drivers of demand. Policies promoting large-scale construction projects and industrial automation are accelerating the adoption of high-performance material handling equipment across various sectors.