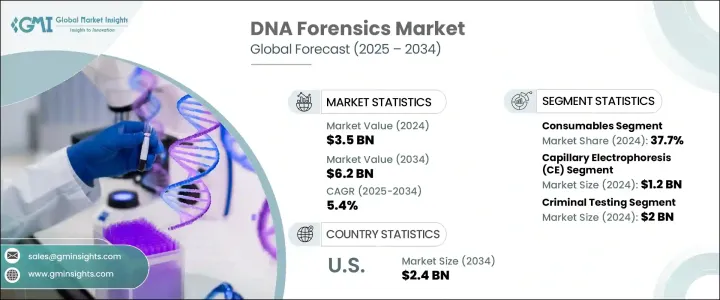

세계의 DNA 포렌식 시장 규모는 2024년 35억 달러로 평가되었고, 2034년에는 62억 달러에 이를 것으로 예측되며, CAGR 5.4%로 성장할 전망입니다. 이러한 꾸준한 성장은 법률 및 범죄 수사에서 정확한 식별 방법과 고급 분석 도구에 대한 필요성이 증가함에 따라 촉진되고 있습니다. 전 세계적으로 범죄율이 계속 증가함에 따라, 현대 사법 제도에서 정확한 DNA 프로파일링에 대한 수요가 점점 더 중요해지고 있습니다. 포렌식 DNA 검사가 널리 채택된 이유는 증거를 용의자와 연결하는 신뢰성과 높은 신뢰도로 법적 절차를 뒷받침하는 능력 때문이라고 할 수 있습니다.

또한 포렌식 연구소에 첨단 기술이 통합되면서 분석 프로세스가 간소화되고 당국이 복잡한 형사 사건을 보다 효율적으로 처리할 수 있게 되었습니다. 여러 지역의 정부 기관은 자금 지원과 인프라 개선을 통해 포렌식 연구소를 적극적으로 지원하고 있으며, 이로 인해 형사 사법 시스템에서 DNA 포렌식의 사용이 더욱 가속화되고 있습니다. 한편, 민간 부문 기업들은 전략적 제휴, 파트너십, 연구 개발(R&D)을 통해 혁신에 집중하고 미개척 시장에 진출하기 위해 노력하고 있습니다. 이러한 공동 노력은 향후 10년간 일관된 시장 성장을 위한 탄탄한 기반을 마련하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 35억 달러 |

| 예측 금액 | 62억 달러 |

| CAGR | 5.4% |

DNA 포렌식 분야의 선도 기업들은 기술 발전과 진화하는 포렌식 표준에 발맞추기 위해 신제품 개발에 막대한 투자를 하고 있습니다. 주요 동향은 정확성을 저해하지 않으면서 효율성을 높이는 휴대성이 뛰어난 고속 DNA 분석 기기로의 전환입니다. 신제품 출시 외에도, 업체들은 새로운 고객 기반을 확보하고 포렌식 도구에 대한 접근성을 개선하기 위해 신흥 경제국에서 사업 영역을 확대하고 있습니다. 생명공학 기업과 공공 기관 간의 협력도 기술 지식의 교환을 촉진하고 새로운 기술을 일상적인 포렌식 워크플로우에 효율적으로 통합함으로써 시장 확대에 기여하고 있습니다. 이러한 전략은 향후 몇 년 동안 업계의 지속적인 발전과 경쟁적 차별화를 위한 기반을 마련하고 있습니다.

솔루션에 따라 소프트웨어 부문에는 LIMS 및 기타 포렌식 소프트웨어 도구가 포함됩니다. 이 중 소모품 부문이 2024년에 37.7%의 가장 큰 매출 점유율을 차지하며 주요 부문으로 부상했습니다. 소모품에 대한 수요 증가는 시료 준비 및 검사에 고품질 재료를 지속적으로 사용해야 하는 DNA 분석 기술의 발전과 직접적인 관련이 있습니다. DNA 프로파일링에 대한 의존도가 모든 부문에서 증가함에 따라 시약, 추출 도구 및 분석 액세서리의 소비가 계속 증가하여 부문의 성장을 촉진하고 있습니다.

시장은 또한 모세관 전기 영동(CE), PCR 증폭, 차세대 염기서열 분석(NGS) 및 기타 기술을 포함한 방법별로도 분류됩니다. 모세관 전기 영동은 2024년에 12억 달러의 매출을 올리며 선두 위치를 차지했습니다. 고해상도 기능으로 잘 알려진 CE는 분해된 샘플에서도 DNA 단편을 정밀하게 분리 및 분석할 수 있어 포렌식 연구소에서 널리 사용되고 있습니다. 신뢰성과 속도가 뛰어나 시간 민감한 사건을 해결하기 위해 빠른 처리가 필수적인 경우, 특히 대량 처리 포렌식 워크플로우에 이상적인 선택입니다.

용도별로는 시장은 범죄 검사 및 친자 확인 및 가족 검사로 나뉩니다. 범죄 검사는 2024년에 20억 달러의 매출을 기록하며 가장 큰 부문을 차지했습니다. 범죄 수사의 고도화와 신뢰할 수 있는 DNA 증거에 대한 강조가 증가하면서 이 부문이 성장하고 있습니다. 유전자 검사가 법 집행에 더욱 필수적인 요소가 되면서, 효율적인 신원 확인 및 용의자 확인을 가능하게 하는 기술에 대한 수요가 계속 증가하고 있습니다. DNA 데이터베이스 및 수사 도구의 사용이 확대됨에 따라 관할권 전반에 걸쳐 DNA 포렌식 기술에 대한 필요성도 커지고 있습니다.

지역별로는 북미가 전 세계 시장을 지배하며 2024년에 전체 매출의 42.1% 이상을 차지했습니다. 이 지역의 선두 위치는 DNA 검사 기술의 급속한 발전, 포렌식 인프라에 대한 강력한 공공 및 민간 투자, 법적 결과의 정확성 개선에 대한 강조가 강화되고 있기 때문에 가능했습니다. 북미 지역에서는 미국이 주요 기여국으로 남아 있으며, 2034년에는 시장 가치가 24억 달러에 달할 것으로 예상됩니다. 미국은 포렌식 시스템의 현대화를 목표로 한 유리한 정책 프레임워크와 이니셔티브에 힘입어 주 및 연방 범죄 연구소에서 포렌식 기술의 도입이 증가하고 있습니다.

경쟁 환경은 Illumina, QIAGEN, Thermo Fisher Scientific, Promega, Danaher 등 주요 글로벌 기업들이 전체 시장 점유율의 50% 이상을 차지하고 있는 것이 특징입니다. 이 기업들은 신속한 DNA 기술, 계보 추적 데이터베이스, 소형 테스트 시스템 등 차세대 포렌식 도구의 개발에 적극적으로 참여하고 있습니다. R&D에 대한 전략적 투자, 연구 기관과의 파트너십, 새로운 시장으로의 진출은 이들 기업의 성장 전략의 핵심입니다. 규제 간소화 및 승인 기간 단축도 시장 진출을 가속화하여, 기업들이 전 세계적으로 증가하는 신뢰할 수 있는 포렌식 솔루션에 대한 수요를 충족할 수 있게 하고 있습니다.

The Global DNA Forensics Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.2 billion by 2034. This steady expansion is driven by a growing need for precise identification methods and advanced analytical tools in legal and criminal investigations. As crime rates continue to rise globally, the demand for accurate DNA profiling is becoming increasingly vital in modern judicial systems. The widespread adoption of forensic DNA testing is largely attributed to its reliability in linking evidence to suspects, as well as its ability to support legal proceedings with high credibility.

Furthermore, the integration of advanced technologies in forensic labs is streamlining the analysis process and helping authorities address complex criminal cases more efficiently. Governments across multiple regions are actively supporting forensic labs with funding and infrastructure upgrades, which is further accelerating the use of DNA forensics in criminal justice systems. Meanwhile, private sector players are focusing on innovation and expanding their reach across untapped markets through strategic alliances, partnerships, and research and development initiatives. These collective efforts are creating a robust foundation for consistent market growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.4% |

Leading companies in the DNA forensics space are investing heavily in new product development to keep pace with technological advancements and evolving forensic standards. A key trend is the shift toward more portable, high-speed DNA analysis devices that enhance efficiency without compromising accuracy. In addition to new product launches, players are expanding their operational footprints in emerging economies, aiming to capture new customer bases and improve accessibility to forensic tools. Collaborations between biotech firms and public institutions are also contributing to market expansion by fostering the exchange of technical knowledge and streamlining the integration of newer technologies into routine forensic workflows. These strategies are positioning the industry for continued advancement and competitive differentiation in the years ahead.

Based on solution, the software segment includes LIMS and other forensic software tools. Among these, the consumables segment emerged as the dominant category, accounting for the largest revenue share of 37.7% in 2024. The rising demand for consumables is directly linked to advancements in DNA analysis techniques that require consistent use of high-quality materials for sample preparation and examination. As the reliance on DNA profiling increases across sectors, the consumption of reagents, extraction tools, and analysis accessories continues to surge, driving segment growth.

The market is also segmented by method, including capillary electrophoresis (CE), PCR amplification, next-generation sequencing (NGS), and other techniques. Capillary electrophoresis held the leading position, generating a revenue of USD 1.2 billion in 2024. Known for its high-resolution capabilities, CE is widely adopted in forensic labs due to its precision in separating and analyzing DNA fragments, even in degraded samples. Its reliability and speed make it an ideal choice for high-throughput forensic workflows, especially when quick turnarounds are essential for solving time-sensitive cases.

By application, the market is divided into criminal testing and paternity and familial testing. Criminal testing represented the largest segment, with a revenue of USD 2 billion in 2024. The increasing sophistication of criminal investigations and the growing emphasis on reliable DNA evidence are pushing this segment forward. With genetic testing becoming more integral to law enforcement, demand continues to grow for technologies that enable efficient identification and suspect verification. The expanding use of DNA databases and investigative tools is also amplifying the need for DNA forensics across jurisdictions.

Regionally, North America dominated the global market, accounting for more than 42.1% of total revenue in 2024. The region's leadership is fueled by rapid advancements in DNA testing technologies, strong public and private investments in forensic infrastructure, and a growing emphasis on improving the accuracy of legal outcomes. Within North America, the United States remains the key contributor and is forecast to reach a market value of USD 2.4 billion by 2034. The U.S. is witnessing increased deployment of forensic technologies across both state and federal crime labs, supported by favorable policy frameworks and initiatives aimed at modernizing forensic systems.

The competitive landscape is marked by the presence of major global players, including Illumina, QIAGEN, Thermo Fisher Scientific, Promega, and Danaher, which collectively contribute to more than 50% of the total market share. These companies are actively engaged in the development of next-generation forensic tools, including rapid DNA technologies, genealogical tracing databases, and compact testing systems. Strategic investments in R&D, partnerships with research institutes, and expansion into new markets are central to their growth strategies. Regulatory streamlining and quicker approval timelines are also enabling faster market entry, allowing companies to meet the growing demand for reliable forensic solutions globally.