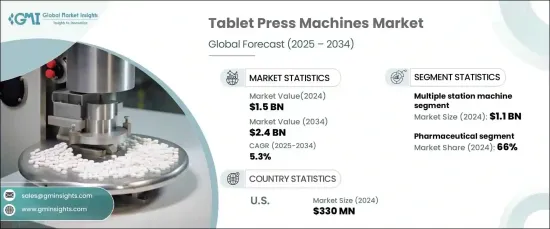

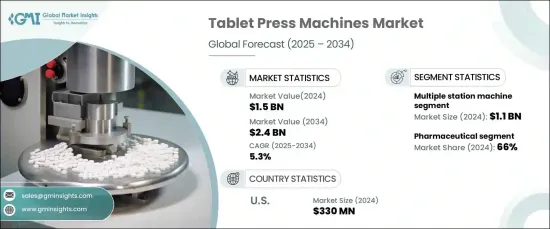

세계 타정기 시장은 2024년 15억 달러에 이르렀으며 2025-2034년까지 5.3%의 연평균 복합 성장률(CAGR)로 견조하게 성장할 것으로 예측되고 있습니다.

이러한 흥미로운 성장은 의약품 생산 증가, 의료 지출 증가, 기술 혁신, 제네릭 의약품 수요 증가 등과 같은 몇 가지 주요 요인으로 인해 발생합니다. 영양보조식품 부문 확대, 수탁제조 증가, 비용 효율성 및 생산성 향상에 대한 강한 관심도 시장 진출에 중요한 역할을 하고 있습니다.

기술의 발전은 특히 생산 효율과 제품 품질을 모두 향상시키는 자동화 시스템의 통합을 통해 타정기의 성능을 크게 향상시키고 있습니다. 최신 타정기는 최첨단 모니터링 시스템, 처리 속도 향상 및 다른 제조 공정과의 원활한 통합을 갖추고 있으며, 제약 제조업체에게 매우 매력적입니다. 게다가 선발 의약품의 특허 부족으로 제네릭 의약품의 생산이 급증하고 보다 대량의 제조가 필요하기 때문에 타정기 수요가 더욱 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 15억 달러 |

| 예측 금액 | 24억 달러 |

| CAGR | 5.3% |

시장은 기계 유형별로 구분되며, 멀티스테이션 기계 부문은 2024년에 11억 달러를 차지했으며 수익으로 선도하고 있습니다. 이 부문은 2034년까지 연평균 복합 성장률(CAGR) 5.4%라는 경이적인 성장이 예상되고 있습니다. 멀티 스테이션 정제 기계 또는 로터리 정제 기계는 일반적으로 10-30 스테이션을 갖추고 있으며 정제의 대량 생산을 위해 설계되었습니다. 이 기계는 여러 정제를 동시에 프레스하여 탁월한 효율성을 제공하며 대규모 제조에 이상적입니다. 정제의 대량 생산에 대한 수요 증가와 스마트 센서, 실시간 모니터링, 예지 보전 등 자동화 기술의 지속적인 발전으로 이러한 기계는 안정적인 정제 품질을 보장하면서 더 높은 생산 속도를 달성할 수 있게 되었습니다.

제약 산업은 정제 기계 프레스 기계의 주요 최종 용도 부문이며 2024년에는 66%의 점유율을 차지했습니다. 이 부문은 복용 형태로 정제에 대한 선호도가 높아짐에 따라 2025-2034년까지 CAGR 5.6%의 안정적인 성장이 예상됩니다. 제약회사는 실시간 모니터링, 자동 데이터 수집, 예측 유지보수를 가능하게 하는 Industry 4.0 기술을 통합한 스마트 타정기의 채용을 늘리고 있습니다. 이러한 발전은 생산 효율성을 높이고 가동 중지 시간을 최소화하는 데 도움이 됩니다. 또한 식품 및 식품 산업에서는 특히 영양 보충제, 비타민 및 기능성 식품의 대량 생산을 위해 타정기에 대한 관심이 높아지고 있습니다.

미국 타정기 시장은 2024년에 3억 3,000만 달러로 평가되었으며 2025-2034년까지 CAGR 5.3%로 성장할 것으로 예상되고 있습니다. 이 성장은 제약 부문의 확대, 지속적인 기술 진보 및 시판 약의 생산량 증가로 인한 것입니다. 게다가 제네릭 의약품의 생산과 소비 증가는 경제적인 의약품을 생산하기 위한 비용 효율적인 솔루션의 필요성을 강화하고 있으며, 정제 기계 시장을 더욱 밀어 올리고 있습니다.

The Global Tablet Press Machines Market reached USD 1.5 billion in 2024 and is projected to grow at a robust CAGR of 5.3% from 2025 to 2034. This impressive growth is driven by several key factors, including the increasing pharmaceutical production, rising healthcare expenditures, technological innovations, and the growing demand for generic drugs. The expanding dietary supplement sector, the rise in contract manufacturing, and a strong focus on enhancing cost-efficiency and productivity also play crucial roles in driving the market forward.

Advancements in technology have significantly enhanced the performance of tablet press machines, particularly with the integration of automated systems that improve both production efficiency and product quality. Modern tablet press machines are equipped with state-of-the-art monitoring systems, higher processing speeds, and seamless integration with other production processes, making them highly attractive to pharmaceutical manufacturers. Additionally, the expiration of patents for branded drugs has fueled a surge in the production of generic drugs, which requires larger manufacturing volumes, further driving the demand for tablet press machines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 5.3% |

The market is segmented by machine type, with the multiple station machine segment leading in revenue, accounting for USD 1.1 billion in 2024. This segment is expected to grow at an impressive CAGR of 5.4% through 2034. Multi-station or rotary tablet presses, which typically feature 10-30 stations, are designed for high-volume tablet production. These machines offer exceptional efficiency by pressing multiple tablets simultaneously, making them ideal for large-scale manufacturing. The growing demand for mass tablet production and continuous advancements in automation technologies, such as smart sensors, real-time monitoring, and predictive maintenance, are enabling these machines to achieve higher production speeds while ensuring consistent tablet quality.

The pharmaceutical industry remains the dominant end-use sector for tablet press machines, holding a 66% share in 2024. This segment is expected to grow at a steady CAGR of 5.6% between 2025 and 2034, driven by the increasing preference for tablets as a dosage form. Pharmaceutical companies are increasingly adopting smart tablet press machines that incorporate Industry 4.0 technologies, which allow for real-time monitoring, automated data collection, and predictive maintenance. These advancements help improve production efficiency and minimize downtime. Additionally, the food and beverage industry is increasingly turning to tablet press machines, particularly for the mass production of dietary supplements, vitamins, and functional foods.

In the U.S., the tablet press machines market was valued at USD 330 million in 2024 and is expected to grow at a CAGR of 5.3% from 2025 to 2034. This growth can be attributed to the expanding pharmaceutical sector, ongoing technological advancements, and the rising production of over-the-counter medications. The surge in the production of nutraceuticals and functional foods, along with increased investment in biopharmaceuticals, is also driving the demand for tablet press machines in the U.S. Furthermore, the rise in generic drug production and consumption has intensified the need for cost-effective solutions to produce affordable medications, further boosting the market for tablet press machines.