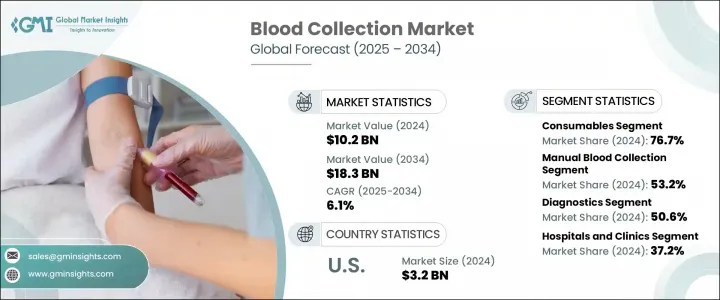

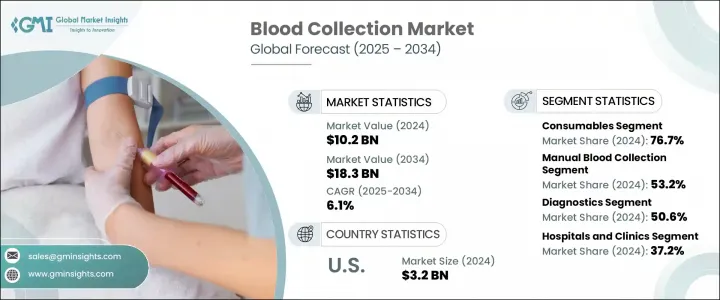

세계의 채혈 시장 규모는 2024년에 102억 달러로 평가되었고, CAGR 6.1%를 나타내 2034년에는 183억 달러에 이를 것으로 추정됩니다.

시장 확대의 원동력이 되고 있는 것은 만성 질환이나 감염증의 부담 증가, 급속한 기술 혁신, 수술 건수 증가, 노인 인구 증가 등입니다. 건강 관리 제산업체는 진단, 치료 및 연구를 위해 안전하고 정확하며 효율적인 샘플 수집을 선호하기 때문에 고급 채혈 솔루션에 대한 수요가 증가하고 있습니다. 채혈 장치는 임상 워크플로우에서 중요한 도구로, 환자의 안전을 고려한 정확한 혈액 샘플 채취를 보장합니다. 이 장비는 병원, 진단 실험실 및 혈액 은행에서 널리 이용되고 있으며, 다양한 의료 검사 프로세스의 백본 역할을 합니다. 이 시장은 또한 업무를 간소화하고 오염 위험을 줄이고 환자 경험을 향상시키는 시스템에 대한 투자를 확대하고 장기 성장 궤도를 더욱 강화하고 있습니다.

제품 유형별로 볼 때 시장은 시스템과 소모품으로 나뉩니다. 소모품 부문은 2024년에 76.7%의 최대 점유율을 차지했으며 일관되고 정확한 샘플 채취에 필수적인 역할을 하는 것이 그 원동력이 되었습니다. 이 분야는 예측 기간 동안 CAGR 6%를 나타내 2034년에는 139억 달러 이상에 달할 것으로 예측됩니다. 한편, 시스템은 업무 효율과 환자의 쾌적성을 향상시키는 통합 솔루션의 채용 증가에 힘입어 2025-2034년의 CAGR은 6.3%를 나타내 약간 높은 성장이 예측되고 있습니다. 의료 서비스 제산업체는 진단 정확도를 높이고 절차 위험을 줄이기 위해 설계된 시스템을 점점 더 선호하고 있으며,이 부문의 기세에 박차를 가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 102억 달러 |

| 예측 금액 | 183억 달러 |

| CAGR | 6.1% |

시장 세분화는 기법별로 수동형과 자동형으로 구분됩니다. 수동 채혈은 2024년 전체 시장의 53.2%를 차지했으며 비용 효율성, 가용성 및 다양한 임상 환경에서의 사용 편의성이 성장을 지원했습니다. 이 접근법은 정확한 샘플 추출을 수행하기 위해 훈련받은 전문가에 의존하는 세계 의료 진료의 중요한 요소입니다. 이 프로세스는 일반적으로 특정 환자 및 검사 요구 사항에 맞게 바늘과 진공 시스템과 같은 독특한 장비를 사용하여 다양한 환경에서 신뢰성을 보장합니다.

응용 분야의 관점에서 시장은 진단, 치료 및 조사로 분류됩니다. 진단 분야는 2024년도 50.6%의 점유율로 지배적이었으며 질병의 검출, 모니터링, 예방을 위해 혈액 샘플에 의존하는 검사가 증가하고 있는 것이 그 요인이 되었습니다. 건강 상태의 조기 및 정확한 식별에 대한 수요 증가는 첨단 채혈 시스템의 필요성에 박차를 가하고 있으며, 이는이 부문의 성장을 가속화하고 있습니다.

지역별로는 북미가 2024년 점유율 35.4%를 나타내 세계의 채혈 시장을 선도했으며, 강력한 헬스케어 인프라, 만성질환의 증례 증가, 진단검사량의 많음에 지지되었습니다. 이 지역은 또한 혁신적인 채혈기술의 급속한 채용과 진단 속도와 정밀도 향상에 중점을 두고 있는 것도 장점이 되고 있습니다. 이 지역에서는 미국이 여전히 주요 공헌국이며 시장 규모는 2023년 31억 달러에서 2024년 32억 달러로 확대되었습니다. 조사방법의 지속적인 개선에 뒷받침되는 고품질의 진단서비스에 대한 일관된 수요는 예측기간을 통해 동국의 주도적 지위를 유지할 것으로 보입니다.

경쟁 구도를 좌우하는 주요 기업은 써모 피셔 사이언티픽, 테르모, 맥케슨, 헤모네틱스, 어봇 연구소, QIAGEN, 프레세니우스 SE&Co, 서스테트 AG&a mp;Co, 글라이너, FL 메디컬, 벡턴 디킨슨 & amp; 컴퍼니, 카디널 헬스, F. 호프만 라 로슈, 슈트렉, 지멘스 헬시니어스, 니프로 등이 있습니다. 이러한 기업들은 지속적으로 제품 혁신을 추진하고, 세계 전개를 강화하고, 세계 의료 종사자의 변화하는 요구에 부응하는 솔루션을 제공하는 데 주력하고 있습니다.

The Global Blood Collection Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 18.3 billion by 2034. Market expansion is being driven by the growing burden of chronic and infectious diseases, rapid technological innovation, a higher volume of surgical procedures, and a rising elderly population. The demand for advanced blood collection solutions is increasing as healthcare providers prioritize safe, accurate, and efficient sample collection for diagnostics, treatment, and research. Blood collection devices are critical tools in clinical workflows, ensuring that blood samples are obtained with precision and patient safety in mind. These devices are widely used in hospitals, diagnostic laboratories, and blood banks, serving as the backbone of various medical testing processes. The market is also witnessing greater investment in systems that streamline operations, reduce contamination risk, and improve patient experience, further reinforcing its long-term growth trajectory.

By product type, the market is divided into systems and consumables. The consumables segment held the largest share at 76.7% in 2024, driven by its essential role in consistent and accurate sample collection. This segment is expected to reach over USD 13.9 billion by 2034, advancing at a CAGR of 6% during the forecast period. Systems, on the other hand, are forecast to grow at a slightly higher CAGR of 6.3% between 2025 and 2034, supported by the rising adoption of integrated solutions that improve operational efficiency and patient comfort. Healthcare providers are increasingly favoring systems designed to enhance diagnostic accuracy and reduce procedural risks, adding to the segment's momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 billion |

| Forecast Value | $18.3 billion |

| CAGR | 6.1% |

Based on method, the market is segmented into manual and automated blood collection. Manual blood collection accounted for 53.2% of the total market in 2024, with growth supported by its cost-effectiveness, availability, and ease of use in various clinical environments. This approach continues to be a key component of healthcare practices worldwide, relying on trained professionals to perform accurate sample extraction. The process typically involves using tailored devices such as needles or vacuum systems to meet specific patient and test requirements, ensuring reliability in diverse settings.

In terms of application, the market is categorized into diagnostics, treatment, and research. Diagnostics remained the dominant segment in 2024 with a 50.6% share, fueled by the growing number of tests that depend on blood samples for disease detection, monitoring, and prevention. Rising demand for early and precise identification of health conditions is spurring the need for advanced blood collection systems, which in turn is accelerating the segment's growth.

Regionally, North America led the global blood collection market with a 35.4% share in 2024, underpinned by a strong healthcare infrastructure, increasing cases of chronic illnesses, and a high volume of diagnostic testing. The region also benefits from the rapid adoption of innovative blood collection technologies and an emphasis on improving diagnostic speed and accuracy. Within the region, the United States remains the primary contributor, with the market size growing from USD 3.1 billion in 2023 to USD 3.2 billion in 2024. Consistent demand for high-quality diagnostic services, supported by continuous improvements in blood collection methodologies, is expected to sustain the country's leadership position throughout the forecast period.

Key players influencing the competitive landscape include Thermo Fisher Scientific, Terumo Corporation, McKesson Corporation, Haemonetics Corporation, Abbott Laboratories, QIAGEN, Fresenius SE & Co, Sarstedt AG & Co, Greiner, FL MEDICAL, Becton, Dickinson and Company, Cardinal Health, F. Hoffmann-La Roche, Streck, Siemens Healthineers, and Nipro Corporation. These companies are consistently focused on driving product innovation, strengthening their global reach, and delivering solutions that meet the changing requirements of healthcare providers across the world.