아시아태평양의 조명기구 시장을 조사했으며, 생산-소비-국제 무역에 관한 2019-2024년 실적 데이터와 2025년, 2026년, 2027년 시장 예측, 주거용, 상업용, 옥외용 등 용도별 분석, 스마트 조명 및 커넥티드 기술에 관한 최신 동향, 주요 기업 판매량, 시장 점유율, 판매 채널별 동향, 주요 기업 개요, 주요 기업의 매출 및 시장 점유율 등의 정보를 정리하여 전해드립니다. 주요 기업의 판매 데이터 및 시장 점유율, 유통 채널 구조 분석 등을 정리하여 전해드립니다.

|

|

|

아시아태평양의 조명기구

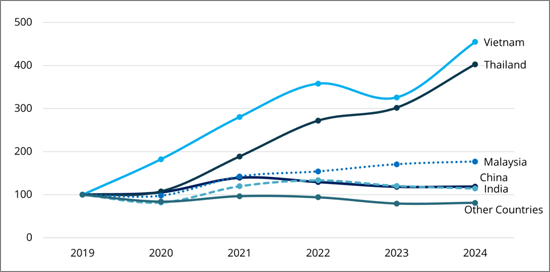

주요 수출국 수출 동향 : 2019-2024년

지수 2019=100

CSIL에 따르면, 아시아태평양의 조명기구 생산액은 580억 달러 이상에 이릅니다. 이 지역에서 가장 큰 조명기구 생산국은 중국이며, 일본과 인도가 그 뒤를 잇고 있습니다. 수출은 총 생산량의 약 절반을 차지하고 있으며, 북미가 주요 수출 대상국입니다. 주요 수출국 중에서는 베트남이 2위 수출국이며, 생산량의 괄목할만한 성장으로 주목받고 있습니다.

아시아태평양의 조명 산업은 규제 프레임워크의 변화와 에너지 효율 목표의 상향 조정으로 인해 큰 전환점을 맞이하고 있습니다. 이러한 요인들이 스마트 조명 시스템으로의 전환을 가속화하고 있습니다. LED로의 전환은 거의 완료되었으며, 최신 기술의 도입, 도시화의 진전, 각국의 에너지 정책, 스마트시티 구상 등이 산업 전반과 경쟁 환경을 새롭게 형성하고 있습니다.

The CSIL report "The Lighting Fixtures Market in Asia and the Pacific" analyses the lighting fixtures market in Asia-Pacific and across 13 countries (Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Taiwan-China, Thailand, and Vietnam), with historical data for production, consumption, international trade (2019-2024) and market forecasts 2025, 2026 and 2027. It explores the lighting fixtures sector, focusing on residential, professional and outdoor applications, with insights into smart lighting and connected technologies. Sales data and market shares are provided for key local and international major players in the industry. An additional section describes the structure of the distribution channels.

The first section offers a comprehensive overview of the Asia-Pacific lighting fixtures sector through:

This chapter describes the features of the Lighting Fixtures market in each considered country, with detailed statistics and key macroeconomic indicators essential for analysing the sector's performance.

For Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Taiwan-China, Thailand, and Vietnam:

A thorough review of the lighting fixtures trade within the Asia-Pacific region over the past six years:

The Asia-Pacific lighting fixtures market analysed by segment (residential lighting, commercial lighting, industrial lighting, and outdoor lighting), applications, and types of products manufactured:

For China, India, Japan: Residential, Professional, and Outdoor lighting Fixtures market is also provided and broken down by destination.

This section also highlights the emerging trends in smart lighting and connected applications. The chapter closes with detailed consumption forecasts for specific application categories, projected for 2025, 2026, and 2027.

Breakdown of sales by distribution channel, with an estimated breakdown of sales by distribution channel in a sample of companies.

The Asia-Pacific Lighting Fixtures market is broken down by the following channels:

For China, India, Japan: the Lighting Fixtures market is also broken down by distribution channel, with a focus that outlines and describes the distribution strategies in the countries.

Insights into the key local and international players in each application segment and country. Detailed tables show sales data and market shares of the top lighting fixtures companies, alongside short profiles of the major players in the industry.

Total production of Lighting Fixtures in a sample of 100 companies with total production value, changes 2024/2023, share of lighting fixtures on company turnover, market share, Lighting Fixtures sales in APAC, share of sales in APAC on total sales.

Sales and market shares in a sample of companies by destination segment/type:

Company sales and market shares by country: Sales of lighting fixtures in a sample of companies in Australia and New Zealand; China; India; Indonesia; Japan; Malaysia; Philippines; Singapore; South Korea; Taiwan (China); Thailand; Vietnam.

The report overall considers a sample of over 400 leading players involved in the Asia-Pacific lighting fixtures market.

Detailed tables on international trade, breaking down lighting fixture exports and imports by country (covering all 13 Asia-Pacific countries) for the past six years, with further breakdowns by geographic area of destination and origin, are also provided, along with a directory of the companies mentioned in this report.

The CSIL Market Research Report "The Lighting Fixtures Market in Asia and the Pacific" provides a comprehensive analysis and valuable data to help answer key industry questions:

CONSIDERED PRODUCTS: Batten lights, Bollards, Ceiling luminaires, Chandeliers, Christmas lighting, Downlights, Embedded, Emergency lighting, Floodlights, Floor light, High and Low Bay, LED panels, Light poles, Linear lighting, Modular systems, Projectors, Spotlights, Step lighting / Guide Light, Strip lighting, Suspensions, Table lighting, Track lights, Wall luminaires.

DESTINATIONS: Residential; Commercial (Hospitality; Office; Retail; Museums and Art venues; Entertainment; Schools and Infrastructure); Industrial (Industrial plants and Warehouses; Hazardous environments; Marine; Horticulture; Healthcare; Emergency); Outdoor (Residential outdoor; Urban Landscape; Christmas and Events; Streets and major roads; Tunnels and Galleries; Sport facilities, parking, oil stations).

GEOGRAPHICAL COVERAGE: Asia and the Pacific - Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan-China, Thailand and Vietnam.

|

|

|

Export trends for the major Asia-Pacific lighting fixtures

exporting countries, 2019-2024.

Index 2019=100

According to CSIL, Lighting Fixtures production in Asia and the Pacific exceeds USD 58 billion. China remains the largest producer of lighting fixtures in the area, followed by Japan and India. Exports account for about half of total production, with North America being the primary destination. Among the major exporting countries, Vietnam, the second-largest exporter, also stands out for its significant production growth.

The Asia-Pacific lighting sector is undergoing a significant transformation, driven by evolving regulatory frameworks and increased energy efficiency targets, which are accelerating the shift towards smart lighting systems. The transition to LED is almost complete; modern technology, urbanization, national energy programs, and smart city initiatives are redefining the entire industry and its competitive landscape